Prime investor Runet and its packages

The article is not a laudatory ode to Usmanov. And not his criticism. And an attempt to understand the harmfulness and usefulness of this person for the Russian Internet business.

Here you will not find anything about Usmanov- "political (or non-political) prisoner." Let the main aggressor of his reputation, the former British ambassador to Uzbekistan, Craig Murray , deal with this . Although the criminal past and the connection with the relevant elements could easily explain the success of Alisher Burhanovich in the 90s. But we adhere to officially adopted documents, such as the 2000 decision of the Supreme Court of Uzbekistan on the rehabilitation of Usmanov and the fabrication of his criminal case. And for the position of his lawyers. It is not enough - the Internet is small. And in those early years, Craig Murray’s blog was covered up. Yes, and with the Internet business, this past has little to do. In general, everyone in life makes mistakes or turns out to be in the wrong place at the wrong time. And in an unambiguous plus, it is necessary to attribute the fact that in 1980 the place in which Usmanov found himself was probably the only time that was wrong. In the 21st century, Usmanov every step is in the right place for him. So.

Photos from the site euromag.ru. Alisher Usmanov. Watch for capital flows and ... elbow - under it - “Read more”

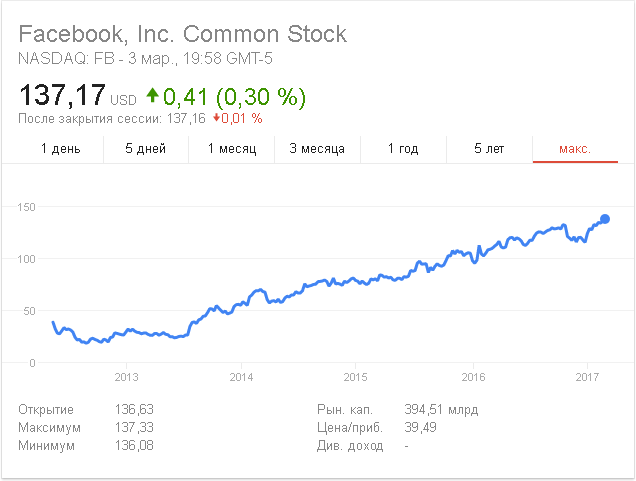

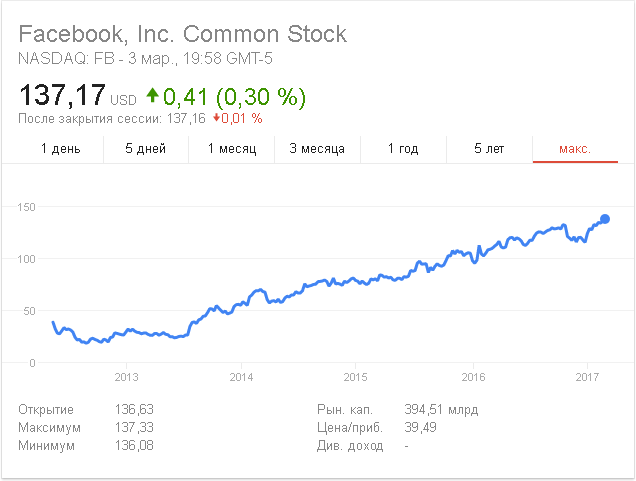

“Well, come on then, Jura, take upon yourself the historical responsibility, write how much Facebook will cost in five years,” he wrote, “up to 50 billion. There is a small postscript with my hand - from 50 to 100 billion. My predictions came true ”, - the voice , the timbre below which I still have to search, quietly gives information about the next prediction of its owner.

Prediction is true, but with this voice you can communicate any nonsense, and they will still believe in it, because it will sound convincing and strong, but it is unlikely to be used for such short-sighted nonsense. Previously, this voice was considered the first earned billion. Then the bill got bored, and the duties were delegated to the treasurer. But the voice is just one detail of a charismatic personality. Much more important is everything else. For Internet entrepreneurs, for example, whether they want to or not, the interest of a given person in their company is very important. And this gives rise to both fear and pride. Fear - because, most likely, you will have to agree to the proposal, following after the expressed interest, - only Yandex could get out of it in due time. Pride - for your company, because it is the number one investor in Runet. Alisher Burmanovich Usmanov.

')

Package, briquette, again package

The main business of Usmanov is Metalloinvest holding. The holding is owned by USM Holdings Ltd , whose shares belong to Usmanov (60%), to the pensioner Vladimir Skoch (30%) - by the way, the richest pensioner in Russia, part-time father of deputy Andrei Skoch, with whom Usmanov began his ascent; as well as Iranian Farhad Moshiri (10%), long-time acquaintance A. B., at the end of the 90s, they even went to London together - they insured political risks for the former President Yeltsin. Collected Usmanov Metalloinvest bit by bit all the 2000s. First Oskolsky Combine, then Lebedinsky, Mikhailovsky and Ural Steel. Around this skeleton-base then very quickly and the meat overgrown.

Photos from theguardian.com. The owner of the letter “S” in the USM Holdings Andrei Skoch (bottom right) and some “strangers”.

Usmanov is a diverse man. But very predictable. In what respect. For whatever business he takes, be it plastic bags, cigarettes, iron briquettes, in a fairly short time he predictably received a staggering profit, several times higher than the investment. But in one case he never sat for a long time, because he understood: Russia is not stable either in law or in executive terms. In his own words, the power in Russia in the 90s was associated with a windy woman — she herself did not know what she wanted. The exception was metallurgy, for the development of which he received a strong message from the state, grateful to Usmanov for returning many significant assets of gas companies under the wing of Gazprom in the early 2000s. Metallurgy is a necessary and strategic business. And A.B. since the 90s he urged his partners to invest in something like that. To date, Metalloinvest is one of the largest producers of hot briquette iron and pellets in the world; iron ore and steel are also not far behind. During the crisis, the demand for a number of holding products fell, revenues declined catastrophically, but more on that below and a little later.

Metalloinvest holding indicators

I (hoo) ndeks

Starting his first big business with plastic bags, Usmanov, from 2008, was seriously interested in high-value paper bags in the Internet industry.

I could get carried away even earlier. During the period of the dotcom crisis of 2001, Usmanov tried to acquire a much cheaper search engine Yahoo !, however, none of the banks decided to issue a loan for such a risky purchase. The value of the company's assets has since increased from $ 2.3 billion to $ 61.7 billion (2014). Net profit also grew steadily and turned out to be negative only in 2015 - minus $ 4.4 billion (in 2014 - $ 7.5 billion). Similarly, A.A. things were in those years with the Dutch metallurgical company Corus. Usmanov was able to receive funds from acquiring its depreciated shares only from his acquaintances (including the head of Petrocommerce Bank, as well as presidential aide Igor Shuvalov, who still didn’t really believe in the project). During the year, invested $ 319 million in total investments rose to $ 614 million return.

Usmanov is the winning man. But there is one annoyingly blank page in his book of investments. Without numbers and banknotes. This page should be Yandex. But did not grow together, even by government pressure.

The main argument of Usmanov and Milner before state minds in 2008 (and the state represented by its representatives very closely followed the upcoming Yandex on the stock exchange) was to prevent the absorption of such a large IT company by some unfriendly Russia competitor.

Photos from the site tvc.ru. The views of government and business intersect somewhere.

Volozh and the company had two options - to rest, to close and, in the end, heroically fall before the state machine or go for a dialogue.

At first they tried to establish a dialogue with potential investors. But when they realized that investors would begin to impose their own order, in particular, they would refuse to give options to managers at all levels of Yandex, owning which, they partially owned the company. When they understood, they came to the conclusion that Yandex would die in the wrong hands, because it was the people in the company that were of primary importance. As Volozh expressed: “I collect people, the rest is attached by itself”. And Yandex will perish, its just niche will take quite unfriendly Google. The situation was resolved only through the acquisition of allies in the state apparatus, who convinced the relevant people that Yandex is good, honors the interests of the state, and who will not sell controlling blocks of shares. Now the “golden share”, which gives the right to veto on any dubious Yandex transaction, belongs to Sberbank.

It is unlikely that this failure disappointed Usmanov. Rather, his partner, Yuri Milner, who almost all the 2000s tried to acquire shares of Yandex. Usmanov has wisdom from fencers on this score: to win means not to get involved in a fight. To get involved is to be killed.

Feisberg-Zuckerbuk

In autumn 2008, the atmosphere in Metalloinvest was heated. The decline in production in half, the sale of recent shares and free assets to pay off debts. In such circumstances, Usmanov’s proposal to invest up to $ 1 billion in Facebook was insane. Almost all partners were against - Farhad Moshiri, Vasily Anisimov, only Andrei Skoch remembered Dutch Corus and American Yahoo, although the logic was in agreement with the rest. The situation was aggravated by the fact that this billion would be the last of the few. But Usmanov showed the traditional Eastern inflexibility. He came into big business to play at an appropriate scale, as promised 15 years before, when he faced a dilemma - either go to Sakhalin and fish in peaceful solitude, or stay in business.

Photo from bfm.ru. Sometimes it's worth looking at things from a different angle.

The main feature of Usmanov is to adapt to any interest. Understand what one or the other side wants. He was chosen more than once as a negotiator in any corporate conflict. Whether it is the return of lost assets to Gazprom or the sale of Lebedinsky GOK. He elegantly, with eastern generosity, resolved conflicts even with direct competitors (as is the case with Megaphone and Friedman's Alpha groups).

With Facebook, the situation is the opposite. Usmanov remained in the shadows. A more Americanized Yuri Milner actually represented a common interest in the purchase. Initially, Milner showed interest in this social network. But he was offered only 1% of the shares. When Yuri Bentsionovich turned to Usmanov, he built a strategy of behavior, thanks to which Facebook agreed to 10% of the shares. What could the duet Usmanov-Milner Facebook offer? First, the deprivation of a seat on the board of directors, and second, the right to vote on shares passed to Zuckerberg. This was not necessary for Usmanov and Milner. Not an influence, but a share in a promising company preparing for an IPO, as well as an international reputation. As a result, Usmanov returned his investment in the amount close to 10 times. When buying shares in 2009, the value of the entire social network was estimated at $ 6-10 billion. When selling, it reached $ 100 billion. For a moment, fix it again. 2009 year. A crisis. Investment in $ 1 billion dollars. Huge risk and misunderstanding on all sides.

“I am not the person who gives everything on trust or on feelings, I study all companies very well,” says Usmanov in 2012. Studying, not studying - but predicting the growth of Facebook in a crisis is not a rational one. It is always a risk. And the risk and excitement are irrational. Nevertheless, gambling by A. B. avoids - never played in a casino, preferring exclusively investment excitement.

Cyber, Uber, Habr

Cybersport is an unexpected investment by Usmanov. In the sense that it happened at the end of 2015. And in 2014, Usmanov decided to invest. “I don’t want to buy anything anymore, almost. In addition, it will support our philanthropic and charitable programs. ” “Almost” - after 2014 it turned into buying shares of the richest startup Uber and investing in eSports startup VirtusPro. The psychology of a working pensioner and an aging oligarch in this perspective is very similar. “I will work for another year and retire,” says every employee after 60. That Usmanov once detached himself a period of vigorous activity to 63-65 years. Therefore, the new “almost”, most likely, is not far off.

Photo from Kommersant.ru website. You can be a member of the game inside as well as outside.

Usmanov has a rare gift. In Russia, it is a common phenomenon to take what is badly lying. He, being only partially Russian, interprets this stereotype a little differently - he takes what is bad, and so far no one needs. But at the same time he feels that he will soon be lying well and will be needed by everyone.

Cybersport is promising because it has recently become a sport again, is very popular among young people and is gaining ratings in the media industry. Where there is a big mass, there is always advertising, but it is not there yet, only representatives of famous brands (for example, Coca-Cola) have just started paying attention to eSports.

In VirtusPro, Usmanov invested $ 100 million. A specialized $ 5 million stadium has already been built. In the autumn of 2016, MatchTV showed the first final of e-sports competitions.

Uber is another example of Usmanov investing in a company before entering the international stock market. So it was with Facebook, the same thing happened with Alibaba.

At the same time, AB, there is already an Indian competitor Uber - Ola. And the most interesting is that in India these services are very tough to compete and even sue among themselves (in March 2016, Uber filed a complaint against Ola's manipulation with fake accounts through which fake orders were sent). It will be interesting to see how Usmanov will behave in such conditions, because he is a fan of resolving such conflicts gracefully.

About relations Usmanov and Habr say only a couple of lines. By and large, they were not there. It was stressful with Milner, Grishin and a number of Mail.ru managers. This is very bright Denis Kryuchkov already told. It is worth noting that if suddenly one day the Habro community decides to enter the stock market (never say “never”?), Who knows, maybe Usmanov will be next, and the presence of this man’s talisman can be considered almost 100 percent happy, of course, if at all possible to calculate happiness as a percentage.

Main disadvantage

In addition to the above, Usmanov and his partners from USM Holdings and DST Global have an unreal amount of investments in Internet projects.

This is the Chinese online retailer Alibaba, investments in which turned to Usmanov in 500% of the profits. He has already got rid of Alibaba's shares, but there is still a competitor JD.com.

This is Apple, in which Usmanov held about $ 100 million until 2013.

Groupon coupon service and Zynga game developer, Arnb real estate rental platform, Spotify music service, Twitter, Nubank Brazilian “bank killer”,

And finally, the main thing is Mail.ru Group, which unites the largest social networks and dozens of additional services. Until recently, the company was the most expensive in RuNet ($ 4 billion), but this year, Yandex with $ 7.6 billion bypassed it (more precisely, the cost of the MRG itself fell due to the crisis). Now Mail.ru Grop is also sold to Megafon-controlled company Usmanov. A loan in the amount of 35 billion rubles from Sberbank until 2024 was allocated for this. Shares of MegaFon itself before repayment of the loan are pledged to Sberbank. Why was this done? Media outlines two options - the official - Megaphone using Mail.ru Grop is starting to master big data technologies for more effective advertising. Unofficial - this loan of 35 billion rubles Usmanov actually got for himself, in order to somehow reanimate Metalloinvest, which is now on the verge of loss. There is also a third option - 35 billion. They will go offshore to AB’s personal accounts. But according to this option, it is better to Navalny - it will shoot another furious and inconvenient for the official government. We are also interested in internet business.

Photo from resistance.today. Investor Gennady Timchenko and A.B. When bought for 5, sold for 100 - funny. And when on the contrary - it is not for us.

Summarize this. Usmanov comes and goes, but companies remain after him. Not to say that they become “bad, sad and lonely.” As a rule, they all stand firmly on their feet. About the harmfulness of investment, we have already written in the last article. Whether they are harmful in the case of Usmanov depends on many factors. For Yandex, as they themselves have estimated, - yes, and this, judging by the present place - is true - they have their own way. Facebook, Twitter, Uber - rather useful for Usmanov himself - maintain the reputation of a successful investor, allow him to rightfully be on a par with great Western people. Twitter is now falling, but because of Usmanov? Of course not. With eSports everything is just beginning. The rest of the companies live quite well before and after. As Alisher Burkhanovich said after the regular sale of shares, “it is necessary for others to be given an opportunity to make a profit”. This can be estimated in general, its place in the Internet business. Usmanov came to him in time and would come out of it in time - he would not break anything, he would not destroy anything, he would just take advantage of the moment and the next billion. Only the companies themselves can destroy themselves.

Mark Licinius Crassus. According to some historians - the very first investor.

Here you will not find anything about Usmanov- "political (or non-political) prisoner." Let the main aggressor of his reputation, the former British ambassador to Uzbekistan, Craig Murray , deal with this . Although the criminal past and the connection with the relevant elements could easily explain the success of Alisher Burhanovich in the 90s. But we adhere to officially adopted documents, such as the 2000 decision of the Supreme Court of Uzbekistan on the rehabilitation of Usmanov and the fabrication of his criminal case. And for the position of his lawyers. It is not enough - the Internet is small. And in those early years, Craig Murray’s blog was covered up. Yes, and with the Internet business, this past has little to do. In general, everyone in life makes mistakes or turns out to be in the wrong place at the wrong time. And in an unambiguous plus, it is necessary to attribute the fact that in 1980 the place in which Usmanov found himself was probably the only time that was wrong. In the 21st century, Usmanov every step is in the right place for him. So.

Photos from the site euromag.ru. Alisher Usmanov. Watch for capital flows and ... elbow - under it - “Read more”

“Well, come on then, Jura, take upon yourself the historical responsibility, write how much Facebook will cost in five years,” he wrote, “up to 50 billion. There is a small postscript with my hand - from 50 to 100 billion. My predictions came true ”, - the voice , the timbre below which I still have to search, quietly gives information about the next prediction of its owner.

Prediction is true, but with this voice you can communicate any nonsense, and they will still believe in it, because it will sound convincing and strong, but it is unlikely to be used for such short-sighted nonsense. Previously, this voice was considered the first earned billion. Then the bill got bored, and the duties were delegated to the treasurer. But the voice is just one detail of a charismatic personality. Much more important is everything else. For Internet entrepreneurs, for example, whether they want to or not, the interest of a given person in their company is very important. And this gives rise to both fear and pride. Fear - because, most likely, you will have to agree to the proposal, following after the expressed interest, - only Yandex could get out of it in due time. Pride - for your company, because it is the number one investor in Runet. Alisher Burmanovich Usmanov.

')

Package, briquette, again package

The main business of Usmanov is Metalloinvest holding. The holding is owned by USM Holdings Ltd , whose shares belong to Usmanov (60%), to the pensioner Vladimir Skoch (30%) - by the way, the richest pensioner in Russia, part-time father of deputy Andrei Skoch, with whom Usmanov began his ascent; as well as Iranian Farhad Moshiri (10%), long-time acquaintance A. B., at the end of the 90s, they even went to London together - they insured political risks for the former President Yeltsin. Collected Usmanov Metalloinvest bit by bit all the 2000s. First Oskolsky Combine, then Lebedinsky, Mikhailovsky and Ural Steel. Around this skeleton-base then very quickly and the meat overgrown.

Photos from theguardian.com. The owner of the letter “S” in the USM Holdings Andrei Skoch (bottom right) and some “strangers”.

Usmanov is a diverse man. But very predictable. In what respect. For whatever business he takes, be it plastic bags, cigarettes, iron briquettes, in a fairly short time he predictably received a staggering profit, several times higher than the investment. But in one case he never sat for a long time, because he understood: Russia is not stable either in law or in executive terms. In his own words, the power in Russia in the 90s was associated with a windy woman — she herself did not know what she wanted. The exception was metallurgy, for the development of which he received a strong message from the state, grateful to Usmanov for returning many significant assets of gas companies under the wing of Gazprom in the early 2000s. Metallurgy is a necessary and strategic business. And A.B. since the 90s he urged his partners to invest in something like that. To date, Metalloinvest is one of the largest producers of hot briquette iron and pellets in the world; iron ore and steel are also not far behind. During the crisis, the demand for a number of holding products fell, revenues declined catastrophically, but more on that below and a little later.

Metalloinvest holding indicators

I (hoo) ndeks

Starting his first big business with plastic bags, Usmanov, from 2008, was seriously interested in high-value paper bags in the Internet industry.

I could get carried away even earlier. During the period of the dotcom crisis of 2001, Usmanov tried to acquire a much cheaper search engine Yahoo !, however, none of the banks decided to issue a loan for such a risky purchase. The value of the company's assets has since increased from $ 2.3 billion to $ 61.7 billion (2014). Net profit also grew steadily and turned out to be negative only in 2015 - minus $ 4.4 billion (in 2014 - $ 7.5 billion). Similarly, A.A. things were in those years with the Dutch metallurgical company Corus. Usmanov was able to receive funds from acquiring its depreciated shares only from his acquaintances (including the head of Petrocommerce Bank, as well as presidential aide Igor Shuvalov, who still didn’t really believe in the project). During the year, invested $ 319 million in total investments rose to $ 614 million return.

Usmanov is the winning man. But there is one annoyingly blank page in his book of investments. Without numbers and banknotes. This page should be Yandex. But did not grow together, even by government pressure.

The main argument of Usmanov and Milner before state minds in 2008 (and the state represented by its representatives very closely followed the upcoming Yandex on the stock exchange) was to prevent the absorption of such a large IT company by some unfriendly Russia competitor.

Photos from the site tvc.ru. The views of government and business intersect somewhere.

Volozh and the company had two options - to rest, to close and, in the end, heroically fall before the state machine or go for a dialogue.

At first they tried to establish a dialogue with potential investors. But when they realized that investors would begin to impose their own order, in particular, they would refuse to give options to managers at all levels of Yandex, owning which, they partially owned the company. When they understood, they came to the conclusion that Yandex would die in the wrong hands, because it was the people in the company that were of primary importance. As Volozh expressed: “I collect people, the rest is attached by itself”. And Yandex will perish, its just niche will take quite unfriendly Google. The situation was resolved only through the acquisition of allies in the state apparatus, who convinced the relevant people that Yandex is good, honors the interests of the state, and who will not sell controlling blocks of shares. Now the “golden share”, which gives the right to veto on any dubious Yandex transaction, belongs to Sberbank.

It is unlikely that this failure disappointed Usmanov. Rather, his partner, Yuri Milner, who almost all the 2000s tried to acquire shares of Yandex. Usmanov has wisdom from fencers on this score: to win means not to get involved in a fight. To get involved is to be killed.

Feisberg-Zuckerbuk

In autumn 2008, the atmosphere in Metalloinvest was heated. The decline in production in half, the sale of recent shares and free assets to pay off debts. In such circumstances, Usmanov’s proposal to invest up to $ 1 billion in Facebook was insane. Almost all partners were against - Farhad Moshiri, Vasily Anisimov, only Andrei Skoch remembered Dutch Corus and American Yahoo, although the logic was in agreement with the rest. The situation was aggravated by the fact that this billion would be the last of the few. But Usmanov showed the traditional Eastern inflexibility. He came into big business to play at an appropriate scale, as promised 15 years before, when he faced a dilemma - either go to Sakhalin and fish in peaceful solitude, or stay in business.

Photo from bfm.ru. Sometimes it's worth looking at things from a different angle.

The main feature of Usmanov is to adapt to any interest. Understand what one or the other side wants. He was chosen more than once as a negotiator in any corporate conflict. Whether it is the return of lost assets to Gazprom or the sale of Lebedinsky GOK. He elegantly, with eastern generosity, resolved conflicts even with direct competitors (as is the case with Megaphone and Friedman's Alpha groups).

With Facebook, the situation is the opposite. Usmanov remained in the shadows. A more Americanized Yuri Milner actually represented a common interest in the purchase. Initially, Milner showed interest in this social network. But he was offered only 1% of the shares. When Yuri Bentsionovich turned to Usmanov, he built a strategy of behavior, thanks to which Facebook agreed to 10% of the shares. What could the duet Usmanov-Milner Facebook offer? First, the deprivation of a seat on the board of directors, and second, the right to vote on shares passed to Zuckerberg. This was not necessary for Usmanov and Milner. Not an influence, but a share in a promising company preparing for an IPO, as well as an international reputation. As a result, Usmanov returned his investment in the amount close to 10 times. When buying shares in 2009, the value of the entire social network was estimated at $ 6-10 billion. When selling, it reached $ 100 billion. For a moment, fix it again. 2009 year. A crisis. Investment in $ 1 billion dollars. Huge risk and misunderstanding on all sides.

“I am not the person who gives everything on trust or on feelings, I study all companies very well,” says Usmanov in 2012. Studying, not studying - but predicting the growth of Facebook in a crisis is not a rational one. It is always a risk. And the risk and excitement are irrational. Nevertheless, gambling by A. B. avoids - never played in a casino, preferring exclusively investment excitement.

Cyber, Uber, Habr

Cybersport is an unexpected investment by Usmanov. In the sense that it happened at the end of 2015. And in 2014, Usmanov decided to invest. “I don’t want to buy anything anymore, almost. In addition, it will support our philanthropic and charitable programs. ” “Almost” - after 2014 it turned into buying shares of the richest startup Uber and investing in eSports startup VirtusPro. The psychology of a working pensioner and an aging oligarch in this perspective is very similar. “I will work for another year and retire,” says every employee after 60. That Usmanov once detached himself a period of vigorous activity to 63-65 years. Therefore, the new “almost”, most likely, is not far off.

Photo from Kommersant.ru website. You can be a member of the game inside as well as outside.

Usmanov has a rare gift. In Russia, it is a common phenomenon to take what is badly lying. He, being only partially Russian, interprets this stereotype a little differently - he takes what is bad, and so far no one needs. But at the same time he feels that he will soon be lying well and will be needed by everyone.

Cybersport is promising because it has recently become a sport again, is very popular among young people and is gaining ratings in the media industry. Where there is a big mass, there is always advertising, but it is not there yet, only representatives of famous brands (for example, Coca-Cola) have just started paying attention to eSports.

In VirtusPro, Usmanov invested $ 100 million. A specialized $ 5 million stadium has already been built. In the autumn of 2016, MatchTV showed the first final of e-sports competitions.

Uber is another example of Usmanov investing in a company before entering the international stock market. So it was with Facebook, the same thing happened with Alibaba.

At the same time, AB, there is already an Indian competitor Uber - Ola. And the most interesting is that in India these services are very tough to compete and even sue among themselves (in March 2016, Uber filed a complaint against Ola's manipulation with fake accounts through which fake orders were sent). It will be interesting to see how Usmanov will behave in such conditions, because he is a fan of resolving such conflicts gracefully.

About relations Usmanov and Habr say only a couple of lines. By and large, they were not there. It was stressful with Milner, Grishin and a number of Mail.ru managers. This is very bright Denis Kryuchkov already told. It is worth noting that if suddenly one day the Habro community decides to enter the stock market (never say “never”?), Who knows, maybe Usmanov will be next, and the presence of this man’s talisman can be considered almost 100 percent happy, of course, if at all possible to calculate happiness as a percentage.

Main disadvantage

In addition to the above, Usmanov and his partners from USM Holdings and DST Global have an unreal amount of investments in Internet projects.

This is the Chinese online retailer Alibaba, investments in which turned to Usmanov in 500% of the profits. He has already got rid of Alibaba's shares, but there is still a competitor JD.com.

This is Apple, in which Usmanov held about $ 100 million until 2013.

Groupon coupon service and Zynga game developer, Arnb real estate rental platform, Spotify music service, Twitter, Nubank Brazilian “bank killer”,

And finally, the main thing is Mail.ru Group, which unites the largest social networks and dozens of additional services. Until recently, the company was the most expensive in RuNet ($ 4 billion), but this year, Yandex with $ 7.6 billion bypassed it (more precisely, the cost of the MRG itself fell due to the crisis). Now Mail.ru Grop is also sold to Megafon-controlled company Usmanov. A loan in the amount of 35 billion rubles from Sberbank until 2024 was allocated for this. Shares of MegaFon itself before repayment of the loan are pledged to Sberbank. Why was this done? Media outlines two options - the official - Megaphone using Mail.ru Grop is starting to master big data technologies for more effective advertising. Unofficial - this loan of 35 billion rubles Usmanov actually got for himself, in order to somehow reanimate Metalloinvest, which is now on the verge of loss. There is also a third option - 35 billion. They will go offshore to AB’s personal accounts. But according to this option, it is better to Navalny - it will shoot another furious and inconvenient for the official government. We are also interested in internet business.

Photo from resistance.today. Investor Gennady Timchenko and A.B. When bought for 5, sold for 100 - funny. And when on the contrary - it is not for us.

Summarize this. Usmanov comes and goes, but companies remain after him. Not to say that they become “bad, sad and lonely.” As a rule, they all stand firmly on their feet. About the harmfulness of investment, we have already written in the last article. Whether they are harmful in the case of Usmanov depends on many factors. For Yandex, as they themselves have estimated, - yes, and this, judging by the present place - is true - they have their own way. Facebook, Twitter, Uber - rather useful for Usmanov himself - maintain the reputation of a successful investor, allow him to rightfully be on a par with great Western people. Twitter is now falling, but because of Usmanov? Of course not. With eSports everything is just beginning. The rest of the companies live quite well before and after. As Alisher Burkhanovich said after the regular sale of shares, “it is necessary for others to be given an opportunity to make a profit”. This can be estimated in general, its place in the Internet business. Usmanov came to him in time and would come out of it in time - he would not break anything, he would not destroy anything, he would just take advantage of the moment and the next billion. Only the companies themselves can destroy themselves.

Mark Licinius Crassus. According to some historians - the very first investor.

Source: https://habr.com/ru/post/323842/

All Articles