Let's deal with the BitCoin exchange

Bitcoin is rapidly gaining popularity, striding the planet by leaps and bounds. Every day, more and more people are thinking about opening a Bitcoin exchange. A recent race course "adds fuel to the fire." Against the background of all this, and also considering the fact of an increase in transactions and the penetration of Bitcoins in people's lives, opening a Bitcoin exchange looks like a very attractive idea.

But is it really so? Let's figure it out.

The first thing that startupers face, with the exception of investment and of course the technical aspect, is the choice of jurisdiction. And here is the first problem.

')

Most countries have not formed an opinion on Bitcoin. As of March 1, 2017, many have taken a wait-and-see attitude, hoping to look at their neighbors or that the market will regulate itself. And then what about the Bitcon exchange?

Well, you can go in several ways. First, register offshore and work without messing with licenses and other financial regulation, the second to make a “white” company.

The main problems with the first option are the very difficult opening of a bank account and the connection of payment systems. It's no secret that most banks do not want to work with Bitcoin, and even more so with the exchange. And taking into account offshore jurisdiction as well, this case is almost not feasible, unless you have good contacts on the board of the bank or you are really a lucky person. The way out is opening an account in an offshore bank. But even here the problem is that payments to such banks automatically fall on financial monitoring and it’s not a fact that they will eventually reach you.

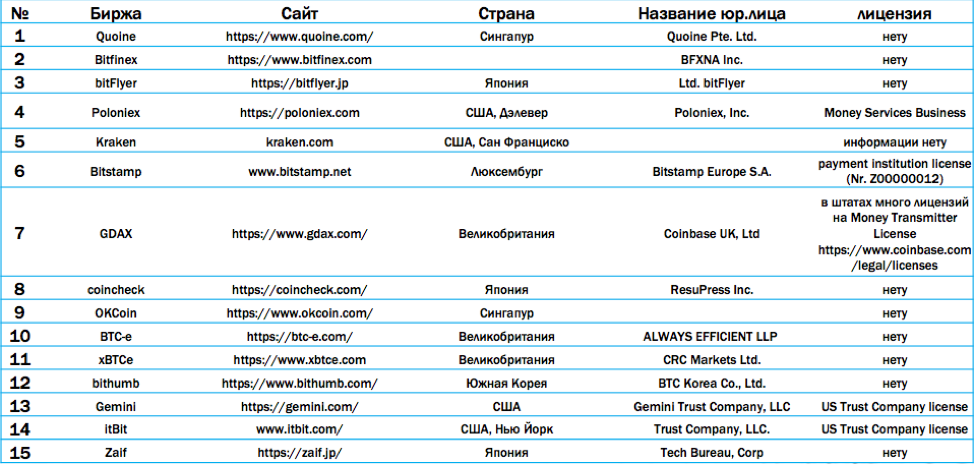

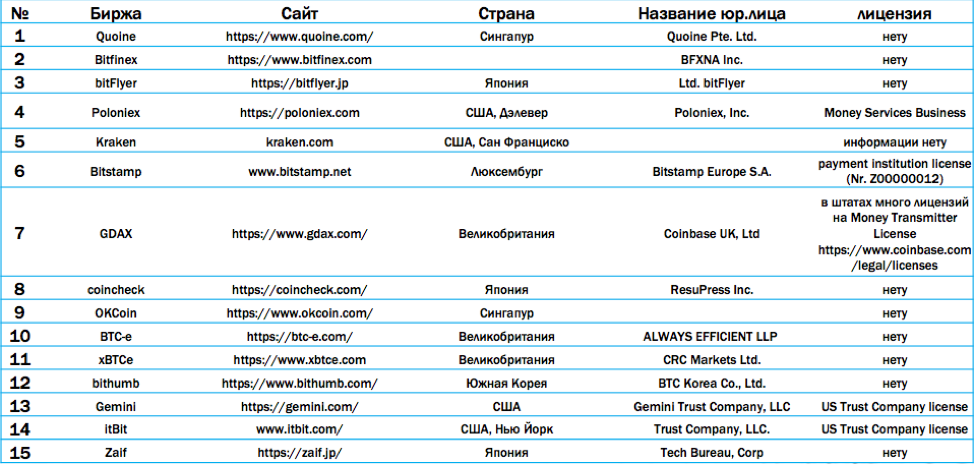

And if with the first option everything is more or less clear, then with the second one everything is much more complicated. But before you figure out, you need the original data. So let's take a look at the table of analysis of the TOP 15 largest exchanges according to the site www.coinhills.com

In a situation with countries, it is still more strange:

This is not a complete list of countries, for the rest to find any information was not realistic. There are no legislative acts and the position of the regulatory authorities is not clear.

As can be seen from the analysis of companies, only 4 are licensed. A distinctive feature of these licenses is that they are issued for the operation of payment systems or trust management of funds. Thus, these exchanges, wishing to bring their activities to the legal plane, receive licenses on the basis of the analogy of law.

The same principle is followed in Luxembourg and the United States, as the leading countries that are trying to streamline this market.

Today, there is one BitLicense special license in New York, USA. It was specially developed and issued by the Department of Financial Services NY for Bitcoin exchanges. However, it is valid only in the territory of the State of New York.

Given the nature of the implementation of Bitcoin operations, according to the p2p scheme, Bitcoin exchanges, which simply place bids and do not trust the funds of users, are not subject to licensing.

However, if the Bitcoin exchange makes transactions on behalf of the user and / or stores its funds, then in this case most countries consider this activity to be similar to the activities of electronic payment systems, and as a result, a license is required from the country where the company is registered. And offshore does not save from this, since financial activities, even in offshore jurisdictions, are taxable and subject to licensing and financial monitoring.

Summary:

Based on the analysis of large stock exchanges, most of them do not have a license to operate a Bitcoin exchange and the reason for this is the lack of a procedure and the license itself, as a legal fact.

Each startup must decide for itself what is best for it. If quick, your choice is offshore (Isle of Man, BVI, Beyliz) or semi-offshore (Panama, Singapore, partnership in England or Scotland). However, prepare yourself so that you will not be able to connect popular payment systems, open bank accounts, etc., as well as investors are unlikely to want to invest serious money in such projects.

A solid approach - is associated with large financial expenditure at the start. Opening a company and paying taxes, in the same Luxembourg, is not a cheap pleasure. And obtaining a license will not be for you a “easy walk under the moon”, but this should bring greater profit in the future. And the marketing effect of having a license should not be underestimated, and if for the CIS it is not a special indicator, then for traders from Europe and developed countries this is one of the fundamental things when choosing a stock exchange.

But is it really so? Let's figure it out.

The first thing that startupers face, with the exception of investment and of course the technical aspect, is the choice of jurisdiction. And here is the first problem.

')

Most countries have not formed an opinion on Bitcoin. As of March 1, 2017, many have taken a wait-and-see attitude, hoping to look at their neighbors or that the market will regulate itself. And then what about the Bitcon exchange?

Well, you can go in several ways. First, register offshore and work without messing with licenses and other financial regulation, the second to make a “white” company.

The main problems with the first option are the very difficult opening of a bank account and the connection of payment systems. It's no secret that most banks do not want to work with Bitcoin, and even more so with the exchange. And taking into account offshore jurisdiction as well, this case is almost not feasible, unless you have good contacts on the board of the bank or you are really a lucky person. The way out is opening an account in an offshore bank. But even here the problem is that payments to such banks automatically fall on financial monitoring and it’s not a fact that they will eventually reach you.

And if with the first option everything is more or less clear, then with the second one everything is much more complicated. But before you figure out, you need the original data. So let's take a look at the table of analysis of the TOP 15 largest exchanges according to the site www.coinhills.com

In a situation with countries, it is still more strange:

This is not a complete list of countries, for the rest to find any information was not realistic. There are no legislative acts and the position of the regulatory authorities is not clear.

As can be seen from the analysis of companies, only 4 are licensed. A distinctive feature of these licenses is that they are issued for the operation of payment systems or trust management of funds. Thus, these exchanges, wishing to bring their activities to the legal plane, receive licenses on the basis of the analogy of law.

The analogy of law is an application to a controversial relationship that is not regulated by some specific norm and to which the norm, general principles and meaning (that is, principles) of legislation cannot be applied.

The same principle is followed in Luxembourg and the United States, as the leading countries that are trying to streamline this market.

Today, there is one BitLicense special license in New York, USA. It was specially developed and issued by the Department of Financial Services NY for Bitcoin exchanges. However, it is valid only in the territory of the State of New York.

Given the nature of the implementation of Bitcoin operations, according to the p2p scheme, Bitcoin exchanges, which simply place bids and do not trust the funds of users, are not subject to licensing.

However, if the Bitcoin exchange makes transactions on behalf of the user and / or stores its funds, then in this case most countries consider this activity to be similar to the activities of electronic payment systems, and as a result, a license is required from the country where the company is registered. And offshore does not save from this, since financial activities, even in offshore jurisdictions, are taxable and subject to licensing and financial monitoring.

Summary:

Based on the analysis of large stock exchanges, most of them do not have a license to operate a Bitcoin exchange and the reason for this is the lack of a procedure and the license itself, as a legal fact.

Each startup must decide for itself what is best for it. If quick, your choice is offshore (Isle of Man, BVI, Beyliz) or semi-offshore (Panama, Singapore, partnership in England or Scotland). However, prepare yourself so that you will not be able to connect popular payment systems, open bank accounts, etc., as well as investors are unlikely to want to invest serious money in such projects.

A solid approach - is associated with large financial expenditure at the start. Opening a company and paying taxes, in the same Luxembourg, is not a cheap pleasure. And obtaining a license will not be for you a “easy walk under the moon”, but this should bring greater profit in the future. And the marketing effect of having a license should not be underestimated, and if for the CIS it is not a special indicator, then for traders from Europe and developed countries this is one of the fundamental things when choosing a stock exchange.

Source: https://habr.com/ru/post/323806/

All Articles