Is bitcoin addicted to China and why is it important?

Recently, my publication on crypto-gold received an obvious, but still detailed answer: "... Bitcoin with its blockchain as the technology only develops . If this technology is in demand, then Bitcoin capitalization will be much higher (well, conditionally $ 100K for Bitcoin is acceptable), with such capitalization, the volatility will be lower, the price will stabilize , everyone will quietly use. And now the process of formation, without exchanges, it is not possible, and exchanges are not possible without speculation . Not very educated people of course can lose money in this process “But the classics are tulips, the bubbling process ended a century ago, and now at every corner we can buy tulips, are cheap, and the capitalization of the tulip business is much higher than those bubbles.”

All this is true (at least for the most part), but the whole question is that Bitcoin is not just a new trading tool. Stock trading: this is a cryptocurrency based on p2p technology.

“And what of that?” You ask me. But the fact is that per-to-per means "from person to person", but today Bitcoin involved in the "ordinary" process of speculation does not meet this requirement.

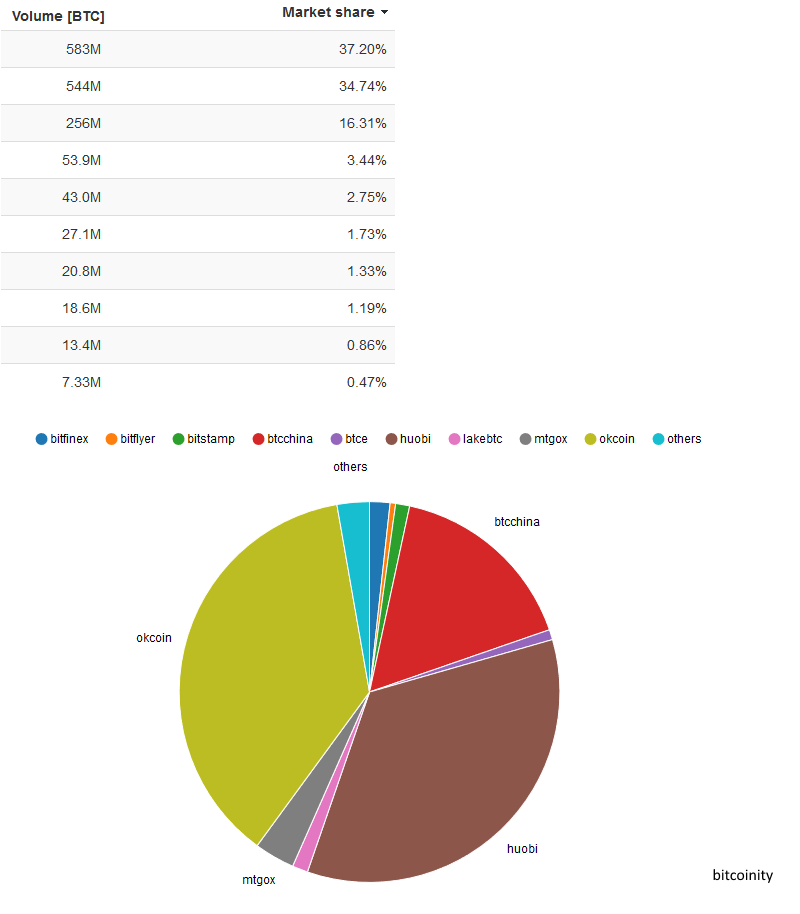

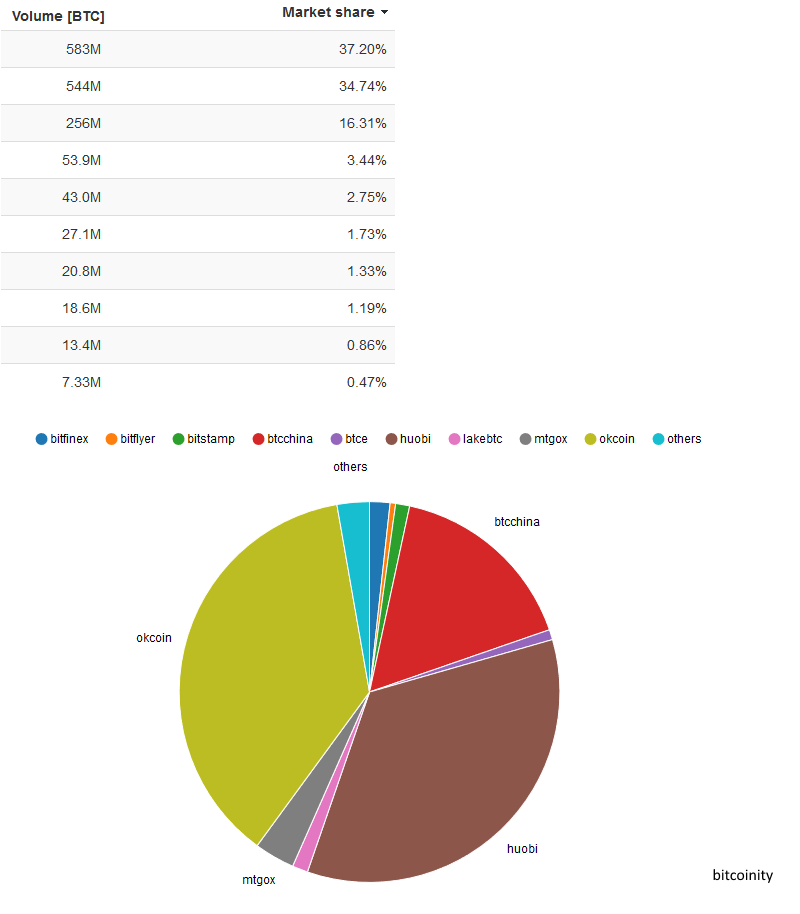

Here are the data on the trading volume of BTC-coins for all time.

')

It turns out that even without the "little things", the Celestial Empire "owns" 88.25% of all trade operations.

And now - we recall the “Revolution in trust” and we see that mining in China is developed and very, very well.

Does this mean btc decentralization is a myth? I think yes. And in general, many people understand this: just look at the influence of news from China on the course of the pioneer crypto (you can read and see other factors here ).

Yes, and on other exchanges, speculation is simply a huge place.

For example:

Or - a little closer (not the whole period, but the last 2 years):

If you look more closely, you can see that the largest up-and-down jumps in price are accompanied by the same amount, that is, someone (the one who took the apple from Buratino) quickly buys up and quickly sells, earning on quite understandable and obvious even the pattern.

The only question is: “what is new here?”. In my third life, I saw more than once in my short life, and every time beautiful theories led to collapse — not just individuals, but entire nations (Iceland, Greece, Russia, Argentina ... you can list them for a long time).

Therefore, for me personally, as a person who believed in p2p-money long before they appeared on the Web, this is a very painful, unflattering, but still - a fact.

Criticism is criticism, but something must be done . In this case, as I see it, you can do the following:

Of course, the last point is the most difficult, but it seems to be a solution that was originally laid in Bitcoin, that is, independence from any centralized authority. Regardless - whether it is banks or someone (something) more.

Otherwise, we risk coming to the model when btc becomes another asset (has already become), which, thanks to the built-in mechanism, will be controlled by just one central bank, instead of the system that exists today (the Fed is the national Central Bank — local banks: see , for example, in the mini-lecture of G. Gref).

Of course, it will seem to someone that the questions raised in this article and others like it are not essential: for someone “the cue ball is just the cue ball”, that is, the “earnings” tool; it is simply not interesting to someone; someone bypasses it ... But there are those who believe and appreciate the idea embedded in this controversial, young and promising currency in its own way?

I think the last thing to think about is whether it is possible to achieve something else, doing the same thing as the great one said.

Perhaps, somewhere already there were interesting solutions to the problems described? I will be glad to links to materials.

PS For those who are interested in watching - the most beautiful "live" map .

All this is true (at least for the most part), but the whole question is that Bitcoin is not just a new trading tool. Stock trading: this is a cryptocurrency based on p2p technology.

“And what of that?” You ask me. But the fact is that per-to-per means "from person to person", but today Bitcoin involved in the "ordinary" process of speculation does not meet this requirement.

Here are the data on the trading volume of BTC-coins for all time.

')

It turns out that even without the "little things", the Celestial Empire "owns" 88.25% of all trade operations.

And now - we recall the “Revolution in trust” and we see that mining in China is developed and very, very well.

Does this mean btc decentralization is a myth? I think yes. And in general, many people understand this: just look at the influence of news from China on the course of the pioneer crypto (you can read and see other factors here ).

Yes, and on other exchanges, speculation is simply a huge place.

For example:

Or - a little closer (not the whole period, but the last 2 years):

If you look more closely, you can see that the largest up-and-down jumps in price are accompanied by the same amount, that is, someone (the one who took the apple from Buratino) quickly buys up and quickly sells, earning on quite understandable and obvious even the pattern.

The only question is: “what is new here?”. In my third life, I saw more than once in my short life, and every time beautiful theories led to collapse — not just individuals, but entire nations (Iceland, Greece, Russia, Argentina ... you can list them for a long time).

Therefore, for me personally, as a person who believed in p2p-money long before they appeared on the Web, this is a very painful, unflattering, but still - a fact.

Criticism is criticism, but something must be done . In this case, as I see it, you can do the following:

- Take for granted that decentralization is (already) not about Bitcoin. And many did, switching to altcoins of all stripes. But the essence of the problem still remains: speculation does not disappear with the change of names.

- Identify the main patterns of speculation and develop a protective mechanism against their harmful influence (for example, Bitcoin is already endowed with the first such - protection against inflation, which, however, is not devoid of flaws).

- Focusing on building a self-sufficient economy “in the style of p2p”, which should differ from the current global model fundamentally.

Of course, the last point is the most difficult, but it seems to be a solution that was originally laid in Bitcoin, that is, independence from any centralized authority. Regardless - whether it is banks or someone (something) more.

Otherwise, we risk coming to the model when btc becomes another asset (has already become), which, thanks to the built-in mechanism, will be controlled by just one central bank, instead of the system that exists today (the Fed is the national Central Bank — local banks: see , for example, in the mini-lecture of G. Gref).

Of course, it will seem to someone that the questions raised in this article and others like it are not essential: for someone “the cue ball is just the cue ball”, that is, the “earnings” tool; it is simply not interesting to someone; someone bypasses it ... But there are those who believe and appreciate the idea embedded in this controversial, young and promising currency in its own way?

I think the last thing to think about is whether it is possible to achieve something else, doing the same thing as the great one said.

Perhaps, somewhere already there were interesting solutions to the problems described? I will be glad to links to materials.

PS For those who are interested in watching - the most beautiful "live" map .

Source: https://habr.com/ru/post/323362/

All Articles