How did a smartphone become a payment device? About the Mastercard Tokenization Platform

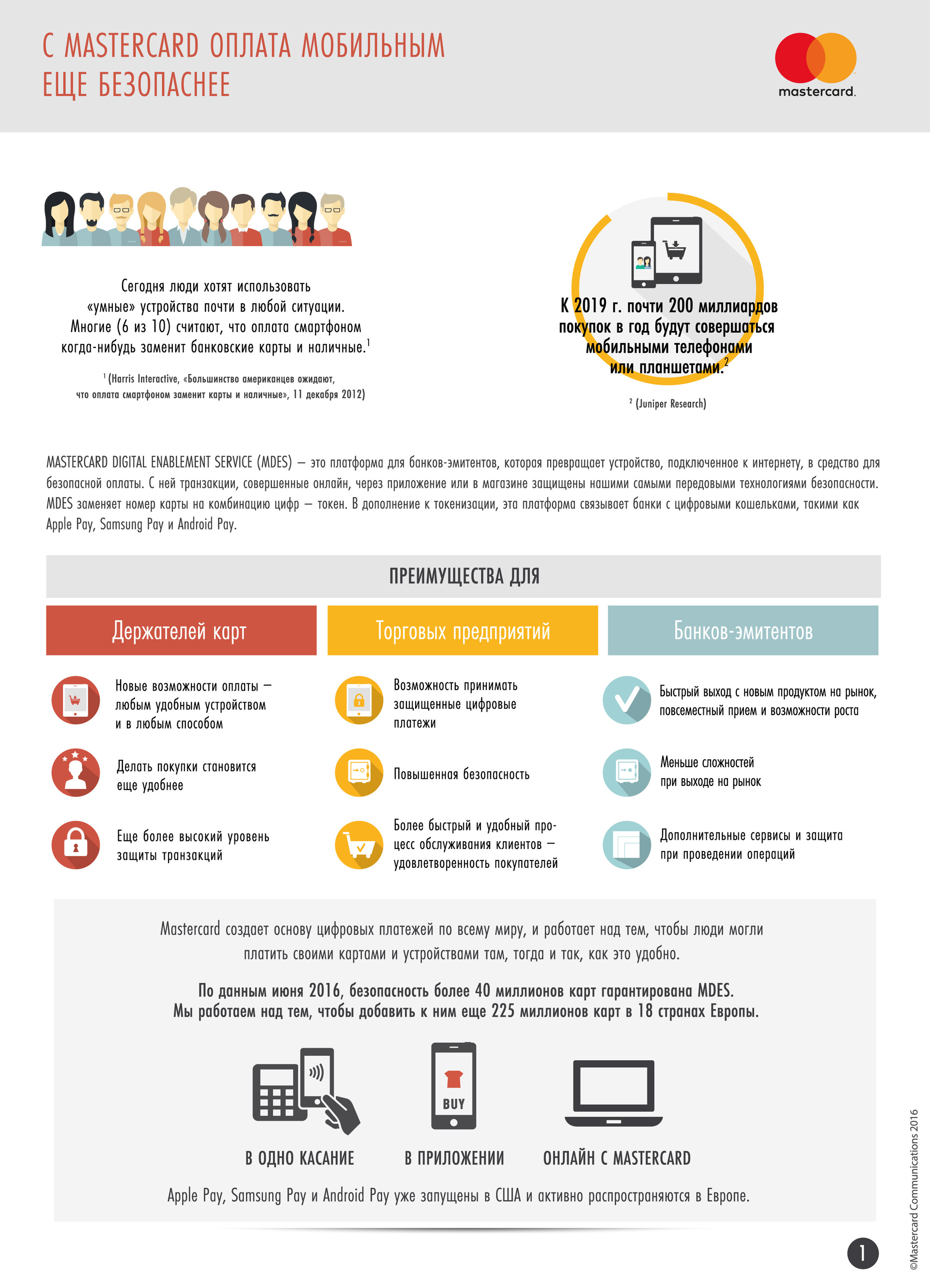

Mastercard was the first in Russia to provide cardholders the opportunity to use Apple Pay and Samsung Pay. The payment system was the first to launch its tokenization platform in this market - Mastercard Digital Enablement Service (MDES) turns the device connected to the Internet into a means for secure payment, it is with this service that world wallets work. How the smartphone has become an alternative to a plastic card, and how technologies have developed that ensure security when paying with a mobile phone - read this post.

One-touch payment as a driver for digital payment development

The creation of contactless payment technology Mastercard (formerly Mastercard PayPass) can be considered a turning point in the development of electronic payments. This happened in 2002: with the new technology, the payment process went beyond the usual plastic form factor - now you can pay with a key ring, wrist watch, mobile phone, sticker, etc.

')

In Russia, contactless technology appeared 8 years ago, and since then the number of cards issued on various (contactless) form factors has also been steadily increasing, as well as the network accepting this payment method.

Today, one touch can be paid off in 6 million outlets in 77 countries of the world, including 42 European states. Within three years, all POS terminals in Europe (including Russia) will accept contactless payment. And this means that you can always pay by phone, clock or jewelry. No, do not give them as payment, but just bring them to the reader!

In addition, Russia has become one of the first and few countries in which 3 main technologies are available with Mastercard for downloading contactless cards to NFC smartphones. Thanks to the Mastercard contactless technology, it is now possible to release a mobile card both on a SIM card (using SIM-centric technology), and on an embedded phone chip (embedded Secure Element), and in the “cloud” (with Host Card Emulation technology).

Russia's first project in the field of mobile contactless payment based on SIM-centric NFC was launched in 2012, and it was launched by Mastercard together with MTS. The user had to go to the point of sale of the mobile operator and replace his regular SIM card with a special, supporting contactless payment function, with a Mastercard card already recorded on it. So NFC phone turned into a means of payment.

Later, a number of projects were launched in this area with the largest communication services operators, mobile device manufacturers and banks.

In 2013, for the first time in Russia, Mastercard, Tinkoff Bank and CardsMobile (i-Free group) launched a full-featured service for remote downloading of contactless Mastercard cards into the Wallet mobile app for a number of HTC, Sony and Philips smartphones with an integrated NFC chip.

In July 2015, an updated version of the Wallet app by Cards Mobile and the Alfa Touch app from Alfa Bank and BPC became available for download on Google Play. The HCE technology and the Mastercard Cloud Based Payments specification have significantly increased the base of supported devices to dozens of models of popular manufacturers and expanded opportunities for new developers and banks.

Developing digital solutions and offering Mastercard cardholders all the new convenient payment methods, Mastercard provides a high level of transaction security. An important step was the service tokenization.

Tokenization for secure payment

The launch of Apple Pay in the Russian market has become possible due to the introduction of tokenization. This technology provides a high level of convenience when releasing card products to mobile NFC devices and the maximum level of security when paying through electronic wallets, for example, Apple Pay and Samsung Pay.

The MDES tokenization platform was first introduced by Mastercard in 2013 and became the basis for further developments in the field of efficient and secure digital payments.

In 2014, Apple Pay was launched in the United States using this platform. Today, MDES guarantees security for more than 40 million cards, and Mastercard is working to add 225 million cards to them in 18 countries around the world, allowing users to pay there, then and in the way that is convenient.

What is tokenization? This is the replacement of the main card account number (PAN) with a 16-digit combination of numbers (token). It is tied inside the Mastercard network to a bank card number. In this case, the token is unique for each of the connected devices.

When making a payment, Mastercard will transform the token into a card number so that the bank is sure that the holder makes the payment. When paying, the token is sent to the seller. When a sales outlet sends data to the bank to authorize a payment, Mastercard checks whether the token is valid and whether it came from the device it is attached to.

Token allows you to hide the actual data of a bank card and ensure the maximum level of transaction security. The buyer can be sure that all data is securely protected.

Additional security is provided by cryptography and biometrics, which create another milestone that ensures the safety of your money. Biometric protection of modern mobile gadgets and the possibility of guaranteed blocking or destruction of data when you lose your smartphone is another milestone that ensures the safety of your money.

MDES for all

Mastercard tried to make working with MDES as simple as possible not only for users, but also for partners - banks and technology companies.

To give customers the opportunity to pay for purchases with a smartphone, the bank does not have to connect to Apple Pay, Samsung Pay or any other wallet. The bank simply needs to connect to the MDES platform and add the corresponding functions to its own mobile application.

Now a person at a retail outlet, physical or online, can pay using existing mobile applications to which credit cards are attached. Mastercard, on the other hand, allows banks - not as a replacement, but as an addition - to do everything the same, but in their wallet, in their application.

Thus, a digital wallet, mobile bank or online bank becomes the same means of payment as a bank card. Only instead of "plastic" - a favorite gadget and biometric authorization.

Ease of implementation

Russian partners of Mastercard noted that the implementation of MDES was one of the fastest in their practice. From a technical point of view, the bank or the electronic money service only needs to certify the platform. The rest, in essence, is organizational issues.

The only thing that differs for the bank in the process of authorization and clearing is the intervention of the so-called “MDES loop” on the side of the payment system, which tokens payment and compares the token during the transaction. Nothing conceptual inside the IT-kitchen of the bank does not change due to the fact that when paying by the phone tokenization occurs. There are certain settings associated with reporting and other nuances, but the principle of transaction processing remains the same. Simple, transparent and efficient.

Simplify authorization

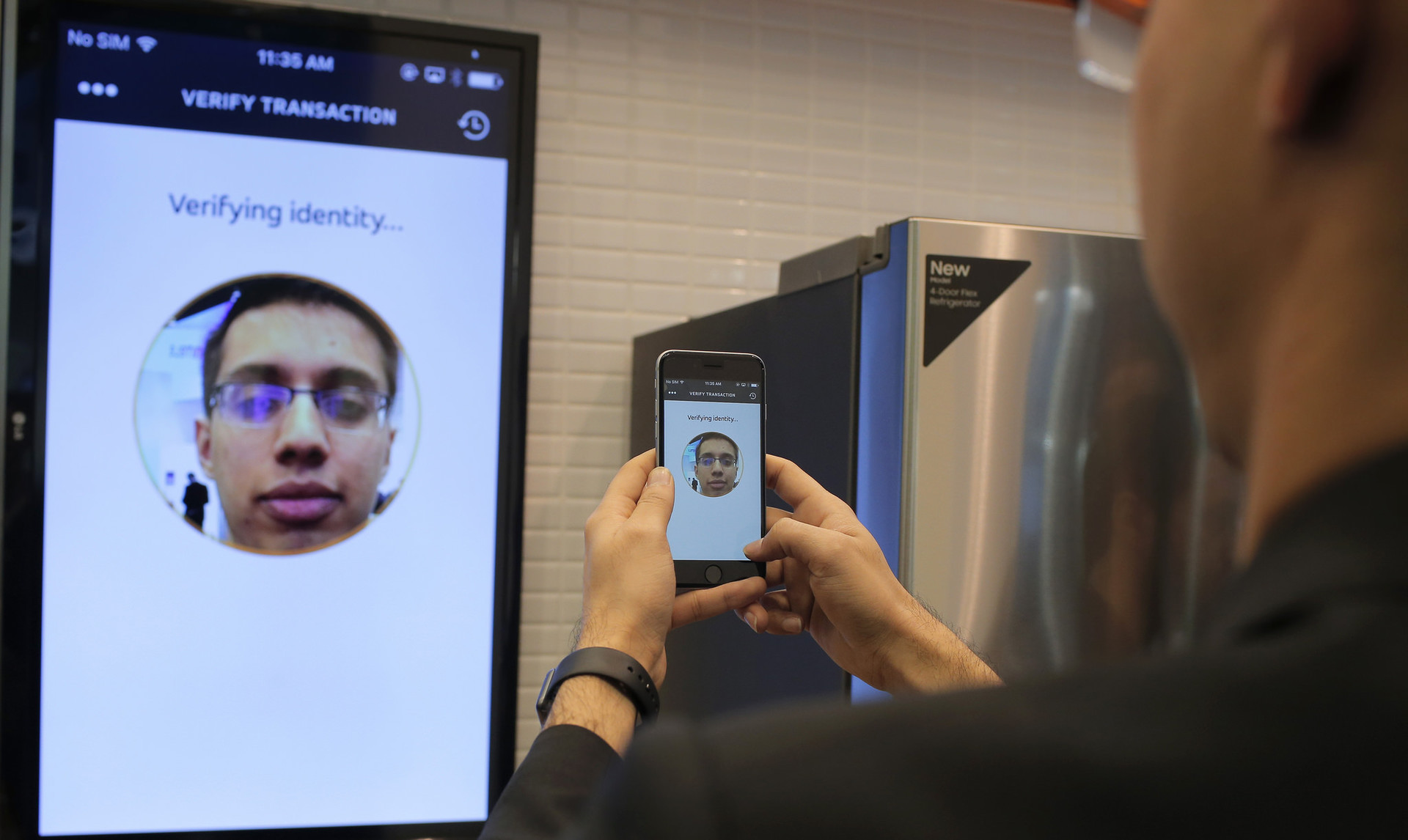

Mastercard is constantly developing new payment confirmation standards and developing the concept of online payments that do not require password input and will replace the 3D Secure protocol. To further simplify the identification of the buyer in online shopping and confirmation of payment by a contactless device, Mastercard has developed a service with which this process takes place with the help of what is always at hand.

The new payment application Identity Check Mobile uses biometric data - fingerprint and face recognition - for online purchases. Paying with a selfie has become a reality! Pilot projects with ID Check are already running in 12 countries. In 2017, this solution will be distributed worldwide. In 2017, this decision is planned to be distributed worldwide.

The idea of confirming a person with a selfie was laughed at before, but the technology works great. To begin with, you will need to download the appropriate application and take a selfie, but not just a photo, but a small video. You need to blink to confirm that there is a live person in front of the camera - the card holder and the device owner.

Mastercard technologies accelerate the development of online shopping, making it even more convenient. Thanks to innovations, the number of people actively shopping on the Internet is constantly growing: ten years ago there were about ten million around the world, and this year three billion people bought something at the online store for once. Simplicity and convenience of payment for each of them - at the forefront.

The pace of digital payments

Moore's law is probably, in one form or another, reflected in almost any human activity, and here, though not directly, it affects how life changes.

The magnetic stripe appeared on the cards in 1972, and protection using a chip became common only thirty years later. MDES platform two years ago did not exist at all! Biometric identification in the form of ID Check a year and a half ago caused ironic comments and smiles at technology exhibitions, and today it is brought to life. And ID Check does have the ability to change how you pay for purchases. Not only fingerprint sensors, but also iris scanners have begun to appear in the phones.

The rapid pace of development of means of payment will find its response in the lives of ordinary citizens (despite the very clear separation of users into “early followers” and skeptical conservatives) and in the development of small business, which is considered one of the drivers of commercial development.

Source: https://habr.com/ru/post/321410/

All Articles