Trends 2016 and 2017 in the Japanese mobile industry

Nintendo and PvP, monetization through Gacha and card games, pokemon bait and online gaming services market - this is how you can briefly describe the mobile application market in Japan. Last year, its revenues reached $ 12.4 billion , making the country the third largest global application market. Many Japanese trends are moving to Western countries in a few years, so we decided to translate an article from Motoi Okamoto 's blog about Japanese trends and forecasts.

1. The success of Nintendo and Sony

2016 will be remembered for an unprecedented rise in popularity in the gaming market of two console platforms - Nintendo and Sony.

')

In 2016, two super-successful games were launched: Niantic's Pokémon Go and Nintendo's Super Mario Run . Pokémon Go was downloaded 500 million times in 8 weeks, and Super Mario Run - 40 million times in 4 days. Both records are impressive. In addition, Nintendo plans to release Animal Crossing and Fire Emblem for smartphones this spring. In Super Mario Run there were problems with monetization: it remains to be hoped that the two future releases will have a more balanced sales model.

Another console giant, Sony (Sony Interactive Entertainment), launched its Forward Works subsidiary in April 2016, which plans to focus on the Japanese mobile market. In addition, they presented several new titles at the December press conference: Hot Shots Golf , Wild Arms and Arc the Lad .

It is worth remembering about Aniplex, a division of Sony Music Entertainment Japan, which deals with music and anime. Have you heard of the Fate / Grand Order ? Last year, this mobile RPG hit the top 3 in revenue growth in Japan, right after Pokémon Go. Among other advantages, it has an excellent design - a sort of mix of JRPG and visual novel.

According to an AppAnnie report, Pokémon Go earned $ 950 million last year. Impressive, yes? Look at this monthly rating (the sum of revenues from iOS and Android): Fip / Grand Order from Aniplex surpassed Pokémon Go and became the fourth in December 2016.

Monthly ranking by revenue growth from AppAnnie

2. PvP is more popular

For a long time, the Japanese industry believed that Japanese online gamers prefer co-op games, rather than PvP. However, in 2016, several brilliant PvPs were released: the Clash Royale strategy, the Shadowverse card and the Yu-Gi-Oh! as well as Shiro-Neko Tennis . Like Mario Tennis, based on the world of Super Mario Bros, Shiro-Neko Tennis is a sports simulator based on the world of Colopl Rune Story (action-RPG). It's all simple: the popular characters in Colopl Rune Story in Japan play tennis.

Shiro-Neko Tennis by Colopl

Of course, new local trends are largely influenced by world stars like Clash Royale or Hearthstone, and their example shows how successful Western and Asian PvP games can become in Japan. However, if these games are aimed at long-term success, then it is important for them to support their loyal regular users and at the same time work with those who avoid PvP because they are afraid of losing.

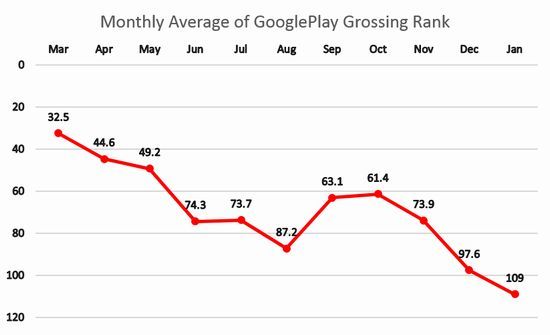

If you look at the average monthly rating of Clash Royale in Google Play in Japan, you will notice how it gradually decreases. We did not do a detailed analysis of it, but it is obvious that maintaining the balance of a PvP game in Japan is very difficult.

Source: data from AndroDB

This graph is based on data from AndroDB. The average monthly rating is based on Google Play daily ratings. The January rating is calculated on the basis of data received before January 21.

3. The success of digital card games

As mentioned above, card games are a huge success in the Japanese market. This situation is reminiscent of the 90s, when, under the influence of the success of Magic the Gathering , Yu-Gi-Oh! and Pokémon, which in turn have become popular around the world.

Here are 3 main reasons for the success of digital card games in 2016:

- Many teenagers who went crazy with such games in the 90s grew up, but did not stop playing.

- Approximately 5 years ago, in the golden era of Mobage and the Gree, publishers released hundreds of card games, following the example of Konami's super-successful Dragon Collection . Today, these games are the basis for many developers.

- Many beautiful artists and studios create beautiful characters and monsters for new stories.

4. RPG in super-competition

RPG is a super popular genre in Japan. They generate high ARPU and sell well, and as a result, competition in the genre becomes very high. The cost of development and advertising is growing, and games that are not associated with popular franchises become more difficult to conquer the market. Combat systems are complicated to the level of RPG on PS4 and PS VITA. The presentations of the games are amazing with the launch videos, full voice acting, detailed 3D battles and history. And although many Japanese gamers are hungry for new games in the first month after release, they, having appreciated the gameplay, quickly get bored and move on to the next updates.

5. Growth in the number of Asian publishers

Japanese developers occupy most of the local gaming market, because Japanese gamers have certain preferences and are not easy to match. That is why the country is considered a very closed market.

However, the number of successful stories from foreign developers is gradually increasing. Last year, Korean and Chinese publishers released several popular games like Seven Knights (Netmarble), THE KING OF FIGHTERS '98UM OL (OURPALM) and HIT (Nexon).

In general, when entering the Japanese market, it is very important to pay attention to the characters and their presentation: drawing and voice are especially important, and Asian developers have recently learned how to cope with it.

Seven Knights Games, THE KING OF FIGHTERS'98 UM OL and HIT

6. A variety of monetization strategies

Usually, Japanese mobile free-to-play games that are monetized through the Gacha-model show new game items every couple of weeks or once a month. Such a frequency of updates complicates the management of the game balance and inflates the rotation of objects in the game. Things quickly become obsolete, lose their effectiveness, and the period when the user is ready to pay into the game is shortened. This is a problem that many long-lived games meet. On the other hand, in digital card games, new products are launched every 3 months, and this is enough time to debug the game balance.

Pokémon Go has demonstrated new ways to monetize - an incubator eggs , "happy" eggs , Lure-module and bait . The incredible success of the game surprised and inspired Japanese developers, who had previously preferred the Gacha model. Although geolocation-based games have appeared in Japan in dozens since the early 2000s, their ARPU was low and the developers chose the proven high-yield Gacha.

Super Mario Run is a bold attempt to monetize using the free-to-start model. It is difficult to say whether the result is in line with expectations, but some experts consider it a good way to make money in the late majority in the Japanese mobile market.

7. Services for online games.

In Japan, companies such as Mynet , funplex, and others specializing in online gaming services are rapidly developing. They do not develop games, but buy them from other companies, refine the quality and receive a higher income.

These companies avoid unpredictability in which you won’t understand, the game will soar or fail. On the other hand, developers get their percentage of sales and can fully devote themselves to developing new titles.

Revenues of most online games fall over time. When earnings cease to cover maintenance costs, developers close the project. However, if, instead, you can sell the game to a company specializing in servicing, the project will continue to live and users will still be able to play.

In recent years, the number of purchases and sales of online games has grown rapidly, and this market has become known as secondary in the industry. Now several new companies are entering it, and Mynet and funplex (GREE subsidiaries) are experiencing serious growth.

Conclusion

All the above trends will continue in 2017, which means that foreign companies have more chances to enter the Japanese market. Finally, I will say only that the segment of games for women should also grow sharply.

Source: https://habr.com/ru/post/320908/

All Articles