Experience using Samsung Pay

Hi Habr, I haven’t published anything for a long time, so I’ll start with a little note of my everyday experience using Samsung Pay. In the end, besides being an expert at ChronoPay, I am also the average buyer. I am not a fan of Apple technology, but in their system the principle is the same as that of Samsung - and in my opinion both systems have one decisive flaw that cannot be eliminated yet.

And so, contactless payment technologies based on NFC technology have appeared a long time ago. There were a number of applications still under the old Samsung'i, allowing to issue virtual cards and use them.

It was all very uncomfortable - first enter the pin on the phone, launch the application, enter the pin in the application. Already 100 times it was possible to get a card and pay. Now it’s enough to lift a finger (fingerprint scan) and the system works. Although I still don’t see much difference in getting a card or phone.

')

Samsung, like Apple, took the path of separation of the interchange fee - so they support those issuers with whom they have already agreed. By the way, it is quite convenient, you no longer need to issue any virtual cards, you simply photograph your card and verify it with SMS. I added the Alfa-Bank card without any problems, but VTB24 could not.

If you don’t go into the generation of different tokens and work technology, then the only plus for me is that now nobody will copy my card. Although the process of targeting the phone by the radiating side to the terminal sometimes represents a whole epic - the card does not want to be read. And I don’t believe in the technology of reproducing a magnetic strip on a map - it is old and highly risky from the point of view of a friendly fraud.

Actually, no revolution happened here. Just the phone manufacturers wanted to get a piece of the same interchange that banks receive. But I was always embarrassed by the fact that bringing a card or inserting it into the terminal you never control the progress of the payment - and if the cashier was wrong, and you instead of 1 thousand rubles will write 100 thousand? Confirmation of payment transactions a few years ago was implemented, even in dying electronic money systems.

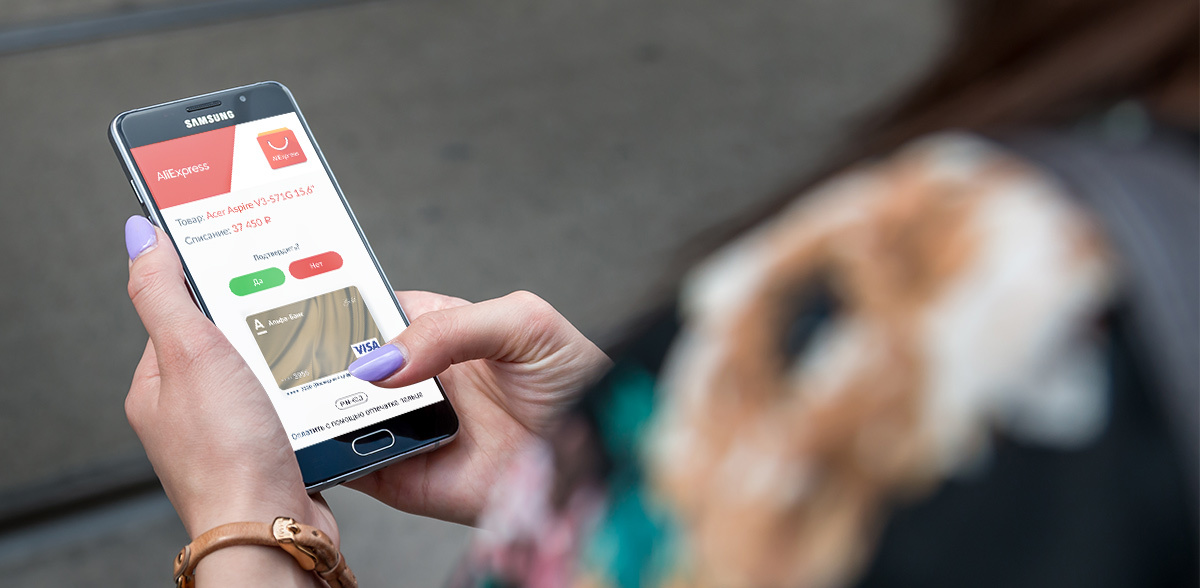

This question will not wait from Samsung / Apple Pay:

Why hasn't Visa / MasterCard done this yet? After all, it would be much more convenient not to pay with a smartphone, but to confirm every operation from a smartphone — then a smartphone would really become a real wallet. You do not post the entire contents of your wallet to the cashier, so that he himself counted out the required amount?

The main reason for restraining this development is not the presence of the Internet or retail objections, that such behavior will greatly reduce the capacity at the cash register (while the card holder will look for his phone and press something there). But concerning the latter, we can safely suggest, for example, Magnit chain stores begin to train their cashiers - that the tape needs to be disassembled, starting not from oneself, but from the buyer, in order to make room for the next buyer.

No, the main reason lies in the rules of the IPU (Visa / MasterCard), and the PS MIR rules copied from them. It turns out the IPU penalizes issuers for exceeding the authorization operation interval. Those. if the issuer constantly responds to authorization requests (payment authorization) for more than 10-15 seconds, he will receive a decent penalty from the IPU.

I wonder how much this technology could reduce the amount of card fraud? Although it is more interesting, is it necessary for our issuers? I think from their point of view it is much more interesting to just sell insurance against fraud and not bother with unnecessary questions.

Source: https://habr.com/ru/post/320894/

All Articles