Entry into international markets: attracting investment abroad

Another material on the results of the Russian Startups Go Global conference about the entry of start-ups into the international market is about the main mistakes made by the founders in communicating with foreign investors and obstacles in obtaining investments. We share the recommendations of the representative of the venture market and the stories of the founders with the experience of attracting investment abroad.

Dmitry Kalaev, Director of the Accelerator of the IIDF: “What prevents start-ups from attracting investments from business angels and US venture funds”

')

“There are several main obstacles that confront Russian (and not only) teams in the process of communicating with the American investor.

1. Competition

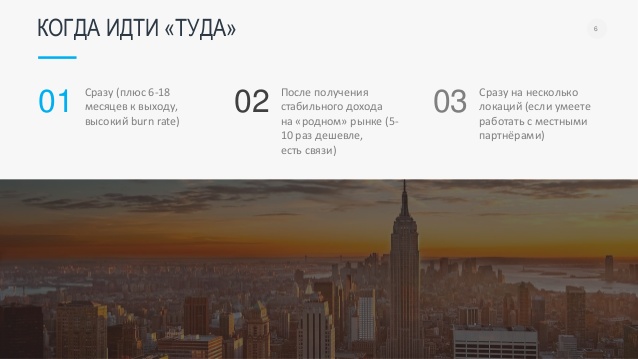

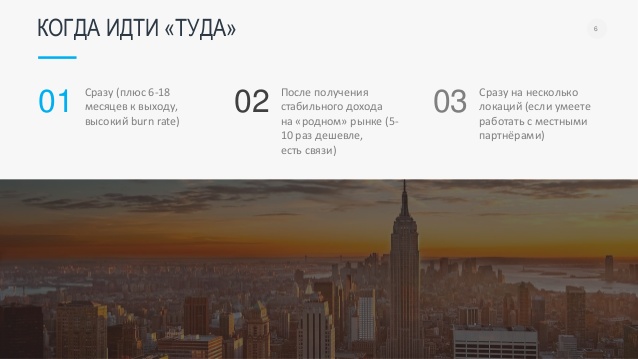

More money - more contenders for the money: the whole world comes to the United States. Therefore, attracting investments often begin in their own country: it is easier and faster to do this. While you are trying to raise money in the United States, you can manage to do it in Russia and reach the break-even point. Then the position of the founders when attracting the next round will increase significantly.

If you start a business and look for an investor immediately in the USA - a high burn rate of the team increases the risk of “not surviving.” On the contrary, if you start with a stable income in the “native” market, it is cheaper to enter the market of another country, and communications acquired in your country can help with attracting investment abroad.

2. Team location

This affects primarily the attitude towards the start-up of business angels: early on, angels make “human” decisions. They want to see the founder and the team. A business angel, most likely, will not give money to the team, with which he will not be able to meet when he wants. In his location, many teams applying for investment, he can invest in any of them. Representatives of venture funds when entering the market of their country often have a question about the visa for the founders. But the location of the team or its part as a whole is not so important in the later stages.

3. Lack of recommendations and good reputation

If you look at the volume of investment in California, you will see that 80% of the invested companies were founded by graduates of two universities: Berkeley and Stanford. In addition to high places in the ranking of universities in the world, both schools are in the Bay area , so their graduates are more likely to be among business angels. A graduate of Moscow State University for US business angels is a set of letters: the quality of education of this graduate is unknown, and the reputational ties with him do not overlap. At the level of angels, it is difficult to raise money if you do not have recommendations from your friends.

Most investors get pipeline deals from their social contacts. For an investor, it is important to make money - and avoid the withdrawal of money and intellectual property, a strong blurring of shares and other unpleasant investor outcomes. This is a matter of trust, which professional investors - venture funds - pay special attention to. For them, it is important to know the team feedback from other investors and partners. Therefore, FRIA is developing a network of business contacts with foreign funds. We bring our portfolio company to the investor in the local market and offer to look at it as a potential investment. If the investor is interested - do an intro.

4. Demand is not confirmed by anything.

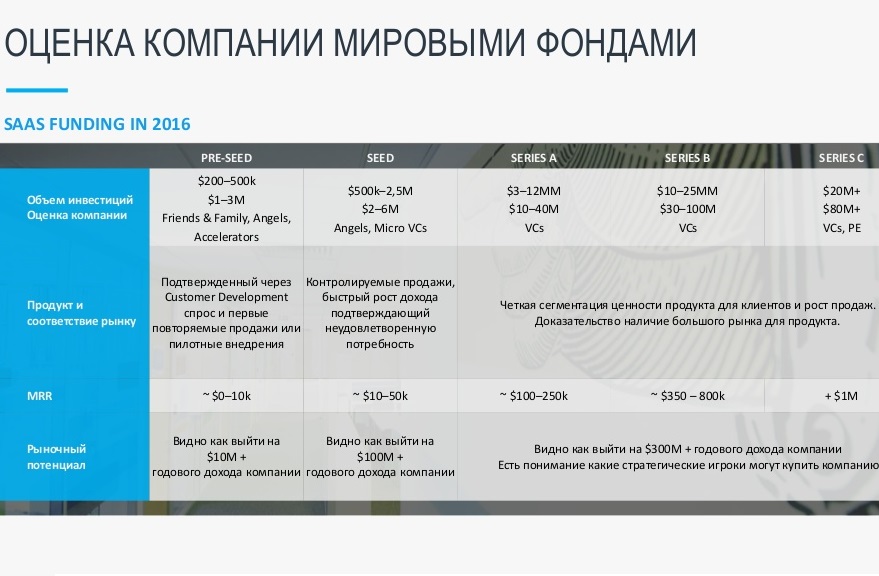

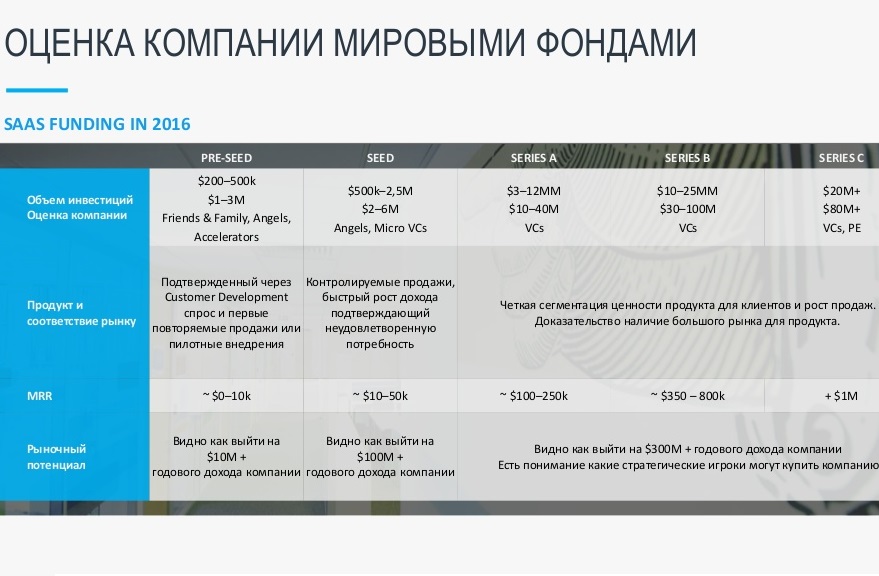

At the pre-seed stage, angels and accelerators like 500 Startups expect that your turnover is already approaching $ 10 thousand a month. Of course, they can invest at zero revenue, but they are guided by companies with a turnover - whose demand is confirmed by at least first sales. When demand is not confirmed by anything - people do not want to invest. Without first sales, it is difficult to show the investor how the company will manage to achieve a significant turnover, depending on the stage of investment.

At the pre-seed stage, the investor must believe that the company can reach a turnover of $ 10 million (pay attention to the label). At the next stage, in order to raise $ 1-2 million, the company must convince the investor that its turnover will grow to $ 100 million. A lot more money - either go into $ 300 million turnover, or understand which market players can buy a company by a similar estimate.

5. No revenue or explosive growth.

At a later stage (rounds A, B, C) representatives of the venture fund may not look at the location of the team, but the company must have income of $ 1 million per year. The decision made by late-stage venture capital funds is more pragmatic and based on money. Of course, Prisma and MSQRD are beyond the scope of this story - in a month they grow from zero to tens of millions of users. Market laws do not affect startups with phenomenal traction . Unfortunately, most companies do not have such explosive growth. ”

Daniil Brodovic, CEO of Cookstream and CPO Just: “Start-up contests and demodni as a way to attract investment”

TalkToChef / Cookstream raised $ 200,000 from angels and accelerators. A graduate of Startup Next and Accelerators Founders Space, Society3 and Start-Up Chile.

“Our startup was born on the Startup weekend in San Francisco at the end of 2012 (pictured above). Having won the competition, we received the first attention of investors. Learn Capital Foundation became interested in Cookstream prototype. There were several nuances: they were interested in education (our cooking lessons generally fit into this profile), and they were ready to invest, but since Cookstream was almost at the idea stage, almost half of the company had to be paid for the proposed $ 300,000. We conferred with the team and thought: “We worked for some three days at the competition, and our company is already valued at a million dollars. What will happen when we work a month or two? ” But contrary to expectations, there were no golden mountains. When, after 3 months of work, the money began to run out, and the working product was still far away, we regretted the refusal. But perhaps it was for the better - we still have a large stake in the company and freedom to make decisions. To solve the problem of financing, we applied to all possible accelerators, knocked on 500 Startups, told about the global vision of the product, about all the expected functions. Basically, we were politely answered, "Guys, everything is fine, but we'll talk later when you have a traction."

We were saved from failure by focusing on one function of our product, as I mentioned in the previous article . Having thrown out our developments and renamed the product to Talktochef, we once again walked around investors and accelerators. The focus on the hotline function helped us sell investors a vision of our company's future strategy: we have a hotline to consult with cooks, then we will make a hotline with lawyers, doctors. Despite the niche market of culinary consultations, we were able to attract two thousand chefs of experts who worked with us, we had seven thousand requests per month.

I got acquainted with the first angel investor at Startup Weekend - at first he was our mentor: he helped me with advice, introduced me to useful people: he had experience in working and investing in online education. After six months of development, we needed financial support for the further development of the product, and he wrote the first check for $ 10 thousand, which we had enough for an application for IOS. Another $ 150 thousand were given to us by other angel investors, one of them was a professional investor in real estate, who recently began to invest in startups, about 20 startups per year. We met him at the pitch day after the end of the accelerator Society3 - there we also took first place. A month later, several personal meetings and exchange of documents, we signed a contract and received money for the account. We also raised $ 40,000 from Startup Chile, an accelerator in Latin America. American accelerators did not give investments, but they helped with bonuses in the form of free hosting on amazon.com, legal incorporation services, and educational services. For this, some of them also took a small share in the company.

The Russian roots of our company were a rather serious barrier - none of the founders had either citizenship or a Green card, and the question always arose when dealing with investors. This prevented getting into the accelerators 500 Startups, Techstars. We reached the final / pre-final stage and were rejected after the question "On what grounds are you in the USA." At that time, the absence of a long-term visa or Green Card was a serious problem, but over the past couple of years, many accelerators have changed their attitude about foreign founders and now international teams are much more likely to accept. As a result, we found a way that allows us to remain safely in the States without the threat of deportation: we continue to work there on a long-term H1B visa. After a year of work, our company issued a work visa to all American employees, this is not against the law. Investors are satisfied.

Due to the fact that we found investors at public events, we did not need personal recommendations, but in general, to continue to communicate with other investors and raise new funds, the recommendation is probably the only working tool when meeting new people. Speeches on the pitch day at the end of the acceleration program - this is the recommendation from the accelerator, and winning the competition is the recommendation of the judges. And in our case, the most successful way to attract investment was a victory at a start-up competition or at demodny after the end of the accelerator. ”

Mike Melanin, co-founder of Statsbot: "8 mistakes that we made in the process of attracting investment in the US"

Statsbot is an analytical bot with 25,000 b2b users that recently invested $ 1.9 million in investments from 500 Startups, Eniac Ventures, Betaworks, the Eric Schmidt Foundation Innovation Endeavors and Slack. Graduates of accelerators 500 Startups and Betaworks Botcamp.

“We co-founded Statsbot with startups together a year and a half ago, the last six months of which we lived between San Francisco and New York, and torn between the 500 Startups and Betaworks Botcamp acceleration programs. Accelerator Betaworks Botcamp invested $ 200 thousand in a startup in exchange for 8% in the project, and 500 Startups invested $ 125 thousand for a share of 5%. Eniac Ventures, the Eric Schmidt Foundation Innovation Endeavors and Slack, have joined the deal - so the total investment has increased to $ 1.9 million less than a year after the company was founded. We did this not immediately, having made some typical mistakes in the process for the startup:

Konstantin Dubinin, CountBOX founder: "Attracting investments is the same sale, but of a different product and another category of buyers."

CountBox at the moment - b2b, offices in Moscow, Chicago and Dublin and representatives around the world, revenue of about 50 million rubles for 2015. Attracted investments totaling € 800 thousand, the company is estimated at € 4 million.

“We have been working since 2008, the staff has grown organically to 15 people. By 2010, I made money in this business and wanted to do something more meaningful. While studying at the Higher School of Economics on the MBA program, I realized that for this I need to build a large company. There they explained to me the strength of attracted investments for business development - this is a lever that increases the growth potential of the company. Since the end of 2013, I began to go through the funds. There were many meetings, but it did not go further. There were several reasons for this:

1. Patriotism of foreign investors

A US or German investor is unlikely to finance a company that will make money in another country. A foreign investor most often wants money to work for the economy of his country. In addition, it is logical to attract an investor with an expertise in this field to enter the country's market.

2. Lack of understanding of your customer and exit strategy

We did not work with American investors primarily because at that time we were not ready. The investor does not try to invent tricky questions, he asks about fairly simple things, for example: “How do you think that a million people will buy your product for so much money?”. Each figure must be confirmed by data with links to sources. 2-3 errors in numbers - this is not a business plan, but a prediction of the weather. Well, the main thing is the confirmation of the potential of the product for an investor - when residents of the country “vote with a ruble”. Only sales or pre-orders confirm the hypothesis that customers will buy a product in this country. Therefore, before raising money for development in the United States or Europe, it is always better to first go and sell the product to customers, having received confirmation in money. Especially in the USA, where everyone verbally admires your product. If there is not enough money to develop a b2c product, kickstarter will help and collect money for pre-orders. In b2b - you can offer corporations to make an advance as a confirmation of interest in the product.

Attracting investment - the same sale, but for a large amount of another product and another category of buyers. When a company manages to sell its usual product in a country where it has neither technical support nor an office, one can also think about attracting investments.

3. The lack of traction in the country where you attract investment

There is a dogma that a Russian bachelor’s degree or MBA in a foreign labor market can be equated to a lack of education. I can say with confidence: millions of dollars in revenue in Russia in the process of attracting investments also mean nothing to American and European investors. Successes in Russia in profit and performance were equal to zero and were not counted. For investors, it was an empty place, they looked at the potential, the product, the adequacy, the team, the traction.

A year later, I can state with full responsibility that investors are absolutely right: whatever you do in Russia, this means nothing in the market of Europe and North America. It seems that here everything is the same, but with some other accent - and the devil is in the details. The fact that I had success in Russia had absolutely no success abroad. A sick example: in developing countries like Russia, cold calls work as a sales channel. I tested the product hypothesis last summer - I chose one of the largest private banks in Russia to test my cold call skills and make a deal. After a week and a half, I was sitting at a meeting with the deputy chairman of the bank and three departmental directors. With this approach to sales, I came to the USA, hired bison sales with my own customer base, which had been working in this market for 25 years, of which 9 years in a competitor company, and a professional in the b2b field. We spent 800 hours - the cost of these man-hours and together with the preparation time was about $ 50 thousand. I burned the money - it turned out that they don’t buy it that way.

Without traction and sales experience in the country’s market it is very easy to burn investments. Under the English-speaking world, the product had to be almost completely redone: there were a lot of new requirements from customers, small cultural differences. It is worthwhile to dwell on them separately.

Cultural features: New York - Silicon Valley - Europe

The main difference between the residents of New York and the surrounding area and Silicon Valley reflects the phrase of the first: "we slam money while in the Silicon Valley doing the next big thing." When you tell a New York investor about your product, you need to be prepared, that at any moment he will say, “Stop, I'm not interested, goodbye.” Or vice versa: "stop, I buy." This is a business approach in everything, the desire to earn and time is worth its weight in gold.

In Silicon Valley, everyone will listen to the fountainer, will admire the product, will nasulit the golden mountains. Founder will come out of the meeting happy and inspired, although it’s far from the fact that after this meeting someone will buy or invest in the product. No one in the face will criticize an idea or a product, and if this is not a profile area for an investor, he may recommend someone to whom it may be interesting. Silicon Valley - about networking, communication, friendship, recommendations. Everyone who met on the path of the founder, will try to help and recommend the right person. They say, "to attract investment in Silicon Valley, we must go there for a year." This is the period for which a person will have the required number of links.

The culture of Europe is similar to the culture of the Valley: Europeans are also open, they can bring them together, they can introduce them. Although in each of the countries of Europe has its own nuances. For example, if in Russia I was late for a meeting by 15 minutes, this is normal. In Germany, this is an automatic loss of 70% chance of success. In England, the founder is obliged to speak good English, to strictly follow the schedule of the meeting, to perform all sorts of open and secret protocols. In England, there is a generally accepted procedure for entering into a partnership. You can not come and sell technology at the first meeting, it does not work. First meeting-acquaintance, then the first sale of the product, then a trip to customers to see how the product works, then feedback, and so on. Whole process. This must be taken into account.

From my own experience

I spent two years to attract the first investment. As a result, it was possible to conclude the first deal for € 550,000 after the opening of an office in Chicago, and this was not a US investor, but a Russian one, but with a European legal entity. the face. We attracted him through the StartTrack investment site. Investors flew to our American office, looked at how we work there, whether we really have employees at this office, how many clients we have in the US sales funnel and at what stage.

In 2015, they began to communicate with representatives of the Irish State Agency for Business Development and Support (Enterprise Ireland). How it happened: I knocked on all relevant and non-core organizations associated with investors. So I went to the organizer of venture fairs in Kazan, showed perseverance, in the end we were given a stand at the fair, paid for tickets. For our part, we prepared, without exaggeration, almost the best of all participants: we brought the finished product, the screen, customers, prepared brochures. The Irish noticed us, and in the process of informal communication after the event they saw the potential. They invited us to Ireland, bought tickets, issued visas. We practically did not spend on the trip. One of the conditions of the deal with Enterprise Ireland was the opening of an office in Ireland. I spent several months running this office. The result was a deal closed in 2016 in the amount of € 250,000 euros, the company was valued at 4 million euros.

Now I am engaged in attracting investment for development in the UK, taking into account all previous “rakes”. To do this, I sit in research centers, study the reports of McKinsey and other companies to get confirmed data. I traveled to England, did research of more than 300 companies, had contact with more than 100 networks to calculate the market. At the same time, I think over the development plan in the country - with it to the UK investors and say that taxes will be spent there.

The main thing in attracting investments abroad is to be bold, open, persistent, build hypotheses and test them, listen to foreign colleagues whom you attract to enter the market of their country. ”

To increase their chances of attracting investment abroad, the founders should:

Dmitry Kalaev, Director of the Accelerator of the IIDF: “What prevents start-ups from attracting investments from business angels and US venture funds”

')

“There are several main obstacles that confront Russian (and not only) teams in the process of communicating with the American investor.

1. Competition

More money - more contenders for the money: the whole world comes to the United States. Therefore, attracting investments often begin in their own country: it is easier and faster to do this. While you are trying to raise money in the United States, you can manage to do it in Russia and reach the break-even point. Then the position of the founders when attracting the next round will increase significantly.

If you start a business and look for an investor immediately in the USA - a high burn rate of the team increases the risk of “not surviving.” On the contrary, if you start with a stable income in the “native” market, it is cheaper to enter the market of another country, and communications acquired in your country can help with attracting investment abroad.

2. Team location

This affects primarily the attitude towards the start-up of business angels: early on, angels make “human” decisions. They want to see the founder and the team. A business angel, most likely, will not give money to the team, with which he will not be able to meet when he wants. In his location, many teams applying for investment, he can invest in any of them. Representatives of venture funds when entering the market of their country often have a question about the visa for the founders. But the location of the team or its part as a whole is not so important in the later stages.

3. Lack of recommendations and good reputation

If you look at the volume of investment in California, you will see that 80% of the invested companies were founded by graduates of two universities: Berkeley and Stanford. In addition to high places in the ranking of universities in the world, both schools are in the Bay area , so their graduates are more likely to be among business angels. A graduate of Moscow State University for US business angels is a set of letters: the quality of education of this graduate is unknown, and the reputational ties with him do not overlap. At the level of angels, it is difficult to raise money if you do not have recommendations from your friends.

Most investors get pipeline deals from their social contacts. For an investor, it is important to make money - and avoid the withdrawal of money and intellectual property, a strong blurring of shares and other unpleasant investor outcomes. This is a matter of trust, which professional investors - venture funds - pay special attention to. For them, it is important to know the team feedback from other investors and partners. Therefore, FRIA is developing a network of business contacts with foreign funds. We bring our portfolio company to the investor in the local market and offer to look at it as a potential investment. If the investor is interested - do an intro.

4. Demand is not confirmed by anything.

At the pre-seed stage, angels and accelerators like 500 Startups expect that your turnover is already approaching $ 10 thousand a month. Of course, they can invest at zero revenue, but they are guided by companies with a turnover - whose demand is confirmed by at least first sales. When demand is not confirmed by anything - people do not want to invest. Without first sales, it is difficult to show the investor how the company will manage to achieve a significant turnover, depending on the stage of investment.

At the pre-seed stage, the investor must believe that the company can reach a turnover of $ 10 million (pay attention to the label). At the next stage, in order to raise $ 1-2 million, the company must convince the investor that its turnover will grow to $ 100 million. A lot more money - either go into $ 300 million turnover, or understand which market players can buy a company by a similar estimate.

5. No revenue or explosive growth.

At a later stage (rounds A, B, C) representatives of the venture fund may not look at the location of the team, but the company must have income of $ 1 million per year. The decision made by late-stage venture capital funds is more pragmatic and based on money. Of course, Prisma and MSQRD are beyond the scope of this story - in a month they grow from zero to tens of millions of users. Market laws do not affect startups with phenomenal traction . Unfortunately, most companies do not have such explosive growth. ”

Daniil Brodovic, CEO of Cookstream and CPO Just: “Start-up contests and demodni as a way to attract investment”

TalkToChef / Cookstream raised $ 200,000 from angels and accelerators. A graduate of Startup Next and Accelerators Founders Space, Society3 and Start-Up Chile.

“Our startup was born on the Startup weekend in San Francisco at the end of 2012 (pictured above). Having won the competition, we received the first attention of investors. Learn Capital Foundation became interested in Cookstream prototype. There were several nuances: they were interested in education (our cooking lessons generally fit into this profile), and they were ready to invest, but since Cookstream was almost at the idea stage, almost half of the company had to be paid for the proposed $ 300,000. We conferred with the team and thought: “We worked for some three days at the competition, and our company is already valued at a million dollars. What will happen when we work a month or two? ” But contrary to expectations, there were no golden mountains. When, after 3 months of work, the money began to run out, and the working product was still far away, we regretted the refusal. But perhaps it was for the better - we still have a large stake in the company and freedom to make decisions. To solve the problem of financing, we applied to all possible accelerators, knocked on 500 Startups, told about the global vision of the product, about all the expected functions. Basically, we were politely answered, "Guys, everything is fine, but we'll talk later when you have a traction."

We were saved from failure by focusing on one function of our product, as I mentioned in the previous article . Having thrown out our developments and renamed the product to Talktochef, we once again walked around investors and accelerators. The focus on the hotline function helped us sell investors a vision of our company's future strategy: we have a hotline to consult with cooks, then we will make a hotline with lawyers, doctors. Despite the niche market of culinary consultations, we were able to attract two thousand chefs of experts who worked with us, we had seven thousand requests per month.

I got acquainted with the first angel investor at Startup Weekend - at first he was our mentor: he helped me with advice, introduced me to useful people: he had experience in working and investing in online education. After six months of development, we needed financial support for the further development of the product, and he wrote the first check for $ 10 thousand, which we had enough for an application for IOS. Another $ 150 thousand were given to us by other angel investors, one of them was a professional investor in real estate, who recently began to invest in startups, about 20 startups per year. We met him at the pitch day after the end of the accelerator Society3 - there we also took first place. A month later, several personal meetings and exchange of documents, we signed a contract and received money for the account. We also raised $ 40,000 from Startup Chile, an accelerator in Latin America. American accelerators did not give investments, but they helped with bonuses in the form of free hosting on amazon.com, legal incorporation services, and educational services. For this, some of them also took a small share in the company.

The Russian roots of our company were a rather serious barrier - none of the founders had either citizenship or a Green card, and the question always arose when dealing with investors. This prevented getting into the accelerators 500 Startups, Techstars. We reached the final / pre-final stage and were rejected after the question "On what grounds are you in the USA." At that time, the absence of a long-term visa or Green Card was a serious problem, but over the past couple of years, many accelerators have changed their attitude about foreign founders and now international teams are much more likely to accept. As a result, we found a way that allows us to remain safely in the States without the threat of deportation: we continue to work there on a long-term H1B visa. After a year of work, our company issued a work visa to all American employees, this is not against the law. Investors are satisfied.

Due to the fact that we found investors at public events, we did not need personal recommendations, but in general, to continue to communicate with other investors and raise new funds, the recommendation is probably the only working tool when meeting new people. Speeches on the pitch day at the end of the acceleration program - this is the recommendation from the accelerator, and winning the competition is the recommendation of the judges. And in our case, the most successful way to attract investment was a victory at a start-up competition or at demodny after the end of the accelerator. ”

Mike Melanin, co-founder of Statsbot: "8 mistakes that we made in the process of attracting investment in the US"

Statsbot is an analytical bot with 25,000 b2b users that recently invested $ 1.9 million in investments from 500 Startups, Eniac Ventures, Betaworks, the Eric Schmidt Foundation Innovation Endeavors and Slack. Graduates of accelerators 500 Startups and Betaworks Botcamp.

“We co-founded Statsbot with startups together a year and a half ago, the last six months of which we lived between San Francisco and New York, and torn between the 500 Startups and Betaworks Botcamp acceleration programs. Accelerator Betaworks Botcamp invested $ 200 thousand in a startup in exchange for 8% in the project, and 500 Startups invested $ 125 thousand for a share of 5%. Eniac Ventures, the Eric Schmidt Foundation Innovation Endeavors and Slack, have joined the deal - so the total investment has increased to $ 1.9 million less than a year after the company was founded. We did this not immediately, having made some typical mistakes in the process for the startup:

1. Uncertainty and lack of preparation for typical investor questions

We arrived in the Valley in early May, we began to call for meetings with representatives of top venture capital funds - our eyes lit up, we decided that success was near. But we were not ready for many questions of investors. Some difficult technical questions pushed into a dead end: you do not know how to answer, and the lack of practice of the English language still slows down your reaction. Naturally, this does not lead to anything good: you need confidence in your eyes, and the answers to the standard pool of questions should bounce off the teeth.

2. Start with venture funds

Our main mistake was a decision from the very beginning to go for venture funds, and not for business angels who can make a decision emotionally, having believed in the team. I would not advise anyone to start attracting investments from venture funds, in Russia or in the USA. In addition, we did not submit an application to the accelerators - this was another mistake that we tried to quickly fix and eventually ended up in two accelerators at once - 500 Startups and Betaworks Bootcamp.

3. To come to the investor without traction or infopovod behind him

Another mistake we made was to go to venture funds without a traction. We did not have an information channel (for example, at that time we were not selected by any accelerator) in order to generate a wave of interest from investors. A position is always better when an investor is interested in your startup than when the founders run after investors.

4. Stretch the fundraising process

This happens when the founders come to investors and ask for money, telling how it is necessary for their cool product and team. What is the point of a venture fund to invest at this moment? It is always better to wait for the risks to diminish - to invest if the startup survives. We had an unpleasant incident: we signed Term Sheet with one fund and waited a whole month, which almost killed the business. The best trigger for all investors is the fear of missing a profitable investment. The founders with a confident understanding of numbers and business show that investments are not really really needed for a startup, and in the funnel there are hundreds more other investors: if this investor thinks for a long time, the startup will go to another. One of the insights that we received in the Valley: 95% of venture capital funds are unprofitable, they earn only 5%! Few people know how to invest at all. We met a lot of investors who say: “I follow the trends! Look at my cool investments! ”And as a result, I invested in Russian-speaking graduates of YCombinator, simply clinging to the cool investors in the train.

5. Not to be selective towards investors

Another mistake is not to ask questions at a meeting with a venture investor. At this meeting, not only the investor is eyeing the startup, but also the startup - the investor. The founder must understand the investment strategy of the fund, the size of the fund and the average check, in which round they invest, at what time they are. This will give an understanding of whether it is worth working with these people, and for investors - that not only they choose a startup, but also vice versa.

6. Too much save on investment

We tried to remain a “lean” startup as long as possible. We calculated the budget for everything from and to, in order not to take more than necessary from venture funds. We wanted to keep a large share for ourselves, not to lose control over the company and have more money on exit. But for an early stage startup, the main thing is to survive. And do not be greedy and recalculate budgets up to a cent. It is better to blur the share a little more, but to survive in the case when something goes wrong (and this will happen). The first few months in the valley without starting money in the Valley almost brought our business to death.

7. Do not have a long-term visa

This is one of the typical questions of a foreign investor. We have adopted a rule for ourselves to raise investments in the country where the main core of clients is. These analysts have helped us understand that for us this country is the United States. Get ready for a visa question from an investor in any country. Even a long-term visa is not, be prepared to answer what is the plan for this issue. In the eyes of investors, it’s bad if you raise money and go to Russia with them. We are now organizing RnD in Russia and this does not look very good in the eyes of investors.

8. Save on lawyers

Arriving in the US, we immediately decided to incorporate the company for $ 1000 dollars. Now a few tens of thousands of dollars were needed just to re-register the documents. It’s better not to do anything than to do it with mediocre lawyers or without them at all.

Konstantin Dubinin, CountBOX founder: "Attracting investments is the same sale, but of a different product and another category of buyers."

CountBox at the moment - b2b, offices in Moscow, Chicago and Dublin and representatives around the world, revenue of about 50 million rubles for 2015. Attracted investments totaling € 800 thousand, the company is estimated at € 4 million.

“We have been working since 2008, the staff has grown organically to 15 people. By 2010, I made money in this business and wanted to do something more meaningful. While studying at the Higher School of Economics on the MBA program, I realized that for this I need to build a large company. There they explained to me the strength of attracted investments for business development - this is a lever that increases the growth potential of the company. Since the end of 2013, I began to go through the funds. There were many meetings, but it did not go further. There were several reasons for this:

1. Patriotism of foreign investors

A US or German investor is unlikely to finance a company that will make money in another country. A foreign investor most often wants money to work for the economy of his country. In addition, it is logical to attract an investor with an expertise in this field to enter the country's market.

2. Lack of understanding of your customer and exit strategy

We did not work with American investors primarily because at that time we were not ready. The investor does not try to invent tricky questions, he asks about fairly simple things, for example: “How do you think that a million people will buy your product for so much money?”. Each figure must be confirmed by data with links to sources. 2-3 errors in numbers - this is not a business plan, but a prediction of the weather. Well, the main thing is the confirmation of the potential of the product for an investor - when residents of the country “vote with a ruble”. Only sales or pre-orders confirm the hypothesis that customers will buy a product in this country. Therefore, before raising money for development in the United States or Europe, it is always better to first go and sell the product to customers, having received confirmation in money. Especially in the USA, where everyone verbally admires your product. If there is not enough money to develop a b2c product, kickstarter will help and collect money for pre-orders. In b2b - you can offer corporations to make an advance as a confirmation of interest in the product.

Attracting investment - the same sale, but for a large amount of another product and another category of buyers. When a company manages to sell its usual product in a country where it has neither technical support nor an office, one can also think about attracting investments.

3. The lack of traction in the country where you attract investment

There is a dogma that a Russian bachelor’s degree or MBA in a foreign labor market can be equated to a lack of education. I can say with confidence: millions of dollars in revenue in Russia in the process of attracting investments also mean nothing to American and European investors. Successes in Russia in profit and performance were equal to zero and were not counted. For investors, it was an empty place, they looked at the potential, the product, the adequacy, the team, the traction.

A year later, I can state with full responsibility that investors are absolutely right: whatever you do in Russia, this means nothing in the market of Europe and North America. It seems that here everything is the same, but with some other accent - and the devil is in the details. The fact that I had success in Russia had absolutely no success abroad. A sick example: in developing countries like Russia, cold calls work as a sales channel. I tested the product hypothesis last summer - I chose one of the largest private banks in Russia to test my cold call skills and make a deal. After a week and a half, I was sitting at a meeting with the deputy chairman of the bank and three departmental directors. With this approach to sales, I came to the USA, hired bison sales with my own customer base, which had been working in this market for 25 years, of which 9 years in a competitor company, and a professional in the b2b field. We spent 800 hours - the cost of these man-hours and together with the preparation time was about $ 50 thousand. I burned the money - it turned out that they don’t buy it that way.

Without traction and sales experience in the country’s market it is very easy to burn investments. Under the English-speaking world, the product had to be almost completely redone: there were a lot of new requirements from customers, small cultural differences. It is worthwhile to dwell on them separately.

Cultural features: New York - Silicon Valley - Europe

The main difference between the residents of New York and the surrounding area and Silicon Valley reflects the phrase of the first: "we slam money while in the Silicon Valley doing the next big thing." When you tell a New York investor about your product, you need to be prepared, that at any moment he will say, “Stop, I'm not interested, goodbye.” Or vice versa: "stop, I buy." This is a business approach in everything, the desire to earn and time is worth its weight in gold.

In Silicon Valley, everyone will listen to the fountainer, will admire the product, will nasulit the golden mountains. Founder will come out of the meeting happy and inspired, although it’s far from the fact that after this meeting someone will buy or invest in the product. No one in the face will criticize an idea or a product, and if this is not a profile area for an investor, he may recommend someone to whom it may be interesting. Silicon Valley - about networking, communication, friendship, recommendations. Everyone who met on the path of the founder, will try to help and recommend the right person. They say, "to attract investment in Silicon Valley, we must go there for a year." This is the period for which a person will have the required number of links.

The culture of Europe is similar to the culture of the Valley: Europeans are also open, they can bring them together, they can introduce them. Although in each of the countries of Europe has its own nuances. For example, if in Russia I was late for a meeting by 15 minutes, this is normal. In Germany, this is an automatic loss of 70% chance of success. In England, the founder is obliged to speak good English, to strictly follow the schedule of the meeting, to perform all sorts of open and secret protocols. In England, there is a generally accepted procedure for entering into a partnership. You can not come and sell technology at the first meeting, it does not work. First meeting-acquaintance, then the first sale of the product, then a trip to customers to see how the product works, then feedback, and so on. Whole process. This must be taken into account.

From my own experience

I spent two years to attract the first investment. As a result, it was possible to conclude the first deal for € 550,000 after the opening of an office in Chicago, and this was not a US investor, but a Russian one, but with a European legal entity. the face. We attracted him through the StartTrack investment site. Investors flew to our American office, looked at how we work there, whether we really have employees at this office, how many clients we have in the US sales funnel and at what stage.

In 2015, they began to communicate with representatives of the Irish State Agency for Business Development and Support (Enterprise Ireland). How it happened: I knocked on all relevant and non-core organizations associated with investors. So I went to the organizer of venture fairs in Kazan, showed perseverance, in the end we were given a stand at the fair, paid for tickets. For our part, we prepared, without exaggeration, almost the best of all participants: we brought the finished product, the screen, customers, prepared brochures. The Irish noticed us, and in the process of informal communication after the event they saw the potential. They invited us to Ireland, bought tickets, issued visas. We practically did not spend on the trip. One of the conditions of the deal with Enterprise Ireland was the opening of an office in Ireland. I spent several months running this office. The result was a deal closed in 2016 in the amount of € 250,000 euros, the company was valued at 4 million euros.

Now I am engaged in attracting investment for development in the UK, taking into account all previous “rakes”. To do this, I sit in research centers, study the reports of McKinsey and other companies to get confirmed data. I traveled to England, did research of more than 300 companies, had contact with more than 100 networks to calculate the market. At the same time, I think over the development plan in the country - with it to the UK investors and say that taxes will be spent there.

The main thing in attracting investments abroad is to be bold, open, persistent, build hypotheses and test them, listen to foreign colleagues whom you attract to enter the market of their country. ”

Let's sum up

To increase their chances of attracting investment abroad, the founders should:

- To earn and / or attract investments in the market of your country in order to have a “financial cushion” and a stronger position in negotiations with the investor (ideally, to reach the break-even point);

- Get investor recommendations and / or speak at start-up competitions and accelerator demo-sites in the selected location;

- Take care of a long-term visa issue for a team to the country;

- To be discriminating with regard to the investor - to choose the right level of the investor depending on the product stage (see the plate at the beginning), the country;

- To confirm the demand with the first sales / pre-orders in the country attracting investments;

- Study the market and prepare for a meeting with an investor (market entry strategy, market research, sales figures);

- To be confident in the team and product and show the investor that a) a startup is able to survive without investment, b) other investors are interested in it.

Source: https://habr.com/ru/post/320478/

All Articles