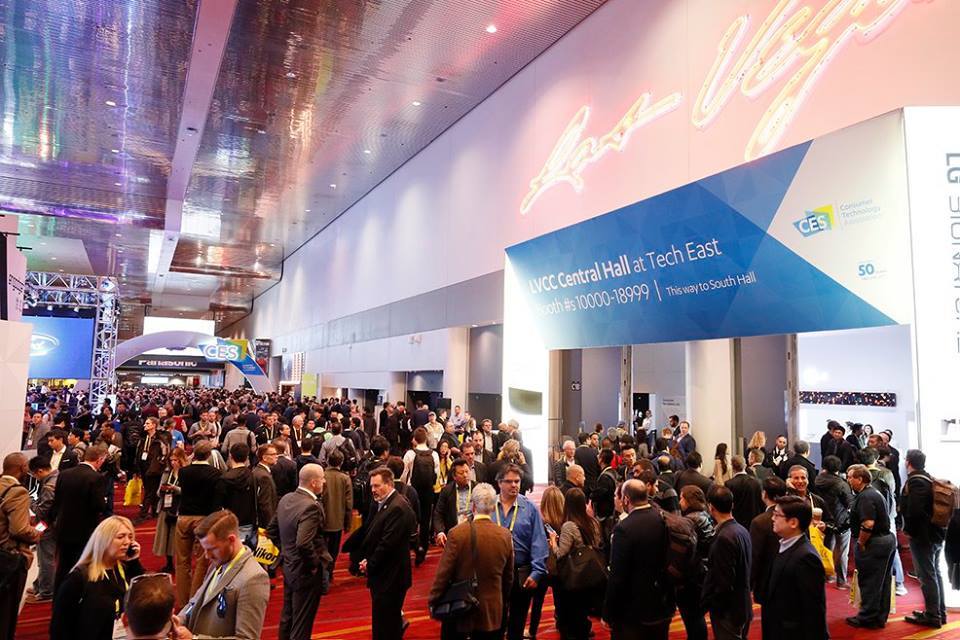

CES 2017 exhibition: payment, e-commerce and fintech trends

This year I was among the 160 thousand colleagues in the industry who received the opportunity to visit CES. At the event, I participated in a series of discussions on the topic of commerce and payments in the digital age. It all started with a discussion of the so-called growing popularity of payment using mobile wallets via POS-terminals. “Growth of popularity”, however, can hardly be called correct, given the research data, confidently speaking just in favor of the opposite. The final part was devoted to the unanimous expression of the love of the industry representatives to the blockchain technology, any attempts to argue with which caused smiles.

Voice platforms are beginning to play an increasing role in future commerce.

Mobile wallets applications and contactless payment systems failed to win the hearts of consumers, and this state of affairs may well never change.

Source: Facebook, @CES

')

Contactless payment systems were stuck at the statistics level of March 2015, according to which 19 out of 20 consumers who had a real opportunity to make purchases at cash POS-terminals using Apple Pay, did not use the services of the longest similar experiment in the market. It is difficult to say what else can be done to change the status quo, especially considering the appearance of a much larger number of alternative ways of using telephones for payments a year later. It would be logical to assume that in the light of the terribly unloved of all the need to insert bank cards into the terminal to make payment, consumers should have already fallen for this bait. However, this did not happen and the market still lacks solutions that can help consumers discard old payment habits using cards or cash.

Apparently, the concept of mobile pre-orders has become the most realistic and urgent solution to this problem today. Starbucks experience has shown that a third of the coffee giant's mobile customers are “addicted” to the service. As for traditional retailers in general, they welcomed the idea cordially, because it gives them the opportunity to lure more visitors to the premises of their physical stores. On top of everything else, mobile pre-order eliminates one of the most pressing problems of consumers - the queue, and helps to find another answer to the ever-relevant question for merchants to find additional sources of sales.

As for the technology of tomorrow, a lot of attention was paid to voice control systems, and, of course, related commercial activities. Such systems may well be called a dark horse in the market of commerce and payments, which could soon become a popular and effective solution.

In the past, I wrote about the potential of Amazon Alexa and its ability to qualitatively change the consumer’s approach to using voice for commercial purposes. At that time, Alexa possessed several hundred skills, was “tied” to the smart dynamics of Echo and was very straightforward in communicating with consumers. Now, thanks to the openness of the system and the efforts of third-party developers using a special proprietary set of tools to work with it, the Alexa skills bank has grown to 7,000 algorithms, and she herself has learned to match requests with the context and has become available as an embedded solution in cars, devices, robots, and soon as an application on Android smartphones Huawei. Alexa, which once used to “pick up” flat jokes and was only suitable for making a shopping list, today serves as a base for new skills-based cases such as ordering pizza from Domino, trips to Uber, 1-800-Flowers or takeaway via Amazon Restaurants.

Payment of all these opportunities, of course, carried out using the Amazon payment system. To activate commerce-related skills, you only need to link to an Amazon user account. Thus, the combination of Amazon Payments and voice services of the company can seriously shake the position of mobile wallets as intermediaries in the field of payments and begin to dictate their conditions to mobile ecosystems due to the popularity and wide range of services provided.

Source: Facebook, @CES

Not surprisingly, Google and its new service Allo, Apple and Microsoft with their assistants Siri and Cortana, as well as Samsung with their new voice assistant Bixby actively joined the game, providing users with their own know-how and variations on the theme, designed to interest them. However, all of these companies, including Apple, are catching up, trying to catch up with the ecosystem, successfully and rapidly succeeding in attracting developers to their voice platform, which users are increasingly using as the best friend to make voice payment authorization and facilitate payment process.

However, the most interesting is the degree of user involvement in work with Alexa, which no contactless payment service could achieve, be it Apple, Android or Samsung Pay. As a consequence of this popularity, sales of devices providing access to Alexa skills are growing.

Amazon managed to make a new platform convenient for consumers by providing them with answers to common requests, such as weather forecasts, answers to simple questions and playing music. This was followed by the introduction of skills to solve the obvious commercial, banking and payment problems of users, such as checking balances, paying bills, ordering food and buying things online. And this is exactly the level to which competitors of the company will try to reach in the near future.

Banks intercept initiative in the market finteha

Banks operate in an ecosystem whose participants are very dependent on each other, and any of their actions always have significant consequences outside their own walls. And, of course, banking organizations are subject to serious inspections by regulators, whose requirements are being tightened every year in all markets of the world. Therefore, no matter how positive such financial institutions are related to innovations, they simply cannot afford to abandon all the “old” and start everything from a clean slate.

Source: Facebook, @CES

Be that as it may, at CES 2017, all expert panels were nudging about the problems of traditional banks and their solutions: “blockchain as an alternative to outdated infrastructure”, “digital banking as a replacement for physical branches”, “banking models and products are too expensive, new models will appear and then banking decisions will lose their relevance ”and so on.

The problem, however, is that among these new vaunted models there is not one that could scale through its own efforts. Most of them rely on banking systems for this purpose. And this is not to mention the fact that without the mediation of banks, none of them could have achieved any results at all.

Of course, all this does not mean that banks should not look for ways to introduce innovations, which they have not done for a long time. The most recent innovations launched and widely popularized by banks include the concept of online and mobile banking, as well as the remote digitalization of checks to the account . Often, during their development, they used the innovations of third-party companies. In the new year, banks will need to continue mutually beneficial cooperation with Fintech players in order to solve actual problems of users. At the same time, financial institutions are likely to devote maximum funds and strength to innovations and investments in the so-called RegTech (regulatory and related new technologies) in order to use it as a way to improve and strengthen risk management and internal audit practices.

Cool apps don't just have to be cool.

A lot of time at the event was devoted to discussing the next major consumer crisis - the inability of the so-called generation of baby boomers to retire with a stable financial situation, and similar problems of generation X and millennials not resorting to saving money, as well as the inability of most consumers to postpone even a minor $ 400 for an emergency.

Source: Facebook, @CES

I have already written recently about the impending FINTECH of the Millennial crisis , which could have a huge impact on all payment and commercial ecosystems. It dealt with a unique study of a group of Stanford scientists, according to which 50% of millennials from middle-income families can never earn more than their parents. For families with lower incomes, the picture is even darker. Of course, the lack of funds from such a large category of people leads to their inability to buy, save, or even get access to cash loans.

Of course, today there are many tools on the market, invented by innovators to help all consumer groups overcome such financial difficulties. We have robot advisors who are able to create and plan a budget, online platforms for creating investment plans aimed at ensuring financial stability at retirement age and other needs. In addition, there are savings platforms that allow consumers to save, and transactional credit programs that allow improving the credit rating for each individual purchase. Such programs are gradually gaining momentum, but only a very small percentage of them managed to gain a critical mass of users. Most try to find ways to monetize in the form of independent applications. Probably, all this suggests that the development of such applications alone is not enough.

That is, it is also important to tell consumers why they need cool apps and to encourage users to create appropriate habits. The question remains open as to which players are in the most favorable position for cooperation with innovators and what position on this issue banks and retailers will take.

Blockchain has replaced Bitcoin as a hottech fintech

Another hot topic of CES 2017 was blockchain and Bitcoin, which could be heard very often.

In this regard, it is impossible not to note the serious attitude of the blockchain community, which seeks to realize its mission of global replacement of absolutely all elements of the existing payment, commercial and financial infrastructure with distributed registries. Blockchain is positioned as nothing more than a universal remedy for all diseases of the international financial system. According to statistics, every single one of the Fortune 100 companies already has their blockchain project in their hands, while those who don’t have one yet are in a hurry to join the rest. According to some reports, the blockchain and Bitcoin ecosystems will attract trillions of dollars in investment investments in the next few years. And as soon as central banks join the process, then in the bright future of the market it will be possible to have no doubt.

Source: Facebook, @CES

According to general impressions, the industry is doing its best.

However, is there someone in her who should be remembered by name? The concept of the blockchain continues to be in the early stages of development, being still more similar to a scientific experiment consisting of many new pilot projects exploring the possibilities of technology in a given context. And if earlier we believed that trillions of dollars would move around the world through publicly available blockchains on Bitcoin rails, now the focus of public attention has shifted to private blockchains and other digital currencies. Of course, the concept of a distributed registry that makes instant clearing and settlement all over the world possible still looks attractive. The reality, however, is that the realization of this idea comes up against the need for a thorough study of a new authoritative and regulated global infrastructure - a project for which even the ambitious word will not be enough to describe.

And we have Bitcoin.

One of the conference participants once called Bitcoin 1.0 the currency of the People's Commissariat, as if making it clear that in the case of Bitcoin 2.0, this reputation is in the past. Indeed, instead, it gradually became the currency of cybercriminals and extortionists, with the result that its chances of acting as a new global currency have never been so low. In addition to the two cryptocurrency scenarios just mentioned, the third and most popular one at the moment is a scheme of avoiding state capital controls in China with a view to its subsequent withdrawal to other countries. Such an outflow of funds can provoke the government of the country to move to decisive actions against the Chinese miners, who, according to statistics, provide as much as 80% of all bitcoin mining activity. The recent story of the closure of the reputable American edition of the New York Times in the Chinese App Store, an objectionable for the authorities, says that the Chinese authorities do not have the courage and this scenario is more than real.

Grass is not always greener on the other side.

Another popular topic was the idea of China's superiority over the United States in the field of digital financial services, very much reminiscent of experts 20 years ago that Japan would outrun the United States and would soon rule the world.

There is no doubt that thanks to companies such as Alipay, Ant Financial and WeChat, China has long become a very innovative country. The digital ecosystem of WeChat, which embodies in practice a variety of user cases, including direct transfer of funds between 400 million active users of the application, looks like a work of art. However, its success is the result of work to solve the pressing problems of Chinese consumers. It is about providing easy access to financial and payment services, through the skillful use of the habit of deeply rooted in the minds of Chinese consumers to use fast messages on social networks, where they spend a lot of time. Embedding commercial functions in such ecosystems was not only a logical step, but also a serious innovation in user experience.

Source: Facebook, @CES

However, it is not necessary to cut one size fits all. Mobile payments were presented to American consumers in a very well-developed physical payment ecosystem, in which almost 100% of all commercial activity took place in physical stores that are easily accessible to consumers and accept bank cards for payment. The users experienced the most serious difficulties while trying to make online payments on Internet sites, which are usually visited from home or office computers. It is precisely the elimination of these obstacles that is easily the basis of the activities of Amazon and PayPal, which began work in this direction in the mid-90s.

Therefore, in order to translate consumers into “contactless payments”, you first need to convince them to quit established and time-tested habits for the sake of the novelty of these services alone. The convenience of the “old” methods from the very beginning raised the bar for new requirements. It is for this reason that the popularization of contactless payments in stores remains a long and tedious process, and cloud-based mobile payments are gaining momentum. For the same reason, commerce in traditional social networks cannot “fly up”, and the development of commerce in messengers is moving forward with difficulty. However, when it comes to mobile payments within applications, especially those that connect the online and offline world and allow you to pay in a mobile browser in one click, the growth is evident.

However, all this, of course, does not detract from the merits of innovators, each of whom seeks to solve primarily the urgent problems of consumers in their market. However, instead of comparing them with each other, we should probably discuss what useful experience we could learn from both countries.

It's all about user experience.

One of the most interesting discussions was the eternal mystery of retailers and consumers: “What contributes to the preservation of consumer loyalty and interest?” The dialogue focused around the topic of contactless payments and the search for ideas that can help increase their popularity when paying for purchases in physical stores. The overwhelming majority of participants came to the conclusion that reward programs should help in this. That is, merchants who want to become leaders should integrate loyalty programs into their mobile applications, or, in other words, adapt the Starbucks mobile payment model.

As the Samsung representatives told during the discussion that I conducted, the company observes a positive trend after entering the reward simply for the fact of using the corporate wallet application from any merchant. We are talking about Samsung Rewards, a program that encourages the habit of using Samsung Pay for any purchases from absolutely everyone who accepts this merchant payment method. USA Technologies, a non-cash and mobile payments operator, spoke about the effectiveness of its reward program for automated outlets, and vending machines based on integration with Apple Pay, which motivates customers to choose this payment method.

But I put other questions to those present: “Do loyalty programs always have to work according to the principle“ you are for me, I am for you ”? Do we really need to constantly “bribe” people to do what we expect from them? And what will happen when the “bribes” stop? ”This approach is similar to the construction of a card house on the basis of the“ Groupon effect ”, which develops loyalty to one-time transactions, and not to the brand.

I asked the participants of the discussion whether a certain consumer experience could help to increase loyalty. In particular, what will happen to the loyalty of Starbucks mobile app users if the company refuses the rewards program, since one third of its customers have already switched to mobile pre-order? What is more important for customers, free coffee or a convenient opportunity to refuse to stand in queues to drink it?

Source: Facebook, @CES

Those present expressed the opinion that user experience - a thoughtful and competent approach to the provision of products and services - is, of course, more important. I think they are right and, in my opinion, when launching these or other programs, you should always ask yourself: “What experience do I need to create so that customers come and remain interested in products?” Maybe this should be special offers or rewards, or maybe - a certain richer and meaningful experience, something that, if I may say so, cannot be bought with money.

In general, if we talk about some general conclusion that I was able to make on the basis of CES 2017, then it can be formulated as follows: “Think big and take on solving rather large problems”. And then you can do something really meaningful, and after working hard, you will see your work grow to noticeable size. Do not take the example of a plug-in hairbrush - one of the "novelties" of the event, unable to do anything with which an ordinary mirror that was invented hundreds of years ago cannot cope.

Source: https://habr.com/ru/post/319738/

All Articles