Why has the activity of venture funds of Russia increased?

According to a new research by Firrma analysts from December 2015 to December 2016, the Russian venture capital market showed a significant increase in activity. The study was supported by the Russian Venture Company ( RVC ) and the British consulting firm EY (Ernst & Young).

Russian venture funds made 390 transactions. Last year, researchers counted only 313 transactions. Thus, their number increased by 24.6%. However, in 2014 there were significantly more transactions - more than 450.

')

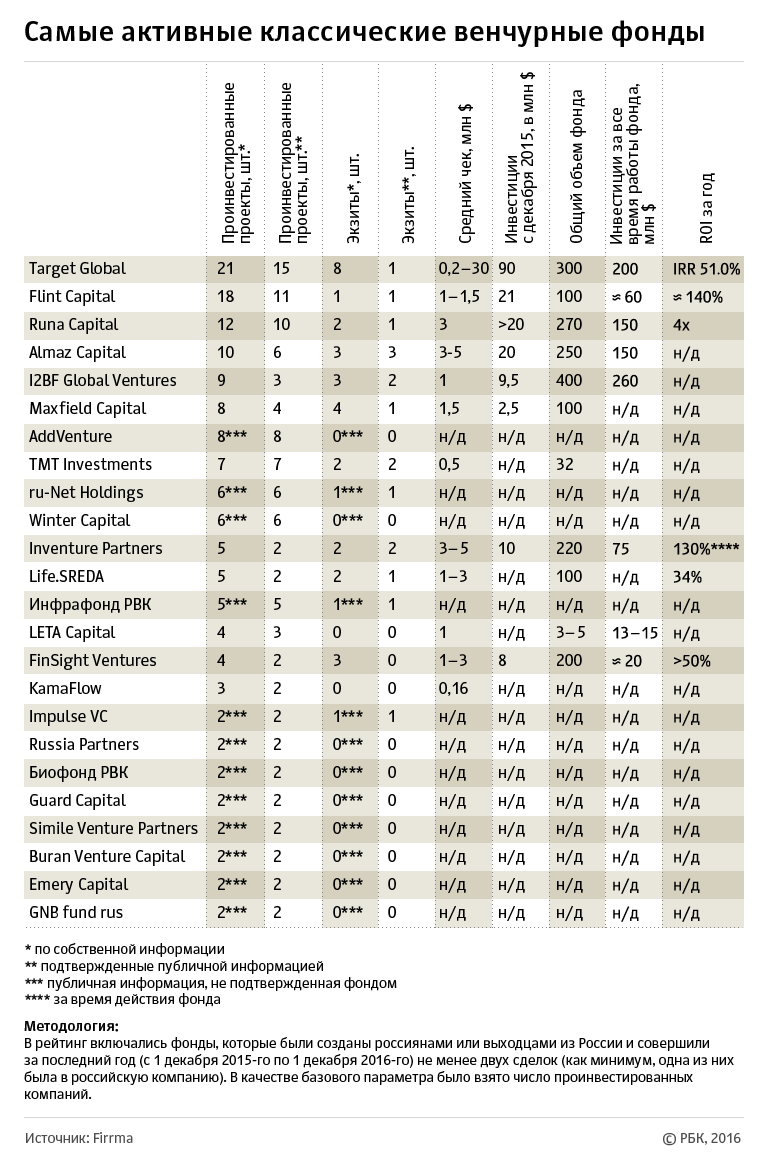

As for the classic funds, they behaved inertly this year. , concludes the edition of Firrma. Many of them have already completed the active investment phase and are now attracting funds to second funds.

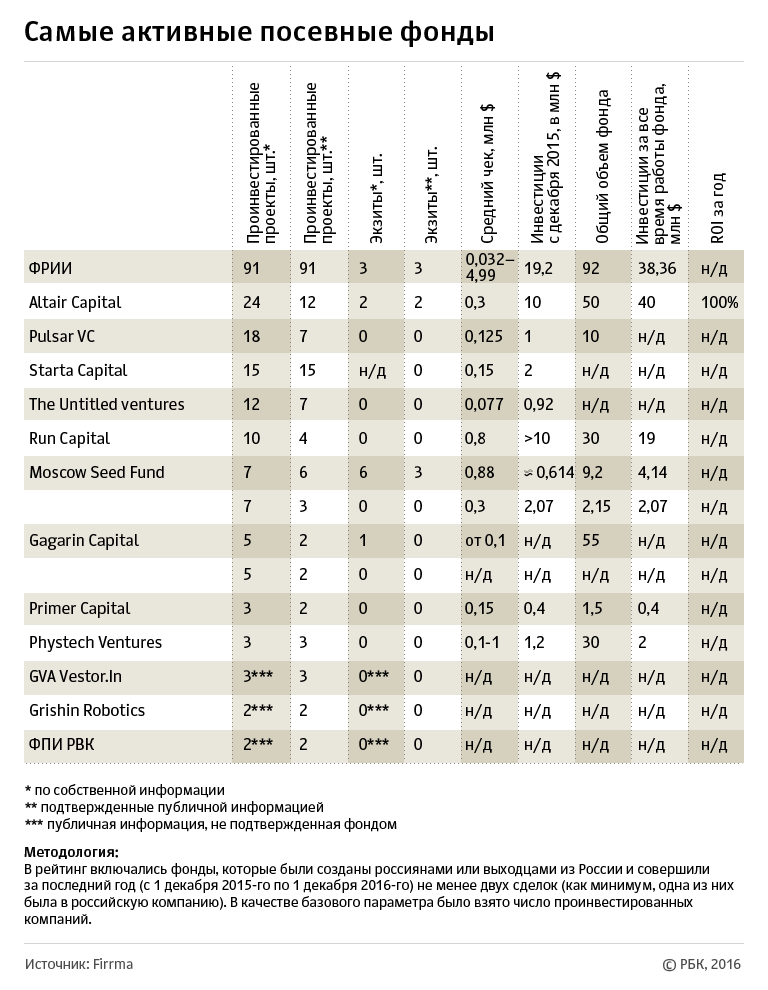

In 2016, the bulk of transactions fell on the seed stage, and the Internet Initiatives Development Fund, which invested $ 19.2 million in 91 projects, became the most active investor. At the same time, the first five classical funds concluded a total of 70 transactions over the year, their amount exceeding $ 160 million.

Alexey Katkov, President of Sistema Venture Capital, confirms that more and more investment transactions are taking place at an early stage of projects. True, he explains the trend is not a shortage of money in the market, and high competition for promising technologies, writes RBC. New technological trends - artificial intelligence and machine learning, virtual and augmented reality, neural networks and telemedicine - have become more common. The vast majority of projects in these areas are at the “seed” stage.

Due to this, the number of transactions at later stages will increase, predicts Sergei Negodyaev, the manager of the investment portfolio of the IIDF.

Globalization

Russian funds have become more active in investing in foreign companies, and the total number of their transactions with domestic startups, on the contrary, has decreased by about 20% over the year.

Flint Capital, a venture fund partner, Andrei Gershfeld, explains this by a more stable economic situation abroad and higher chances of finding buyers in the international market.

Foreigners, in turn, have become more willing to enter the Russian venture capital market. If in 2014 only five foreign funds invested in start-ups from Russia, in 2015 it was already 13, and in 2016 it was 17. In total, in 2016 they spent 32 investments, which is more than two times more than last year.

Source: https://habr.com/ru/post/317696/

All Articles