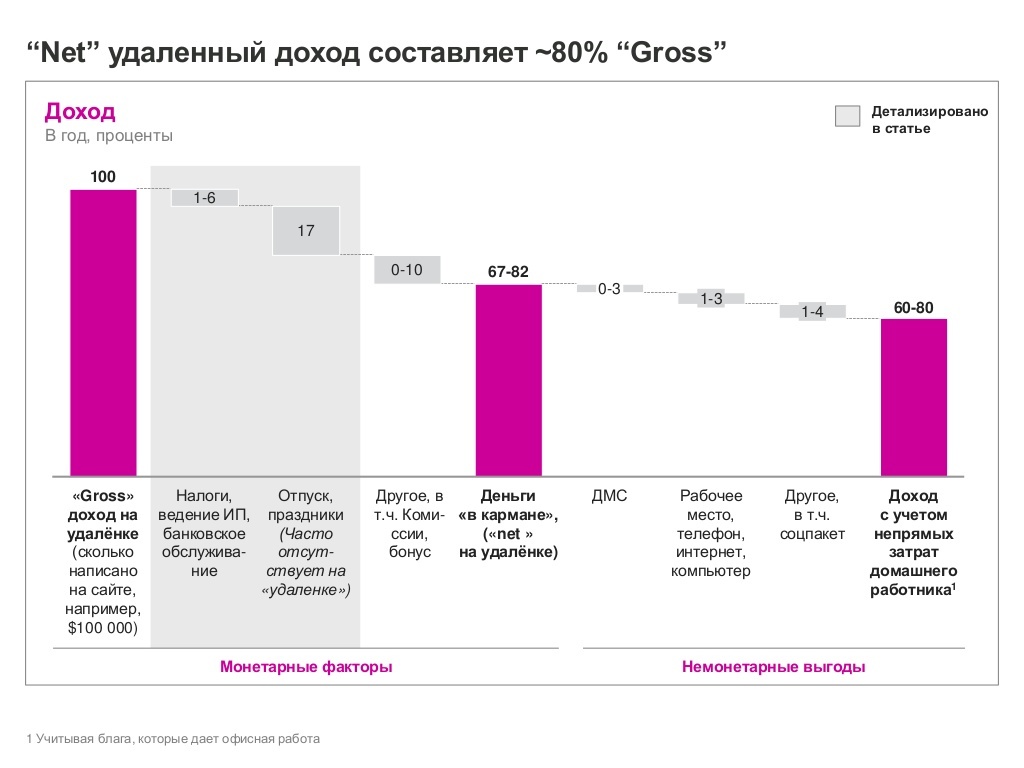

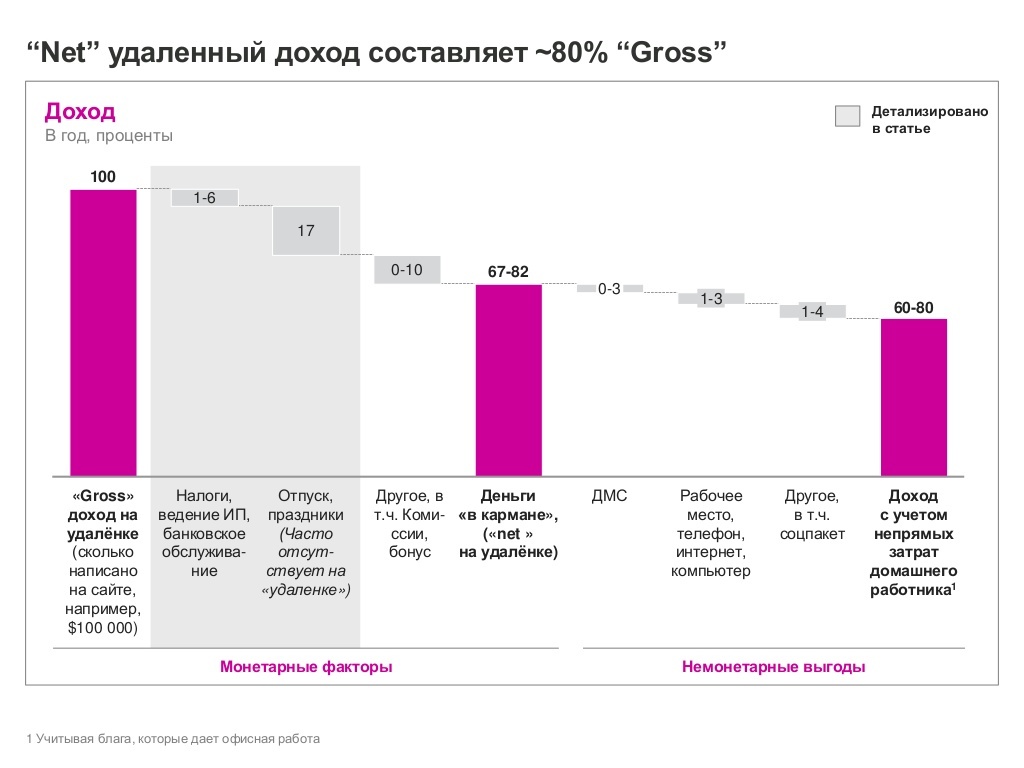

Remote work - how much% net? (stays in pocket)

Before you get the experience of remote work and registration of incomes in the Russian Federation, doubts roam in your head. It seems like a dirty “gross” income from distant work is higher, but how much will remain in your pocket? How to compare office earnings with earnings on the "remote"?

As a preacher of a remote way of working, I will clean, like a bulb from a husk, the value of “net” income for remote work.

Monetary factors are taxes, bonuses and premiums, which also include incentives in the form of company shares, a fashionable option today, ext. companies' expenses on employee's cumulative pension, paid vacation, time off, holidays and sick leave.

Non-monetary benefits - the relationship of colleagues and the corporate spirit, LCA (voluntary medical insurance) and a warm bright equipped workplace, where there is a table, computer, telephone, Internet. A traditional employer generously provides comfortable offices with secretaries, office equipment, and pays for courier services and mail. At your disposal there are meeting rooms with tea, water and coffee. Separate small happiness can be called corporate holidays with artists and snacks, corporate discounts to the gym, corporate canteen and other small joys. Not the last non-material factor that turns into material in skillful hands is the brand of the company-employer. What weight to assign to non-monetary factors is a personal matter for everyone: after all, work ultimately is not only money, but also a set of emotions, experience, education, relationships, which form the way of life. Depending on the nature, one is more suited to traditional office work. Many may be happier and more successful at a distance, as Fried says in the book Remote , but this is a separate topic. Well, below, the simplest - calculations for monetary factors.

')

Most of the employers who offer a remote job will advise you to open the PI (registration of income for physical persons, 13% of personal income tax - a separate topic). The “service delivery” relationship well reflects the legal essence of the relationship. Usually, IEs choose a simplified taxation system or buy a patent. For many activities in 2016, many tax in the Russian Federation offer to buy a patent.

As an entrepreneur, you have the right to acquire a patent that has a fixed value. The cost of the patent varies depending on the region where the IP carries out the activity. Unfortunately, in this case you will not have the right to deduct contributions to the PFR and the FFOMS from the amount of tax. You will have to pay fixed payments and a one-percent payment, as well as the cost of the patent. But no matter how much money you earn, the state will no longer have to pay. This makes an effective tax rate for incomes that exceed 2 million rubles a year, less than 1% for some regions and many types of activities — here is a link to a patent value calculator . For example, the Moscow region, software development - 11,687 rubles per year (for individual entrepreneurs it is necessary to specify 0 hired workers in the calculator).

In the case of the simplified tax system of all your income will have to take 6%. You will also have to pay insurance premiums "for yourself" (fixed payments), even if you do not receive any income. During 2016, the entrepreneur needs to make 2 contributions: Pension Fund - 19 356.48 rubles, FFOMS - 3 796.85 rubles. Total 23 153.33 rub. Individual entrepreneurs, whose annual income for 2016 will be more than 300,000 rubles, will have to additionally pay 1% of the amount of income exceeding these 300,000 rubles by April 1 of the next year. But paid fixed payments and a one-percent payment can be credited against the payment of tax. It turns out that if 6% of the tax on your income goes more than the amount of fixed payments and a one-percent payment, you do not incur additional expenses.

Let's draw a line. It is better to lay 1-6% of the income on taxes, bank account maintenance and other expenses. If you work remotely for a foreign organization, you are unlikely to be “forced” to open an IP. At the same time paying taxes is entirely your responsibility.

In 2016, there are 14 holiday (non-working) days in the Russian Federation, but the days paid by the employer are January and May holidays, February 23 and March 8, and on June 13 from November 4. Also, the “traditional” worker is entitled to 28 calendar days of paid vacation. Thus, with an average of 21 working days per month and 252 working days per year, 42 non-working days are paid. This is approximately 17% of the total working time. On the remote, forget about it and dream. You will rest, of course, but at your own expense. Of course, there are still official payments for hospital and maternity leave in our country. But they are so miserable that in any way I consider them to be superfluous. And, accordingly, I conclude - reduce the remote income by another 17%, taking into account holidays and holidays.

The article “other” is affected by a lot, including + expenses for transport and clothing, which are associated with office work - the cost of receiving money for remote work (transfers and conversion fees, usually less than 3-5%).

It turns out that if you want to adequately compare your office (traditional) income with the remote one, subtract approximately 20-30% from the latter. Nevertheless, from the experience of colleagues in remote work, I note that the majority of the transition from traditional to remote employer has doubled its net income (especially at the current ruble rate). In many ways, this is due to the fact that the level of salaries in San Francisco or London is higher. That is, at a distance the salary is really “cloudy”, average world, and not average Russian (if the mediator does not take a substantial part for himself). But this is the topic of a separate article ...

The article is taken from my LinkedIn blog .

As a preacher of a remote way of working, I will clean, like a bulb from a husk, the value of “net” income for remote work.

Monetary and non-monetary factors

Monetary factors are taxes, bonuses and premiums, which also include incentives in the form of company shares, a fashionable option today, ext. companies' expenses on employee's cumulative pension, paid vacation, time off, holidays and sick leave.

Non-monetary benefits - the relationship of colleagues and the corporate spirit, LCA (voluntary medical insurance) and a warm bright equipped workplace, where there is a table, computer, telephone, Internet. A traditional employer generously provides comfortable offices with secretaries, office equipment, and pays for courier services and mail. At your disposal there are meeting rooms with tea, water and coffee. Separate small happiness can be called corporate holidays with artists and snacks, corporate discounts to the gym, corporate canteen and other small joys. Not the last non-material factor that turns into material in skillful hands is the brand of the company-employer. What weight to assign to non-monetary factors is a personal matter for everyone: after all, work ultimately is not only money, but also a set of emotions, experience, education, relationships, which form the way of life. Depending on the nature, one is more suited to traditional office work. Many may be happier and more successful at a distance, as Fried says in the book Remote , but this is a separate topic. Well, below, the simplest - calculations for monetary factors.

')

Taxes

Most of the employers who offer a remote job will advise you to open the PI (registration of income for physical persons, 13% of personal income tax - a separate topic). The “service delivery” relationship well reflects the legal essence of the relationship. Usually, IEs choose a simplified taxation system or buy a patent. For many activities in 2016, many tax in the Russian Federation offer to buy a patent.

Patent (easy and cheap)

As an entrepreneur, you have the right to acquire a patent that has a fixed value. The cost of the patent varies depending on the region where the IP carries out the activity. Unfortunately, in this case you will not have the right to deduct contributions to the PFR and the FFOMS from the amount of tax. You will have to pay fixed payments and a one-percent payment, as well as the cost of the patent. But no matter how much money you earn, the state will no longer have to pay. This makes an effective tax rate for incomes that exceed 2 million rubles a year, less than 1% for some regions and many types of activities — here is a link to a patent value calculator . For example, the Moscow region, software development - 11,687 rubles per year (for individual entrepreneurs it is necessary to specify 0 hired workers in the calculator).

Simplified taxation system (less relevant than patent)

In the case of the simplified tax system of all your income will have to take 6%. You will also have to pay insurance premiums "for yourself" (fixed payments), even if you do not receive any income. During 2016, the entrepreneur needs to make 2 contributions: Pension Fund - 19 356.48 rubles, FFOMS - 3 796.85 rubles. Total 23 153.33 rub. Individual entrepreneurs, whose annual income for 2016 will be more than 300,000 rubles, will have to additionally pay 1% of the amount of income exceeding these 300,000 rubles by April 1 of the next year. But paid fixed payments and a one-percent payment can be credited against the payment of tax. It turns out that if 6% of the tax on your income goes more than the amount of fixed payments and a one-percent payment, you do not incur additional expenses.

Let's draw a line. It is better to lay 1-6% of the income on taxes, bank account maintenance and other expenses. If you work remotely for a foreign organization, you are unlikely to be “forced” to open an IP. At the same time paying taxes is entirely your responsibility.

Social

In 2016, there are 14 holiday (non-working) days in the Russian Federation, but the days paid by the employer are January and May holidays, February 23 and March 8, and on June 13 from November 4. Also, the “traditional” worker is entitled to 28 calendar days of paid vacation. Thus, with an average of 21 working days per month and 252 working days per year, 42 non-working days are paid. This is approximately 17% of the total working time. On the remote, forget about it and dream. You will rest, of course, but at your own expense. Of course, there are still official payments for hospital and maternity leave in our country. But they are so miserable that in any way I consider them to be superfluous. And, accordingly, I conclude - reduce the remote income by another 17%, taking into account holidays and holidays.

The article “other” is affected by a lot, including + expenses for transport and clothing, which are associated with office work - the cost of receiving money for remote work (transfers and conversion fees, usually less than 3-5%).

Let's sum up

It turns out that if you want to adequately compare your office (traditional) income with the remote one, subtract approximately 20-30% from the latter. Nevertheless, from the experience of colleagues in remote work, I note that the majority of the transition from traditional to remote employer has doubled its net income (especially at the current ruble rate). In many ways, this is due to the fact that the level of salaries in San Francisco or London is higher. That is, at a distance the salary is really “cloudy”, average world, and not average Russian (if the mediator does not take a substantial part for himself). But this is the topic of a separate article ...

A source

The article is taken from my LinkedIn blog .

Source: https://habr.com/ru/post/317404/

All Articles