Why corporate funds can earn more on investment than consumer?

Sometimes it is useful to take a step back and look at the big picture. For example, if you represent venture capital, it is useful to ask yourself whether you can provide a greater return on capital by investing only in corporations, or consumer companies, or is it better to invest in both? How should the investment experience and trends in exits from investment projects over the past five years influence the size of your fund and your chosen strategy?

In general, venture capital should increase the value of a company and ensure the distribution of profits for investors. You can’t handle it and go broke. Therefore, we thought it was important to examine the stability of the investment market over the recent past, collecting data through Pitchbook and Capital IQ. Some of the results of our research are presented below.

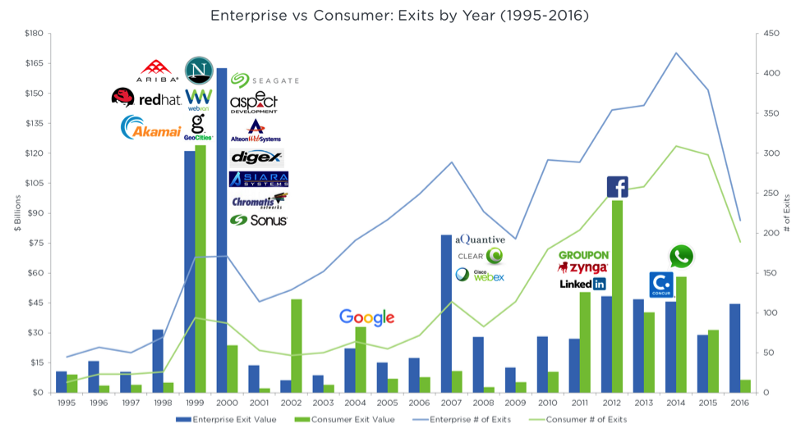

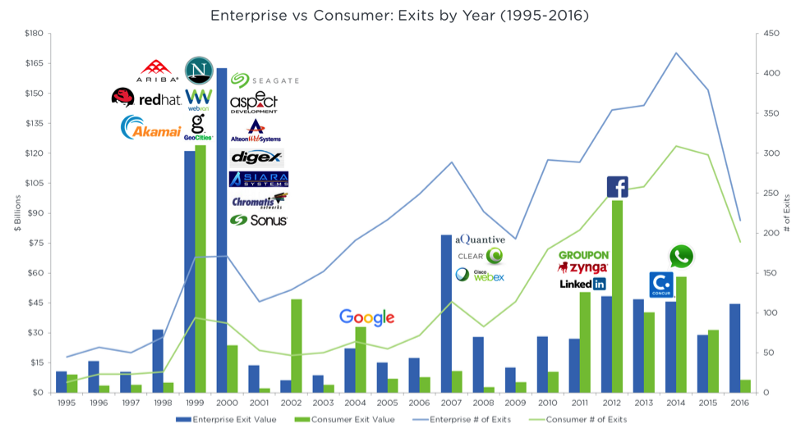

Since 1995, the number of exits from investment projects in corporations has significantly exceeded the number of exits from investments in consumer companies (compare the blue line with the green one). Over the past five years, the value of transactions in the consumer sector regularly exceeded the value of exit transactions in the corporate sector per year. Note that the exit value for the initial public offering is based on the total market capitalization at the time of entering the stock exchange.

Corporations vs. Consumer Companies: Outputs per year (1995-2016)

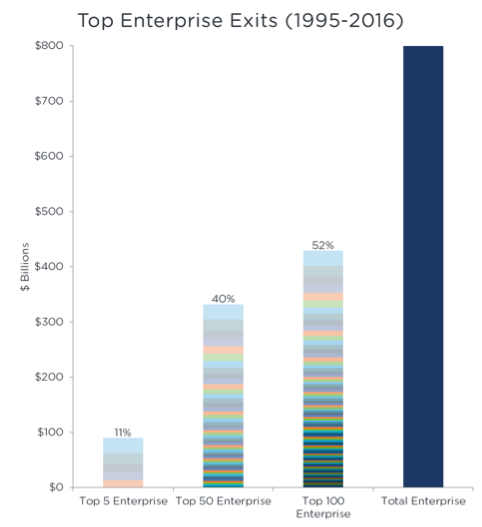

Data from 1995 indicates that the increase in the cost of technical corporations observed over the years is often caused by several exit transactions, while in the consumer sector the cost increases after one major exit transaction. This concentration of increase in the cost of consumer companies becomes apparent when comparing corporations and consumer companies on a chart. Does this trend mean that it is much more difficult to rely on a return on investment in the consumer sector, given that there are fewer peak values?

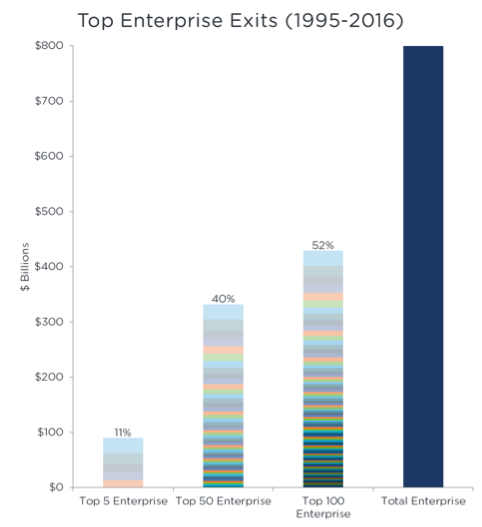

Largest exit deals in corporations (1995-2016)

The largest exit deals in consumer companies (1995—2016)

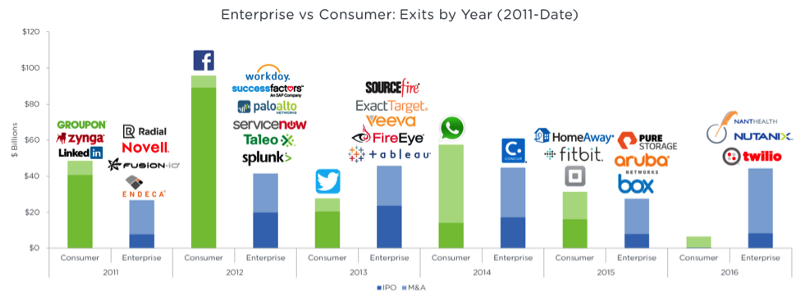

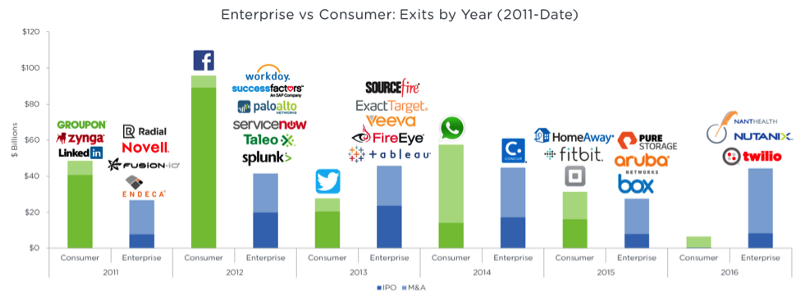

The trend of surges in the increase in the cost of consumer companies is clearly manifested in the study of transactions over the past five years. Profit from investments in large consumer companies, such as Facebook, Twitter or WhatsApp, is often more than the sum of profits from deposits in many corporations for any year.

Corporations vs. Consumer Companies: Outputs per year (2011 — present)

Thank you so much to Eugene Chau (Sapphire Ventures) , who helped collect data for this project.

Confirmation Disclosure:

The information presented above is not an investment advice and under no circumstances may the information provided be used as an offer or be considered an offer to purchase a share in any investment fund managed by Sapphire Ventures. Sapphire Ventures does not provide advice or services, and its funds currently do not attract new investors. Historical data is not indicative of future forecasts.

None of the portfolio companies mentioned above is necessarily an investment project recommended by Sapphire Ventures, and has not been selected based on the profits earned by Sapphire Ventures. The above information does not confirm that these investments were or will be profitable. Not all Sapphire Ventures fund investments will be profitable or will be similar to the companies listed in the article.

Original: Why Enterprise Funds May Return More Than Consumer Funds

In general, venture capital should increase the value of a company and ensure the distribution of profits for investors. You can’t handle it and go broke. Therefore, we thought it was important to examine the stability of the investment market over the recent past, collecting data through Pitchbook and Capital IQ. Some of the results of our research are presented below.

Since 1995, the number of exits from investment projects in corporations has significantly exceeded the number of exits from investments in consumer companies (compare the blue line with the green one). Over the past five years, the value of transactions in the consumer sector regularly exceeded the value of exit transactions in the corporate sector per year. Note that the exit value for the initial public offering is based on the total market capitalization at the time of entering the stock exchange.

- Technical corporations funded by venture funds have increased their value to $ 825 billion since 1995: 410 billion due to mergers, and 414 billion after the placement of shares.

') - The cost of consumer companies has increased to 582 billion since 1995: 168 billion - due to mergers, and 414 billion after the placement of shares.

- In total, more than 4,600 exit transactions were conducted with the support of venture funds in corporations and more than 2,600 in consumer companies.

Corporations vs. Consumer Companies: Outputs per year (1995-2016)

Data from 1995 indicates that the increase in the cost of technical corporations observed over the years is often caused by several exit transactions, while in the consumer sector the cost increases after one major exit transaction. This concentration of increase in the cost of consumer companies becomes apparent when comparing corporations and consumer companies on a chart. Does this trend mean that it is much more difficult to rely on a return on investment in the consumer sector, given that there are fewer peak values?

- The five largest corporations with the largest increase in net worth — 90 billion, which is 11% of the 825 billion mentioned — have been on the market since 1995.

Largest exit deals in corporations (1995-2016)

- The five largest consumer companies with the largest indicators of increase in their own value - 211 billion, which is 36% of the 582 billion mentioned - appeared on the market since 1995.

The largest exit deals in consumer companies (1995—2016)

The trend of surges in the increase in the cost of consumer companies is clearly manifested in the study of transactions over the past five years. Profit from investments in large consumer companies, such as Facebook, Twitter or WhatsApp, is often more than the sum of profits from deposits in many corporations for any year.

Corporations vs. Consumer Companies: Outputs per year (2011 — present)

Thank you so much to Eugene Chau (Sapphire Ventures) , who helped collect data for this project.

Confirmation Disclosure:

The information presented above is not an investment advice and under no circumstances may the information provided be used as an offer or be considered an offer to purchase a share in any investment fund managed by Sapphire Ventures. Sapphire Ventures does not provide advice or services, and its funds currently do not attract new investors. Historical data is not indicative of future forecasts.

None of the portfolio companies mentioned above is necessarily an investment project recommended by Sapphire Ventures, and has not been selected based on the profits earned by Sapphire Ventures. The above information does not confirm that these investments were or will be profitable. Not all Sapphire Ventures fund investments will be profitable or will be similar to the companies listed in the article.

Original: Why Enterprise Funds May Return More Than Consumer Funds

Source: https://habr.com/ru/post/317044/

All Articles