PIN cards of bank cards. How modern technology replaces paper mail

Today, in banking services, the expectations of customers using mobile technologies have increased significantly. Technological leap has led to the growth of instantly available services, which, in turn, determined the requirements of users. Banks that are actively developing mobile capabilities offer options for providing financial information in real time, as well as the latest advances in mobile technology.

According to the cloud computing center Salesforce, which is based in the United States, almost half of the respondents from among the youth (generation Y, or milleniali) responded that they wanted to receive bank SMS alerts . Of the 285 users, 43% of respondents subscribed to such alerts.

This is one of those rare types of content that users are usually willing to loyally receive on their smartphone. Still would! After all, this is money that is known to love counting and control.

')

When managing or viewing personal finances, the client is fully focused on exploring the information that is provided through a mobile device. This is because the bank sends data that: a) is completely relevant and b) well protected. Thus, the task of the bank is to combine smooth integration, security and mobility.

In recent years, professional SMS platforms have spent a lot of time and resources developing A2P SMS solutions that are able to cope with such tasks. Thus, specialized providers lend banks and cardholders the use of SMS systems for enterprises, which include a wide range of mobile financial services.

As a result of serious research and security infrastructure updates, the capabilities of the new generation of SMS systems have been greatly expanded, and now they include options for delivering unprotected data for authentication — for example, PIN codes for bank cards — in real time. This type of SMS protected process (SSMS) is in many ways close to the standard letter-based service.

We all remember these bank protected envelopes with PIN codes inside. This technology is associated with some risks, costs and time for delivery. In addition, cardholders can not use new cards until the pigeon arrives. Jokes are jokes, but such time intervals entail financial losses. Regular mail delivery takes about a week, and banks lose time providing a PIN code. Such losses amount to about 2% of the expected annual costs for each first issued card. In fact, our internal research has shown that on average, the savings compared to standard printed and mailed data are 40-60% for each PIN.

Today, with the help of a specialized provider, such a long process can be easily replaced by convenient mobile delivery of PIN codes.

All messages that are sent through our SSMS platforms are delivered directly to a trusted telecommunications operator via the communication card Payment Card Industry Data Security Standard (PCI DSS) Level 1. This secure process for delivering a PIN code works without intermediaries and ensures security throughout the cycle. .

RSA 2048-bit encryption, public and private keys are used to ensure security during the information exchange process. The client requests a PIN, providing the appropriate secret data - a combination of the secret word, card number and phone number, which are used to select the correct PIN. After creating and encrypting the PIN-code, it is stored separately from the mobile phone, and the secret word is used in the process of using the card. During this process, no one can recover or intercept the PIN codes for a particular card. After successful delivery, the PIN is automatically removed from the system.

The constant adaptation of fraud detection systems to credit card transactions due to the increasing number of dangerous scenarios is the main task for all major players in the financial sector. However, fraud can be reduced by using appropriate technology.

Many cardholders travel abroad, and banks operating around the world must handle multiple transactions internationally. Using services — such as Number Checking and Geolocation — allows you to determine if a customer is roaming and use the data to accurately assess fraud risks.

If an attempt to carry out a card transaction is registered abroad, we can determine whether the mobile number of the client is roaming or not. If the number is not roaming, then the user is probably not abroad, and the legality of the transaction is in doubt. Thus, using data on determining the location of an ATM, such a system allows banks to carry out additional checks before blocking a credit card in order to prevent such fraudulent scenarios.

In a world where mobile technologies occupy two of the three most frequent ways of alerts from banks preferred by young audiences, and where 27% rely entirely on mobile banking applications, it is important that banks communicate with customers on conditions suggested by customers. These technologies are becoming as familiar as voice communication or the Internet, and users expect adequate solutions from banks for modern conditions.

According to the cloud computing center Salesforce, which is based in the United States, almost half of the respondents from among the youth (generation Y, or milleniali) responded that they wanted to receive bank SMS alerts . Of the 285 users, 43% of respondents subscribed to such alerts.

This is one of those rare types of content that users are usually willing to loyally receive on their smartphone. Still would! After all, this is money that is known to love counting and control.

')

When managing or viewing personal finances, the client is fully focused on exploring the information that is provided through a mobile device. This is because the bank sends data that: a) is completely relevant and b) well protected. Thus, the task of the bank is to combine smooth integration, security and mobility.

In recent years, professional SMS platforms have spent a lot of time and resources developing A2P SMS solutions that are able to cope with such tasks. Thus, specialized providers lend banks and cardholders the use of SMS systems for enterprises, which include a wide range of mobile financial services.

As a result of serious research and security infrastructure updates, the capabilities of the new generation of SMS systems have been greatly expanded, and now they include options for delivering unprotected data for authentication — for example, PIN codes for bank cards — in real time. This type of SMS protected process (SSMS) is in many ways close to the standard letter-based service.

We all remember these bank protected envelopes with PIN codes inside. This technology is associated with some risks, costs and time for delivery. In addition, cardholders can not use new cards until the pigeon arrives. Jokes are jokes, but such time intervals entail financial losses. Regular mail delivery takes about a week, and banks lose time providing a PIN code. Such losses amount to about 2% of the expected annual costs for each first issued card. In fact, our internal research has shown that on average, the savings compared to standard printed and mailed data are 40-60% for each PIN.

Today, with the help of a specialized provider, such a long process can be easily replaced by convenient mobile delivery of PIN codes.

How it works?

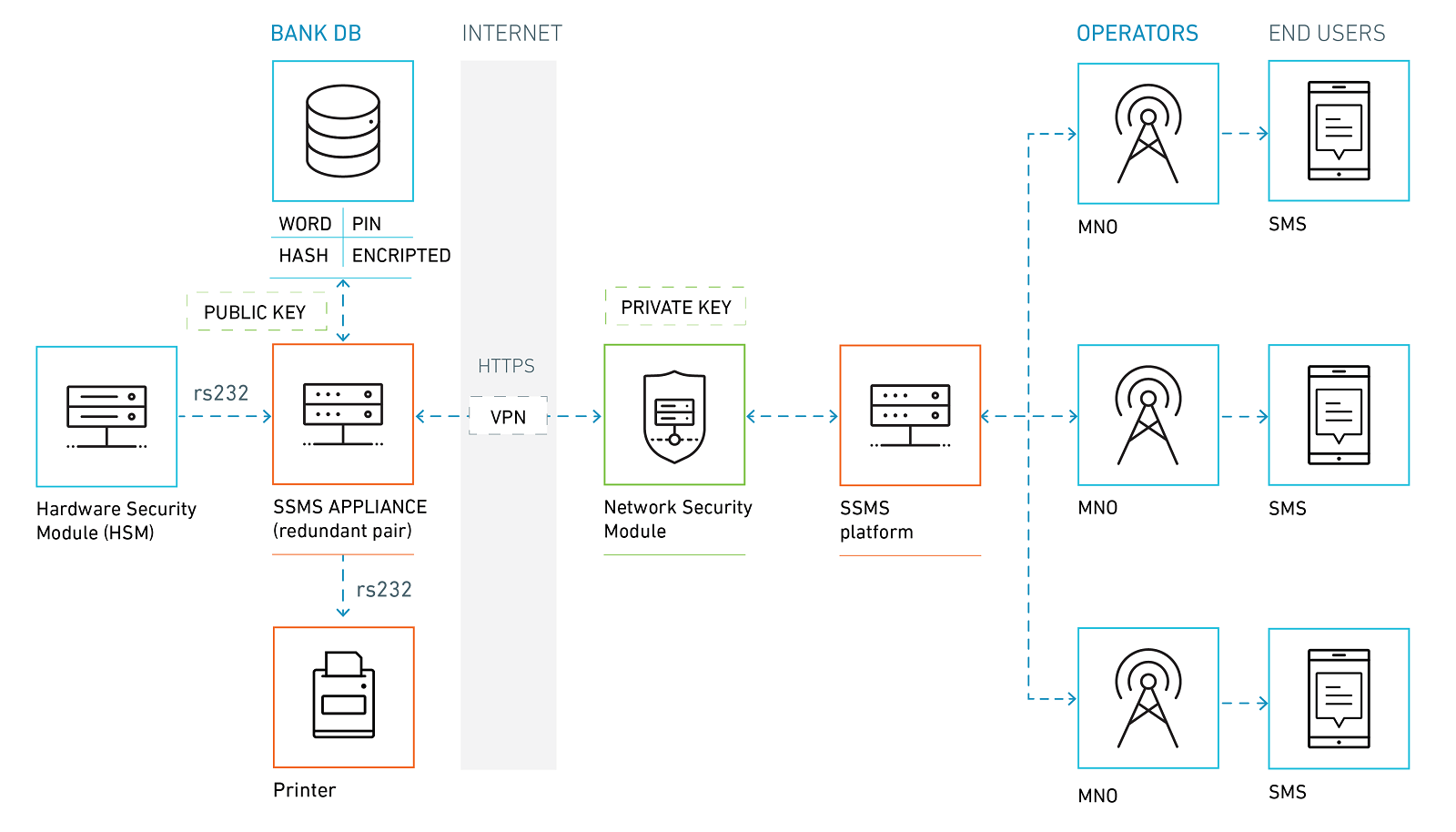

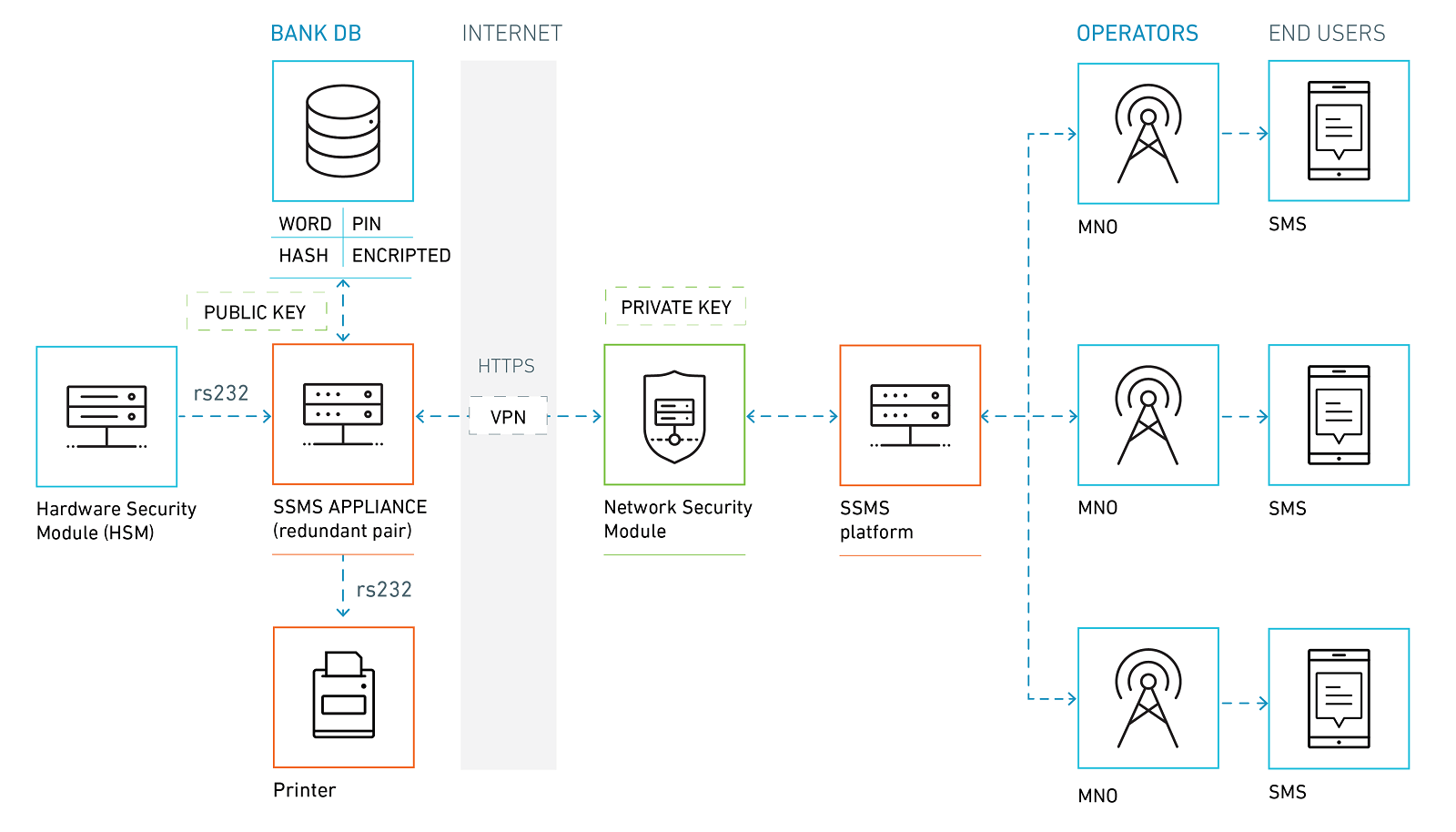

All messages that are sent through our SSMS platforms are delivered directly to a trusted telecommunications operator via the communication card Payment Card Industry Data Security Standard (PCI DSS) Level 1. This secure process for delivering a PIN code works without intermediaries and ensures security throughout the cycle. .

RSA 2048-bit encryption, public and private keys are used to ensure security during the information exchange process. The client requests a PIN, providing the appropriate secret data - a combination of the secret word, card number and phone number, which are used to select the correct PIN. After creating and encrypting the PIN-code, it is stored separately from the mobile phone, and the secret word is used in the process of using the card. During this process, no one can recover or intercept the PIN codes for a particular card. After successful delivery, the PIN is automatically removed from the system.

Security technology

The constant adaptation of fraud detection systems to credit card transactions due to the increasing number of dangerous scenarios is the main task for all major players in the financial sector. However, fraud can be reduced by using appropriate technology.

Many cardholders travel abroad, and banks operating around the world must handle multiple transactions internationally. Using services — such as Number Checking and Geolocation — allows you to determine if a customer is roaming and use the data to accurately assess fraud risks.

If an attempt to carry out a card transaction is registered abroad, we can determine whether the mobile number of the client is roaming or not. If the number is not roaming, then the user is probably not abroad, and the legality of the transaction is in doubt. Thus, using data on determining the location of an ATM, such a system allows banks to carry out additional checks before blocking a credit card in order to prevent such fraudulent scenarios.

In a world where mobile technologies occupy two of the three most frequent ways of alerts from banks preferred by young audiences, and where 27% rely entirely on mobile banking applications, it is important that banks communicate with customers on conditions suggested by customers. These technologies are becoming as familiar as voice communication or the Internet, and users expect adequate solutions from banks for modern conditions.

Source: https://habr.com/ru/post/316886/

All Articles