The future of financial technology in 9 charts

At EXANTE, we are actively following the technological trends in the financial industry and want to share with you on this blog what we find interesting.

The financial industry is actively changing, and not everyone will be able to adapt to the new reality. There are at least three areas where the confrontation between traditional players and novices will be the most severe:

The technological revolution comes in almost all areas of the financial industry:

')

We are closely following the trends and want to show a few graphs from the presentation of the CB Insights analytical company, which, based on an analysis of Internet requests, identified 9 of the hottest areas at the junction of finance and technology. The graphs show the movement of the relative popularity of search queries in arbitrary units (maximum value = 100 points) for the period from 2012 to 2016.

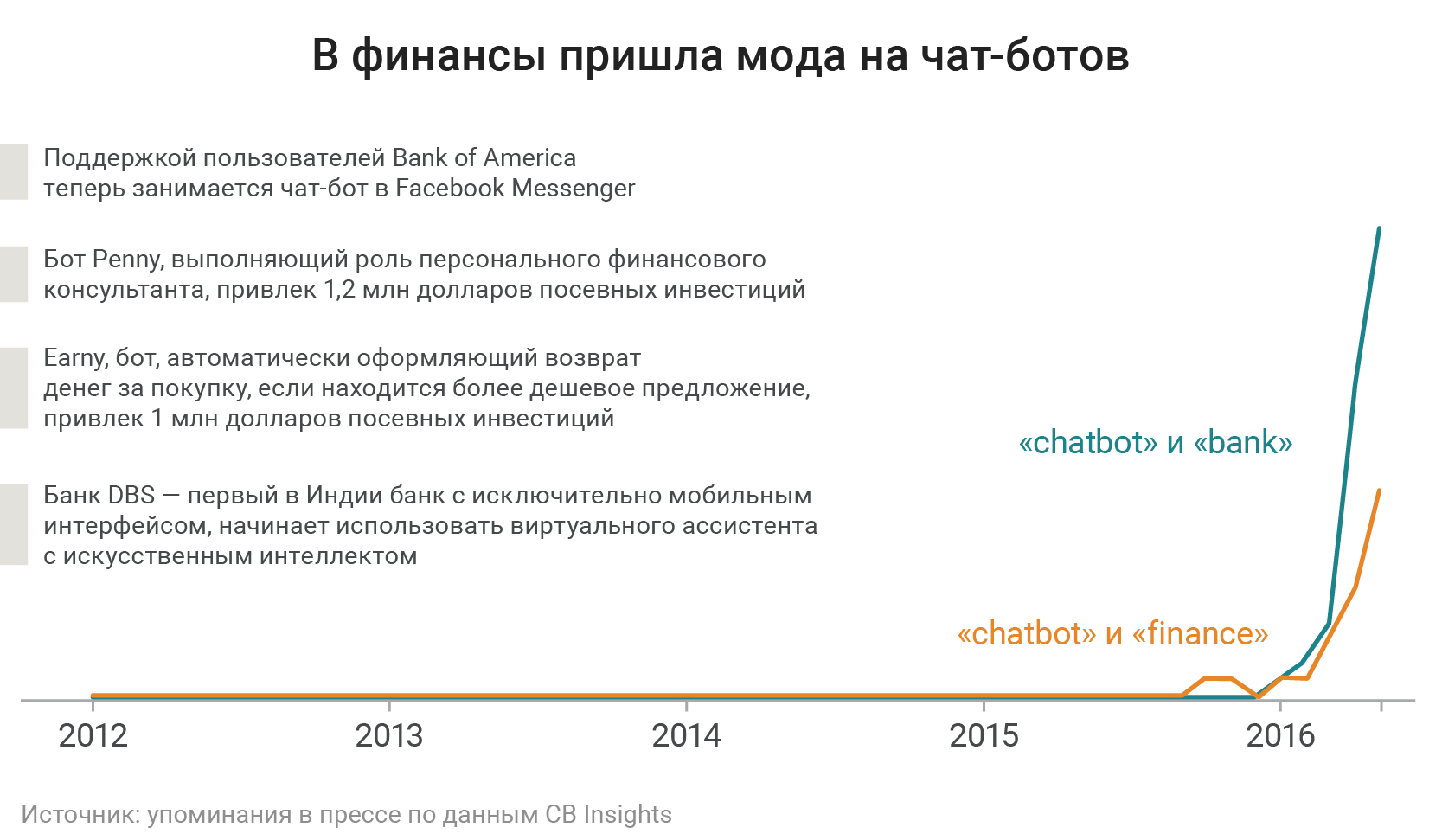

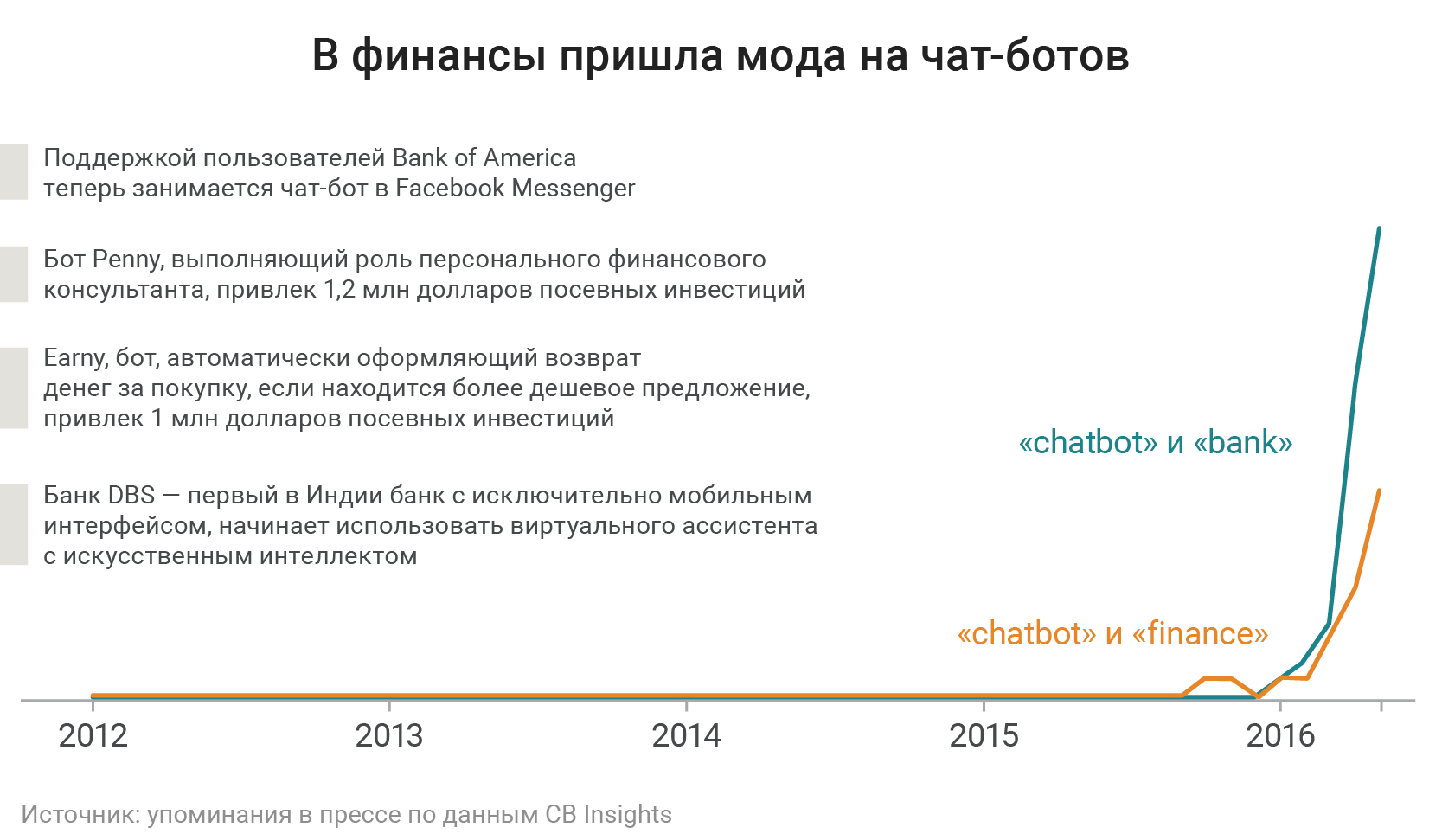

1. Financial and banking chat bots

2. Mutual insurance

3. Foreign investors invest in American fintech

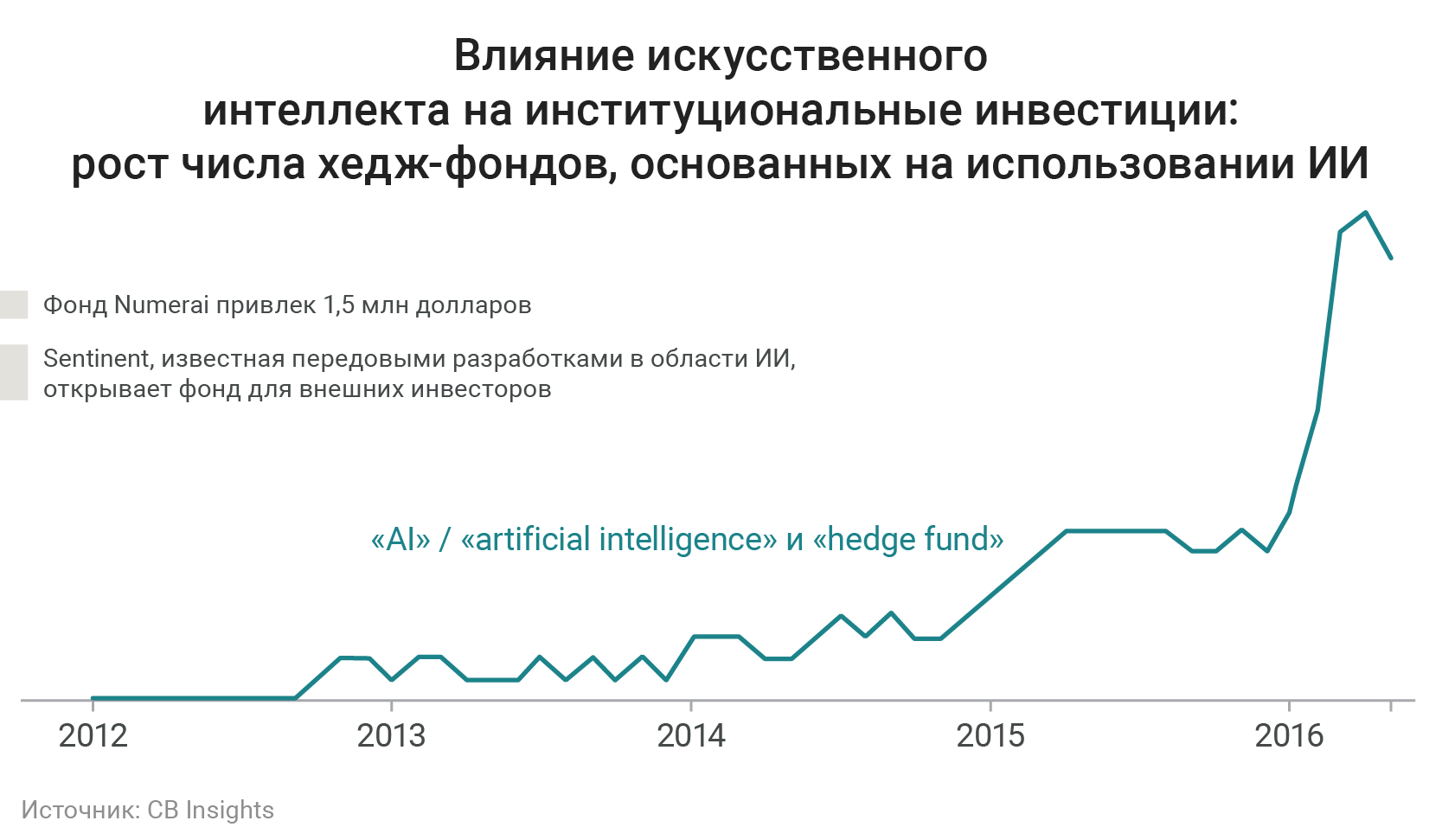

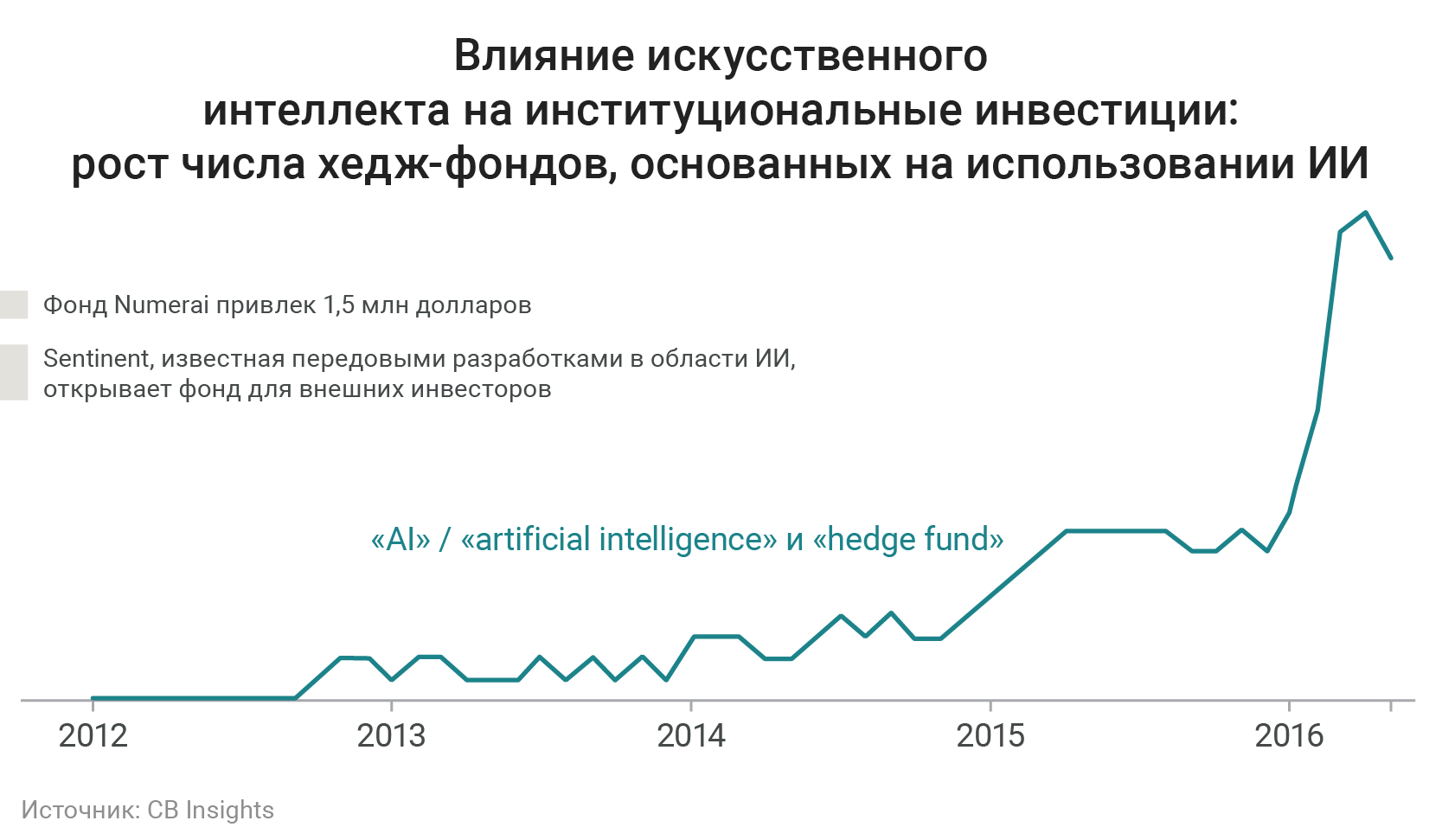

4. Hedge funds using AI

5. Service of those who are not available traditional financial services

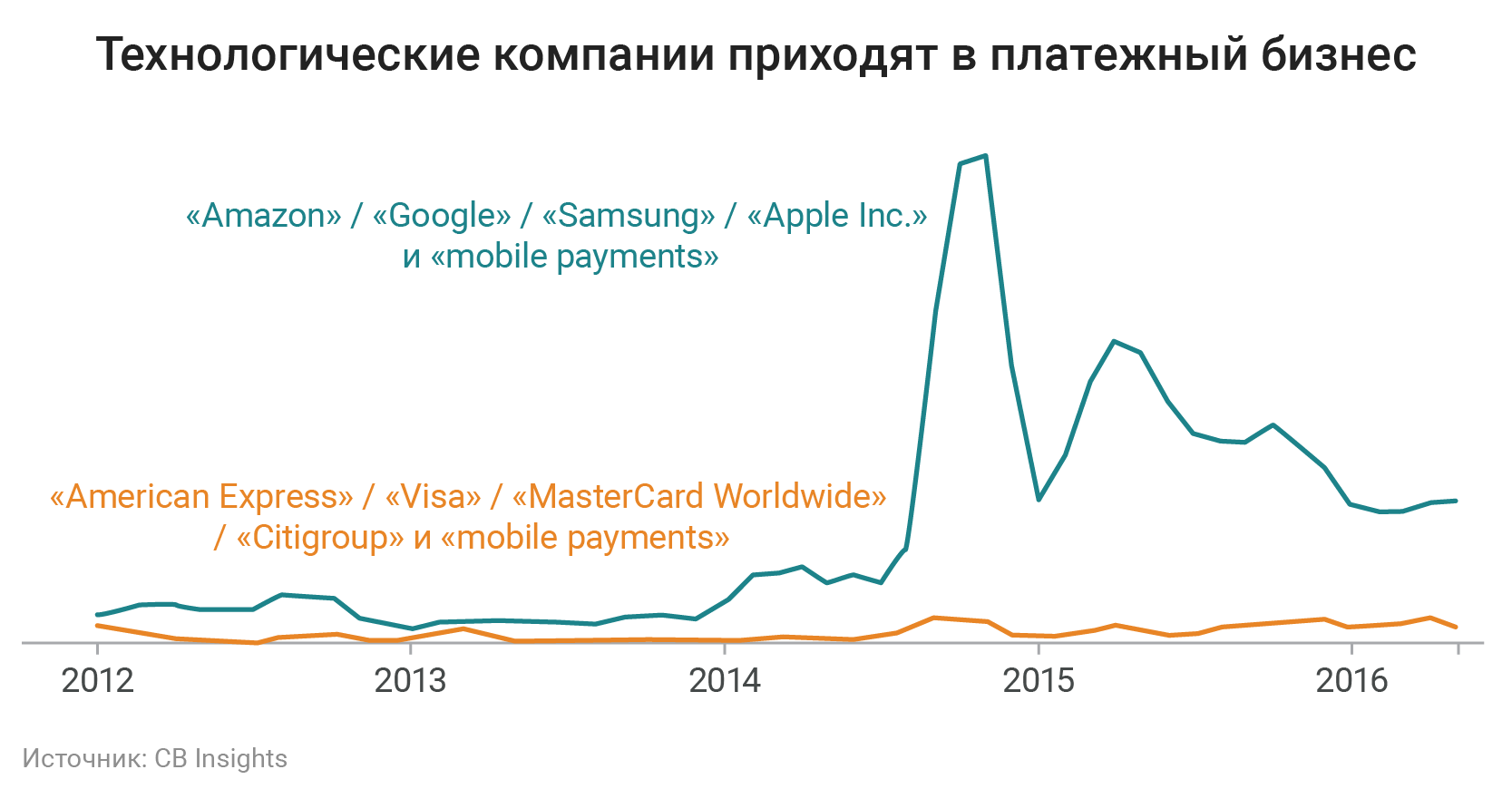

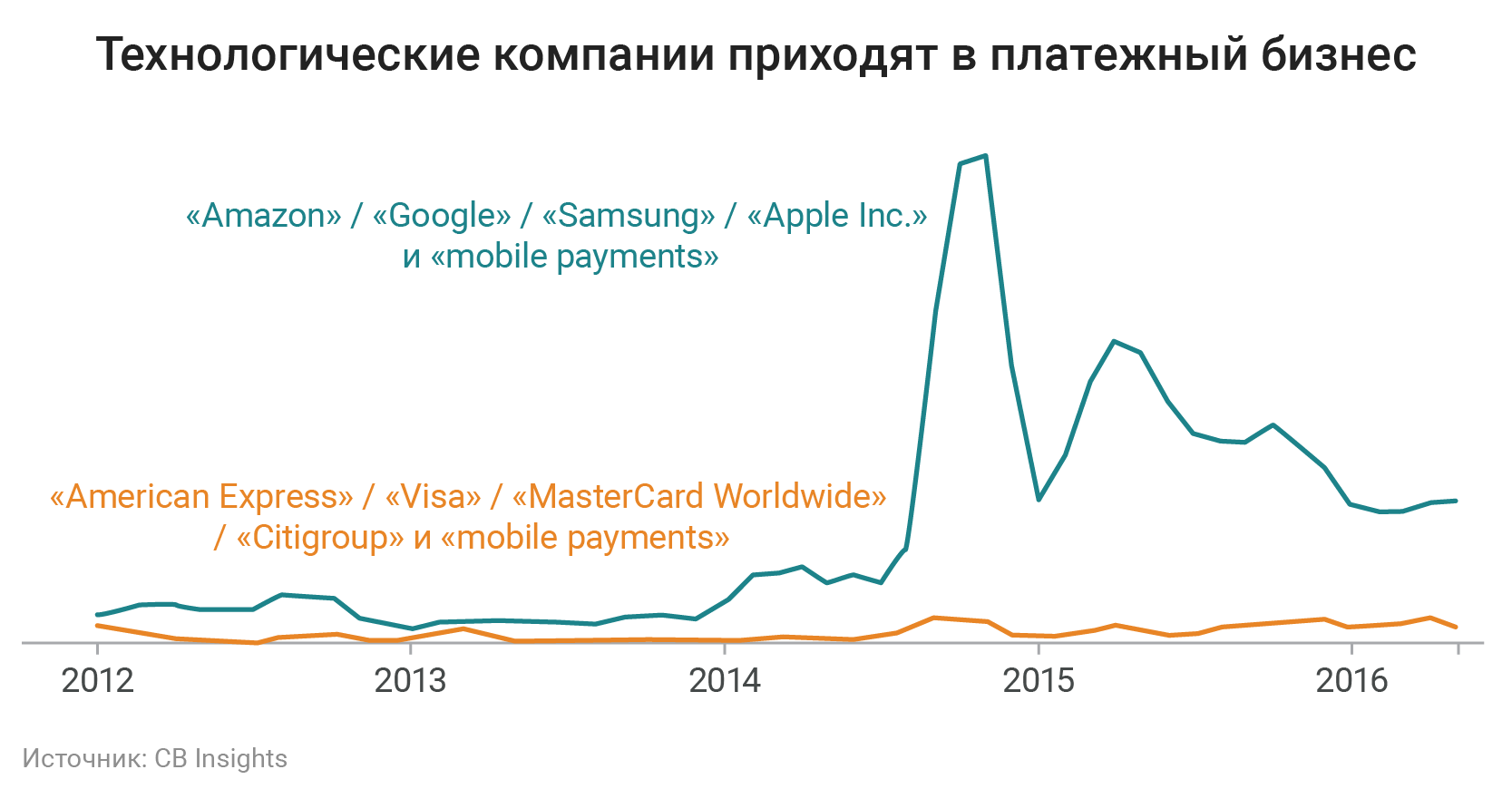

6. Large technology companies come into the payment business.

7. Real estate investment

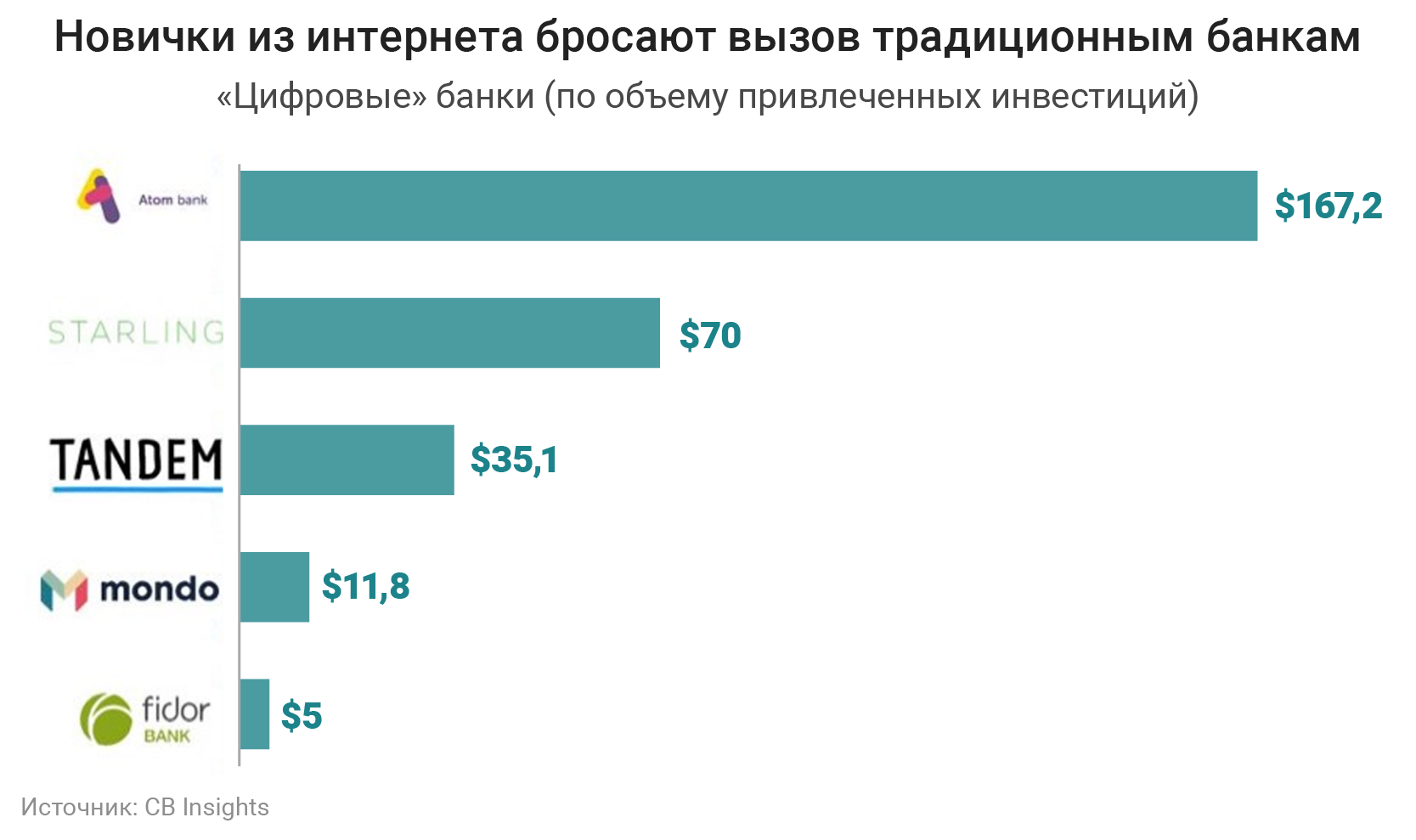

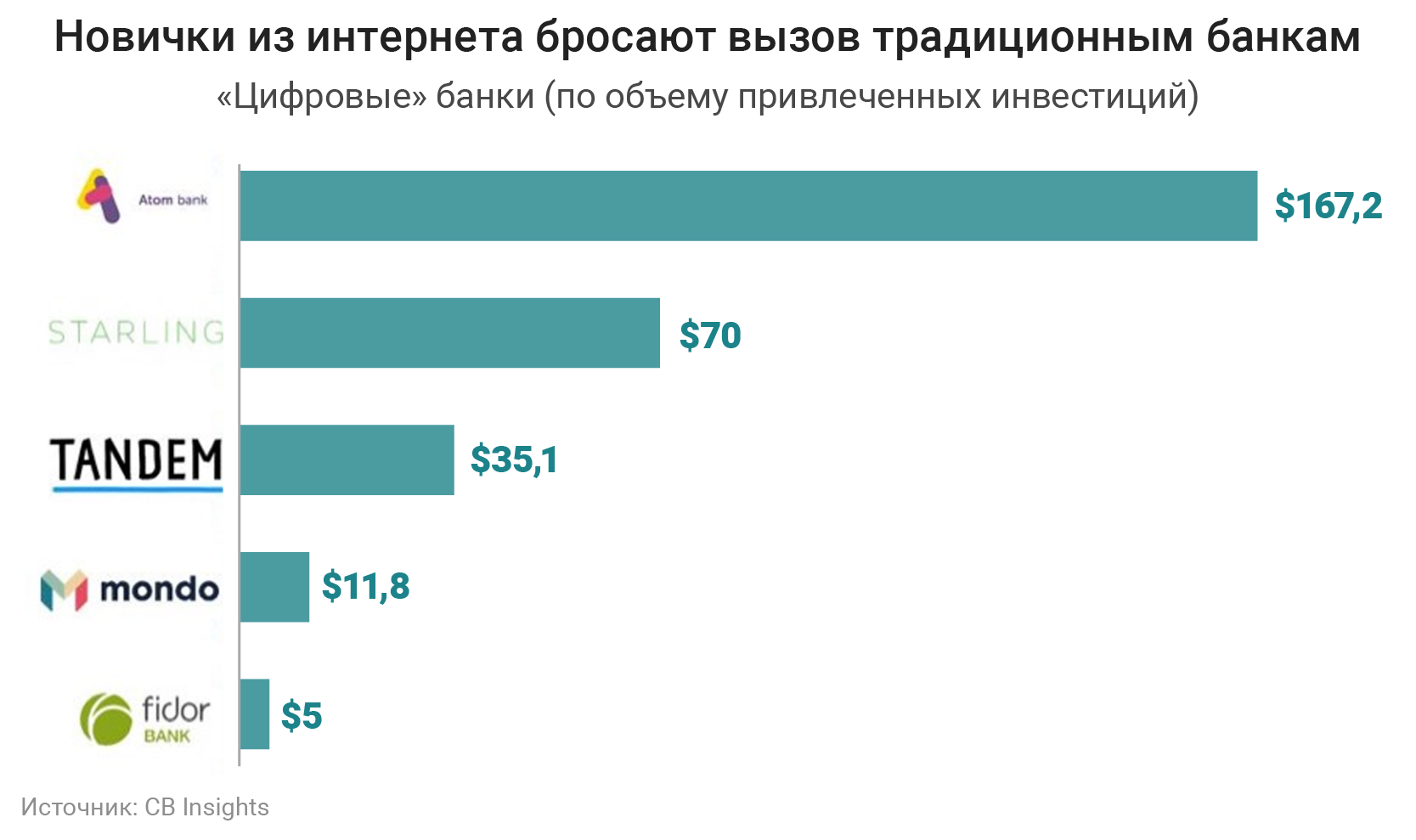

8. Online banks

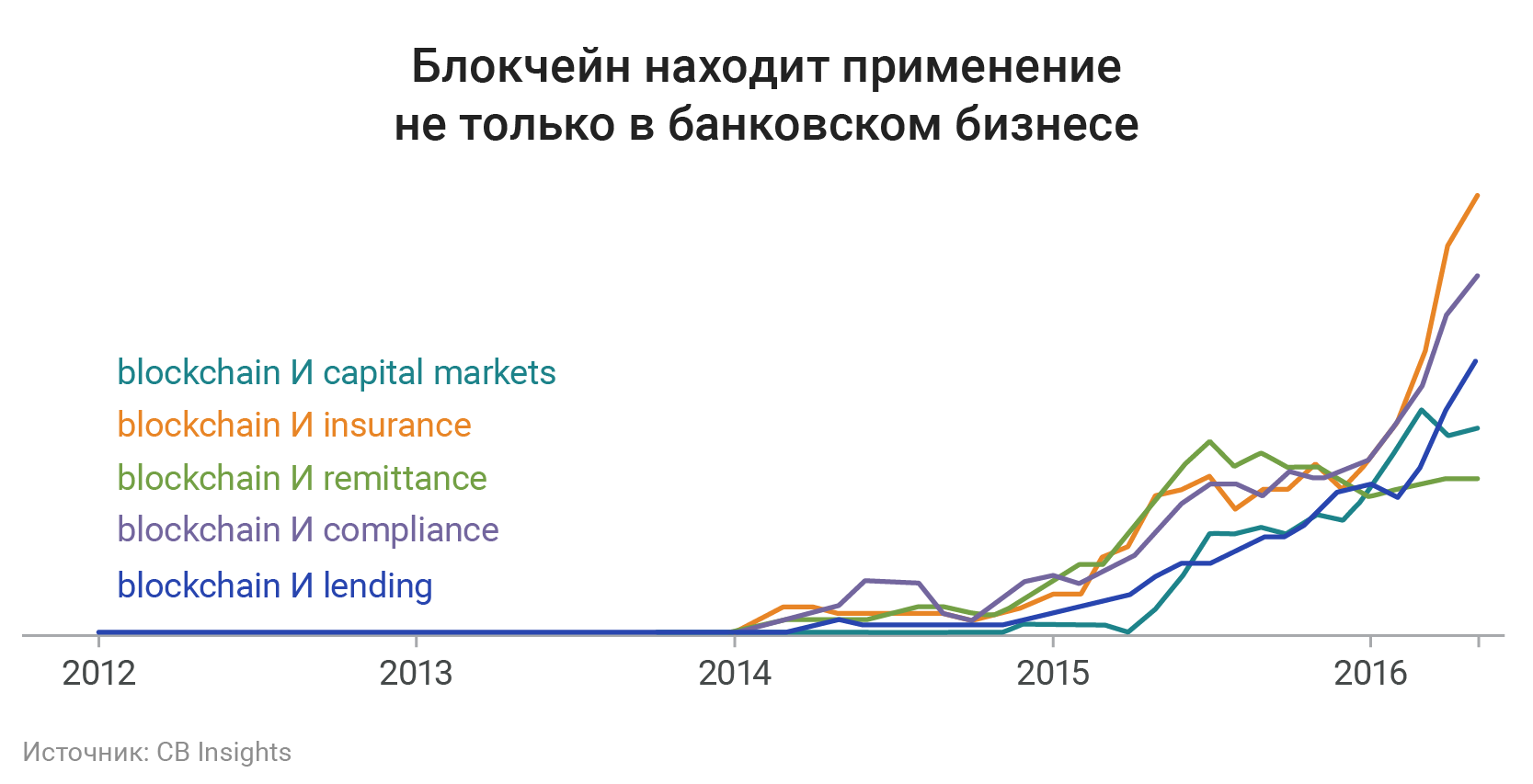

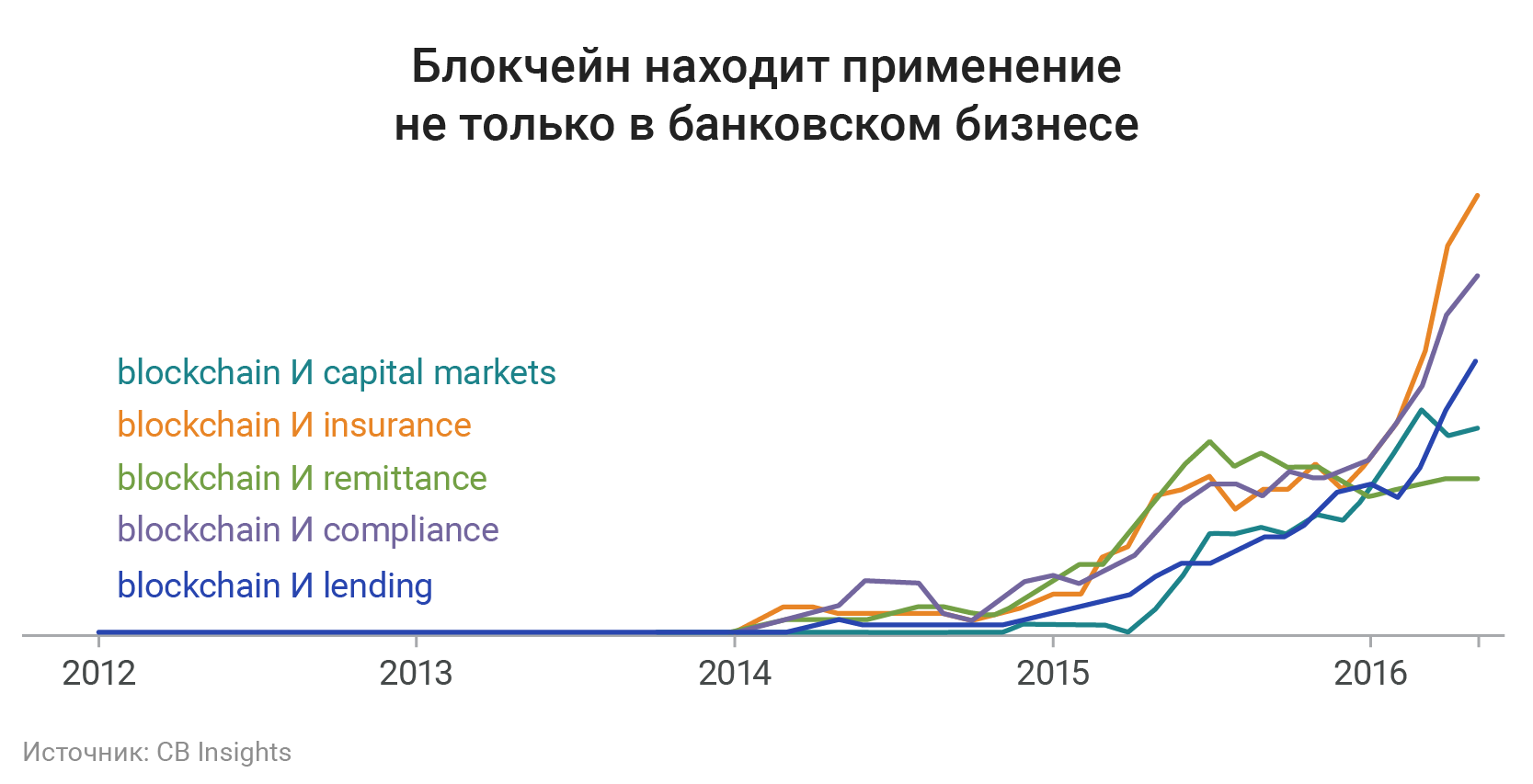

9. Practical blockchain applications

Last year was a record year for fintech industry in terms of investment. According to KPMG, more than $ 19 billion was invested in the industry, 13.8 of which went to companies that received venture financing. According to the results of the first two quarters of 2016, this amount should grow by half by the end of the year, and this is the fastest growing industry for new players.

In the next posts we will talk about what entrepreneurs usually face when they decide to do business at the junction of finance and technology, what technical difficulties can be met and how to solve them working in the financial industry, where to get free financial data and how to make a FINTECH product, not thinking about the implementation of its own infrastructure for access to financial markets.

The financial industry is actively changing, and not everyone will be able to adapt to the new reality. There are at least three areas where the confrontation between traditional players and novices will be the most severe:

- Retail banks against banks that work only on the Internet. Most of the retail services offered by classic banks can be provided at a lower price, and high-quality offices are not at all necessary for quality service.

- Credit institutions against p2p lending. Platforms acting as intermediaries for borrowers and lenders are actively advancing on the banking sector, offering higher returns to investors and automated decision-making for those who want to get a loan.

- Portfolio managers against robo-consultants. Robo-consultants offer investors lower commissions, lower investment thresholds and higher returns. In addition, automated strategies are not subject to the human factor and have a transparent account of your investments online. Many investment houses and banks are not missing the trend and are actively introducing automated consultants for their clients.

The technological revolution comes in almost all areas of the financial industry:

')

- Retail Banking Services

- Crediting

- Payments and transfers

- Asset Management

- Markets and exchanges

- Insurance

- Blockchain technology

We are closely following the trends and want to show a few graphs from the presentation of the CB Insights analytical company, which, based on an analysis of Internet requests, identified 9 of the hottest areas at the junction of finance and technology. The graphs show the movement of the relative popularity of search queries in arbitrary units (maximum value = 100 points) for the period from 2012 to 2016.

1. Financial and banking chat bots

2. Mutual insurance

3. Foreign investors invest in American fintech

4. Hedge funds using AI

5. Service of those who are not available traditional financial services

6. Large technology companies come into the payment business.

7. Real estate investment

8. Online banks

9. Practical blockchain applications

Last year was a record year for fintech industry in terms of investment. According to KPMG, more than $ 19 billion was invested in the industry, 13.8 of which went to companies that received venture financing. According to the results of the first two quarters of 2016, this amount should grow by half by the end of the year, and this is the fastest growing industry for new players.

In the next posts we will talk about what entrepreneurs usually face when they decide to do business at the junction of finance and technology, what technical difficulties can be met and how to solve them working in the financial industry, where to get free financial data and how to make a FINTECH product, not thinking about the implementation of its own infrastructure for access to financial markets.

Source: https://habr.com/ru/post/316584/

All Articles