5 reasons not to use your personal account in freelance

Given: programmer Vasily Ivanov (even before he registered an LLC ) during his free time from freelance, completing orders and receiving payment from clients on his physical person card. At some point, there were so many customers that Vasily decided to legalize and open an IP .

Having studied the legislation, he learned that the individual entrepreneur is not obliged to open a current account. “Fine,” Vasily decided, “I will continue to accept payment on my card, because it is convenient and, most importantly, free. There is no need to pay the bank monthly for maintaining a current account. ”

As a result, Vasily wrote out the following arguments on a sheet in favor of using a personal account:

- There is no time spent on opening and maintaining a settlement account of the IE ;

- savings on maintenance (no settlement account - no cost);

- savings on taxes (I show tax in the declaration, from that I pay the tax, or I will sit on the minimum payments for individual entrepreneurs).

The question is: can Vasily, with the obvious advantages, so calmly use his personal account in business?

Indeed, there is no explicit prohibition on using a personal account in a business in the law, but we counted 5 compelling reasons why it shouldn’t be done.

1. Banks do not like such a scheme

In the Instructions of 30.05.2014 N 153-I, the Central Bank determines that current (personal) accounts are opened for individuals for operations not related to business or private practice. And article 848 of the Civil Code obliges banks to perform only those operations that are provided for accounts of this type. That is, if the bank makes business payments on the current account, then it violates the requirement of the Civil Code.

On the other hand, the bank does not have the right to determine and control the direction of use of the client’s funds (Article 845 (3) of the Civil Code of the Russian Federation). It turns out that there is a requirement, and there is no mechanism for controlling the income received by the physical person’s current account (unless you or you have transferred 600 thousand or more, because this operation immediately comes under control, by virtue of Article 6 of Law No. 115-, 07.08.01 ). In order to relieve themselves of part of the responsibility for violation of Article 848 of the Civil Code of the Russian Federation, banks indicate in the contract that the client undertakes not to conduct operations related to business or private practice on the current account.

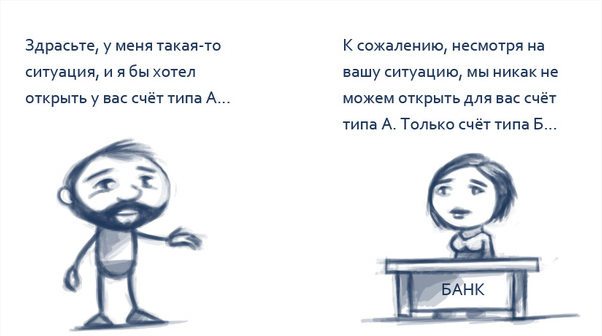

Do not forget about the economic component, because the maintenance of settlement accounts for the bank is a permanent source of income. Accordingly, it is profitable for banks to separate personal accounts and business accounts. In this regard, the banks usually miss receipts to the personal account of an individual (unless the payment directly states that the recipient is IE Vasily Ivanov), but refuse to conduct operations that are clearly related to business, for example, paying taxes insurance premiums, licenses, commercial supplies, etc.

Responsibility / consequences: some special responsibility for violation of the account regime by the client has not been established, therefore, when revealing the facts of unlawful use, the bank simply terminates the contract. Usually, this is followed by a written warning and an offer to open, as it should, a current account. You can, of course, then go to another bank, but the story is likely to repeat there.

2. The risk of being controlled by Rosfinmonitoring.

Financial intelligence monitors the activities of banks, including by examining the passage of operations on customer accounts. The prohibition to control the origin of income (“bank secrecy”) received on a personal account does not apply to Rosfinmonitoring. In the framework of countering money laundering and terrorist financing, financial intelligence may wonder who these generous people regularly replenish the personal account of an individual. And although the likelihood of such a development for an ordinary entrepreneur is not so great, but it really exists and increases in proportion to the amount of incoming amounts to your personal account.

Responsibility / consequences: if you didn’t do anything wrong with Rosfinmonitoring, the maximum you face is a temporary freezing of the account until all the circumstances of the origin of the funds are ascertained.

3. Tax risks for customers

Each customer, working under a contract or GPC with an ordinary individual, and not an individual entrepreneur, is obliged to pay for the amount of remuneration at his own expense insurance premiums to the FIU and the MHIF (27.1%). In addition, with the cost of services, the customer must withhold 13% of income tax and transfer their budget. Such a variant of the contract with an individual to the customer, of course, is not very interesting. Here it is more profitable to work with an officially registered entrepreneur.

What happens if this individual concludes an agreement as an individual entrepreneur, but at the same time prescribes the current account of an individual in the details? In this case, an experienced customer can simply refuse to enter into such an agreement, requiring the indication of the current account. The reason is that when checking such contracts, the customer himself may be accused of not fulfilling the duties of a tax agent and the insured, because the payment went not to the PI, but to an ordinary individual.

Understanding exactly which account is specified for payment is very simple - by its first numbers:

- 423 - deposit account;

- 40817 - current account of individuals;

- 40802 - current account PI.

So, the customer, who does not want to have additional problems, will first of all look at these numbers and demand to register the details of the settlement account.

Responsibility / consequences: for a customer, such a turn of events is threatened with additional charges at his own expense of insurance premiums (27.1% to the payment that was transferred to you for services) and a fine of 20% of unused PIT. For you - the potential loss of the customer in the future.

4. Tax risks for you

Here we will immediately turn to responsibility and consequences.

Responsibility / consequences: the sophisticated logic of the FTS staff can be admired, simply as a phenomenon, but when it is directed against you personally, it becomes not so much fun. Here are the top 3 tax implications of using a personal account in an IP activity instead of a calculated one:

- Non-recognition of business expenses under OSNO, USN Revenues minus expenses and UAT. A different account cannot be used a priori in business, and the expenses on it cannot reduce the tax base, even if they are obviously entrepreneurial in nature. Accordingly, taxes will have to pay more.

') - The taxation of income received on the current account at the maximum possible rate. Suppose you are IP on one of the preferential regimes (USN, UTII, PSN). When checking revealed the fact that payment from customers was carried out on a personal, rather than on the current account. This means that you received such income not as an individual entrepreneur, but as an ordinary individual, so they will be taxed at the rate of 13% as personal income tax (and not at 6% each, such as on the simplified tax system).

- Taxation of non-business income. If you keep both business income and funds received from other sources on your personal account, the Federal Tax Service may try to tax the entire amount on the account.

Yes, it is possible to fight off claims of inspectors, while often this is done only through the courts. But why have extra problems, lose personal time and extra money? In all senses, it is wiser to separate the proceeds from legal business and personal funds.

5. Problems of receiving subsidies, compensations (refunds) from the state

If an entrepreneur is entitled to reimbursement from the budget (tax deduction, tax refund or overpayment) or from funds (reimbursement of sick leave allowances), the money will be returned to the current account of the PI, and not to the personal one. The same applies to the receipt of subsidies and other state support measures - they will be transferred only to the current account.

Responsibility / consequences: you simply can not return what you could return under the law, or receive money for development.

Summary

In general, there is no point in persisting in using a personal account in business. A big plus for legal entrepreneurs is the absence of additional taxation when transferring income received from a business to your personal account or card. It is enough to indicate in the payment order that the money is transferred for the personal needs of the individual entrepreneur. There are no restrictions on the amounts and no taxes are charged. For comparison, the founder of LLC, receiving income from the business in the form of dividends, pays income tax of 13%.

Other articles from our blog on Habré:

Source: https://habr.com/ru/post/316394/

All Articles