What is the strength of the affiliate network, why does power become weak as it progresses, and what to do about it

We at Solar Staff collaborate a lot with partner networks, so we decided to write a short series of articles on how the partner network works from a legal point of view.

In this article we will talk about why affiliate networks are not born beautiful, and what they do when it comes time to "get married."

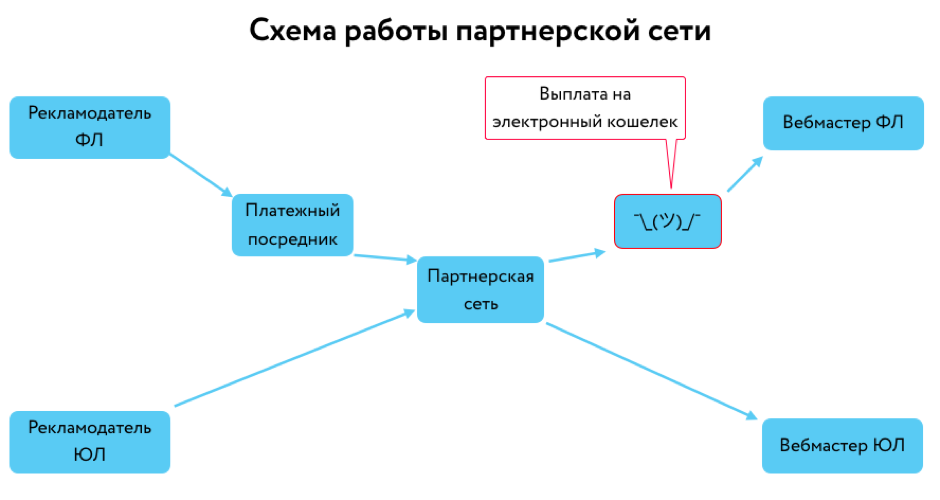

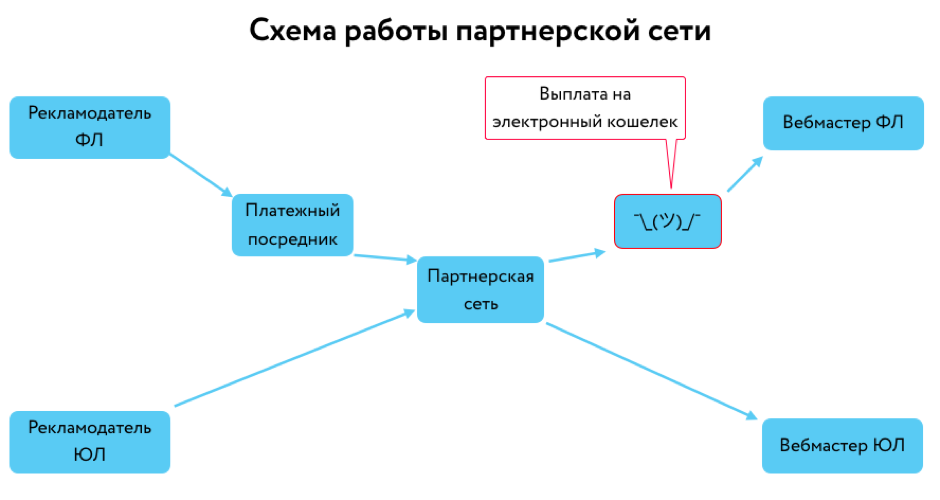

Let's start from the beginning: why affiliate programs are often “ugly” business? The answer to this question is contained in the very model of the affiliate network, the special economic effect of which is achieved through the ability to better than the advertiser to work with many “small” partners - webmasters (the diagram in the picture above).

This increased efficiency is achieved in different ways, and not all of them are related to technology, business processes and a deep understanding of the market. Often this efficiency is the result of a much more “free” approach to the design of calculations with webmasters - individuals.

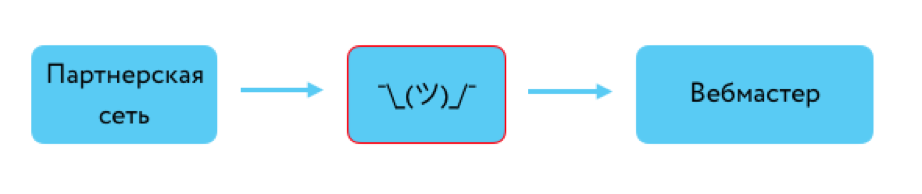

')

Partner networks, on the contrary, gave and give the webmaster partner a maximum of freedom due to the rejection of many bureaucratic procedures: he accepted the offer, set the network code, tied the e-wallet and was ready!

But this simplicity often implies the "ugliness" of the implementation of this model and the tangible risks associated with the transformation of advertising revenue into the same WebMoney or other electronic means of payment.

Affiliate networks are starting to think about changing the current model of relationships with webmasters in two cases:

And what to do in this case? There is a way out, but it is connected with the need to conduct international business.

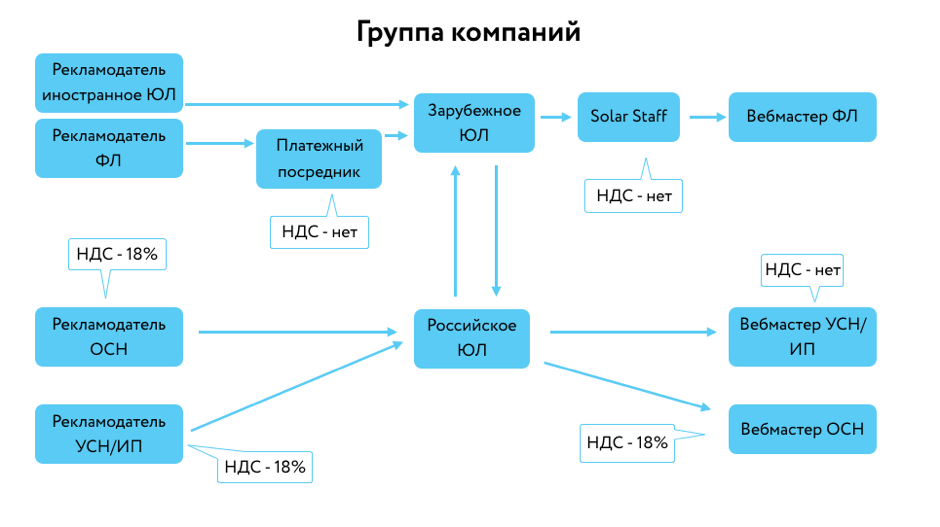

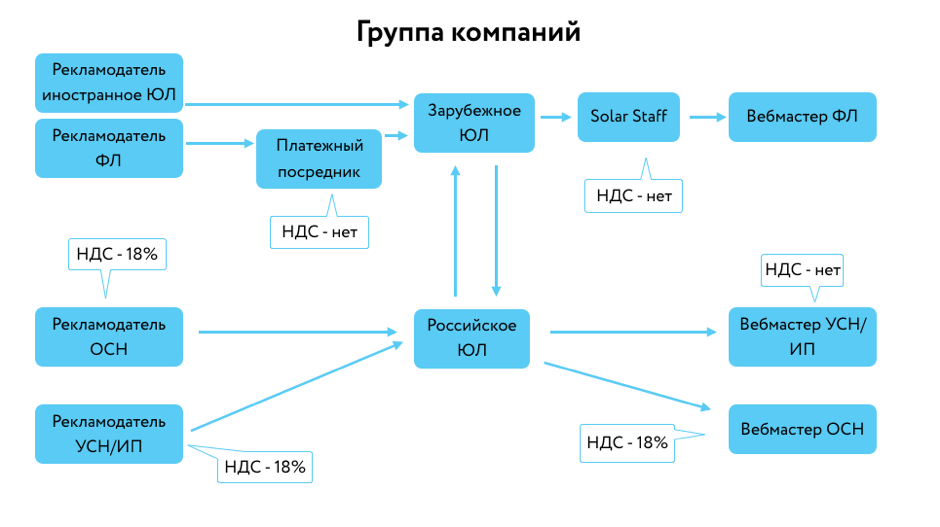

Partner networks had to enter foreign markets, establish companies in Europe (more often) or in Hong Kong (less often) and turn one advertising partner network into several interconnected partner networks. Thus, in the Russian segment, there remained only work with Russian companies by customers (advertisers) and with those advertising sites that are managed by legal entities or individual entrepreneurs. And all the work with foreign advertisers and webmasters had to be taken out to a foreign company.

This exit was quite expensive for advertising affiliates, but allowed to live and scale with a clear conscience. Why expensive? Because the creation of a foreign partner network is not only “registering a company, opening an account in a bank and agreeing with payment systems” (as if this is not enough). The opening and maintenance of an office in the country of presence and the relocation of personnel to this country is turned into a much greater expense. Usually such an “exercise” requires from 6 to 12 months of preparation and 150 thousand dollars of costs only at the installation stage.

On the pros, cons and pitfalls of this process, we'll talk in the next article.

In this article we will talk about why affiliate networks are not born beautiful, and what they do when it comes time to "get married."

Let's start from the beginning: why affiliate programs are often “ugly” business? The answer to this question is contained in the very model of the affiliate network, the special economic effect of which is achieved through the ability to better than the advertiser to work with many “small” partners - webmasters (the diagram in the picture above).

This increased efficiency is achieved in different ways, and not all of them are related to technology, business processes and a deep understanding of the market. Often this efficiency is the result of a much more “free” approach to the design of calculations with webmasters - individuals.

')

Why don't advertisers create affiliate programs?

Many large Russian companies-advertisers (for example, Ozone) tried to create their own CPA networks at different times, but this was not for everyone. The main reason for the failure was a more traditional approach to the design of relationships with webmasters:

The consequence of all these limitations and inconveniences is the loss of partners who are used to much greater freedom.

- Restriction in the choice of webmasters (only IE or LE)

- Paper workflow

- The requirement of full disclosure from the webmaster (a copy of the passport, SNILS, TIN), which is understandable from a legal point of view, but absolutely disastrous from practical

- Withholding personal income tax and social accrual. contributions (with the transfer of this burden on the shoulders of the webmaster)

The consequence of all these limitations and inconveniences is the loss of partners who are used to much greater freedom.

Partner networks, on the contrary, gave and give the webmaster partner a maximum of freedom due to the rejection of many bureaucratic procedures: he accepted the offer, set the network code, tied the e-wallet and was ready!

But this simplicity often implies the "ugliness" of the implementation of this model and the tangible risks associated with the transformation of advertising revenue into the same WebMoney or other electronic means of payment.

Affiliate that complies with all formal requirements

In RuNet there is an example of an affiliate program that works according to the rules - this is Yandex Advertising Network. Here the guys really were able to comply with all the formal requirements and fully remain in the legal field. The truth is to say that for the majority of partner networks, the implementation of such a mechanism is almost impossible. Not so much from the point of view of tax costs, but rather from the point of view of the utopianism of the idea of collecting data from individuals sufficient for tax reporting and tax withholding.

Affiliate networks are starting to think about changing the current model of relationships with webmasters in two cases:

- When the turnover of the affiliate network has grown to such values that the “liberties” of the webmaster payments have already sown fears in the minds of the owners or top management

- If an investor came, at the due diligence stage he saw a “black hole” at the site of the webmaster payments and was upset. The hole may have different shapes, but is usually present.

And what to do in this case? There is a way out, but it is connected with the need to conduct international business.

Partner networks had to enter foreign markets, establish companies in Europe (more often) or in Hong Kong (less often) and turn one advertising partner network into several interconnected partner networks. Thus, in the Russian segment, there remained only work with Russian companies by customers (advertisers) and with those advertising sites that are managed by legal entities or individual entrepreneurs. And all the work with foreign advertisers and webmasters had to be taken out to a foreign company.

Why work through non-resident structures

Let's look at this question on the example of the largest affiliate network in the world - AdSense. All work with Russian webmasters AdSense does not lead through the Russian UL, but through Ireland: webmasters sign contracts with Google Ireland and receive money from Ireland. The reason is that non-resident companies working with Russian performers do not act as their tax agent.

So, they have the opportunity to apply their local norms in relation to the rates of withholding taxes and local rules for the conduct of workflow :)

So, they have the opportunity to apply their local norms in relation to the rates of withholding taxes and local rules for the conduct of workflow :)

This exit was quite expensive for advertising affiliates, but allowed to live and scale with a clear conscience. Why expensive? Because the creation of a foreign partner network is not only “registering a company, opening an account in a bank and agreeing with payment systems” (as if this is not enough). The opening and maintenance of an office in the country of presence and the relocation of personnel to this country is turned into a much greater expense. Usually such an “exercise” requires from 6 to 12 months of preparation and 150 thousand dollars of costs only at the installation stage.

On the pros, cons and pitfalls of this process, we'll talk in the next article.

Source: https://habr.com/ru/post/315482/

All Articles