Six stages of the player in social f2p-games

Candy Crush is one of those games that best understand their players.

The developers of social games face a difficult task: try to get the players back to the game as long as possible. But no strategy can reach everyone, and Optimove wants to help you with this.

Optimove is a user retention and marketing company. She smashed social game players into six main categories and talks about the steps that developers can take to conquer users and maximize the game's lifespan. Most of the market for f2p-games is obsessed with attracting players and marketing costs. However, more and more studios are starting to work on retaining and understanding their users, because it is more cost effective. Optimove wants to make this task even easier.

Here are the six types that Optimove has divided social players:

')

Non-spending newbies

These are the players who have installed the game or are registered in it, but have not completed a single game transaction during the first 14 days. Approximately 34 percent of all paying players complete their first transaction after the first two weeks, and this is a fairly large share of potential profits.

Optimove Strategic Services Director Moshe Demri:

“The goal in this segment is conversion. Here, patience is above all: it is critical to quickly get newbies interested in the first few days after registration in order to motivate them to become highly active players, and only then try to push them to the first purchase. A suitable strategy will be to increase interest in the brand, content marketing based on player behavior, and only then - an incentive to first purchase. ”

“It is also a good step to use predictive models in order to study consumer benefits and find the optimal amount of payment for each player. Consider that according to the available data there is a direct correlation between the activity levels of non-spending newbies and the transformation into paying players who generate profits for a site or game. Non-spending newbies with high activity levels are on average more valuable to the game owner. ”

New buyers

After the first purchase, the behavior of the players usually changes. New buyers are players who are at the stage of the 14-day period after the first purchase. Focusing on their desire to spend money requires the developer to target quickly, because the second purchase is made 39 percent of the time the next day. And 64 percent - in the first week.

Demry:

“According to our data, new buyers with fast conversion (up to two days after registration) have a longer play period compared to players with late conversion. During this time period, be aggressive, make sure that the players have good feelings from the game. Here, gamified campaigns (for example, three payments for three days open on the fourth day of the bonus stages) and „starter kits“ can work. It is important to treat new customers as being in the “incubation” stage. Your goal is to offer them something that motivates them to become active buyers while maintaining the desire to buy. Provide them with various rewards based on their previous actions. For example, players who were very active before their first purchase should receive enticing offers, such as gamified campaigns, as well as messages that help them understand the advantages of paying players over non-paying ones. ”

“With players who did not have activity before the first purchase, you need to handle differently. These players are not yet aware of the brand, and may not be completely familiar with the product. In cases where they are very active, try increasing their shopping activity. Otherwise, try to attract them to the product. ”

"It should also be borne in mind that if the two-week phase passes without additional payments, the cost of reactivation is usually similar to the cost of attraction."

Active buyers

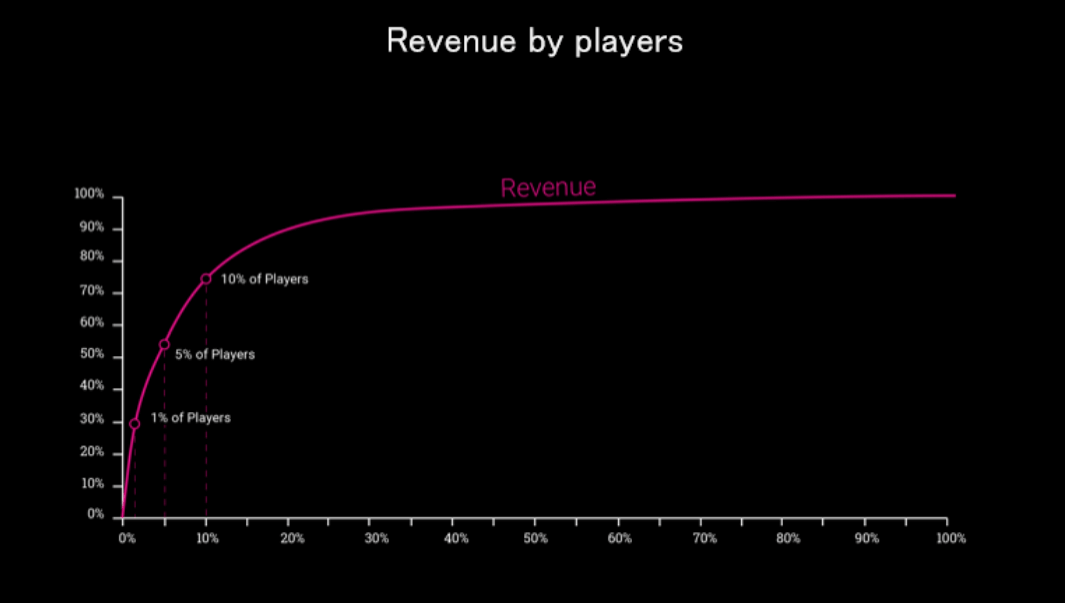

These are players who have spent money on two separate days in the last two weeks. Included in this category are “whales”: 1 is the top percentage of buyers, generating 30 percent of the profits of most games.

Demry:

“Since 5 percent of active players make 55 percent of the monthly profit, game owners need to be sure that they have studied the top 5 percent well. This means that you need to daily monitor their actions and get involved with them after important events (big victories or defeats and level changes). Make sure that these players are well aware that they are VIP. If you do not have a VIP rate, then this is the very first thing to enter. They should receive restricted games and special games, invitations to events, special gifts and a personal approach. ”

“In addition, it is important to track the highest bar achieved by each player. Players who enter and leave the 5% group should receive more attention because they have an increased potential. ”

Active players who do not spend money

These are the players who have spent the money in the game, but have not completed the subsequent payment for more than 21 days. Optimove claims that this group potentially signals problems in an f2p game economy.

Demry:

“The goal in this segment is to induce the player to the next purchase, because after it the probability of losing the player decreases. To understand the potential of such players, we use segmentation by payment activity based on three attributes: the number of days after the last purchase, the number of purchases, and the amount of purchases. This segmentation identifies "lost" players with a high level of spending, players with a low level of spending, for whom much time has passed since the last purchase, etc. In other words, the amount of past purchases [reflects] the likelihood of purchases by a player next month and the potential for losing it in the event of an outflow. ”

“Players with high levels of spending, recently stopped shopping, should receive more attractive offers with bonuses for large amounts of purchases. On the other hand, players who have long ceased to pay should receive small offers that can stimulate them to make another purchase. Also note that there is a risk of withdrawal for some of these players. Of course, you can include in this logic the detection of the risk of players leaving, and try to attract them with a game before motivating them to make another purchase. ”

Occasional returning buyer

When a player leaves the game for more than 21 days, he is called “occasionally a returning buyer.” Developers can potentially return this group with appropriate targeting and updates.

Demry:

“The goal in this segment is reactivation. In the [segment] occasionally returning buyers there are many easily accessible ways to make a profit. To determine the future potential of each player in this group, it is important to monitor both the duration of the player’s absence and the level of its activity before leaving. ”

“One more parameter that needs to be monitored is the first transition to the stage of the life cycle of occasionally returning buyers (TTI). Observing the number of transitions in the TLI cycle, we can assess if there is a risk of withdrawal and non-return for individual players, or if they just took a short pause. Players who have been in the first round of the IWP must receive stronger offers and pay more attention to them than to players who have already left and returned several times. ”

“Also an important factor is the long-term game. Players who leave after 90 days of play are much more likely to return than players who stayed in the game for a shorter or longer time. Ninety days is the peak duration of the game, because the players who have lasted so long, on the one hand, are already well acquainted with the brand, and on the other hand, they did not play long enough to part with the game. After 90 days of inactivity, the probability of reactivation is significantly reduced. You can try to "sell" them to other developer games. "

Reactivated buyers

And finally, the players who have passed the full cycle. They moved from active shopping to shopping occasionally, and now they are back in the game. According to Optimove, it is very likely that they will quickly leave the game again, so it is important for developers to pay attention to them.

Demry:

“The goal here is to“ grow ”the players again so that they remain active as long as possible. First you need to distinguish them by the method of reactivation. Players who reactivate with a purchase usually stay more often than players who reactivate to simply play. ”

“Experienced players who have recently left and then reactivated do not need familiarity with the brand and product. Players who have not been playing for a long time and who have not played so much may need familiarity with the brand. Therefore, these types of players need to send different messages. ”

How to use this information

At this stage, it is clear that all successful mobile developers are aware of the different stages of the relationship of social players with the game. But creating an understanding of these categories and ways of interacting with them is still very important for any developing studio.

Of course, understanding and influencing players requires the collection and processing of large amounts of data. Knowing this and knowing what to do with it are two completely different things. Therefore, the market for b2b tools for social and mobile games is so big.

And so we see how even the largest developers like Blizzard choose a universal approach, including the constant addition of new content and events, attracting all types of players in the Optimove classification.

Source: https://habr.com/ru/post/314992/

All Articles