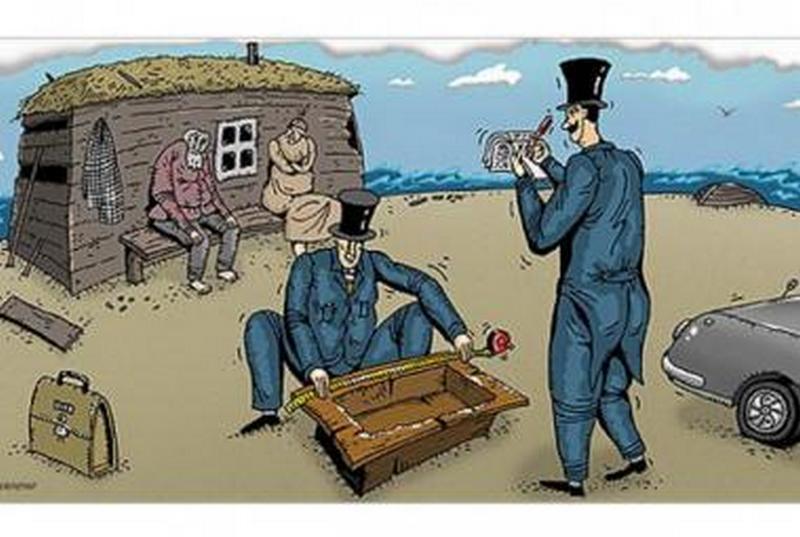

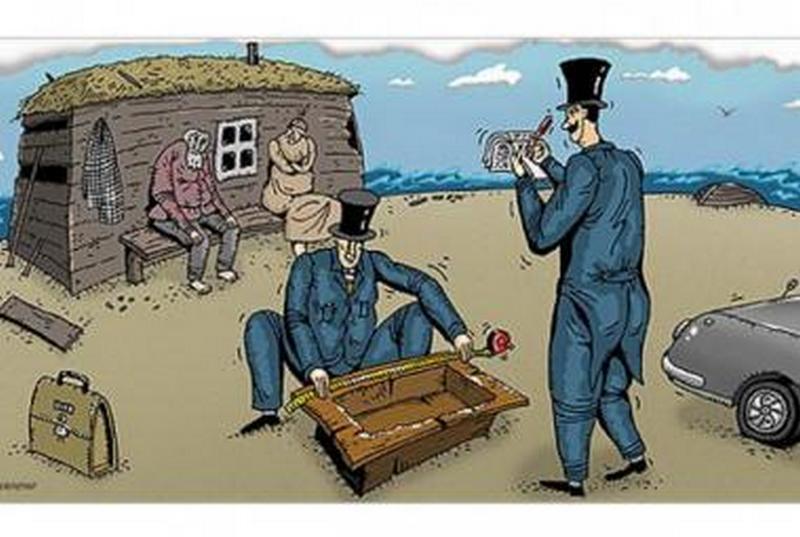

Ratings instead of money

There will be no money in the future. And not at all because universal communism will come. Just the place of money will be taken by promises of money expressed or embodied in the ratings of the subjects of turnover. Of course, this is nothing more than a prediction. In the most thoughtful and reasonable way I saw him from a famous journalist and part-time futurologist Konstantin Frumkin. Without repeating the whole course of his reasoning, we present only the result.

After non-cash money spread in the world, which is not real money, but a promise to give cash in return, after non-cash money all became credit, after the appearance of credit cards and credit limits, the next qualitative leap in the evolution of monetary systems will be the transformation of credit limits credit ratings and the emergence of a fundamental gap between the value of the credit rating and the amount of the loan received.

Thinking over this idea, I was surprised and even amazed at how powerful and flexible a tool for solving essentially all current financial problems of our time can be just one additional degree of freedom resulting from the gap between the credit rating value and the amount of the loan received.

')

Further in the article I will give some naturally speculative rules by which a rating system can work instead of money. And you will see for yourself how flexibly it will be possible to set up a new monetary and financial system of the state.

And since one more tendency in the development of the modern economy is its “flattening”, in which the place of large vertically arranged holdings will increasingly be occupied by small flexible enterprises and individual entrepreneurs, we will talk about new “non-money” in relation to the universal medium of exchange “everything is exchanged with all "(or A2A abbreviated).

In this system, objects of exchange can be and will be anything: goods, services, ideas, advice, etc., and the ratings themselves (i.e., everything except those prohibited by law for exchange).

To begin, we will focus on exchange of exchange, which we will call transactions for convenience.

For settlements on transactions, all entities registered in the A2A system (citizens, enterprises, government bodies and organizations) were assigned ratings (on the mechanism for assigning ratings - a little later).

When registering a transaction (that is, when the buyer fixed his desire to purchase the goods put up for sale), the buyer is virtually allocated funds in the amount of the price of the goods, which are “transferred” to the seller and ... which are immediately destroyed.

The simplest algorithm by which virtual money is allocated to customers for settlement (S below in the formula) can be the following rule:

S = Individual_Rating * sum_pricies_of_products_country_proposals_to_sale / Sum_in all_individual_profits (formula 1)

At the same time, the rating of the buyer in the transaction does not change, and the rating of the seller should increase according to a certain rule.

Is inflation possible in such a system? In principle, no.

But deflation and strong is just possible. This is when potential buyers do not have enough rating to buy some specific products, and those who have enough rating - these products are not needed. This will manifest itself when selling relatively expensive goods (large household appliances, cars, apartments, etc.).

And if the virtual money allocated according to the formula “1” is in fact not a loan and should not be returned as something, then in order to purchase more expensive goods for which the current rating is not enough, the buyer should either receive a loan consisting of additional ratings or sell part of your rating.

In a “good” economy, any created thing (or product) for which one of the subjects of trade has a demand must be sold and must be provided for this purpose with funds for payments. Those. The economy does not matter who buys it - it is important to buy.

Therefore, after part of the transactions with payment according to the formula “1” is closed (paid), and the goods for sale still remain, the “second round” is held - all remaining buyers are asked to confirm their intention to buy, but already on credit (by taking credit ratings) or for account of his ratings (i.e., with a decrease in his rating).

And again - no inflation - the amount of virtual money in the calculations can not exceed the amount of the value of the goods offered for sale.

Ratings received on credit naturally make it possible to make only one transaction. Do I need to return such loans from the ratings?

I believe that the repayment of loans directly to the economy itself is not needed. And for the proper functioning of the state and for social norms to work, partial repayment of loans is sufficient. We introduce such a rule: you can return all credit (from additional ratings) - return everything, you can return only a part of the credit - you will return that part that you can.

You can immediately come up with several options - how exactly to ensure and guarantee the repayment of loans, according to the borrower's existing opportunities.

For example, until you return the "credit" - you can not freely dispose of the purchased item. And the transfer of ownership of a thing (for any reason: sale, donation, inheritance) is allowed only if the new owner assumes the obligation to continue to return the “credit”. Well, the income from the commercial use of a thing (goods) purchased on credit should, in some part (according to the norm established by law), be automatically received in repayment of the loan.

Another regulator of overconsumption will be some taxes - such as property taxes. And this tax will have to be paid directly by its rating.

An automatic increase in the seller’s rating in any transaction will also be one of the regulators of excessive consumption.

Indeed, if you only buy, then you will increase the ratings of sellers, and the relative value of your rating (your purchasing power) will constantly fall.

To further illustrate the workings of the rating economy, we turn to the consideration of the mechanisms of formation and the correction of ratings. Which may be:

Ratings increase or arise as follows:

1. The starting rating is received by each person who has registered in the system (only it will be necessary to provide measures for protection against multiple registration, although in principle it will be unlikely - whoever wants to constantly start life from scratch).

2. As already written, the rating increases when something is acquired from a subject, and not necessarily something material. They get advice, an idea - the rating also grows (and this also does not lead to inflation - ratings do not affect the total amount of virtual money in circulation).

3. Rating can be won in the lottery. Well, why not. This is a chance that everyone should have. And it is fairer than the current financial system, in which money goes to money and the stratification of society increases.

4. The rating should be increased by the socially significant actions of a citizen: the birth of a child, military service, obtaining a diploma of education. This list should and can be significantly expanded.

5. And of course for the support of the current functioning of the A2A system will be charged a few ratings.

Consider the cases when the rating may go down:

1. The subject (citizen, organization) exchanged a part of their rating for a product that was otherwise unavailable to them.

2. Antisocial actions have been committed, which either led to a court decision that has entered into force, or have received a large negative public assessment. To be honest, this is a very slippery moment, as it will take shape in practice.

3. Ratings should “grow old” - decrease with time (demurrage ratings). Otherwise, a new layer of rentier will appear, living exclusively on past merits. A pension can be largely replaced by a minimum rating guaranteed by the state.

Let us consider briefly the following important topics: taxes, savings, how to evaluate labor and which sources of investment will be in our rating economy.

1. Taxes.

Taxes as a means of replenishing the budget are completely redundant. If a rating is an opportunity to make expenses, then nothing prevents the state from law by assigning ratings to its authorities in the amount of the estimated state budget expenditures. Those. if the amount of budget expenditures is ¼ of the value of GDP, then the total amount of “state ratings” should be of the total amount of ratings in the country. And for this you do not need to create a stream of virtual money in paying taxes. The overall size of all state ratings is relatively easily determined by the prevailing ratio between the expenditure side of the budget and the country's GDP. The state can increase the total amount of ratings of state bodies - this will never lead to inflation, but always increasing the total amount of state ratings by an automatic machine will reduce the purchasing power of citizens.

At the same time, taxes that perform other functions (not replenishing the budget, but let's say some regulatory functions, such as property taxes) should be preserved. But they will be much less ches now.

2.Saving.

You can not spend everything at once. For various reasons, something must be saved. Well, since the ratings "are aging", then for savings you can use the acquisition for ratings of special bonds with a zero rate of return (that in conditions when the ratings themselves are aging, and there is no inflation in principle, it will be a very good tool for savings).

3. How to evaluate the work.

Aging ratings automatically leads to the need to pay salaries in the ratings.

Consider this conditional numerical example. Suppose a certain employee has a current consumption level of 100 thousand virtual rubles per month and he has to maintain it with his salary. Suppose in order to receive 100 thousand virtual money during a month, it needs to have a current rating of 1000 units for calculations. Let's say ratings grow old at a rate of 1% per month. Then the salary of this employee should be more than 10 rating units per month. And given the desired rate of savings and taxes paid by ratings, it (salary) should be, say, 15-20 rating units per month. This is of course in a certain steady state, when the current ratings of all have already been formed. And for every 100 thousand revenues (expressed in virtual money, which will in fact only fulfill the measure of value), the employer will need to get approximately (well, of course approximately) 30-50 ratings (or more).

4. Source of investment.

In essence, these are again credit ratings (for commercial organizations) or assigned ratings for public investments. And if for citizens it would be right to postulate the sufficiency of partial repayment of loans, then for the organization repayment of loans is a separate issue. For some types of investments (for example, long-term infrastructure projects with low returns), partial repayment is also sufficient, and for some others there should be a 100% return.

Conclusion

Someone written above certainly will seem to be a complete nonsense, to someone pure utopia. And even a few years ago it would have been so.

But today it is not so. Technically, now all this can be implemented. There are different blockchain platforms that are in different degrees of completion. Known project Ethereum. Some kind of developer blockchain tools are offered by Microsoft. Other projects are also being developed.

Why not try in the new electronic payment systems (first P2P, and then A2A) some of the ideology of the ratings and not implement it now?

Or make a new game “create your own state” on the blockchain platform?

Or easier, understanding that the ratings are the future, we will make a rating system based on user behavior in the network and in life.

Therefore, this article on Habrahabr, and not somewhere else. Ideas need to be shared.

After non-cash money spread in the world, which is not real money, but a promise to give cash in return, after non-cash money all became credit, after the appearance of credit cards and credit limits, the next qualitative leap in the evolution of monetary systems will be the transformation of credit limits credit ratings and the emergence of a fundamental gap between the value of the credit rating and the amount of the loan received.

Thinking over this idea, I was surprised and even amazed at how powerful and flexible a tool for solving essentially all current financial problems of our time can be just one additional degree of freedom resulting from the gap between the credit rating value and the amount of the loan received.

')

Further in the article I will give some naturally speculative rules by which a rating system can work instead of money. And you will see for yourself how flexibly it will be possible to set up a new monetary and financial system of the state.

And since one more tendency in the development of the modern economy is its “flattening”, in which the place of large vertically arranged holdings will increasingly be occupied by small flexible enterprises and individual entrepreneurs, we will talk about new “non-money” in relation to the universal medium of exchange “everything is exchanged with all "(or A2A abbreviated).

In this system, objects of exchange can be and will be anything: goods, services, ideas, advice, etc., and the ratings themselves (i.e., everything except those prohibited by law for exchange).

To begin, we will focus on exchange of exchange, which we will call transactions for convenience.

For settlements on transactions, all entities registered in the A2A system (citizens, enterprises, government bodies and organizations) were assigned ratings (on the mechanism for assigning ratings - a little later).

When registering a transaction (that is, when the buyer fixed his desire to purchase the goods put up for sale), the buyer is virtually allocated funds in the amount of the price of the goods, which are “transferred” to the seller and ... which are immediately destroyed.

The simplest algorithm by which virtual money is allocated to customers for settlement (S below in the formula) can be the following rule:

S = Individual_Rating * sum_pricies_of_products_country_proposals_to_sale / Sum_in all_individual_profits (formula 1)

At the same time, the rating of the buyer in the transaction does not change, and the rating of the seller should increase according to a certain rule.

Is inflation possible in such a system? In principle, no.

But deflation and strong is just possible. This is when potential buyers do not have enough rating to buy some specific products, and those who have enough rating - these products are not needed. This will manifest itself when selling relatively expensive goods (large household appliances, cars, apartments, etc.).

And if the virtual money allocated according to the formula “1” is in fact not a loan and should not be returned as something, then in order to purchase more expensive goods for which the current rating is not enough, the buyer should either receive a loan consisting of additional ratings or sell part of your rating.

In a “good” economy, any created thing (or product) for which one of the subjects of trade has a demand must be sold and must be provided for this purpose with funds for payments. Those. The economy does not matter who buys it - it is important to buy.

Therefore, after part of the transactions with payment according to the formula “1” is closed (paid), and the goods for sale still remain, the “second round” is held - all remaining buyers are asked to confirm their intention to buy, but already on credit (by taking credit ratings) or for account of his ratings (i.e., with a decrease in his rating).

And again - no inflation - the amount of virtual money in the calculations can not exceed the amount of the value of the goods offered for sale.

Ratings received on credit naturally make it possible to make only one transaction. Do I need to return such loans from the ratings?

I believe that the repayment of loans directly to the economy itself is not needed. And for the proper functioning of the state and for social norms to work, partial repayment of loans is sufficient. We introduce such a rule: you can return all credit (from additional ratings) - return everything, you can return only a part of the credit - you will return that part that you can.

You can immediately come up with several options - how exactly to ensure and guarantee the repayment of loans, according to the borrower's existing opportunities.

For example, until you return the "credit" - you can not freely dispose of the purchased item. And the transfer of ownership of a thing (for any reason: sale, donation, inheritance) is allowed only if the new owner assumes the obligation to continue to return the “credit”. Well, the income from the commercial use of a thing (goods) purchased on credit should, in some part (according to the norm established by law), be automatically received in repayment of the loan.

Another regulator of overconsumption will be some taxes - such as property taxes. And this tax will have to be paid directly by its rating.

An automatic increase in the seller’s rating in any transaction will also be one of the regulators of excessive consumption.

Indeed, if you only buy, then you will increase the ratings of sellers, and the relative value of your rating (your purchasing power) will constantly fall.

To further illustrate the workings of the rating economy, we turn to the consideration of the mechanisms of formation and the correction of ratings. Which may be:

Ratings increase or arise as follows:

1. The starting rating is received by each person who has registered in the system (only it will be necessary to provide measures for protection against multiple registration, although in principle it will be unlikely - whoever wants to constantly start life from scratch).

2. As already written, the rating increases when something is acquired from a subject, and not necessarily something material. They get advice, an idea - the rating also grows (and this also does not lead to inflation - ratings do not affect the total amount of virtual money in circulation).

3. Rating can be won in the lottery. Well, why not. This is a chance that everyone should have. And it is fairer than the current financial system, in which money goes to money and the stratification of society increases.

4. The rating should be increased by the socially significant actions of a citizen: the birth of a child, military service, obtaining a diploma of education. This list should and can be significantly expanded.

5. And of course for the support of the current functioning of the A2A system will be charged a few ratings.

Consider the cases when the rating may go down:

1. The subject (citizen, organization) exchanged a part of their rating for a product that was otherwise unavailable to them.

2. Antisocial actions have been committed, which either led to a court decision that has entered into force, or have received a large negative public assessment. To be honest, this is a very slippery moment, as it will take shape in practice.

3. Ratings should “grow old” - decrease with time (demurrage ratings). Otherwise, a new layer of rentier will appear, living exclusively on past merits. A pension can be largely replaced by a minimum rating guaranteed by the state.

Let us consider briefly the following important topics: taxes, savings, how to evaluate labor and which sources of investment will be in our rating economy.

1. Taxes.

Taxes as a means of replenishing the budget are completely redundant. If a rating is an opportunity to make expenses, then nothing prevents the state from law by assigning ratings to its authorities in the amount of the estimated state budget expenditures. Those. if the amount of budget expenditures is ¼ of the value of GDP, then the total amount of “state ratings” should be of the total amount of ratings in the country. And for this you do not need to create a stream of virtual money in paying taxes. The overall size of all state ratings is relatively easily determined by the prevailing ratio between the expenditure side of the budget and the country's GDP. The state can increase the total amount of ratings of state bodies - this will never lead to inflation, but always increasing the total amount of state ratings by an automatic machine will reduce the purchasing power of citizens.

At the same time, taxes that perform other functions (not replenishing the budget, but let's say some regulatory functions, such as property taxes) should be preserved. But they will be much less ches now.

2.Saving.

You can not spend everything at once. For various reasons, something must be saved. Well, since the ratings "are aging", then for savings you can use the acquisition for ratings of special bonds with a zero rate of return (that in conditions when the ratings themselves are aging, and there is no inflation in principle, it will be a very good tool for savings).

3. How to evaluate the work.

Aging ratings automatically leads to the need to pay salaries in the ratings.

Consider this conditional numerical example. Suppose a certain employee has a current consumption level of 100 thousand virtual rubles per month and he has to maintain it with his salary. Suppose in order to receive 100 thousand virtual money during a month, it needs to have a current rating of 1000 units for calculations. Let's say ratings grow old at a rate of 1% per month. Then the salary of this employee should be more than 10 rating units per month. And given the desired rate of savings and taxes paid by ratings, it (salary) should be, say, 15-20 rating units per month. This is of course in a certain steady state, when the current ratings of all have already been formed. And for every 100 thousand revenues (expressed in virtual money, which will in fact only fulfill the measure of value), the employer will need to get approximately (well, of course approximately) 30-50 ratings (or more).

4. Source of investment.

In essence, these are again credit ratings (for commercial organizations) or assigned ratings for public investments. And if for citizens it would be right to postulate the sufficiency of partial repayment of loans, then for the organization repayment of loans is a separate issue. For some types of investments (for example, long-term infrastructure projects with low returns), partial repayment is also sufficient, and for some others there should be a 100% return.

Conclusion

Someone written above certainly will seem to be a complete nonsense, to someone pure utopia. And even a few years ago it would have been so.

But today it is not so. Technically, now all this can be implemented. There are different blockchain platforms that are in different degrees of completion. Known project Ethereum. Some kind of developer blockchain tools are offered by Microsoft. Other projects are also being developed.

Why not try in the new electronic payment systems (first P2P, and then A2A) some of the ideology of the ratings and not implement it now?

Or make a new game “create your own state” on the blockchain platform?

Or easier, understanding that the ratings are the future, we will make a rating system based on user behavior in the network and in life.

Therefore, this article on Habrahabr, and not somewhere else. Ideas need to be shared.

Source: https://habr.com/ru/post/314600/

All Articles