Mobile solutions for the financial sector

Money is an unusually sensitive issue for customers in any industry, regardless of the amount. Equally worried about their hard-earned money and the poor, and the oligarch. But in the financial sector, loyalty is directly dependent on the technological solutions that are offered to the client for managing and controlling accounts. At the same time, the security and confidentiality of such communications is more acute than in any other field. Here it is not only necessary to provide the client with timely and accurate information, but also to give a guarantee that this data is an almost intimate communication space between him and the bank.

Customers will be loyal to the bank, which works "like a clock." Everything is important here: both the stability of mobile communication (the client is unpleasantly alerted by even one unattached transaction notification), and personalization (we will gladly accept credit or insurance when we really need them, not when the bank needs it), and so on.

As with any customer-oriented business, omni channel is becoming increasingly important in banking communications. The approach is not new, and it is based on the understanding that the client communicates with the brand as a whole, and not with some of its individual manifestations (bank branch, mobile application, social network page, call center, sms-notifications, email from the bank etc.). In other words, the client should not worry about how the bank will contact him. It is important for him that this connection be operational, comfortable and unobtrusive, and meet his current needs. And all the anxiety, or, conversely, the satisfaction he brings to the brand as a whole. In the era of social networking is very noticeable.

')

Good old letters

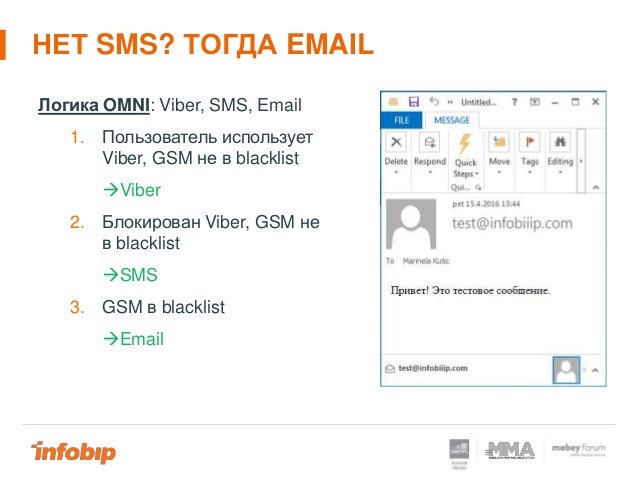

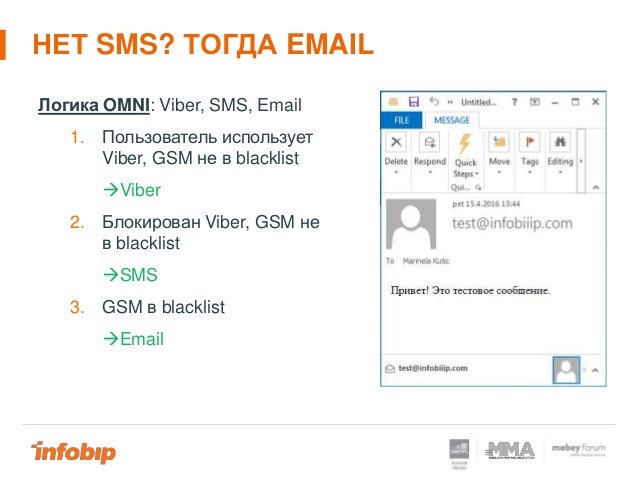

If for a client, omni-channel means the ability to contact the bank at any time in the most convenient way, for a bank it is the ability to use the right tool for each individual case. There are several such tools: SMS, instant messengers, push notifications, e-mail, phone calls.

OMNI is an opportunity to convey information to customers of different levels of technological involvement.

For each type of client and for each case you need to choose your mix of instruments. For example, the marketing proposal of a new product is better to send by e-mail, since it can be large in volume, and requires no urgent reaction, but reflection and weighing. And you can draw attention to him in the SMS or using a call from the call center. At the same time, it is better to report on the movement of funds in the account by means of a short message, and on suspicious activity - by all channels at once in turn: a phone call, push-notification, SMS and e-mail.

To work with our mailing platform in Infobip , you choose: connect to the mailing platform via the API and manage mailings, for example, from your CRM system, connect through your Personal Account or install the mGate business mailing solution on your capacities.

This system is designed specifically for financial organizations and helps, on the one hand, to flexibly configure mailings, and on the other hand, to connect with databases and with mailing channels on an encrypted channel.

Depending on the configuration, the mobile eco-system allows you to combine tools for managing mailings in one shell, generate and upload different report cuts, receive feedback from subscribers in incoming SMS and check the database for port numbers that are turned off, or roaming.

Well, as mentioned above, the focus is on increased security, which is especially important for financial institutions.

Informing. Notifications about the status of accounts, expenses and crediting of funds, the status of applications for a loan, other information that must be conveyed to the client as quickly and as quickly as possible.

Security. First of all, it is client authentication (two-factor authentication via SMS or messenger message), as well as information about any suspicious activity, for example, when the system sees that the location of the client’s mobile phone and the ATM from which it withdraws funds does not match.

Advertising and marketing. Bank news, promotions and special offers, as well as personalized messages, such as a loan offer or birthday greetings.

Feedback. Thanks to her, the client learns about the process of solving problems through a support service and feels care from the bank.

As mentioned above, for each of the described types of messages its own communication channel is optimal. Moreover, the choice of the channel is not constant, and can be determined, as they say, on the fly. For example, it is convenient to report on the state of balance by means of a message in the messenger (it is cheaper than SMS), but the client may not always be online. In this case, you have to send SMS. The advertising message is more convenient to read in e-mail, but short-term offers can be sent to the instant messenger and so on.

Another important tool already mentioned above is the verification of the correctness of the database of numbers. It will help reduce the cost of mailing and update the database. Often, users change the number without informing the bank immediately, and a disabled number can be stored in the database. Or the subscriber has transferred to another operator, and if you send an SMS to him by regular mailing, the message will be sent first to the old operator, then it will be sent to the new one. As a result, the sender will pay twice: for sending a message, and for sending between operators. The Check Number tool allows you to clear the database of invalid numbers, and check the ported numbers (transferred to another operator).

Communication with the brand is the most important factor in loyalty to the bank today. Often, users are ready to forgive companies for shortcomings if they are corrected quickly and with maximum attention. Loyalty is directly related to well-built communication, which will use all possible channels of communication with the client, and at the same time not to throw it with unnecessary information. Automation of these processes with the help of modern technology is constantly being improved, and we will continue to share with you all the new products.

Customers will be loyal to the bank, which works "like a clock." Everything is important here: both the stability of mobile communication (the client is unpleasantly alerted by even one unattached transaction notification), and personalization (we will gladly accept credit or insurance when we really need them, not when the bank needs it), and so on.

OMNI

As with any customer-oriented business, omni channel is becoming increasingly important in banking communications. The approach is not new, and it is based on the understanding that the client communicates with the brand as a whole, and not with some of its individual manifestations (bank branch, mobile application, social network page, call center, sms-notifications, email from the bank etc.). In other words, the client should not worry about how the bank will contact him. It is important for him that this connection be operational, comfortable and unobtrusive, and meet his current needs. And all the anxiety, or, conversely, the satisfaction he brings to the brand as a whole. In the era of social networking is very noticeable.

')

Good old letters

If for a client, omni-channel means the ability to contact the bank at any time in the most convenient way, for a bank it is the ability to use the right tool for each individual case. There are several such tools: SMS, instant messengers, push notifications, e-mail, phone calls.

OMNI is an opportunity to convey information to customers of different levels of technological involvement.

For each type of client and for each case you need to choose your mix of instruments. For example, the marketing proposal of a new product is better to send by e-mail, since it can be large in volume, and requires no urgent reaction, but reflection and weighing. And you can draw attention to him in the SMS or using a call from the call center. At the same time, it is better to report on the movement of funds in the account by means of a short message, and on suspicious activity - by all channels at once in turn: a phone call, push-notification, SMS and e-mail.

To work with our mailing platform in Infobip , you choose: connect to the mailing platform via the API and manage mailings, for example, from your CRM system, connect through your Personal Account or install the mGate business mailing solution on your capacities.

What is mGate?

This system is designed specifically for financial organizations and helps, on the one hand, to flexibly configure mailings, and on the other hand, to connect with databases and with mailing channels on an encrypted channel.

Depending on the configuration, the mobile eco-system allows you to combine tools for managing mailings in one shell, generate and upload different report cuts, receive feedback from subscribers in incoming SMS and check the database for port numbers that are turned off, or roaming.

Well, as mentioned above, the focus is on increased security, which is especially important for financial institutions.

Typical mailing scripts:

Informing. Notifications about the status of accounts, expenses and crediting of funds, the status of applications for a loan, other information that must be conveyed to the client as quickly and as quickly as possible.

Security. First of all, it is client authentication (two-factor authentication via SMS or messenger message), as well as information about any suspicious activity, for example, when the system sees that the location of the client’s mobile phone and the ATM from which it withdraws funds does not match.

Advertising and marketing. Bank news, promotions and special offers, as well as personalized messages, such as a loan offer or birthday greetings.

Feedback. Thanks to her, the client learns about the process of solving problems through a support service and feels care from the bank.

As mentioned above, for each of the described types of messages its own communication channel is optimal. Moreover, the choice of the channel is not constant, and can be determined, as they say, on the fly. For example, it is convenient to report on the state of balance by means of a message in the messenger (it is cheaper than SMS), but the client may not always be online. In this case, you have to send SMS. The advertising message is more convenient to read in e-mail, but short-term offers can be sent to the instant messenger and so on.

Another important tool already mentioned above is the verification of the correctness of the database of numbers. It will help reduce the cost of mailing and update the database. Often, users change the number without informing the bank immediately, and a disabled number can be stored in the database. Or the subscriber has transferred to another operator, and if you send an SMS to him by regular mailing, the message will be sent first to the old operator, then it will be sent to the new one. As a result, the sender will pay twice: for sending a message, and for sending between operators. The Check Number tool allows you to clear the database of invalid numbers, and check the ported numbers (transferred to another operator).

Communication with the brand is the most important factor in loyalty to the bank today. Often, users are ready to forgive companies for shortcomings if they are corrected quickly and with maximum attention. Loyalty is directly related to well-built communication, which will use all possible channels of communication with the client, and at the same time not to throw it with unnecessary information. Automation of these processes with the help of modern technology is constantly being improved, and we will continue to share with you all the new products.

Source: https://habr.com/ru/post/313440/

All Articles