Features of Internet acquiring and alternative payment instruments in the European market

Anna devoted her presentation to the peculiarities of pricing in the service sector of European Internet acquiring, the stages of connecting an Internet merchant to an acquiring bank, as well as the specifics of alternative payment instruments in EU countries.

At the beginning of her presentation, Anna defined the concept of Interchange - the interchange charge that is charged to the acquiring bank in favor of the issuing bank.

')

After explaining the meaning of the term Interchange, Anna gave the international classification of payment lines:

- Domestic - the payer's card is issued in the same country where the legal entity in whose favor payment is registered is registered. Example: a payment transaction from a buyer to a merchant, in which both parties are located in Latvia.

- Intra - a payer card issued in the Eurozone (SEPA), within which a legal entity is registered. Example: payment from a Latvian customer to a merchant in Lithuania.

- Inter (cross border) - the payer's card is located outside the Eurozone. Example: payment from a buyer from Russia to a merchant registered in Latvia.

Interchange rates vary depending on the direction of payment, the type of card (Consumer Debit - 0.2% and Consumer Credit - 0.3%), as well as the type of business of the online merchant. If a merchant is registered in Europe, but he wants to accept payments from around the world, then the Interchange rate will be higher than when accepting payments within the Eurozone.

There are 2 pricing models for an online retailer in Europe: BuyRate is a fixed rate, as well as a rate, the amount of which may vary depending on the Interchange.

BuyRate is of two categories: Intra (1.5-2.2%) and Inter (2.7-3.2%).

Interchange rate varies depending on the above factors. It consists of the Interchange itself, to which CardScheme Fees is added (the cost of servicing the acquiring bank in payment systems) plus the rate set by the acquiring bank and processing center.

Visa serves more countries than Mastercard. Anna gave an example: when online stores from Israel turn to PayOnline, they can only connect Visa card accepting

Processing currencies and billing currencies are also different. The processing currency is the currency of debiting from the card, the settlement currency is the currency in which funds are credited to a bank account.

The list of available currency depends on the acquiring bank. For example, the PayOnline processing center supports 120 currencies and is capable of withdrawing any of the European currency to the current account. In Europe, the following commission sizes are also set:

- Connection cost: from 0 to 500 euros (depends on the number of write-off currencies).

- Monthly cost: from 0 to 150 euros.

- Annual cost: from 0 to 500 euros (depends on the acquiring bank and the type of merchant).

- The cost per transaction from 0 to 0.30 euros per transaction.

- Refand cost: from 0.4 to 1.5 euros per transaction.

- The cost of chargeback: from 20 to 100 euros.

- Rolling reserve 5-10% of the transaction amount for 120-180 days or security deposit.

- The cost of withdrawal on the p / s: in euro currency: from 0 to 20 euros; in US dollar currency: from 20 to 80 $.

Some European acquiring banks charge a fee for connecting the merchant to the payment system, while others charge a monthly fee depending on the number of transactions processed per month - for example, 150 euros per 1000 transactions. As soon as the quantity passes the limit value, the monthly cost increases. Also in Europe, a model is often found when not only interest is taken from each transaction, but also a fixed transaction cost, for example, 2.9% + 0.30 EUR.

Banks also take a "rolling reserve" - a percentage of the amount of each transaction, which is deducted from the merchant account by the acquiring bank for a period of 120 to 180 days. An alternative to such a scheme can serve as a security deposit - a fixed amount that lies in the company's current account and is used as a guarantee to cover chargebacks.

Withdrawal of funds from the current account of the merchant is most often carried out once a week. At the same time, acquiring banks often keep money for another 7 days in order to insure themselves in this way against chargebacks. The total amount in this case is paid in full only after two weeks. Funds are collected in a week, and then they can be paid either next Monday or even Monday (in this case, the additional hold is called 7 days hold).

Daily withdrawal of money from the merchant’s account is also possible, however, such conditions are usually provided by the acquiring banks at business turnover in excess of 2 million euros per month. This model is valid if the merchant cooperates with PayOnline partner - Fin Trust Company - a payment institution registered in the Czech Republic, having the status of facilitator from Rietumu Bank, Latvia. This approach allows ecommerce companies to withdraw money daily and with a smaller amount of monthly turnover of 100,000 euros per month. In the case of PayOnline, withdrawals are made no earlier than the 4th day from the moment they are received on the current account.

Having told about the specifics of the service and possible commissions that any e-commerce business may encounter in the process of working on the European market, Anna turned to the question of connecting a merchant to the services of an acquiring bank. The procedure is called KYC (Know Your Customer). Sometimes the term Due Diligence is also used.

As part of her presentation, Anna provided a list of documents that need to be prepared by a legal entity when submitting an application for connection to the infrastructure of a European acquiring bank:

- Certificate of incorporation.

- Charter

- A document containing information about the shareholders of the company, as well as the size of shares that they own.

- The document on appointment of the general director.

- Trust declarations for the final beneficiary (if available).

- Power of attorney to the signatory, if it is not the beneficiary.

- Passport to the beneficiary and the signatory with a residence permit or utility bills.

- Extract from the register of legal entities for the last 90 days.

Among other documents that must be signed by the merchant:

- Extended profile.

- Contract

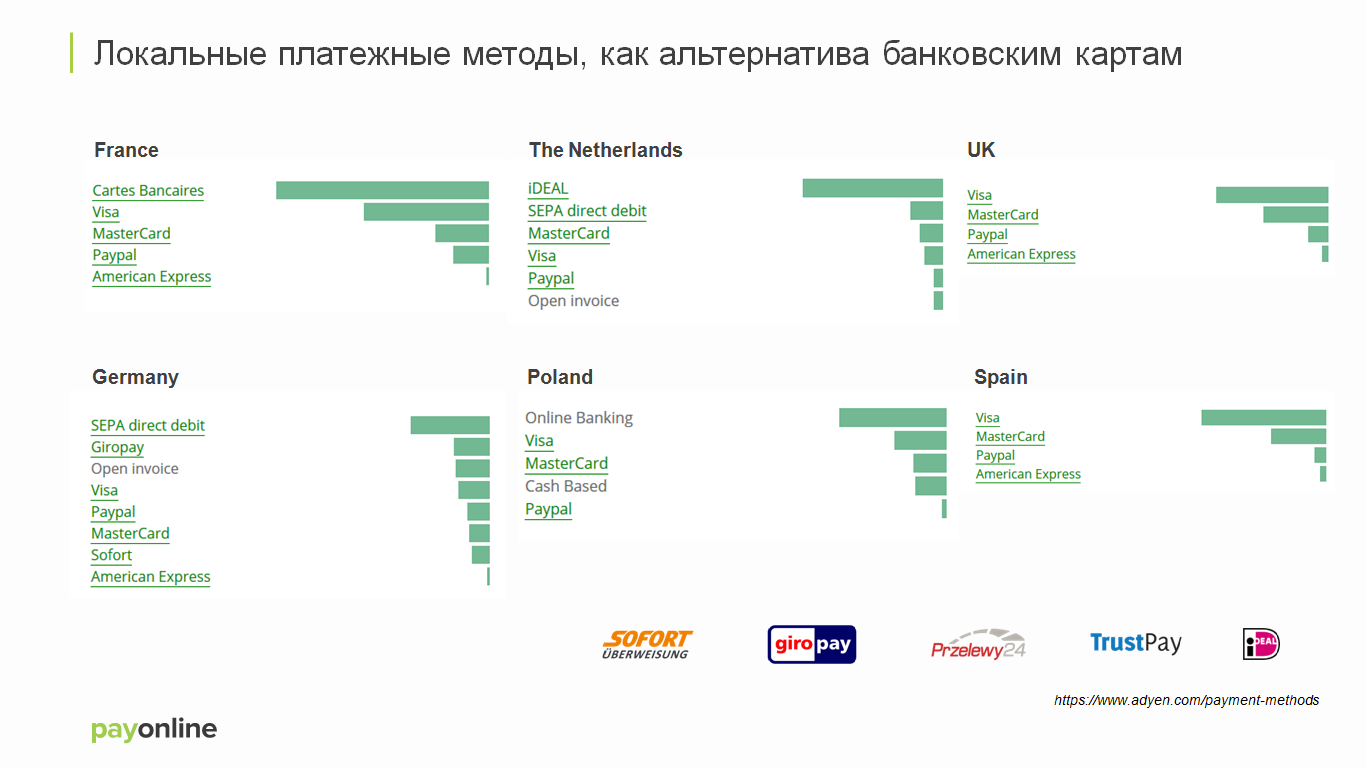

In addition to Internet acquiring, alternative payment methods are also developed in Europe. If you look at the statistics of the Netherlands and Poland, you can see that alternative payment methods - direct debiting of funds from bank accounts (by analogy with the Russian service of Sberbank.Online) - are more popular than bank cards.

For example, in Germany for each newborn child a bank account is registered to which the card is not attached. Having matured, such a user can make payments directly from the bank’s mobile application without using a card. The commission for acquiring for this type of payment below.

As another alternative payment method, Anna cited the example of SOFORT. This tool is a direct bank transfer from the buyer's account. This payment method is available in Germany, Austria, Switzerland, Holland, Great Britain, Belgium, the Czech Republic, France, Italy, Poland, Spain, Slovenia and Hungary.

Using this payment tool is quite simple. For this, the payer needs:

- Select a country and bank from the list.

- Enter the data to enter the personal account of the bank.

- Enter the data to confirm the transaction - TAN.

- Wait for information about the operation.

Due to two-factor authorization, the percentage of fraud is negligible. In this case, a full refund to the payer when using SOFORT is guaranteed.

According to the experience of our team, among all European countries, the payment service is the easiest to work with merchants registered in the Czech Republic. This is due to the fact that connecting to an acquiring bank, the financial institution Fin Trust in the Czech Republic, does not require the translation of documents into other languages and, therefore, the merchant is connected to the acquiring bank much faster.

At the same time, a package of document scans is sufficient from the merchant for initial approval. Next, the merchant must come to the office of Fin Trust / PayOnline or meet with an accredited verification agent and bring the agreed documents.

In case of successful completion of the ecommerce-business verification procedure, the bank connects the merchant to its infrastructure, provided that it has the correct website that meets the requirements of payment systems: there are logos, correct contact information, information about all merchant policies (delivery and return), etc. d.

The organization of payment acceptance in Europe is associated with a number of nuances, but by understanding them and observing all the necessary formalities, a company can expand the geography of a business, increase its client audience and reach new revenue indicators. Continue to follow the blog of the processing company PayOnline, and in a timely manner learn about the most current events of the global payment industry.

Source: https://habr.com/ru/post/312380/

All Articles