Payments in correspondence: chat bots as separate services and fintech solutions inside instant messengers

Chat bots are well suited for mobile devices - perhaps even more than apps. Messaging underlies the use of mobile devices, and a universal, unified chat interface to communicate with various companies attracts users - they do not need to install a new application and figure out how it works - just use the familiar messenger, be it FB Messenger, Slack or Viber .

While mobile applications are widespread, in the case of spontaneous purchases, when a customer pays attention to a share on a social network, not everyone who has clicked through is ready to install another application to pay. And thanks to chat bots, downloading applications becomes unnecessary - you can use the functionality of the payment service or the promotional offer of a particular brand in the usual messenger using a chat bot.

One of the first bots of PayPal was launched last month in Facebook Messenger. Customers who shop at various online stores are able to make transactions in Facebook Messenger using the PayPal payment service.

')

Sending and receiving money to friends and family has long been one of the most popular transactions in PayPal. In 2015, through PayPal, Venmo and Xoom, users performed p2p operations worth $ 41 billion. The new PayPal app, integrated with Siri on iOS 10 in November 2016, allows iPhone and iPad owners to send and request funds using voice. Suffice to say: “Hi, Siri, send $ 50 to Bill using PayPal” or “Send 100 rubles to Tatiana using PayPal” (Russian is supported), and confirm the payment using Touch ID.

In February, PayPal announced a bot for the corporate Slack messenger. Slack has about five million active users per day and one and a half million at paid rates. The PayPal bot allows Slack customers to send each other p2p payments just by chatting, and the amount of one transaction is limited to 10,000 US dollars.

Fintech startup TransferWise, which deals with international money transfers and processes transactions totaling $ 1 billion monthly through its website, also launched a bot for Facebook Messenger in February.

The service guides the user step-by-step through the procedure of sending money transfer using a text interface, and its use does not affect the transfer fee.

EBay also came to Facebook, starting last October with testing its ShopBot to attract new users. The service will use AI to learn more about each customer through their profiles and search queries on Facebook. ShopBot can remember the details, such as the size of clothes for more convenient online shopping next time.

Smartphone users spend their time on fewer applications, and Facebook Messenger is one of the most popular. eBay wants to get access to the maximum number of these people, allowing you to make purchases through the chat service.

So far, Facebook does not receive money from purchases that pass through its Messenger, but the company sells advertisements for news feeds that direct users to chat with a brand bot. Total on eBay 164 million active accounts as of June 30 last year, in Facebook Messenger the same number of active users exceeded 1 billion people.

At the end of October 2016, Mastercard announced plans to launch a bot platform that will allow cardholders to make transactions and manage finances via instant messengers.

For pilot launch Mastercard cooperates with Kasisto . Mastercard chat bot works on the artificial intelligence platform KAI Banking, which specializes in providing financial services in an interactive form.

The bank bot will expand the boundaries of the payment system, making it available in instant messengers, where requesting account information or performing financial transactions will soon become commonplace for customers, and it will be possible to pay for them through Masterpass .

Another American Express payment system also chose Facebook Messenger as the main platform for launching its chat bot. The robot began work in September, and in December updated its functionality.

Chat bot Amex allows you to connect a payment card to your Facebook Messenger account to receive messages about each purchase using push notifications. He also helps to compile reports on purchases for a certain period and offers current promotions.

In December, the item “Add a card” became available, which allows you to make purchases on Facebook. Previously, adding a card was possible only with the help of a separate banking application.

The prospects for Facebook Messenger for fintech startups and large companies (financial services, mobile wallet, PFM platform and tools for p2p loans) were discussed in the article “ Why Facebook is the“ dark horse ”of the financial services industry .”

Not messenger th one

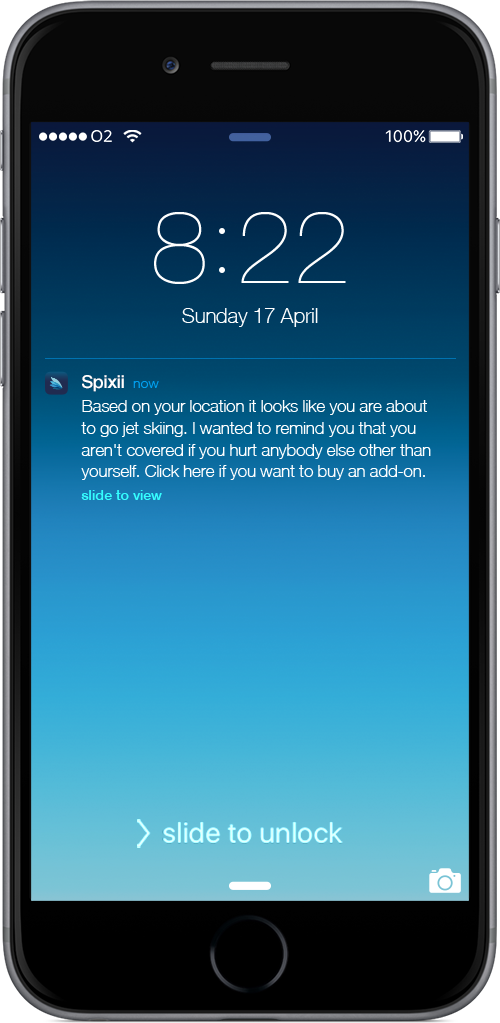

The developers of SPIXII, an insurance chat bot that speaks 5 languages, want to make insurance faster, easier and more humane than ever before. The bot allows you to find out that the selected insurance program is suitable for a specific user, using a simple conversation. According to them, now there are no confusing terms and there is no need to fill out forms.

The developers of SPIXII, an insurance chat bot that speaks 5 languages, want to make insurance faster, easier and more humane than ever before. The bot allows you to find out that the selected insurance program is suitable for a specific user, using a simple conversation. According to them, now there are no confusing terms and there is no need to fill out forms.SPIXII is notable for the following. If the bot finds that the user is traveling and is engaged in activities that are not covered by the current insurance policy (water skiing, scuba diving), it will rationally remind you of this. Now, along with insurance companies in several EU countries, the bot is being beta tested.

Cleo, a Fintech startup that develops a chat bot in financial management, received $ 700,000 from eight

business angels, including from Skype co-founder Niklas Zennström (Niklas Zennström).

Chat bot using AI, created by Cleo to help users manage their finances. The application is designed to provide answers to requests for the current balance, share how much was spent on certain MCC (trade categories) and merchants. The functionality also includes setting reminders and alerts.

Users can communicate with Cleo using several channels: chat bot in Facebook Messenger, via SMS, in the future communication with the bot will be available through Alexa Amazon and Google Home.

A British FINTECH startup company with Russian roots Revolut, whose mobile application and multi-currency card allow you to convert and send currency at favorable interbank rates, presented its bot Rita in early February. Rita - Revolut's Intelligent Troubleshooting Assistant - embedded in the mobile application Revolut.

During the pilot, the chat bot resolved 20% of the 7,500 customer requests, receiving a score of 4.3 out of five. The development is based on AI, so Rita can recognize normal human speech and will become smarter by learning from conversations with customers.

Messengers as a full-fledged payment platform

Unlike instant messengers, which provide players with financial and ecommerce market opportunities to develop payment chat bots, or individual chat bots, presented as independent services, a number of communication platforms are also expanding their own payment functions, strengthening their position in fintech .

Western Union money transfer system chose Viber to provide customers with the ability to send funds using a pair of buttons. As of December 2016, Viber had about 754 million unique users worldwide, and Western Union transfers within Viber were available to customers from the United States, Great Britain, Ireland and France.

Now Viber is aimed at the development of the messenger as a platform for e-commerce. The new CEO appointed in February of this year, Djamel Agaoua, was surprised that Viber did not start developing trading functions earlier. After all, Viber was bought by “Japanese Amazon” Rakuten, which is very interested in expanding its presence.

To overcome the situation and expand the monetization of the messenger, video and other functions will be used. So, already on March 6, the American Viber users will have a button, clicking on which users will receive a list of recommended products. Initially, customers will be redirected to the page in the application or to the mobile website of the brand, if the application is not installed, the function will be expanded and refined later.

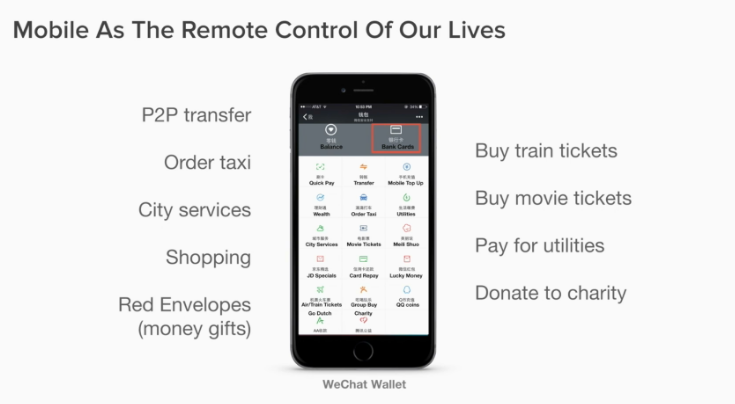

The WeChat platform, owned by one of the largest Chinese companies Tencent , for many years strengthened the exchange of messages with additional functions - games, shopping - which helped to generate significant income and user involvement.

In 2016, only for the Chinese New Year period, WeChat mobile transaction volume indicators exceeded PayPal figures for the entire 2015: 420 million people sent “ red envelopes ” to each other through the payment service in the app. In total, 8.08 billion of financial gifts were sent, which is eight times more than last year.

In China, 656 million people have smartphones. Many of them spend most of their time in one application - WeChat. This messenger allows you to do everything - from paying utilities to ordering food. Connie Chan, a partner at investment firm Andreessen Horowitz, gives examples of thoughtful application work. With WeChat, a person will be able to book an appointment with the doctor and set an exact time to collect the prescription from the pharmacist. Here the user can follow his child in kindergarten and get a visual confirmation that someone took him from there. Thanks to the application, a person does not need to open services such as UberEats, as he has the opportunity to order food delivery via WeChat.

Despite the fact that the App Store and the Play Market have a huge number of applications, they all cannot offer such a natural integration of various services into one platform that WeChat has. Amazon wants Alexa to be a tool for ordering taxis, deliveries and more. Google is pursuing the same with Home, Apple with Siri and Facebook with its assistant M. But it still takes a long time for these intelligent assistants based on artificial intelligence to perform all the same functions that are in WeChat.

The experience of the above solutions suggests that even now almost any services, including payment services, cannot be considered separately from the users' communication habits. Behavior of users, one way or another, should be taken into account by any companies that seek to strengthen their interaction with users in chat rooms and social networks.

Source: https://habr.com/ru/post/312372/

All Articles