How to choose the best RKO when opening a business

Good day to all! This is our first publication, to which we walked long enough. It focuses on the selection of RKO for small businesses. If you are planning to open an IP or LLC in the near future, we hope that our experience will be useful for you. So, using the example of RKO selection for our friends from the Admirals company (approx. Guys are involved in projects in the field of VR and augmented reality), we consider the subtleties that will allow you to choose the most suitable option from the variety of tariff plans present in the market.

According to the results of our experience, we have compiled a tariff matrix that contains more than 30 current tariff plans of banks from Top - 10 for entrepreneurs. In addition, in order to simplify the procedure of choosing cash management services, we linked our matrix with an online questionnaire , responding to which the system finds the best solution for you. As a result, you receive a recommendation from the top 3 tariff plans, indicating the pros and cons of each, as well as a description of the strategy for what to do in the future when expanding your business.

Today, there are more than 600 banks in Russia, and each of them has different conditions, tariff plans and commissions, obligations.

')

Where to begin? First you need to digitize the number of operations that your organization performs (for existing companies) or plans to carry out in the next 6-12 months (for Start-Up).

What are these operations?

With regard to cash management services, the following operations can be distinguished:

1. Servicing of current accounts in Russian rubles (hereinafter - Rub) and foreign currency, servicing the remote banking service system (hereinafter - RBS) and transfers in Rub.

! It is important to pay attention to the Start-up organizations, whether there will be a charge for servicing the current account, if the first few months have neither receipts nor write-offs. Some banks charge the cost of servicing the tariff plan, regardless of the availability of income on the accounts.

2. Transfers in foreign currency, purchase of currency for settlements under import contracts, currency control (relevant for those working with currency transfers - export of goods, works, services, or vice versa, import of goods, works, services).

3. Cash withdrawal in cash for salary payments, salary payments to employees on cards as part of salary projects, cash withdrawal for household needs (travel, purchase of consumables, etc.)

In order to calculate the cost of the monthly service, you need to digitize the above operations, find all the tariffs of the banks you like, analyze, and everything that you cannot find on the bank’s website (and this often happens) will need to be clarified either at the bank’s office or through the contact center.

Note that in addition to the monthly cost of banking services, there is also a one-time commission, which banks hold one-time when opening current accounts. Such commissions can be: the cost of opening a current account in Rub, the cost of opening a current account in currency, connection to the RBS system, the fee for providing an electronic key, the fee for certifying the statute and signature card, as well as other legal documents that are required when opening bills, checkbook and others.

Summing up the fixed costs (monthly maintenance fees) and one-time, you can calculate the cost of banking services.

When you calculated the cost of banking services is it worth deciding whether you have enough information to make a decision? Only the question of value is important when opening a current account?

It may seem that the price criterion is the only one when choosing a bank, but it is not. You should pay attention to the following important criteria: the speed of opening accounts, the presence of branches of the bank in your city, the credit level of the organization. The latter criterion is especially important given the fact that in the last 6 months of 2016 licenses were withdrawn from 44 banks, and in 2015 - from 101. What are your risks if a bank is revoked a license? In fact, the bank cannot fulfill its obligations to you, thus your accounts are blocked and difficulties arise already in how to return funds that are “stuck” on accounts ?!

We were approached by Admirals, which had a goal to conduct analytics on banks and choose the best option for cash settlement services. The company is engaged in interactive installations, virtual and augmented reality.

Remember, recently everyone was catching Pokemon on the street through a smartphone, so, the guys are successfully introducing this technology for business solutions, complex applications with high-quality content and sound. Among the realized projects, they have already managed to replenish the list with such names as BMW, Oriflame, MTS, Money Museum (SPB), Central House of Artists (MSK), BDT (SPB).

In an informal setting, communicating with them, we, first, tested interesting applications with virtual reality, and, second, we processed their request, turning it into a structured list of criteria that are most important to them.

The main selection criteria were as follows:

1. You need an option where the maintenance fee for the cash management office will be minimal.

2. The first few months may not be cash receipts on accounts, respectively, do not want to pay for services that are not currently in use.

3. The number of payments up to 10 per month (excluding tax payments)

4. Receipts on accounts - up to 5 million. Rub

5. 50% of the total revenue - foreign exchange earnings, respectively, there will be expenses for currency control

6. Cash withdrawal at the initial stage - up to 1 million Rub

7. There should be offices in Moscow, St. Petersburg, Yekaterinburg, Nizhny Novgorod, Kazan and other million-plus cities

So, for the analysis, we have allocated the TOP - 8 or 17 tariff plans and conditions for cash management services, more than 30 different operations for which the bank retains certain commissions. These banks were considered on the basis of the latitude of regional offices or banks that specialize only in working with legal entities.

The following banks were analyzed:

In order for you to understand the depth of case study, we present the main analysis criteria:

According to the preliminary analysis, proceeding only from the cost of the Settlement and Cash Services, the following tariff plans were in the Top 3 ver.1 (without the cost of the salary project):

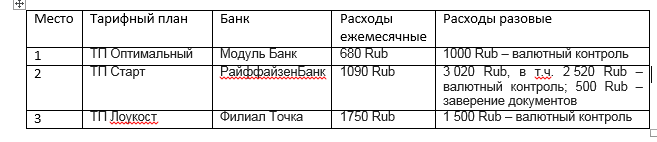

Here we decided to stop and analyze 2 options. It is presented in the summary table:

Preliminary conclusion: if for the convenience of the current activities of the enterprise, you can open a payroll project, we recommend that you choose ModuleBank.

For the guys from Admirals, the cost of cash withdrawal was also important, for this reason the following Top 3 ver.2 tariff plans were compiled:

Also for in-depth analysis we compare two banks from the Top 3 ver.2:

Based on the needs of the company Admirals, 17 tariff plans were analyzed. From these 17 tariff plans, 3 best offers were selected at the moment on the Russian banking market. Thus, the CreditSecurity team advised Admirals to open current accounts with Raiffeisen Bank.

After analyzing the offers of banks, we want to advise companies of the micro and small business segment the following:

1. When choosing a servicing bank, determine those operations that you use or will use in the future, digitize them.

2. Cash withdrawals through the bank’s cash desks significantly increase the organization’s banking costs in comparison with payroll projects.

3. Pay attention to non-price indicators, such as, the territorial location of offices, reviews on specialized sites, forums, the credit rating of the organization. This information will allow for an in-depth analysis of service offerings in the banking market.

4. If time is limited, then consult with professional companies in the financial market.

According to the results of our experience, we have compiled a tariff matrix that contains more than 30 current tariff plans of banks from Top - 10 for entrepreneurs. In addition, in order to simplify the procedure of choosing cash management services, we linked our matrix with an online questionnaire , responding to which the system finds the best solution for you. As a result, you receive a recommendation from the top 3 tariff plans, indicating the pros and cons of each, as well as a description of the strategy for what to do in the future when expanding your business.

Today, there are more than 600 banks in Russia, and each of them has different conditions, tariff plans and commissions, obligations.

')

Where to begin? First you need to digitize the number of operations that your organization performs (for existing companies) or plans to carry out in the next 6-12 months (for Start-Up).

What are these operations?

With regard to cash management services, the following operations can be distinguished:

1. Servicing of current accounts in Russian rubles (hereinafter - Rub) and foreign currency, servicing the remote banking service system (hereinafter - RBS) and transfers in Rub.

! It is important to pay attention to the Start-up organizations, whether there will be a charge for servicing the current account, if the first few months have neither receipts nor write-offs. Some banks charge the cost of servicing the tariff plan, regardless of the availability of income on the accounts.

2. Transfers in foreign currency, purchase of currency for settlements under import contracts, currency control (relevant for those working with currency transfers - export of goods, works, services, or vice versa, import of goods, works, services).

3. Cash withdrawal in cash for salary payments, salary payments to employees on cards as part of salary projects, cash withdrawal for household needs (travel, purchase of consumables, etc.)

In order to calculate the cost of the monthly service, you need to digitize the above operations, find all the tariffs of the banks you like, analyze, and everything that you cannot find on the bank’s website (and this often happens) will need to be clarified either at the bank’s office or through the contact center.

Note that in addition to the monthly cost of banking services, there is also a one-time commission, which banks hold one-time when opening current accounts. Such commissions can be: the cost of opening a current account in Rub, the cost of opening a current account in currency, connection to the RBS system, the fee for providing an electronic key, the fee for certifying the statute and signature card, as well as other legal documents that are required when opening bills, checkbook and others.

Summing up the fixed costs (monthly maintenance fees) and one-time, you can calculate the cost of banking services.

When you calculated the cost of banking services is it worth deciding whether you have enough information to make a decision? Only the question of value is important when opening a current account?

It may seem that the price criterion is the only one when choosing a bank, but it is not. You should pay attention to the following important criteria: the speed of opening accounts, the presence of branches of the bank in your city, the credit level of the organization. The latter criterion is especially important given the fact that in the last 6 months of 2016 licenses were withdrawn from 44 banks, and in 2015 - from 101. What are your risks if a bank is revoked a license? In fact, the bank cannot fulfill its obligations to you, thus your accounts are blocked and difficulties arise already in how to return funds that are “stuck” on accounts ?!

We were approached by Admirals, which had a goal to conduct analytics on banks and choose the best option for cash settlement services. The company is engaged in interactive installations, virtual and augmented reality.

Remember, recently everyone was catching Pokemon on the street through a smartphone, so, the guys are successfully introducing this technology for business solutions, complex applications with high-quality content and sound. Among the realized projects, they have already managed to replenish the list with such names as BMW, Oriflame, MTS, Money Museum (SPB), Central House of Artists (MSK), BDT (SPB).

In an informal setting, communicating with them, we, first, tested interesting applications with virtual reality, and, second, we processed their request, turning it into a structured list of criteria that are most important to them.

The main selection criteria were as follows:

1. You need an option where the maintenance fee for the cash management office will be minimal.

2. The first few months may not be cash receipts on accounts, respectively, do not want to pay for services that are not currently in use.

3. The number of payments up to 10 per month (excluding tax payments)

4. Receipts on accounts - up to 5 million. Rub

5. 50% of the total revenue - foreign exchange earnings, respectively, there will be expenses for currency control

6. Cash withdrawal at the initial stage - up to 1 million Rub

7. There should be offices in Moscow, St. Petersburg, Yekaterinburg, Nizhny Novgorod, Kazan and other million-plus cities

So, for the analysis, we have allocated the TOP - 8 or 17 tariff plans and conditions for cash management services, more than 30 different operations for which the bank retains certain commissions. These banks were considered on the basis of the latitude of regional offices or banks that specialize only in working with legal entities.

The following banks were analyzed:

1. Alpha Bank

2. Rosbank

3. Sberbank

4. RaiffeisenBank

5. Bank Opening

6. Promsvyazbank

7. Bank Point

8. ModuleBank

In order for you to understand the depth of case study, we present the main analysis criteria:

According to the preliminary analysis, proceeding only from the cost of the Settlement and Cash Services, the following tariff plans were in the Top 3 ver.1 (without the cost of the salary project):

Here we decided to stop and analyze 2 options. It is presented in the summary table:

Preliminary conclusion: if for the convenience of the current activities of the enterprise, you can open a payroll project, we recommend that you choose ModuleBank.

For the guys from Admirals, the cost of cash withdrawal was also important, for this reason the following Top 3 ver.2 tariff plans were compiled:

Also for in-depth analysis we compare two banks from the Top 3 ver.2:

Based on the needs of the company Admirals, 17 tariff plans were analyzed. From these 17 tariff plans, 3 best offers were selected at the moment on the Russian banking market. Thus, the CreditSecurity team advised Admirals to open current accounts with Raiffeisen Bank.

After analyzing the offers of banks, we want to advise companies of the micro and small business segment the following:

1. When choosing a servicing bank, determine those operations that you use or will use in the future, digitize them.

2. Cash withdrawals through the bank’s cash desks significantly increase the organization’s banking costs in comparison with payroll projects.

3. Pay attention to non-price indicators, such as, the territorial location of offices, reviews on specialized sites, forums, the credit rating of the organization. This information will allow for an in-depth analysis of service offerings in the banking market.

4. If time is limited, then consult with professional companies in the financial market.

Source: https://habr.com/ru/post/311752/

All Articles