How we updated the contact center of a large bank in 2 months: migration without jambs (almost)

Once there was a large bank, and he had a contact center on Nortele. In 2009, Nortela’s management decided to sell the company piece by piece - something went to Erickson, something to Avaya, and so on. Accordingly, the bank remained in rather strange conditions regarding technical support and further development of the contact center. During the year, it was possible only to ensure its working capacity (or to refuse breaking features). It became clear that the existing solution is a dead-end branch.

The bank announced a competition for the migration of a contact center for a new solution. The most difficult time was a short time - several months. But we finally managed. The project was comprehensive. We have raised a lot from scratch: from ARMs to the Quality Monitoring system. After the contact center started working on a new solution, the project smoothly moved from one to the next — modernization — the bank had new options for functionality and tasks on features.

')

I will tell you more about the hottest period - migration and preparation of the contact center.

to work, and also about the further expansion of functionality - introduction of BI and statement on monitoring.

What has been and worked

First , we moved the IVR (Interactive Voice Response system) to a new platform, plus implemented speech recognition. They made a separate branch from scratch in search of ATMs - the subscriber can ask IVR where the nearest ATM is located, the system recognizes speech and, accordingly, promptly issues information. IVR also quickly accesses the databases for exchange rates, various statuses and general customer data, such as the next loan payment date. In general, there are several integration buses to which the IVR was connected.

Appeared call priorities for VIP-clients, so they did not wait in the queue. On the basis of the same IVR, a part of the quality management system was built - the customer’s rating for the service in the contact center after the end of the conversation with the operator.

By the way, with the help of IVR, the bank introduced a rather convenient service for clients abroad. It is clear that this is roaming and calls are not cheap. Therefore, in order for clients not to call Russian numbers from abroad, they dial a specific number, through which their call gets into the bank's IVR. When the call is confirmed, the person hangs up. After that, the IVR system itself dials the client and connects with the operator.

Below is the new IVR architecture:

Secondly, they created AWPs for operators and supervisors based on Avaya solutions, plus our code for a bank. In the process of implementation, we were faced with the fact that the customer did not have enough full-time functionalities of the Avaya AWPs, so we had to strongly customize this software. Through several phases of development, ARM began to take into account almost all the “wishes” of the customer.

Prior to this, the workstations at the workplaces of the bank did not exist, and it was not particularly convenient for operators to work. As jobs, they were ordinary computers. Calls were controlled from the phone - they just pressed the buttons. After the migration was completed, there were several stages of customization of the solution. So, step by step, the automated workplaces completely adjusted the specific requirements of the bank.

One of the “cosmetic” features is the opportunity for supervisors to send a running line with information to groups of operators - something like SMS to AWPs.

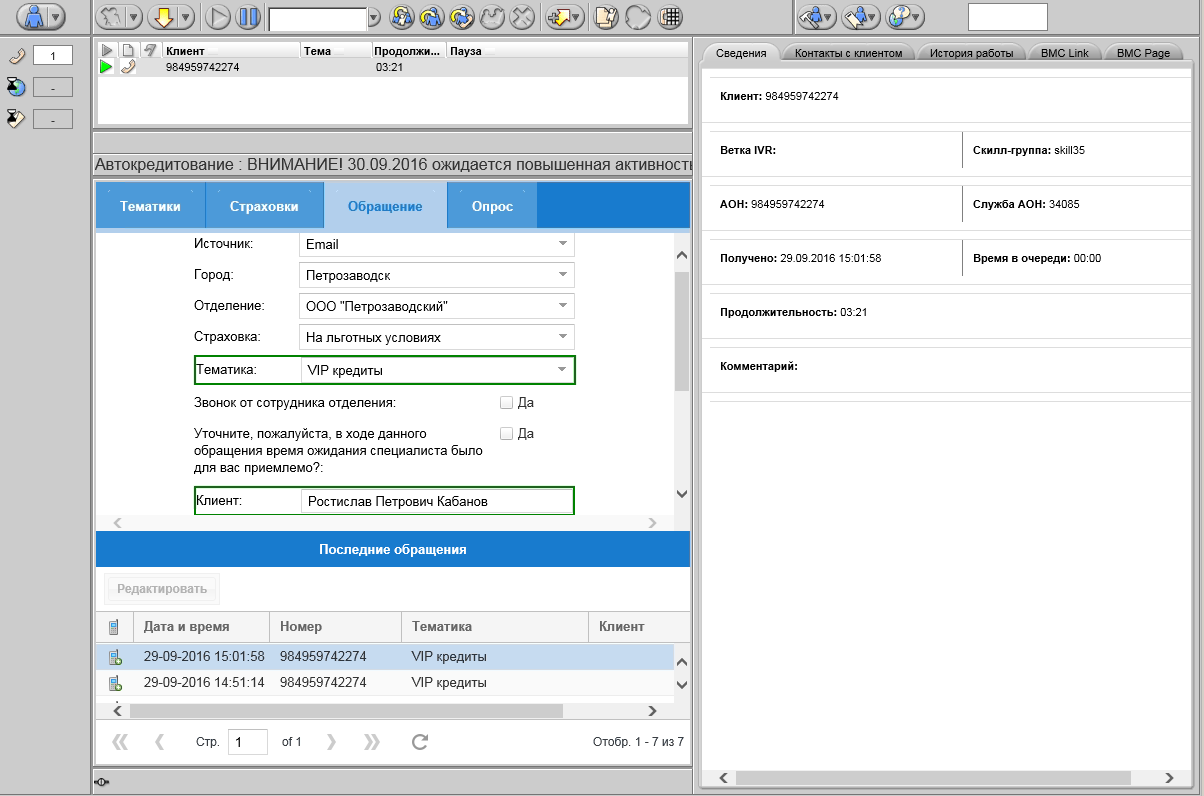

Screenshot operator interface operator

To increase the automation of operator workplaces, in the framework of the subsequent phases of the project, the contact center was integrated with Siebel CRM. Most of the operators are now working through it, and not through the workstations.

Thirdly, they modernized the outgoing dialing system. Chip - predictive dialing, this is when operators do not spend time listening to beeps when connecting to the subscriber, the system connects the employee of the contact center at the moment when the person has already picked up the phone. This greatly speeds up dialing and reduces the time lost on the callback.

Fourth, they implemented the Quality Monitoring system, which allows supervisors to evaluate the quality of operators' work, to generate various reports and KPIs. So the customer decided the issue of bonus operators.

An example of a call recording evaluation form from the Quality Monitoring system, with which supervisors listen and evaluate calls.

Fifth, for the convenience of customers, the contact center supports multi-channel. In addition to voice calls, customers can contact the bank via e-mail and web chat on the site.

Sixth, they implemented the BI reporting module to build analytical reports based on data from several contact center systems.

What was difficult

Taking into account several delays (the plan is summer, in fact the tender was delayed until autumn, but the deadline for implementation was not shifted), there were serious risks not to meet the deadlines for the implementation of the contact center. The customer could not move the deadlines, because one of the divisions, which rented the premises and part of the resources, ended the lease term. And they had to physically move.

For objective reasons, the IT service of the bank did not always manage to agree that they provide us with the necessary information and tolerances as soon as possible. Fortunately, the contact center management (our business customer) was convincing enough, and it was possible to negotiate inside the bank without significant delays. As often happens in projects with banks, a lot of energy was spent on interaction with IT security guards of the bank.

For example, at one of the iterations, it went like this:

- You run with a flash drive to the computer.

- You type information security, again step by step explaining who you are, what, why, why

- Open the USB port for 20 minutes.

- You insert a USB flash drive and quickly take data from it.

- And move on to the next place.

There were no problems with end users - operators.

If we talk about AWP, then there were also certain difficulties. During the contact center migration project, the bank transferred the workstations of operators and supervisors from ordinary computers to virtual machines deployed in a virtualization environment (VDI - Virtual Desktop Infrastructure). Each virtual machine exists somewhere out there separately, and the user has only a thin client and a monitor. Accordingly, we had to quickly help the bank create images of virtual machines, deploy and test our workstations and other contact center software there. Plus it was necessary to install various infrastructure software, such as Java and ActiveX.

There was a story with Java too - once the bank upgraded Java on virtual machines, which is why the AWPs stopped working correctly. There were compatibility issues when working with AWP in a virtualized environment with a new version of Java, which we quickly won.

Also during the project on the new version of IE 11, which also caused a compatibility problem, a revision of the workstations, etc. This was also an unplanned difficulty with which they coped.

Fought with false calls. The operator at the workplace came on 10 calls in a row, and as soon as he picked up the phone, she was immediately thrown. Even the customer initially complained to us that the system does not work correctly and does not connect the client with the operator. We dealt with this claim, conducted a bunch of inspections, studies, and found that the system worked correctly. It was possible that the automatic telephone call systems (it could be telemarketing, which “knocked” on numbers), since The number for calls was often the same. Together with the bank, we even attracted a communications provider to analyze all this, found out the part for which the bank is responsible - for the telephone infrastructure, investigated the contact center. There were no problems anywhere, everything worked correctly everywhere. As a result, I still had to block these numbers with the help of the functional “black list” so that operators would not be disturbed.

Migration

We immediately planned a fault-tolerant contact center configuration with geo-redundancy for two data centers. All contact center servers were deployed on the bank virtualization platform. We started with installation and configuration of voice gateways, deployed virtual servers together with bank virtualshchiki.

PBX architecture - contact center core.

Raised PBX, configured routing and contact center. We carried out tests on manual calls, then we gave a large test load, then we did combat tests on several phones and several operators.

The contact center is open 24/7, so we chose the least loaded time - we worked a lot at night. The combat test was like this: “sat” all day on Avaya, then rolled back to the old system in the evening, analyzed the results of the work. There were no problems, so the next day they switched smoothly.

Then they transferred all records of customer conversations with operators from the old system to the new one, so that nothing was lost. Additionally, on top of the new recording system, we have implemented the Quality Monitoring system with the functionality of quality assessment, reporting and the operator screen recording module.

Our project team was not small: a manager, contact center engineers, monitoring system engineers, BI, developers, testers, and other specialists. The bank also had a lot of participants - from IT specialists to representatives of a business customer.

In words, simple, but in fact the preparation was quite long. There were long groups phoned for 2 hours, in which we discussed how everything will be, what to do if a failure occurs, what options, how to roll back in case of accidents. Each reported on its sub-topic. Then they discussed minor issues. On hot days before and after switching, we organized daily conf calls from 10-12 people.

After implementation, we went to visit the customer several times. One night we redid the routing with telecom operators: we had to redo all the call processing logic for 70 city numbers in Moscow and the regions overnight.

For customers, migration was invisible, there were no interruptions in service, despite the fact that there were major changes inside. And in terms of moving people, and in terms of changing equipment and systems, and in terms of even changing approaches in work. In order not to affect the service for customers, operators were transferred to a new solution in small groups. During the week, each operator got used to the AWP, learned new interfaces (it was necessary to move from the push-button control of the phone to mouse-based call control).

Contact Center Monitoring

The customer had a good expertise in this matter, and his requirements for monitoring the contact center systems were quite serious. As a result, this resulted in a separate project. It is important to note here that most of the contact centers either “don’t put” their systems on monitoring at all, or they do it to a limited extent and by standard means. And as a rule, the customer does it on his own. The difficulty here is that Avaya has few recommendations on how to monitor the operation of applications (apart from the standard use of SNNP), and there is no unified monitoring tool. Therefore, we faced the challenge - for each of the subsystems to come up with ways to check the performance of applications.

It was impossible to simply “climb” into memory and see the status of applications - the fact that it hangs in memory does not mean that it actually works correctly. Naturally, integration with banking monitoring systems was needed so that the customer could build a map of observations of all systems. If an accident occurred at night - the duty officer was supposed to raise the necessary unit on alert and report the information. Ticket tickets were automatically started up directly from the monitoring system.

Business intelligence

The second large part of the project after moving to a new platform was the introduction of BI. Here, frankly, I had to break my head over a non-standard task. The fact is that earlier the customer used Excel for reporting, and there were about 40 different tablets. All of them were processed inside XLS, and the output was complex aggregated reports. There was no opportunity to generate reports in the usual format for the bank. The question arose whether to connect the old non-centralized fragmented reporting to the systems or make your own, unique, transferring everything to it. The customer chose a BI system that perfectly closed his consolidated reporting requirements. In words, too, everything is simple, but it took a lot of effort. For this, later the vendor even awarded us in one of his contests.

Initially, the reporting was as follows: each system in its interface showed separate indicators. Contact center quality staff from different systems reduced it all to XLS.

For two months, we transferred standard reporting forms and connected to information sources, wrote connectors, and set up the exchange. The customer appreciated the flexibility of the system. There are many new reporting forms. All reports are based on data from two main systems: Avaya Call Management System provides call-center data, and Avaya Experience Portal provides IVR statistics. Also in BI pulls data from other systems. Everything is made on the basis of Pentaho, an open source product. He extremely successfully met the requirements: his full stack was very suitable for converting and extracting data for the framework that does the analysis. Another plus is that the bank did not have to take an expensive license.

The architecture is in three layers: there are sources in the form of business systems, there are intermediate storages for collecting data regularly and there are showcases with calculated indicators. On top of all this is the presentation layer, which in the form of a web application gives everything up to the customer over the network. For adapters, they partially cooperated with representatives of vendors to modify their applications. As we, no one has done before, there were no free or paid funds.

BI bank is used as an integration system that collects data and sends them, without forecasting and in-depth analysis - this is still in the future.

The main difficulty here is to combine calls after transfer to one, analyzing logs. The contact center analytics gave raw data to the systems, and the customer needs high-level business indicators. For example, raw segment data about the call: each of the call routing transitions is enriched with flags like “was redirected”, “where it was redirected”, “which agent was processed”, the start and end times of the segment. A high-level indicator, for example, the average time the call is held by the operator. There was also a whole methodology for assessing the business efficiency of IVR.

Calls collect and calculate diversity: the average processing time, the number of answered, how long, up to history reports - everything is shown in an enriched format: who called, what kind of customer, what topic, did he log in, what operators were handling the call. The bank uses all these data to investigate claims, and I must say, the process is very simplified. They find a call, watch its history - listen in the recording system. The quality department analysts no longer need to reduce the data on the cuts - they received it all in one window. Centrally.

Then came the third business area: reporting on topics. This is what the operator records about the call to the automated workplace: why did he get a call, what did they complain about, what did they ask. This is a separate showcase that is associated with data on calls and other reports.

the end

Migration realized on time, but the last two weeks have slept for five to six hours. As a result, the bank entered the period of peak consumer loans with a new modern solution. Full migration, including analytics, reporting systems, differentiation of skill groups and translation of about 10 different service support lines, was done in 6 months.

According to the results of the project, the bank, on the basis of its methodology for measuring indicators, said that after the upgrade, the number of calls processed by operators per day increased by 60%, and their efficiency increased by 6%. Moreover, it has doubled

quality interactive speech interaction.

Difficult, but interesting was the project, more such.

References:

- The main subsystem of the contact center

- Domestic call center from Naumen and Eltex

- Recognition of Russian speech for KC and paranoids -

- My mail is DPesotskiy@croc.ru

Source: https://habr.com/ru/post/311650/

All Articles