In the new list of the most profitable IT companies in Russia, 50% of the seats are occupied by foreign firms.

Last year, the analytical center TAdviser published the first in the history of the Russian information technology market ranking of IT companies in terms of net profit. This year the ranking of the most profitable IT companies in Russia has undergone some changes.

Analysts evaluated companies that develop, implement or distribute IT products, as well as manufacturers of consumer electronics and industrial automation. For groups of companies analyzed individual legal entities indicated in the report of analysts.

')

At the end of 2015, the total net profit of the listed companies increased by 61.5% - from 24.1 billion to 38.9 billion rubles, and revenue decreased by 2.6% - from 615.8 billion to 599.5 billion rubles .

Net profit is a part of gross income, which remains at the disposal of the company after the formation of a wage fund and taxes, deductions, mandatory payments to the budget, to higher organizations and banks.

Last year's rating was headed by IBM, or rather, its Russian representative office - IBM IM BEA. This year the leader has not changed. According to the results of 2015, the net profit of IBM BEA increased by 77.8% and amounted to 5.4 billion rubles, while revenue increased by 49.3% to 13.6 billion rubles.

The second place is occupied by software developer Peter-Service from St. Petersburg. According to analysts TAdviser, this company is the most profitable among software developers: by the end of 2015, its profit more than doubled - from 861.2 million to 2.9 billion rubles. Over the year, the company's revenue reached 6.2 billion rubles, showing an increase of 119.8%. A year ago, Peter-Service was in seventh place in the ranking.

The third place is again occupied by the Russian representative office of a foreign company. Last year, Samsung Electronics Rus Kaluga was not included in the rating. At the end of 2015, the company's profit increased by 0.4% and amounted to 2.7 billion rubles. The company's revenue fell by 16.1%, to 45.1 billion rubles.

The representative of TAdviser explains that other legal entities of the company were not included in the rating, since they did not show “a sufficient level of net profit”. In addition, there are legal entities engaged in other areas: for example, transportation, construction and so on - they are also not included in the list, since they are not IT companies.

The most profitable integrator is Lanit, the equipment manufacturer is IBM. The leader in profitability in the consumer electronics segment was Samsung, in the industrial automation segment - Schneider Electric.

In ninth place is responsible for consumer electronics Microsoft Mobile Rus with a net profit of 1 billion rubles, and 12th place is Microsoft Rus, which is responsible for software development, with a profit of 836.5 million rubles. So, foreign companies can take several positions in the rating at once.

Moreover, the profit of foreign companies in Russia accounts for 51.4% of the total net profit of the rating participants. Revenues of foreign companies in Russia also account for almost half of total revenues.

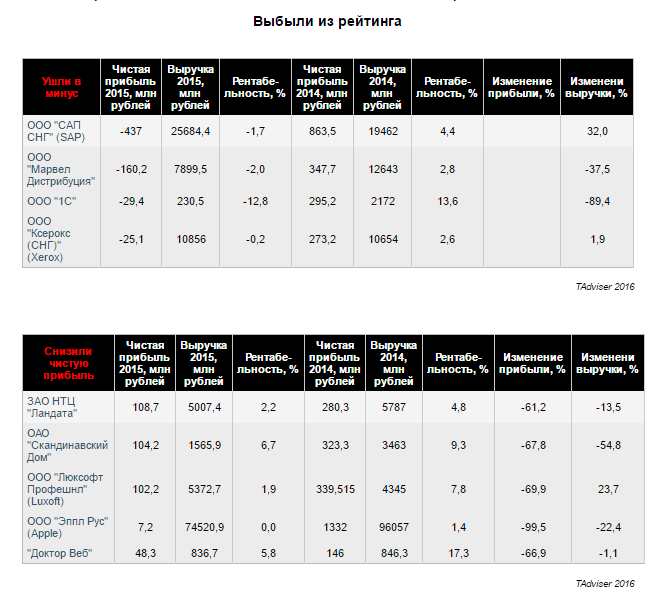

At the end of 2015, nine participants from last year’s rating dropped out of the TAdviser rating. Someone did not enter the list due to unprofitability, someone because of the decline in profits, analysts explained.

For example, the SAP division in the CIS ended 2015 with a loss of 437 million rubles against a profit of 863.5 million rubles in 2014. Apple Russia’s Apple Representative office showed a nearly 100 percent drop in profits from 1.3 billion rubles in 2014 to 7.2 million rubles in 2015.

The methodology for compiling the ranking TAdviser Profit 50, as a year ago, formed the company's reports on the Russian accounting standard. In compiling the ranking, the financial statements of about 500 legal entities, including companies included in the TAdviser 100 ranking, were analyzed, TAdviser said in a statement.

The state of the IT market

According to Gartner, the global IT market declined by about 3% to $ 2 billion in 2015 compared with 2014. Last year, the volume of the global IT market amounted to $ 3.51 billion and showed a record decline - by 5.4%. For all the time monitoring the market analysts Gartner recorded this for the first time.

In the Russian IT industry, the situation is more serious: the market has shrunk by 40% in dollar terms. Such data led IDC in March 2016.

“The dynamics of IT costs in Russia historically repeats the dynamics of oil prices. Unfortunately, 2015 was no exception, and according to its results we are witnessing a record decline in the market in monetary terms, ”said Robert Farish, vice president of IDC in Russia and the CIS, in December 2015.

The fall of the information technology segment of the Moscow ICT market was 21.6%, and the total revenue, according to the Moscow Department of Information Technology (DIT), amounted to 192.4 billion rubles.

Perspectives

Periodically, certain segments of the market come to the fore. Such segments are growing even against the background of the fall of the market as a whole. For 2015, and most likely, for 2016, these are converged solutions and flash memory for storage systems (DSS), as well as solutions for cloud data centers.

According to 451 Research, in 2015, 40% of enterprises planned to increase spending on the creation of converged infrastructure and continue to invest in its creation in 2016. The demand for flash technology has shown explosive growth. According to IDC, the global flash market in 2014 amounted to $ 11.3 billion, and in the second quarter of 2015 it grew by 101% in the EMEA region compared with the second quarter of 2014.

At the same time, server, storage and Ethernet switches show a drop, writes CNews.

Source: https://habr.com/ru/post/308958/

All Articles