What are the reasons Alphabet claims to be the most expensive IT company?

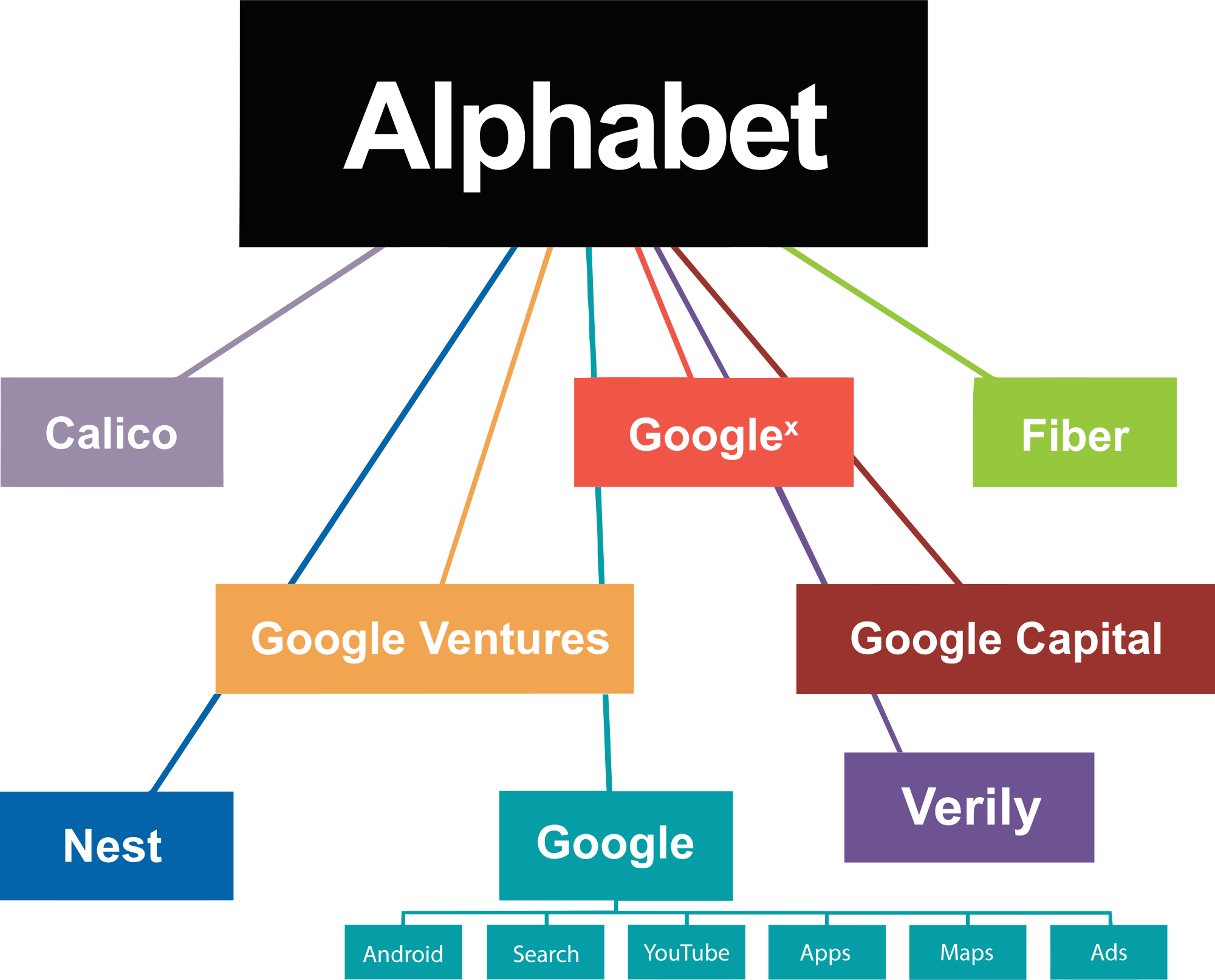

Alphabet appeared a little over a year ago, as a result of the restructuring of Google. All Google shares were fully converted into Alphabet shares without any changes to their parameters. Alphabet Holding has become a new player in the market, which included, as subsidiaries, Google itself and all its previous projects - in particular Calico, Fiber, Google Ventures, Google Capital, Google X, Life Sciences and Nest. This, according to representatives of the company, was to ensure their greater autonomy and a clearer management structure.

Google will maintain the search engine, as well as maps, advertising business, Google Play Store service, YouTube video hosting and development of the Android operating system, as well as Chrome, Google Apps and Google+ social network.

So far, most of the most profitable divisions still belong to Google. Far from all the projects that Alphabet now manages show satisfactory results.

Alphabet CEO has already been appointed by the former head of Google - Larry Page. Co-founder of the search giant Sergey Brin was appointed president of the holding.

')

“Alphabet is a strange holding. Only one part of it brings him significant income - this is Google. From the CEO of the holding, almost nothing is heard, but this does not mean that it does not exist at all. All heads of departments report to him about their activities, he makes the main decisions. And although the press practically does not see him, he still participates in the weekly TGIF meetings, which can be attended by any employee of the corporation, personally or via video link, ” says well-known writer and journalist Stephen Levy.

According to Levi, it is still not clear to representatives of the IT community how the Alphabet work is arranged: “It seems that the holding is still in shock - and the recent departure of several top managers has only aggravated the situation. Larry Page remains the head of Alphabet, but does not answer any questions. This is very bad, because the restructuring that has been carried out so far causes them. ”

“After the reorganization, the question hung in the air: how it will work. Many, including myself, were not sure that the heads of individual departments would be able to support the global vision of Larry Page and Sergey Brin, which they had been working out for many years, ”Levy said.

The results of the year

The value of shares for the year increased significantly: the Alphabet capitalization in February 2016 reached $ 550 billion. But so far almost all the company's profits accounted for Google projects.

According to one of the versions, the Alphabet was also created to “retain” top managers. However, in early June 2016, the head of the Nest division, Tony Fadell, left his post. In mid-August, the head of Google Ventures Bill Maris left his post.

Moreover, employees note internal tension in the company. Thus, the head of the scientific unit Verily, fired several of his direct subordinates.

Problems also arose in Google X - in preparation for separating the project of a self-driving car into a separate company, Page appointed a new division of the general director who had previously worked in the automotive industry. A few months later, the team left a few of the strongest engineers, including the technical director of the direction of Chris Urmson.

As suggested by The New York Times, one of the reasons for the conflict between Urmson and Page was the candidacy of a new division head.

The main income Alphabet bring technology search and advertising platform. Levy calls this company “a money machine”, which makes bold bets - and in the near future, Levy believes, many of these bets can pay off. “The company has powerful machine learning technologies, petabytes of various data, and kilometers of embedded fiber,” Levy cites the example. In the last quarter, Alphabet reported revenue of $ 21 billion.

Google Fiber

In the meantime, the project on which Alphabet had high hopes did not justify them. According to the plan, the Google Fiber provider was supposed to gain 5 million subscribers by 2016. In 2014, Google Fiber had 200 thousand subscribers.

In this regard, Alphabet CEO Larry Page made the decision to cut the Google Fiber team in half - to 500 people.

The Google Fiber provider launched the project in 2010. The company spent hundreds of millions of dollars on laying fiber-optic communication lines in a number of cities in order to ensure an Internet connection speed of about 30 times higher than the average for the United States. However, after six years of network development, it was decided to use wireless systems on the “last mile” wireless systems, wrote Vedomosti, citing The Wall Street Journal.

This will affect a number of cities connected to the project now, including Los Angeles, Dallas and Chicago. In San Jose (California) and Portland (Oregon), the project is suspended. Google Fiber also reported that the launch of their service in Palo Alto and surrounding cities has been postponed for at least six months.

More than a thousand cities have applied to connect to Google Fiber, and in November 2012, this service began operating in Kansas City. Google CEO Eric Schmidt said that Google Fiber is “not just an experiment, but a real business” and that the company decides where its further expansion should be directed. For six years, the service managed to cover only six large agglomerations.

The financial indicators of the Fiber project were not disclosed - they are included in the indicators of a group of departments that are not related to the search and are united under the name “other bets”. In addition to Fiber, this group includes such units as Nest and Verily. The total revenue of these units for the last quarter was $ 185 million, and operating losses reached $ 859 million. Quarterly investments for this entire group were $ 280 million, most of which came from Fiber.

Alphabet expects that Fiber will pay for itself at the expense of the subscription fee and, indirectly, the growth of the online advertising business. The provider sells internet access for $ 70 per month, TV service for another $ 60. In March 2016, Fiber served about 53 thousand TV viewers - the same as at the end of 2015, analysts of MoffettNathanson calculated. Analysts believe that connecting a single house to Fiber costs Alphabet more than $ 500, while not all apartments in houses become subscribers.

The problem with Google Fiber is not the only one for Alphabet. Last year, the company stopped selling the first version of the wearable smart device Glass, and recently the team that developed the robots was disbanded.

Alphabet and "four commas club"

However, Alphabet has serious ambitions, which ultimately boil down to an increase in market capitalization of up to $ 1 trillion.

To do this, the company must have prospects in a growing market. In addition, it must dominate its segment or be one of several dominant companies. There are three companies that meet the conditions and are close to a trillion-dollar estimate: Alphabet, Amazon, and Apple.

Alphabet dominates the online advertising market. Positions of the company and prospects of the market promote growth of cost of actions Alphabet.

According to analysts, the company's profits will grow until 2018. By this time, Alphabet capitalization could reach $ 950 billion. According to forecasts, the company has every chance of becoming a member of the “club of four commas”.

According to analysts, Amazon's sales by 2018 will exceed $ 28 trillion, and only 5.5 percent will be provided by e-commerce. The bet is made on AWS - Amazon's cloud business, which has great potential. Corporate infrastructure spending is growing, the market is growing and Amazon’s market capitalization will grow. Analysts believe that the company may reach trillion dollars in the next decade.

So far, the most expensive of these three is Apple. Apple is doing well, but there is a problem that is preventing Apple from reaching the promised trillion dollars.

Apple has reported a drop in revenue for the second quarter in a row. The main reason is the drop in iPhone sales, mainly in the Chinese market. Revenue for the third fiscal quarter fell by 14.6% compared to the same period in 2015. If in the third quarter of last year this figure was $ 49.6 billion, in 2016 it dropped to $ 42.4.

While the growth of the company has slowed. Major iPhone updates will be released less frequently, Apple’s car will not have to wait anytime soon.

Source: https://habr.com/ru/post/308630/

All Articles