Voice biometrics in the contact center of the bank. Introduction case

Hello! Last year, we introduced our solution for voice verification of VoiceKey.Agent contact center users to Priorbank (this is one of the largest commercial banks in Belarus, part of the Austrian Raiffeisen group) and now we want to tell you about how we did it and why it all took the bank. On the territory of Russia and the CIS, this is the second introduction of voice biometrics in the Bank's KC, therefore we have become practically pioneers.

Why can a biometrics bank

We will not tell you once again that traditional user verification technologies (that is, proof of identity using knowledge: passwords, PIN codes, code words, etc.) are cumbersome and do not give a guaranteed result. It is extremely difficult to ascertain whether on the other end of the wire is the very person for whom he claims to be. The operator of the contact center can only ask clarifying questions and compare the voice of a person with his gender, age and other features. It is quite obvious that this is not enough to protect financial information.

Therefore, banks, insurance companies, pension funds, etc. looking for ways to optimize remote maintenance through KC. For example, the number of customer calls to contact centers of banks with requests that require personal identification is growing. So, if in November-December 2007, 46% of calls were recorded in Priorbank KC with the need to request personal information, in the same period of 2015 the number of such calls increased to 68% of the total number of all calls, and this is already two of the three calls.

')

Typical questions asked by customers by phone

To date, the contact center operators of Priorbank monthly process tens of thousands of calls, more than half of the calls are requests for information on accounts and operations. The main questions are: “why the card does not work”, “what is the loan debt”, “why the operation does not go through” and so on. These issues cannot be resolved without confirming the client’s identity - by law, information on accounts is provided only to their owners.

Such information is not just trying to get the account holders, and third parties. That is why the person who called the bank is always asked for passport information, card number, mother's maiden name, and so on. On the clarification of these issues takes an average of 30−40 seconds per customer.

It turns out that, firstly, the danger of giving out information to the wrong person is rather serious, and secondly, the average customer service time is growing, and this is one of the main performance indicators of any CC.

Thus, the bank needs to minimize the time spent on servicing a single client, increase the level of data protection and do it all so that it is still convenient and simple for the client to receive the necessary information from CC. To solve these problems, we suggested Voicebank KeyAAgent Priorbank.

How VoiceKey.Agent works

At each call (incoming or outgoing) at the moment of the beginning of a conversation with the operator, the user is started to be checked in the background and data about his voice is collected. The information is then transferred to the server for processing and is compared directly with the client's voice sample stored in the system. The result of the test is displayed in the operator interface of the contact center. This process is called verification (there is still such a thing as identification, and they need to be distinguished).

The architecture of VoiceKey.AGENT has a client-server and provides flexible possibilities for integration with contact center and CRM.

The process is so reliable that it makes it possible to distinguish, for example, the voices of twins or the call of a parodist. The system will verify the voice with the standard in a few seconds and report that the verification failed. The system is language independent, so a bank customer can speak in any language available to him.

But in order to have voice fingerprints (or voice samples) of customers appear in the database, they must first be recorded.

How was the customer base formed in Priorbank?

There are several processes when working with voice samples:

• initial filling of the database with voice samples of customers based on the recordings of their calls to the contact center. Moreover, when creating a standard, the client must confirm his consent to his (reference) record;

• updated voice benchmarks;

• verification of customers by voice.

The database with voice samples of customers was formed in the process of their calls to the contact center of the bank by phone. If during a conversation with an operator, a client could confirm his identity in a standard way (using passport data, secret words, contract numbers and other details), then when a sufficient amount of speech material was collected, the system created a digital standard based on the unique features of his voice: accent and the speed of speech, pronunciation, etc. The physical features were also taken into account: speech tact, shape and size of the mouth, nose structure. Thus, already on the next call to the KC, the client verification procedure was significantly reduced in time due to background verification of the person’s voice.

Register a voice reference

• When calling, the client is identified by a phone number (if he is calling from a mobile phone whose number is registered with the bank).

• Then he goes through the procedure of standard authentication based on his knowledge of his full name, date of birth, passport and contract number, secret phrase. In general, up to the name of the cat.

• During the conversation, the system accumulates the amount of speech needed to create a voice standard (usually about 40 seconds of clear speech), and when it is collected enough, it informs you about the readiness to create a standard. The operator presses the button, and if the information that the customer has reported about coincides with the data from the bank’s systems, the operator saves the voice reference. Otherwise, no save occurs. The bank receives consent from the client to create a voice standard in advance, at the stage when the client signs a service contract.

An example of a client-operator dialogue:

Customer verification

The customer calls and is identified by the mobile phone number. If a voice standard has already been created for it, then the system will begin:

• verification procedure, if not, see the story about the registration of a new standard. The operator asks a few simple questions to the client (asks to introduce himself and indicate the date of birth).

• Within a few seconds of a conversation, when a sufficient amount of client’s clear speech has been accumulated (7–9 sec.), The system compares his voice with the standard and shows the result to the operator (“his”, “alien”, “not sure”).

• The operator either ends the survey, or continues, because the system is “not sure” that this is his own, or gently refuses the client, because he is “alien.”

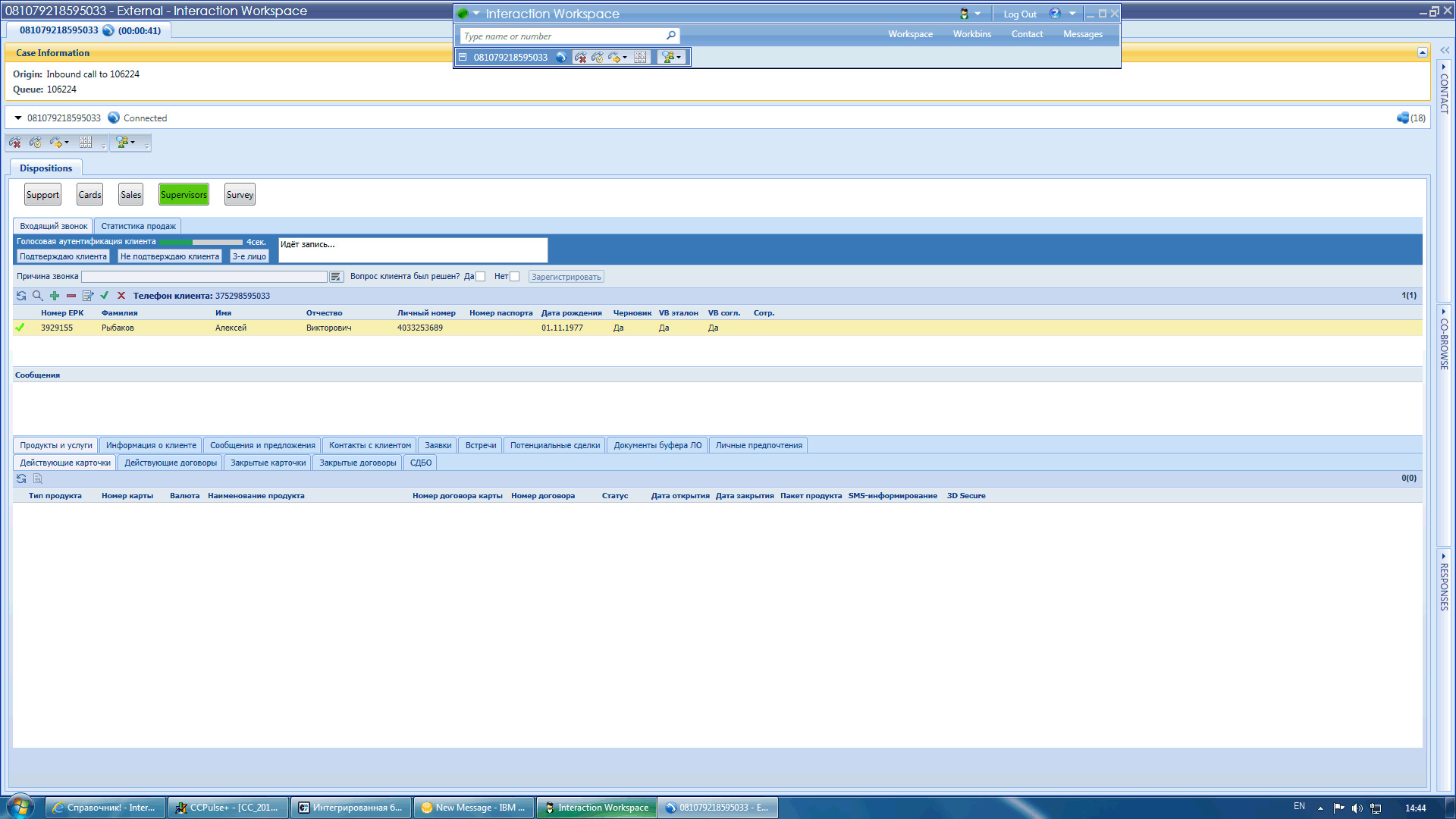

Example of successful verification:

If necessary, the operator can manually restart the client's biometric verification procedure, for example, if a third participant intervened in the conversation during the verification process.

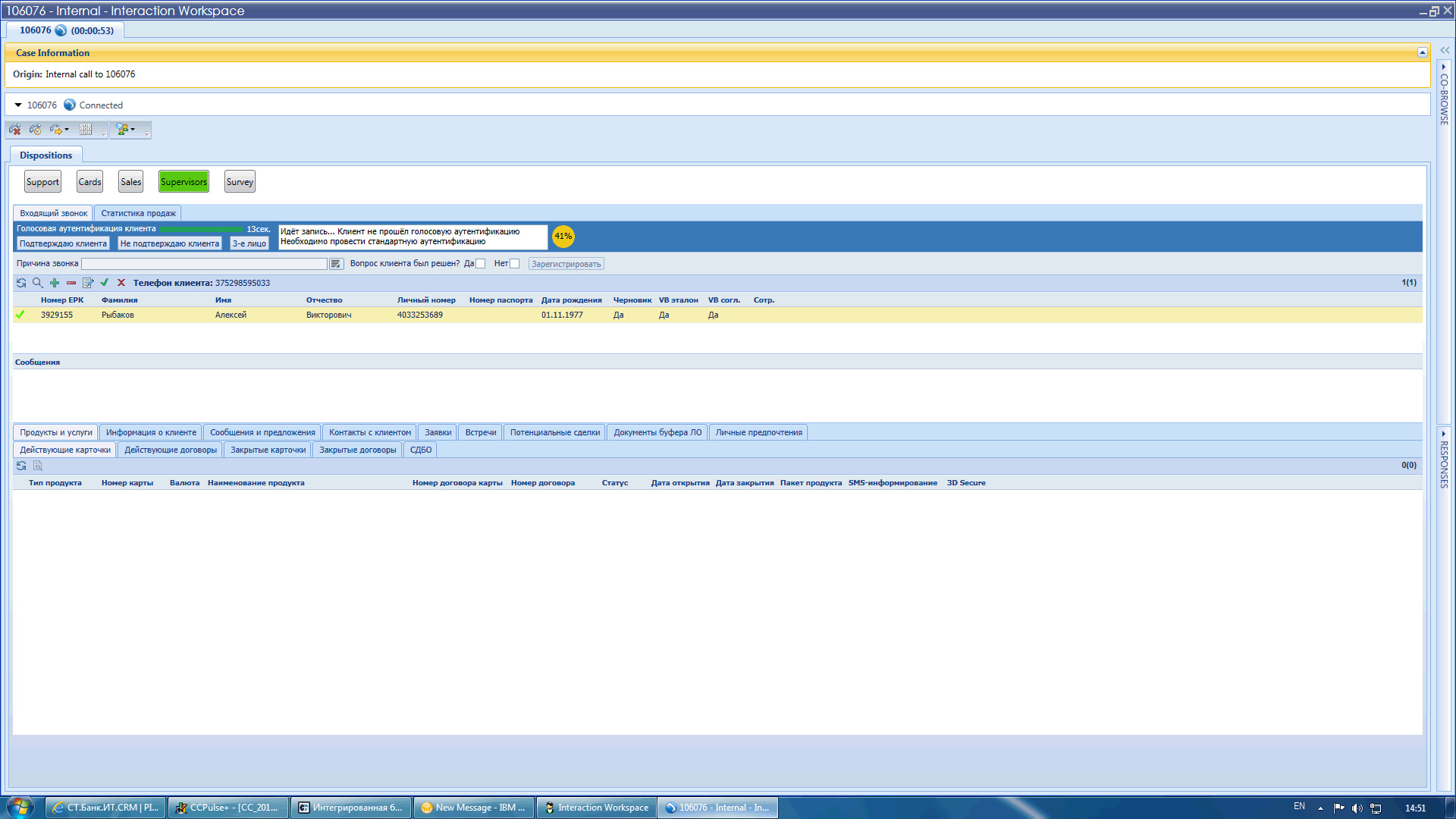

Or transfer a client to your manager or security service:

After the verification procedure is completed, the system no longer “listens” to the conversation, and its resources are not used.

Stages and features of implementation

• Development of technical specifications, design and implementation.

• Integration with CRM.

• Calibration system.

• Testing / trial operation.

• Delivery of works.

To determine the solution in the system, three thresholds are configured (“first”, “second” and “enrichment”). If the result of the comparison is higher than the first threshold, then the system considers that the client is “its own”, if it is lower than the second, the client is “alien”, if between - this means that the system cannot be sure of its decision.

If, when comparing, the result is higher than the first threshold and higher than the “enrichment” threshold, the system automatically updates the voice standard. This allows you to keep standards up to date.

Of course, no biometric system can provide a 100% result, as it is probabilistic. Sometimes, though very rarely, mistakes occur.

They come in different types.

Types of errors

Errors are of the first and second type, or, otherwise, a false pass of the “alien” (False Acceptance Rate, FAR) and errors of the false refusal of “one's own” (False Reject Rate, FRR). These errors are interrelated, and setting up biometric systems requires finding a “compromise” between the levels of these errors in order to satisfy the task as much as possible.

Voice biometrics can be applied in various applications. For example, to verify users during a conversation with a contact center operator, automatic voice verification in IVR, provide user access to a mobile application (shared with other types of biometrics: fingerprint or face), identify fraudsters by voice (antifraud), etc.

References:

»Learn more about the VoiceKey biometric platform.

»Report on the project at the Belarusian Interfax .

Source: https://habr.com/ru/post/307894/

All Articles