How trading on the exchange actually works, and how it can be improved: A simple algorithm (part 4)

We continue the series of articles of the former HFT-trader Marco Stucchio, in which he explains on his fingers how high-frequency trading on the stock exchange works (the first part , the second part , the third part ). It's time to whiten HFT from accusations of responsibility for short-term disruptions in the work of financial markets.

In 2012, a lot was written about the failure of the trading company with Wall Street Knight Capital (KCG). The company began to practice high-frequency trading and suffered a crushing failure, losing $ 440 million and shaking investor confidence in HFT. You can read more about this here , here and here . Journalists usually have no time to delve into the technical details of such stories. But, according to the author of the HFT blog, there was no reason to panic. Trader systems are reliable, if built wisely.

There are two basic rules for how to build a solid and reliable HFT system. They only contradict each other at first sight. The first is called the Transportation Security Agency method. Its essence is to create a pair of ideal systems, "x-ray scanners", through which even the mouse will not slip. Then, based on them, do the rest of the structure. If your protection apparatus is done correctly and you can trust it, then everything else should work as it should. The motto of this method: any error is excluded.

')

The second approach can be called the Netflix method. It is based on the idea that any system ever begins to fail. The Netflix network has a program called monkey chaos. When someone from the developers starts working with the software of the company (and we are talking about tens of thousands of individual servers), the program starts and starts to disconnect in random order some of the servers. If the system cannot handle it, it is discarded as unreliable. Netflix’s motto can be defined like this: “shit happens” - be prepared for this.

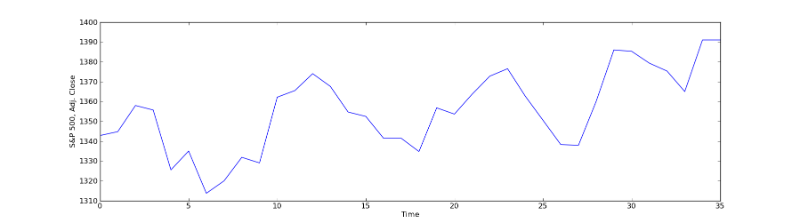

In the stock market, one can well illustrate the principle of the second approach. Shit happens here all the time. But joint actions of the market and regulators ensure that all sorts of technical perturbations (for example, surges in the activity of HFT traders) do not cause any special harm. The graph shows the positions of the S & P 500 index in time, one point per day.

This is the type of chart that attracts people who trade slower than any day trader. Like Warren Buffett, George Soros and the like. It demonstrates the impact on the market of Flash Crash (the collapse of the New York Stock Exchange, which occurred in 2010).

If you do not write detailed values on the X axis, it is impossible to understand from where and when the market collapsed. The author tells the story of a friend-trader, who just at the time of the collapse left for the toilet. Within 20 minutes while he was there, the market managed to subside and recover. Yes, there are things that need to be cleaned up. But overall, the recovery did not take long.

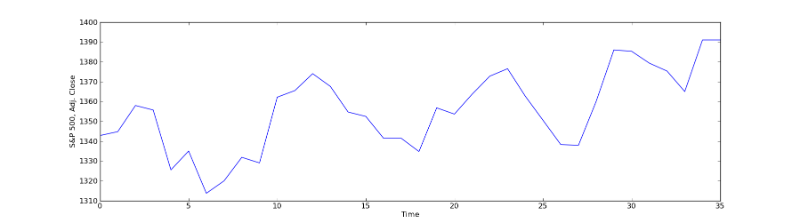

Here is another chart that illustrates the story of Knight Capital in 2012:

Here are two options, the author says: either the failure of this diagram is not really visible, or he simply does not know how to use Matplotlib to display the data correctly.

The time has come for the next grand exposure. The only line that points to the troubles from the activities of Knight Capital is the price of the company's shares.

To summarize, what happened when Knight Capital crashed? We may notice some irregularities in the bidding process at the time of trouble with the company, while everyone else was trying to figure out what happened. In fact, all I did was to knock out a single computer program, Knight Capital, which began to buy high and sell low. As a result, it has enriched some other traders for $ 400 million. The market itself slipped a bit on Tuesday, but it fully recovered by Friday.

It seems that the only victim of this “collapse” was Knight Capital. That is, the financial market acted on the principle of Netflix: if someone sank, throw him overboard, and the market would quickly recover.

In 2012, a lot was written about the failure of the trading company with Wall Street Knight Capital (KCG). The company began to practice high-frequency trading and suffered a crushing failure, losing $ 440 million and shaking investor confidence in HFT. You can read more about this here , here and here . Journalists usually have no time to delve into the technical details of such stories. But, according to the author of the HFT blog, there was no reason to panic. Trader systems are reliable, if built wisely.

There are two basic rules for how to build a solid and reliable HFT system. They only contradict each other at first sight. The first is called the Transportation Security Agency method. Its essence is to create a pair of ideal systems, "x-ray scanners", through which even the mouse will not slip. Then, based on them, do the rest of the structure. If your protection apparatus is done correctly and you can trust it, then everything else should work as it should. The motto of this method: any error is excluded.

')

The second approach can be called the Netflix method. It is based on the idea that any system ever begins to fail. The Netflix network has a program called monkey chaos. When someone from the developers starts working with the software of the company (and we are talking about tens of thousands of individual servers), the program starts and starts to disconnect in random order some of the servers. If the system cannot handle it, it is discarded as unreliable. Netflix’s motto can be defined like this: “shit happens” - be prepared for this.

In the stock market, one can well illustrate the principle of the second approach. Shit happens here all the time. But joint actions of the market and regulators ensure that all sorts of technical perturbations (for example, surges in the activity of HFT traders) do not cause any special harm. The graph shows the positions of the S & P 500 index in time, one point per day.

This is the type of chart that attracts people who trade slower than any day trader. Like Warren Buffett, George Soros and the like. It demonstrates the impact on the market of Flash Crash (the collapse of the New York Stock Exchange, which occurred in 2010).

If you do not write detailed values on the X axis, it is impossible to understand from where and when the market collapsed. The author tells the story of a friend-trader, who just at the time of the collapse left for the toilet. Within 20 minutes while he was there, the market managed to subside and recover. Yes, there are things that need to be cleaned up. But overall, the recovery did not take long.

Here is another chart that illustrates the story of Knight Capital in 2012:

Here are two options, the author says: either the failure of this diagram is not really visible, or he simply does not know how to use Matplotlib to display the data correctly.

The time has come for the next grand exposure. The only line that points to the troubles from the activities of Knight Capital is the price of the company's shares.

To summarize, what happened when Knight Capital crashed? We may notice some irregularities in the bidding process at the time of trouble with the company, while everyone else was trying to figure out what happened. In fact, all I did was to knock out a single computer program, Knight Capital, which began to buy high and sell low. As a result, it has enriched some other traders for $ 400 million. The market itself slipped a bit on Tuesday, but it fully recovered by Friday.

It seems that the only victim of this “collapse” was Knight Capital. That is, the financial market acted on the principle of Netflix: if someone sank, throw him overboard, and the market would quickly recover.

Other materials on the topic from ITinvest :

- How trading on the exchange actually works, and how it can be improved: A simple algorithm (part 3)

- Analytical materials from ITinvest experts (for a gradual immersion in the topic of finance, you can start with weekly reviews of financial markets )

- How trading on a stock exchange actually works: A simple algorithm (part 2)

- How trading on a stock exchange actually works: A simple algorithm (part 1)

- Can all financial models be erroneous: 7 sources of risk of losses

- Experiment: What does the random walk hypothesis say about financial market forecasting?

- Experiment: Using Google Trends to predict stock market crashes

Source: https://habr.com/ru/post/307738/

All Articles