Contactless Payments - Towards Consumer and Developer Trust

Contactless technologies are gradually becoming an important part of modern life - both for companies and for ordinary users. Over the past few years, for example, we could observe how companies operating in the passenger transportation market went from introducing their own systems based on contactless payment cards, to accepting instant payments through bank cards that support contactless technologies, and more recently and began to support payment through cell phones and wearable devices with NFC support, such as the Apple Watch. And if earlier contactless terminals were rather unusual for us, now we see them almost every day. Today, companies from other industries are starting to explore what opportunities contactless technologies offer them in their sector.

Recently, many consumer opinion and penetration studies of contactless solutions have been conducted, and although initially the level of trust in this technology was very low, as users realized the benefits of contactless payments and the availability of this technology increased, the level of trust in it also increased . It has grown so much that this year the largest UK banks have increased the maximum limit for contactless transactions from £ 20 to £ 30 (a bit, but the dynamics are important for us now).

If, from the consumer’s point of view, the picture is more or less clear, then there is not much discussion of the opinions of companies or their experience in working with contactless technologies in the press. Considering that experts predict that as a result of the launch of Apple Pay, the volume of contactless payments made through mobile digital wallets will reach 200 million pounds sterling by the end of 2016, now is the right time to discuss what forces companies to do or these solutions, and how to overcome the difficulties involved. This was the purpose of our study "Contactless Business: The State of Play" ("Contactless payment technologies: state of affairs"), which examined the level of penetration of contactless payments, attitude and plans to deploy these technologies in companies from the UK, Germany and Spain. Russia is still lagging behind in the application of technology, but the experience of leaders may be indicative of predicting the future.

The survey was conducted in October 2015 among 240 company executives in the UK (80), Germany (80) and Spain (80). The distribution by industry was as follows: banking sector (90), retail (83), telecommunications (34) and transport (33). Were interviewed both private and state-owned companies - airlines, taxi services, etc. - with a staff of more than 250 people.

The speed of penetration of contactless technologies has accelerated, and these technologies provide an increasingly powerful tool for differentiating and introducing innovations in companies from the retail, transport and banking sectors. In order to maintain competitiveness or accelerate growth rates, in the coming months and years, organizations will have to intensify their strategies for introducing contactless technologies.

- The level of penetration of contactless technologies is very high and the overall picture in Europe is very uniform. Only very few companies (8%) have not yet launched support for contactless payments, and among the respondents there was not a single company where they would not plan to implement such a project in the near future.

- Arguing about the future, European companies expect that in the next three years, the share of contactless payment technologies will account for up to 10% of all transactions.

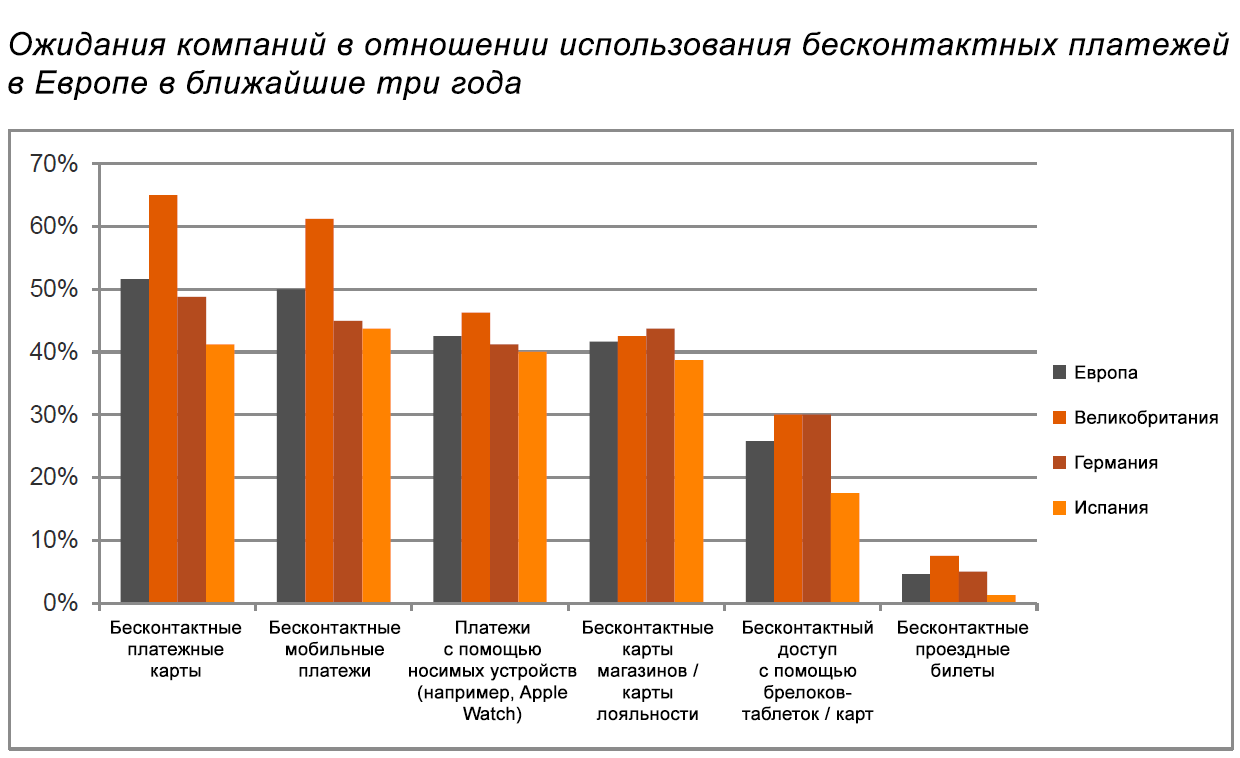

- Contactless technologies will be divided into various groups as follows: contactless payment cards (52%) are the most popular among companies, mobile payments are the next most popular (50%), payments using wearable devices (43%) and store / loyalty card contactless (42%). New types of payments will most actively develop in the UK, where 61% and 46% of companies expect the introduction of, respectively, contactless payment solutions and payment solutions using wearable devices.

- UK companies intend to invest more in contactless technologies than their counterparts from Germany or Spain, while in vertical markets, banks are leaders in the implementation of contactless technologies.

- The main growth factor for investment in contactless technology is an increase in the speed of payment processing (for 74% of companies). Other important factors include the ability to acquire an image innovator (43%), an increase in cost efficiency (42%) and the ability to differentiate one's offer from competitors (33%). For consumers, the most important factor is increased convenience (47%), a higher degree of satisfaction (43%) and simplified payment processes (43%).

- More than half of the companies intending to introduce contactless technologies will prefer to work with partners. Among the most sought-after qualities that companies would like to see in their partners are solutions that provide a high level of security (59%), good reputation and industry competencies (53%), as well as convenient integration with other solutions (51%).

- As for deployment plans, they differ: 30% of companies intend to develop contactless technologies under their own brand, 33% plan to do this collaboration with a partner who launches services under their brand, and 22% plan to cooperate with several partners at once.

Success story: implementation of fast and secure payment for purchases for Saracens fans using wristbands for contactless payments

Saracens Rugby Club, one of the most successful clubs of the UK rugby union, uses wristbands with a pre-paid amount for them to organize faster and more convenient sales of snacks and drinks at their Allianz Park stadium. As part of the tests before the full-scale implementation of this solution in the season 2015/2016, Gemalto intellectual bracelets were charged £ 5 each, after which bracelets were given to fans so that they could pay for the purchase of drinks and snacks by simply touching the bracelet to a special payment terminal. The use of bracelets eliminates the need to look for the right bills and coins, significantly speeds up the payment process and contributes to a more optimal viewing experience during the big game. The balance of the bracelet is easily replenished in real time, for this it is enough to simply tie the bracelet to an existing credit or debit bank card, after which the bracelet is used in all remaining matches of the season.

Prospects for the use of contactless payments and investment in new technologies

As for the prospects of the next three years, the results of the research indicate that contactless technologies will become an even more significant part of our life, both in private life and at work. According to the forecasts of European companies, in the next three years, the share of contactless technologies will account for about 10% of all transactions, while all companies adhere to this forecast, regardless of the country or the vertical market in which they operate. Given the relatively young age of contactless technology in comparison with traditional payment methods, this is indeed a significant shift.

The pace of perception of contactless technologies will differ depending on their form factor. The graph shows that in the next three years, most European companies expect to see new projects using contactless payment cards (52% of companies), then projects using mobile payments (50%), payment solutions using wearable devices (43% ) and projects with contactless store cards / loyalty cards (42%). Non-contact access using keyfobs / cards (26%) and contactless travel cards (5%) will not be so popular in the next three years. Nevertheless, a significant increase in the number of projects is expected with the use of new form factors. In particular, in the next three years, the number of companies that decide to implement payment projects using mobile phones will increase by 28%, and the number of those who intend to implement payment solutions using wearable devices will grow by 39%.

Also noteworthy is the fact that in the course of the survey no one was discovered who would not be going to use contactless technologies for the next three years.

Success story: the use of mobile NFC technology to sell tickets on public transport

A pilot project was implemented in the Madrid public transport system, providing a convenient and secure mechanism for subway and city buses using NFC technology. Gemalto provided its Allynis Trusted Service Manager (TSM) and UpTeq Multitenant SIM solutions based on MIFARE DESFire technology, respectively, for the Madrid Public Transport Consortium (CRTM) and Telefonica, the leading mobile operator in Spain. After that, the Municipal Transport Company of Madrid (Empresa Municipal de Transportes de Madrid, EMT), implemented the Gemalto TSM solution into the CRTM server systems.

The project was implemented to demonstrate the speed and convenience of new payment technologies for end users, as well as numerous advantages for service providers. To use this service, consumers need to download an application developed by Samsung that allows you to purchase digital tickets. The new solution is also beneficial for CRTM, which has received an extremely efficient ticket sales channel, available to consumers via their mobile phones 7 days a week, 24 hours a day. At the same time, delays on turnstiles are reduced, which often have jams when passengers try to find the right card in their wallet, while in the new solution it is enough to simply touch the telephone of the contactless reader with which the turnstiles in Madrid public transport are already equipped.

Moscow’s public transport has also implemented a similar scheme for selling tickets via mobile phones, in which passengers can take a train, a tram or a bus, simply by touching the payment terminal with a phone that supports NFC technology. Russian mobile operators Megafon and VimpelCom are cooperating with Gemalto, which provided the UpTeq Multi-Tenant NFC SIM cards necessary for the implementation of this project.

To use this service, passengers can get such a SIM card free of charge from the operator, and then they can purchase tickets through a special mobile application on their smartphones. The ticket price will be automatically deducted from the subscriber's mobile phone account, and to get on the bus, the passenger will only need the mobile phone itself. It is expected that this scheme will help to significantly reduce the queues, to improve the overall impression of the passenger from the trip and in the next few years will be very popular among the seven million passengers who use the services of public transport in Moscow every day.

Growth factors and benefits

All survey participants showed a clear understanding of why both consumers and organizations are willing to invest in contactless technologies and actively use them.

From a consumer perspective, the main benefits are:

- Convenience

- Satisfying needs

- Ease of use

Key business benefits:

- Accelerating Payment Processing

- Improving the image (the image of the technology leader)

- Cost effectiveness

Among European companies, Germans are the least optimistic and introduce contactless technologies in order to "keep up with competitors."

Overcoming difficulties and doubts

Of course, the introduction of contactless technologies is not necessarily a simple task, and in order to take advantage of the new technology, companies have to overcome a number of difficulties.

In general, about a quarter of companies (24%) currently believe that contactless payment technology is extremely secure and can be fully trusted, another 52% consider the technology as a whole safe, but at the same time admit that it can be protected even better .

Risks to consumers

In addition to the difficulties from a business point of view, contactless technologies carry certain potential risks to consumers. Currently, according to companies, about a quarter of their customers do not trust contactless payment cards (28%), mobile phone payments (25%) or wearable devices (28%), despite the ever-increasing transparency and popularity of these technologies. Thus, there really is something to work on. Statistics show that British consumers are less trustworthy in payments made using wearable devices (29% tend not to trust this technology), whereas both Germans and Spaniards do not trust payments using contactless cards (they are not trusted, respectively, 25% and 41% of respondents in these countries).

Obviously, contactless technologies are permanently entrenched in our life and will be actively developed and applied in all aspects of our life - at home and at work. The study shows how important the role of contactless payments play in the life of European companies - regardless of their shape or size, and how high the expectations that companies place on these technologies in the next few years.

Although some respondents believe that they are forced to “act together with everyone,” the truth is that in some cases consumer demand will grow faster than in others.

Of course, to increase the popularity of contactless payments, it is first of all important to ensure the protection of financial data. Organizations need to build a security infrastructure for contactless payments, which would cover virtually all aspects - from protecting basic data to protecting access at the periphery of the network. And there are a number of factors that need to be taken into account - from staff training and raising awareness of potential threats to the choice of partners who will be involved in the design and implementation of systems.

In the near future, contactless payment cards, as one of the most well-established forms of contactless solutions, will continue to dominate the market, while payments using mobile technologies and wearable devices will rapidly increase their share. The growth of investment in new technologies is also promoted by the desire of companies to provide a faster and more convenient payment mechanism for their clients, as well as their desire to increase cost efficiency and gain a reputation as an innovator and market leader.

')

Source: https://habr.com/ru/post/306844/

All Articles