Bank card from MegaFon

The amount of available funds to pay for electronic (and not only) services and conduct banking operations is growing every year. Now almost every large IT company has its own e-wallet services (Apple Pay, Google Wallet, Yandex.Money, WebMoney, Money Mail.ru, Rambler.Money, RBK Money, QIWI and others), not to mention the number of banks.

Each of these systems requires registration, and for carrying out such routine operations as withdrawing funds to a card or withdrawing cash, additional personal identification may be required. To transfer funds to some partner or friend, ideally have an account in the same bank or account in the same system in order to make this payment with minimal fees and as quickly as possible.

To solve such problems and make the process of transferring funds more convenient and faster, our new MegaFon card is designed. The only thing needed to receive it is to be a MegaFon subscriber.

Maxim Potapov (IT Financial Services MegaLabs) and Andrei Vengerov (Marketing Financial Services) will tell you more about the new project.

')

Idea of creation

When creating the card, we were repelled by the vision of the subscriber’s account as a full-fledged payment instrument. That is, in fact, funds in the subscriber account are again becoming liquid. This is not just any credits credited to your account, which provide you with minutes of conversation, the number of SMS or megabytes of traffic.

This is exactly the money for which you can buy a cup of coffee in a cafe, pay them off at any store that accepts cards, or transfer it to someone’s account (subscriber or any bank). In general, it is possible to handle funds on the account as with ordinary money. You put 1000 rubles on the phone - and this no longer means that this thousand is only for communication services. This is still your thousand rubles.

At the moment we are the first in the world who launched a similar technology.

One of the main problems of such a bundle is that mobile billing systems usually simply do not keep up with the processing. But we were able to overcome this during the development.

Development

The beginning of the transition from an emerging idea to development dates back to mid-2015, at which point MegaFon, MegaLabs and a partner bank (Round Bank) are starting to create a single bundle for banking processing, mobile billing and mobile applications from which all of this can be managed. Already, we are ready mobile applications for popular platforms - iOS and Android.

MegaLabs

MegaLabs is a subsidiary of MegaFon, whose goal is to find and create innovative technologies, products and services for subscribers and business partners of a mobile operator.

About MegaLabs has repeatedly been written on Habré, a number of successful projects in the field of financial services, cloud and geographic services, content and communications left the laboratory.

“MegaFon TV”, “Mobile Ticket”, payment terminals, as well as a number of other projects - all this was released thanks to the efforts of the Megalabs team. And today we will tell about the new product of the laboratory - MegaFon's bank card

About MegaLabs has repeatedly been written on Habré, a number of successful projects in the field of financial services, cloud and geographic services, content and communications left the laboratory.

“MegaFon TV”, “Mobile Ticket”, payment terminals, as well as a number of other projects - all this was released thanks to the efforts of the Megalabs team. And today we will tell about the new product of the laboratory - MegaFon's bank card

One of the main difficulties here was the integration of all this in a very short time - a year for everything.

Of course, when developing a solution of this level, it is impossible to avoid other technical nuances.

For example, MasterCard and other payment systems have a well-regulated time for all operations. That is, the whole chain “Entering a PIN at the checkout - store - store acquiring bank - payment system - bank Round - debiting funds from billing - the answer is in the opposite direction” should fit in at this time. It is about 12 seconds.

Due to the fact that operator billing does not work in the same way as processing, at the very start we had many cases where billing simply did not have time to write off funds, and the operation was rolled back due to a timeout.

Therefore, we had to rebuild the system of debiting funds to work with the card. In fact, we transferred its work from a mobile commerce system to a system similar to calls. For example, when you make a call from a mobile phone, you will immediately be charged off money - we also had to make a card.

It is worth mentioning the interaction between the processing of the bank and our billing. With the current scheme of work, the funds themselves are not stored in the bank - they are on the personal account of the MegaFon subscriber. And the processing of the bank here plays the role of transit, and it turns out that any operation performed by you on the card is a write-off of money from MegaFon billing.

Given the spacing of billing by branches, it took about 5 months to establish the system. In addition to the speed of processing payments, it was necessary to build a service system. We have developed an IVR for customers with automatic PIN code generation.

Another situation is the return of funds to the card in case you bought something with it, but decided to return the goods back to the store. Again, because the funds are not in the bank, but on MegaFon’s personal account, respectively, the refund is also made to the BOS. And the return chain on the same day of return already looks like “MasterCard - Bank Round - crediting to MegaFon's personal account”.

The result of all this work was a kind of symbiosis of telecom billing and processing, each of which solve their problems.

MegaFon Bank Card

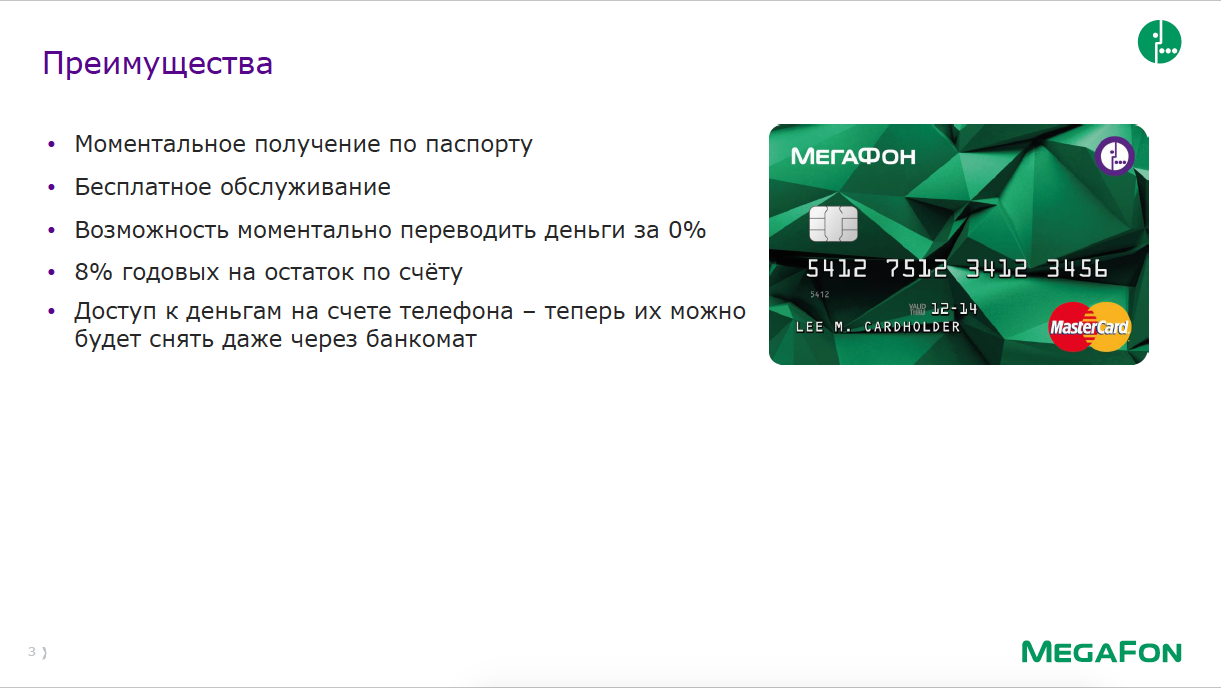

Perhaps the most important thing to note right away is the usual and familiar to all MasterCard, with the only difference that in order to receive it you need to be a MegaFon subscriber. The procedure for obtaining a card takes about 5 minutes.

By the way, one subscriber can issue up to 10 different cards for his account. This can be useful if you want to distribute these cards to children and control their expenses for them (you will receive an SMS notification about each operation), or, for example, buy something on the Web, but do not want to shine data your main card.

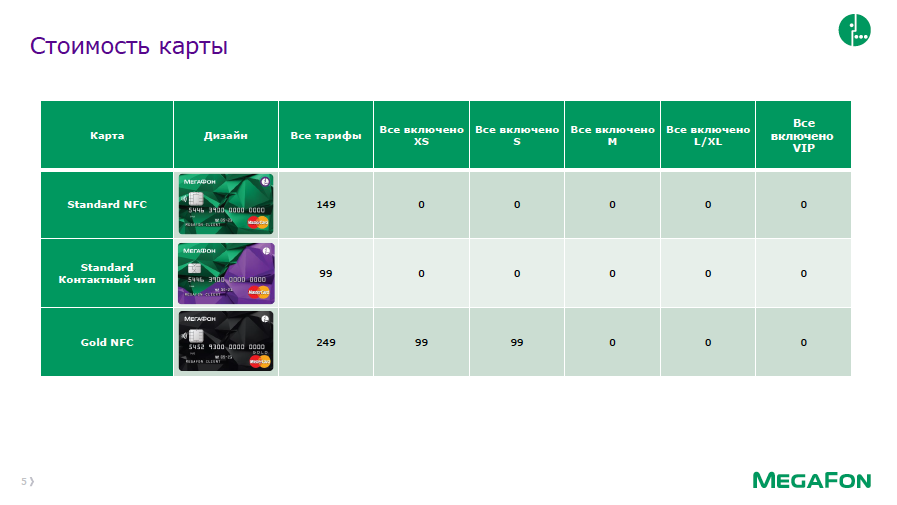

If you are a subscriber of the tariff plan from the “All Inclusive” line, then the issue and annual maintenance of the card will be free for you. Regardless of whether you order one card in the cabin, five or ten.

If you have a different tariff plan, then you only need to pay for receiving the card itself (99 rubles for the Standard card and 249 for the Gold). Card service at other rates is also free. As SMS-notifications.

The type of cards issued by us is slightly different depending on the region of residence of the subscriber (this is due to the readiness of the infrastructure of the city to receive contactless payments everywhere). For example, for Moscow, St. Petersburg, Nizhny Novgorod and Kazan, a default card is issued with a Paypass (both Gold and Standard). For other cities, subscribers can choose between Standard (without Paypass) and Gold (with Paypass). To clarify, Gold cards in such cases are available on tariff plans from the "All Inclusive M" and above.

Interest and cashback

We charge 8% per annum on the amount of the balance above 500 rubles and up to 200,000. Interest is credited once a month if one condition is met - at least one transaction must be performed on the card this month (there is no minimum transaction size, you can spend 1 ruble per month).

That is, having 10 500 rubles a month on a subscriber account, you will receive 800 rubles per annum.

You can withdraw cash from a card at any ATM for 2.5% of the withdrawal amount. It took you urgently to withdraw 1000 rubles from your mobile account into cash - and for 25 rubles it can be done at the nearest ATM. At the same time, there is no minimum amount of commission (for example, 100 rubles) or a withdrawal threshold - no need to remove at least, say, 3000.

As for the transfer of funds to the account of this card, the whole matter is simplified by the fact that you can transfer them not to the card number (so that other banks do not charge for this interest), but replenish your (or recipient) telephone account from any other bank account. For this usually do not take commissions.

Even being in Moscow, you can transfer money to a relative's card in the Far East, simply by replenishing his mobile account with the required amount, without fees. Of course, if the relative is our subscriber who received the card.

Well, where is the cashback, if we are talking about a full-fledged bank card. We return to the card up to 10% of purchases from our partners. Of course, not bonus points are returned, minutes, etc. - money that you can spend on anything will be returned.

Usage scenarios

The card can be a good addition to the cards you already have. It can be used wherever you want to enter your payroll or credit card details.

For example, link its data to a taxi call application, use it for shopping on the Net and on trips, pay for freelance services (or accept payment on a card, if you yourself are freelance), transfer funds to friends and relatives quickly. Or give a card to a child so that he learns how to handle them.

Yes, and the immediate question - to go into a minus on such a card will not work - the card can be paid only with a positive balance on the account.

We will be happy to answer your questions in the comments.

Source: https://habr.com/ru/post/306700/

All Articles