“Shoemaker in our boots”: as we wrote the module of financial resources management for internal EDS

It is not a secret that we ourselves use CES Thesis in Holmont. It would be strange, having in hands a modern and reliable tool for storing and harmonizing documents, to use something else. It is not surprising that sometimes for any sufficiently large company the standard functionality of the SED is not enough. In this article, we will describe how the additional module was created for our internal CED TEZIS — a module for managing financial resources, or simply a module for financial applications, as we call it. And at the same time we will use the opportunity and show a little how the project implementation of the system is carried out using the example of a single organization.

Start: Pre-Project Financial Resource Management Survey

The project implementation of the electronic document management system TEZIS is designed to automate the business processes of the customer’s enterprise with a view to finalizing the system and expanding the typical functionality of the software product. As you can see, this is quite our case - we needed to create specific functionality for interacting with the financial department.

In the internal terms of our company, a financial application is a document that allows an employee to receive company money from the accounting department with a subsequent report on the expenditure of funds. This is a paper document signed by the director and chief accountant, and it could easily have been converted into electronic form.

')

On this basis, the automation of financial resources management pursued the following goal: to automate the processes of receiving money, agreeing on non-cash payments and a report on the expenditure of funds received with 100% elimination of paper workflow at all stages.

To this end, it was decided to introduce a new module “Finzayavki” into the corporate EDMS TEZIS. The implementation of the module should have provided for the simplest use case, requiring minimal end-user training.

To accomplish this goal, the following tasks were required:

- Development of a new card and a list of cards. Create a new numerator.

- Development of a specialized "wizard" to simplify the procedure for creating new applications.

- Development of reference books for use in the application card.

- Development of the process of its coordination and relevant process folders.

- Development of new system roles to control the ability to use new functionality.

Stage Two: Functional Specification for Financial Resource Management

At this stage, our specialists are developing a functional specification of the future workflow system. It includes a description of automated business processes, form design and system requirements. The functional specification is coordinated with the key representatives of the customer (in our case, with the commercial and executive director). The result is a complete picture of the functionality of the future system.

The functional specification of the new financial resource management module, according to the stated objectives, includes a description of the following new functionality:

Roles

Four types of users work with us with the new module: initiator, coordinator, approver and accountant. The role of the initiator, coordinator and approver in the system already exists (they are standard), but the latter had to be added.Directories.

To work with financial applications, it took two new reference books: “Types of applications” and “Per diems”. The first one contains, as the name implies, application types with their names and mandatory attachments of the scanned application. The second one contains fixed subsistence rates for employees who leave for business trips (we have a lot of such). Data from reference books, as a rule, are selected when creating an application card - this is faster and easier.Application card.

In fact, we made it on the basis of an ordinary document card with the “Office” tab cut out (we do not intend to transfer the files to the archive). But divided application cards into four types:• Reimbursement of expenses: the applicant already has all the necessary documents to confirm the expense, or confirmation is not required;

• For report: the applicant already needs money now, but he does not yet have supporting documents;

• Payment from the card: the funds must be transferred to the employee in a cashless form;

• Payment from the account: the applicant attaches the account, and it is paid;

• Advance report: in fact, the applicant's report to the company about how much and why was spent.

And here the difficulties begin: the application card must contain exactly those fields that allow you to effectively confirm the withdrawal of funds. Their mass, and we will not dwell on them.

The applicant, however, does not have to fill in all the fields on his own: the system provides for filling out an application using a template. Moreover, when creating an application, he is reminded what attachments should be attached to the card to confirm the expense.

Interestingly, one of the attachments is the applicant’s scanned signature - after all, work is underway on a financial document. The history of this functionality is generally amazing. The signature can be downloaded as an image, obtained from the scanner, but another possibility to download the signature turned out quite by accident.

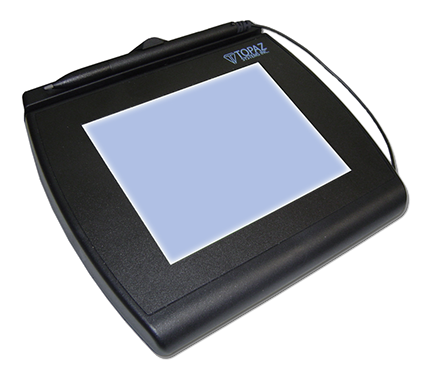

In the wilds of the acquired company over the years of the existence of the technology, we discovered the following device:

Electronic signature tablet Topaz Systems. You can sign it with a stylus, and the device will generate and send a digital image to the computer. We did not pass by such an opportunity, and our employees now sign on the Topaz tablet.

To do this, in the signature download window there is a special button - “Get from Topaz tablet” , which must be clicked on, after which you can put a signature on the device screen. The thesis will “pick up” the image from the device and attach it to the application.

Buisness process.

The visual designer of business processes is an integral part of SED TEZIS and, to be honest, we happened to implement the processes more difficult. Here the initiator creates an application and sends it to the coordinator first, then to the approver. Both of these users have the right to reject the application and send it for revision; if everything is in order, the application is transferred to the accountant. The only trick is that none of the participants in the process, other than the accountant, can edit the application while it is in progress. If rejected or canceled, the performer can and should correct it himself.Stage Three: the actual refinement and creation of a module for managing financial resources

It was smooth on paper, but how does it really work?

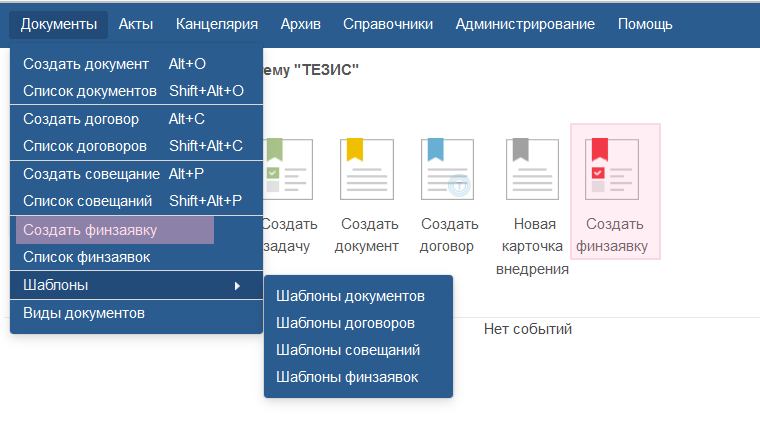

You can create a financial application in TEZIS in four different ways:

- • via the Documents menu -> Create Finished Application

- • by clicking on the red icon on the main screen of the THESIS

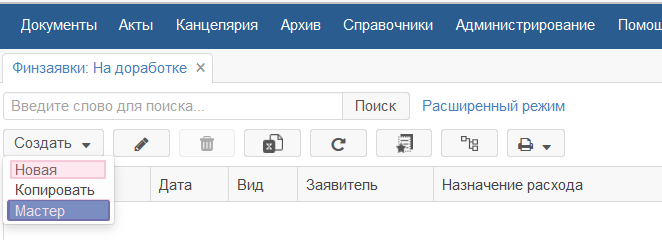

- • In the list of requests through the Create -> Wizard button

- • In the list of requests through the Create -> New button

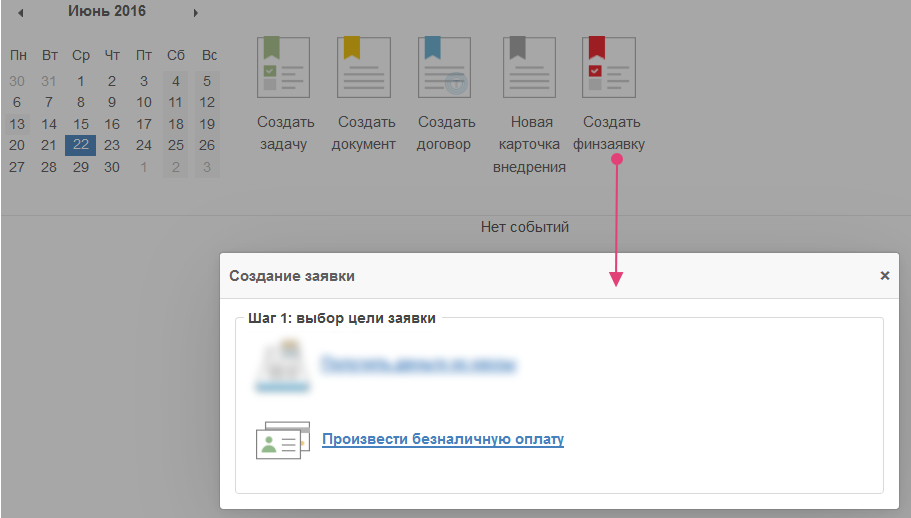

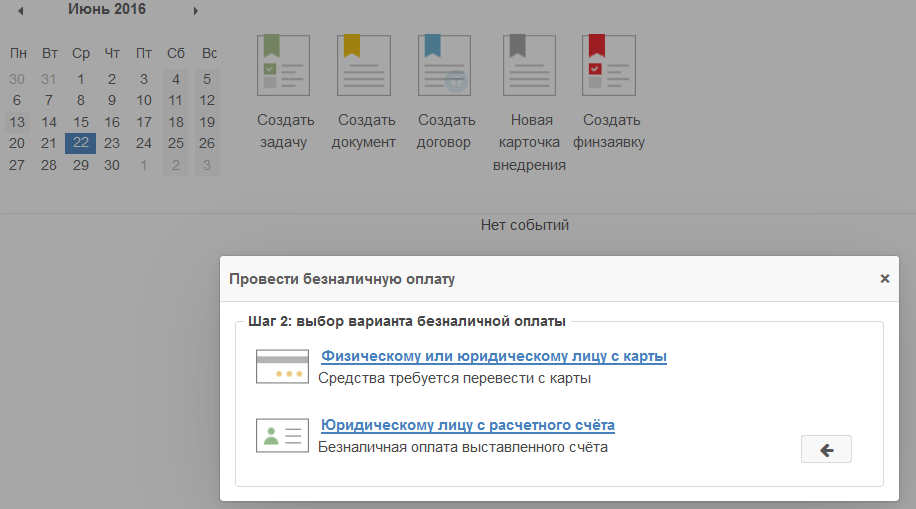

Consider this situation: the manager goes on a business trip and wants to write per diems for three days. Money must be transferred to a bank card. Using the button on the main screen of the system, he enters the menu of the wizard for creating a new appliance:

Clicking "Make a non-cash payment", he gets into the menu for choosing a non-cash payment option. Here he needs to choose "Physical or legal entity from the card".

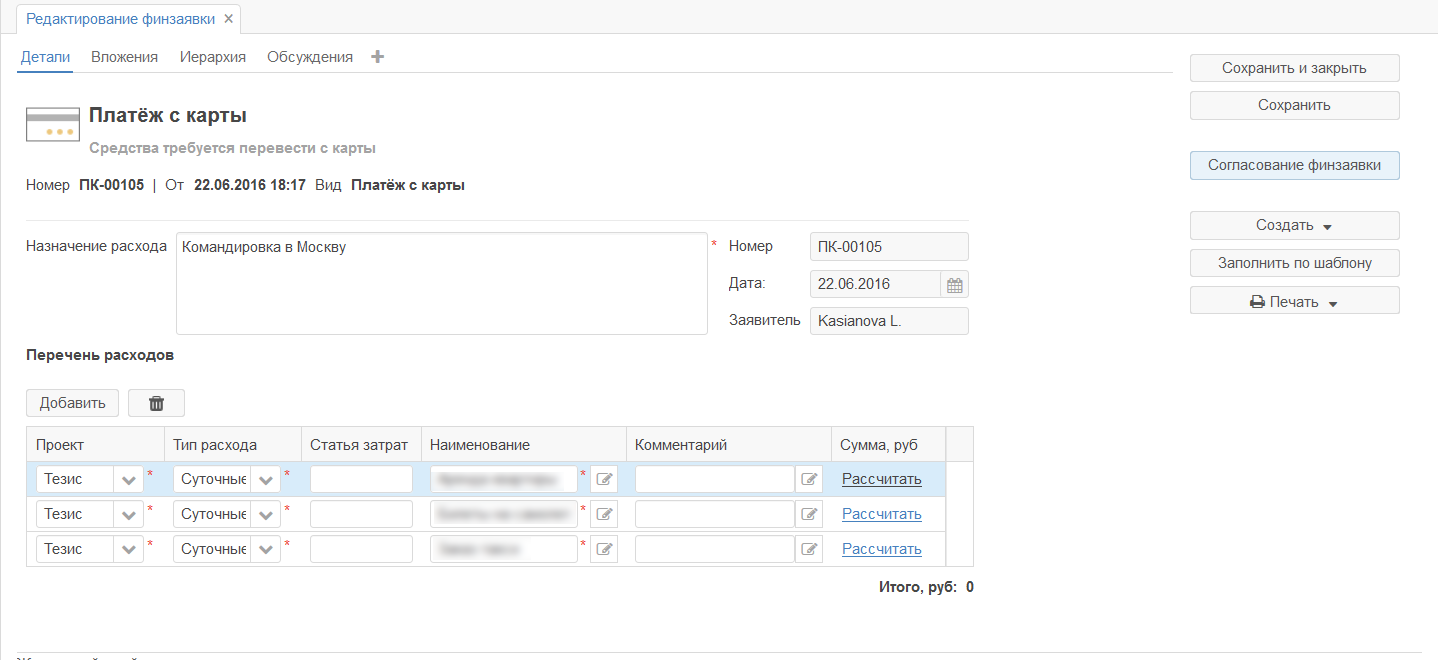

Thus, he creates a request for payment from the card described above. The corresponding card opens.

It is required to enter the purpose of the application and the list of expenses: project, type, name.

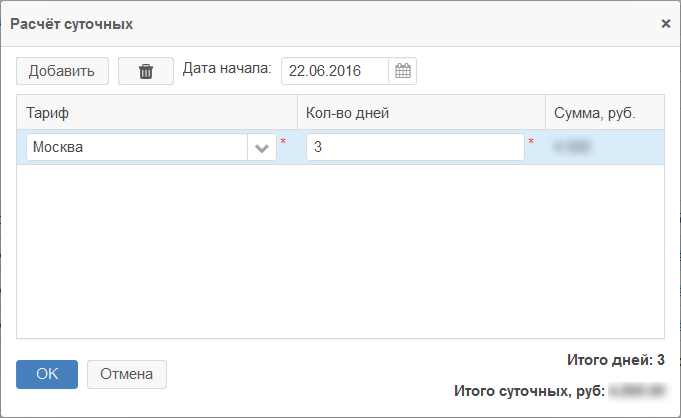

In the case of applications for daily allowances (and as we have said, many of us go on business trips, so this is super-factual for us), we implemented an interesting thing: the daily allowance calculator. It works on the basis of the “Tariffs daily allowance” directory, which is filled in by the responsible persons.

For example, to calculate the amount required for renting an apartment, you need to click Calculate next to the corresponding article. The internal logic of the card will redirect the user to the calculator window, where he needs to add tariffs and specify the number of days for which funds are requested:

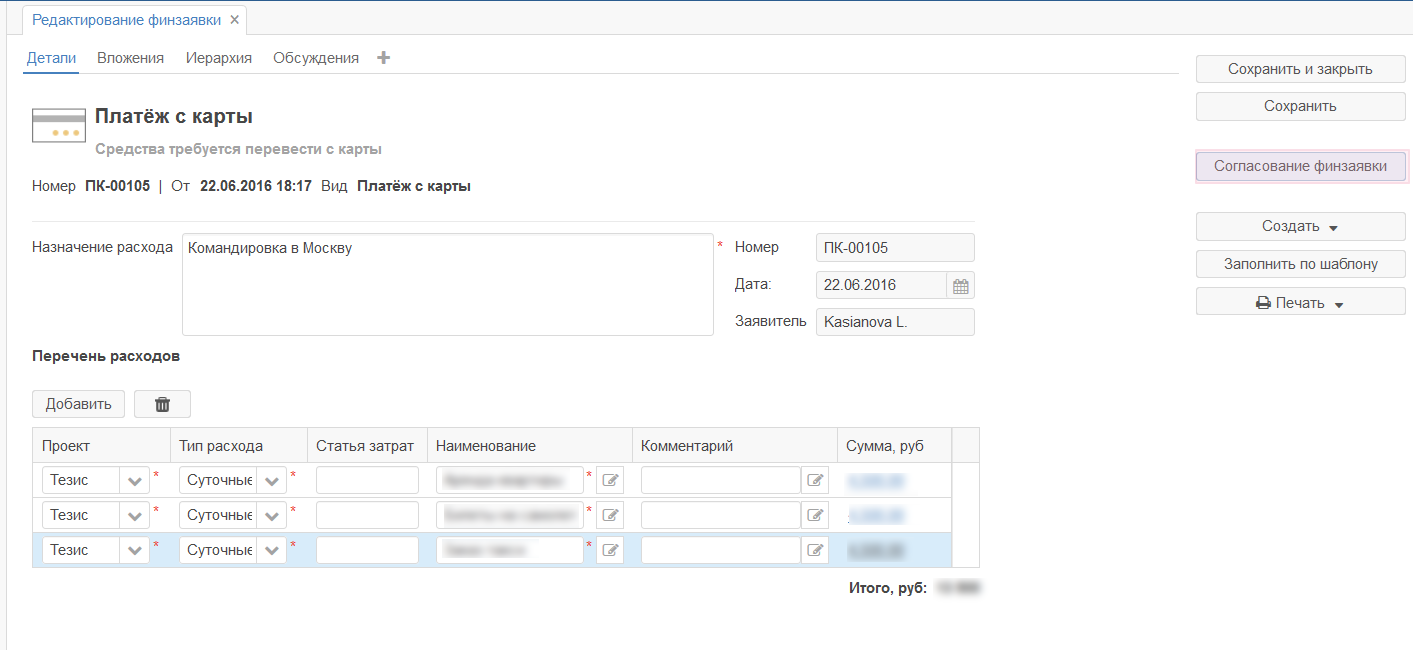

The calculated amount will be added to the list of expenses, after which the financing application can be sent for approval by the corresponding button.

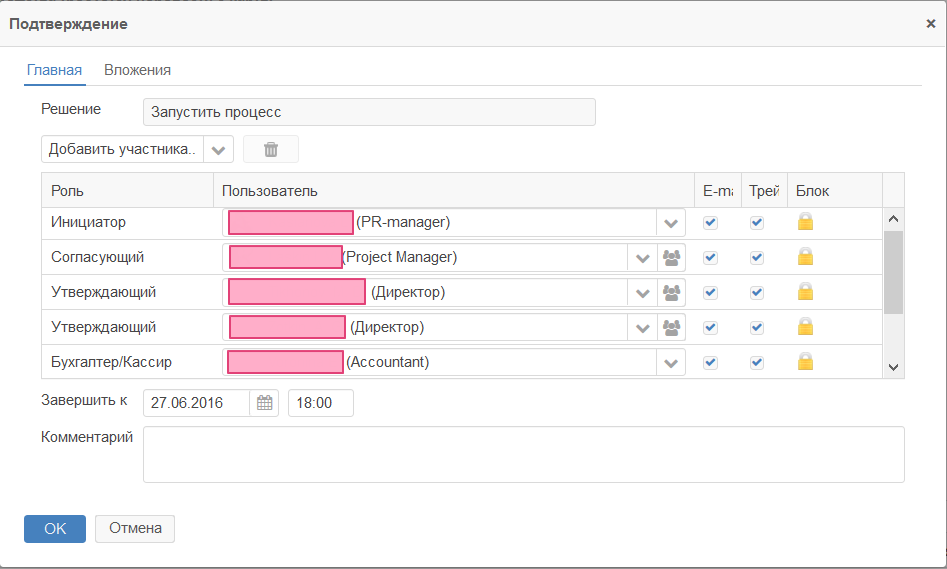

Participants in the approval process are selected automatically according to the project selected in the application and the roles configured in the system. You can not change them. After clicking on the OK button, the application is sent along the route described above. There are two approvers for the process, the application goes to them in parallel. It is enough to approve one of the approvers to proceed to the next stage.

Thus, work with the management of financial resources is maximally protected from the user's initiative. Most of the data is filled out of directories, which, in turn, are filled with responsible persons. This allows you to maintain transparent control over the costs of each project and eliminate financial anarchy in the company.

Stage Four: Installing the Financial Resource Management Module

Since CES TEZIS is already installed in our company, all that was left for us was to restart the application server with the new financial resources management module, and the coordination of financial requests appeared in the system. After that, we started training users, using the computer of one of the quality engineers as a training server.

In general, when working with a client, at this stage we test the electronic document management system, as well as create and transmit user and administrator instructions. At this stage, the system administrator is trained. But here the administrators and specialists were all their own, so the module was simply installed and began trial operation.

Stage Five: trial operation of the financial resource management module

It is currently being conducted. The essence of trial operation is that the new features of the system are being tested by key users, and the collection of wishes and opinions is collected.

We have the whole TEISIS project involved in testing the financial management module - developers, the sales department, the head of the Electronic Document Management section, the general director of the company.

During the trial operation there were interesting questions. All of them demanded the decision. For example, experienced users also wished to have a mobile version of the module, as a result of which a second release was designed, including the development of a mobile interface and the sending of full SMS alerts about financial applications.

Stage Six: User Training in Financial Resource Management

Usually, we conduct training for users of the system (groups of no more than 10 people) in the territory and equipment of the customer, and the system commissioning certificate is signed.

We had our own territory, we also used our own server, and trained users in chronological order.

At first, they trained the accounting department, which directly works with the management of financial resources, and all project managers.

Then, the sales staff (who were already familiar with the module as part of trial operation) and, finally, technical support were trained. That is, in fact - all users except the manual. The manual coped

Conclusion and development perspectives of the financial resources management module

We are not going to dwell on this, and we are already planning a second release. Subsequently it is planned to develop a module for managing financial resources in the following areas:

- Synchronization of reference books with internal enterprise systems (for example, bonus calculation system).

- Mobile version.

- SMS confirmation of authorization from mobile devices.

- Budgeting

- Automatic payment of bonuses and bonuses.

Summing up, we can say that it took us only a month and a half to develop and complete the project implementation of the new module in our system. This is one of the advantages of the electronic document management system TEZIS - high speed of implementation and configuration of the ERMS, achieved thanks to technological advantages. In addition, the system has a simple, intuitive interface (which you could see in the screenshots), and this also plays into our hands, reducing the time for employees to adapt to the new system.

Source: https://habr.com/ru/post/305664/

All Articles