How chat bots gradually eliminate the human factor in the Russian banking sector

By itself, the technology of the virtual interlocutor - chat-bot is not new, as it may seem at first glance. One of the first such decisions appeared back in 1966, when an American scientist of German origin, an expert in artificial intelligence, Joseph Weizenbaum, presented Eliza’s computer program capable of simulating the psychotherapist’s responses during a dialogue with a client, based on the empathic hearing technique. Despite the fact that, in fact, Eliza simply rewrote the statements of clients into clarifying questions, many of them could not immediately understand that the machine was actually talking to them, and not a living psychotherapist.

The basis of the functioning of chat bots is the concept of natural language processing, which is one of the main areas of artificial intelligence. Among the financial chatboats, which will be discussed further, there is still no perfect service that can fully solve all the needs of clients, but the gradual development of this technology indicates significant progress and global potential of chatbots.

Today, virtual interlocutors are increasingly found in service with financial companies and banks seeking to automate the process of interaction with customers, and thus, on the one hand, optimize personnel costs, and on the other, improve the quality of communication with consumers of their products, completely eliminating the notorious human factor.

')

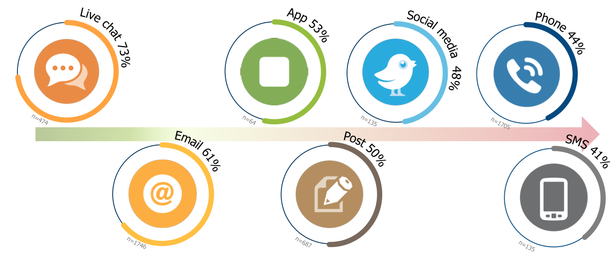

In accordance with the statistics cited by one of the most well-known publications of the LTP payment industry, among the various customer service channels, chats satisfy consumers of financial services most of all - as much as 73%, while e-mail can correspond to customer needs only by 61%, and the call center and even less - by 44%.

In accordance with the statistics cited by one of the most well-known publications of the LTP payment industry, among the various customer service channels, chats satisfy consumers of financial services most of all - as much as 73%, while e-mail can correspond to customer needs only by 61%, and the call center and even less - by 44%.In the material of the publication “Banking Review”, Danil Pominov, a columnist, cites statistics according to which the number of instant messengers in Russia is at least 50 million people. At the same time, WhatsApp and Viber users account for a share in excess of 50%. Next comes Skype and social networking applications VKontakte, Facebook Messenger and Odnoklassniki. The audience of Telegram - the most technologically advanced messenger in terms of opportunities for the implementation of bots, is only 1-1.5 million users. Nevertheless, despite the relatively small audience, it is Telegram, apparently, has the greatest potential in the field of bot-development.

Moreover, according to forecasts of research and consulting company Gartner, by 2020, customers will manage 85% of the total mass of communication processes with service providers, without contacting people. In this context, the trend of the frequent introduction of chat bots in the financial sector looks quite natural.

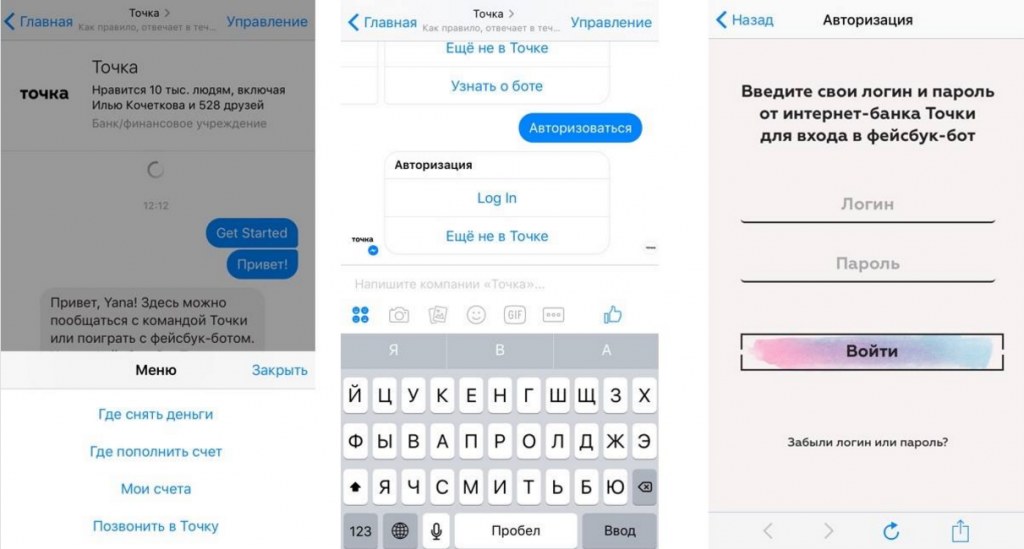

Thus, the domestic bank “Tochka” announced last month the launch of a chat bot, which allows customers to stay up to date with information on accounts, find nearby ATMs, contact the bank and support service, as well as carry out transactions. The first step to start communication with the bot is to send a message in PM to Fb. To make payments, you must be a registered user of the online bank. At the same time, representatives of “Point” hurried to remove all security questions and stated that the bot does not store either logins or passwords, and the verification of transactions occurs via SMS.

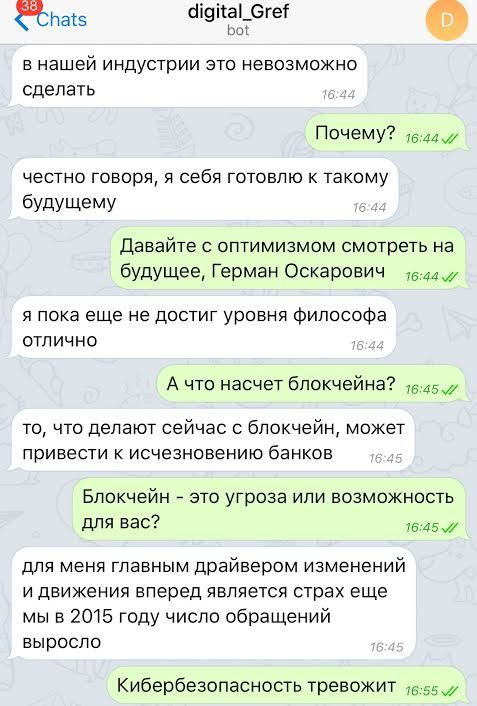

Thus, the domestic bank “Tochka” announced last month the launch of a chat bot, which allows customers to stay up to date with information on accounts, find nearby ATMs, contact the bank and support service, as well as carry out transactions. The first step to start communication with the bot is to send a message in PM to Fb. To make payments, you must be a registered user of the online bank. At the same time, representatives of “Point” hurried to remove all security questions and stated that the bot does not store either logins or passwords, and the verification of transactions occurs via SMS.And in June, on the eve of the St. Petersburg International Economic Forum, the ex-manager of Sberbank Digital Ventures and an expert in machine learning and big data Viktor Kuryashkin presented a Telegram bot, copying the communication style of the head of Sberbank German Gref. By the way, Sberbank itself has its own chat bot in Telegram, which has limited functionality and allows bank customers to find out the addresses of nearby branches and ATMs, receive information about bonus programs, exchange rates and quotes.

It is worth noting that, despite the limited functionality of the Sberbank bot, the largest Russian bank has already announced the launch of its own instant messenger for iOS with an open API, based on which developers can also create chat bots. Thus, Sberbank plans to fundamentally resolve the issue of servicing instant messengers by creating its own platform based on Sberbank Online. Closed beta test Sberbank messenger is planned this month. Today it is known that users of a new banking solution will be able to communicate with each other, as well as to find, order and pay for the necessary goods and services. For entrepreneurs, Sberbank messenger will provide additional tools designed to attract new customers, as well as processing incoming applications.

It is worth noting that, despite the limited functionality of the Sberbank bot, the largest Russian bank has already announced the launch of its own instant messenger for iOS with an open API, based on which developers can also create chat bots. Thus, Sberbank plans to fundamentally resolve the issue of servicing instant messengers by creating its own platform based on Sberbank Online. Closed beta test Sberbank messenger is planned this month. Today it is known that users of a new banking solution will be able to communicate with each other, as well as to find, order and pay for the necessary goods and services. For entrepreneurs, Sberbank messenger will provide additional tools designed to attract new customers, as well as processing incoming applications.Among the instant messengers who elegantly combined communication and money transfers, the palm belongs to the Chinese service WeChat, in 2016 only for the period of the Chinese New Year surpassed the figures of the mobile transaction volume PayPal for the entire 2015. Perhaps Sberbank in Russia will be able to repeat the global success of WeChat.

Alfa-Bank's chat bot for Telegram, like the current Sberbank Telegram bot, has rather limited functionality: it is able to search for ATMs and branches, starting from the user's geolocation, and also helping customers to navigate the bank's website.

But Russian Standard Bank was able to offer users a more functional Telegram bot compared to some other banks. The decision of the Russian Standard allows not only to receive up-to-date information about the products and services of the bank, but also to keep abreast of its own “financial health” by learning about the account balance, credit status and cash flow.

The Sovcombank bot also has its "chip", allowing customers to send an application for a bank loan. To do this, you just need to write the bot the desired amount of the loan, as well as send him a scan of the passport.

There was a lot of talk about the innovativeness of chatbots always claiming to be progressive at Tinkoff Bank and Rocketbank this spring, but at the moment these solutions, oddly enough, are not functioning, as they are probably in the process of being finalized.

Telegram bots of Promsvyazbank , Raiffeisenbank and Ak Bars Bank cannot boast of outstanding functionality. The decisions of these banks are also aimed solely at informing users.

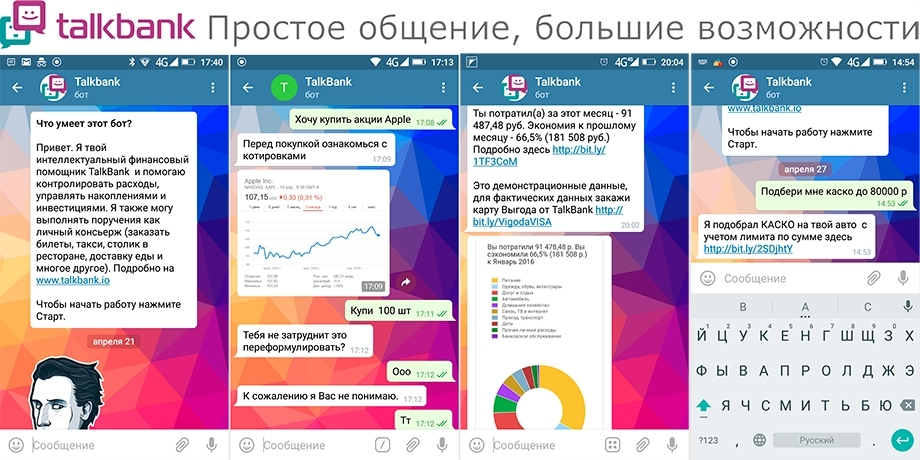

At the end of May this year, the PFM-service team EasyFinance introduced the virtual bank TalkBank , which allows you to manage your bank account and card using a chat bot in the Telegram messenger. At the time of the release of the service, its functionality seemed rather limited, unable to process some requests formulated in natural language. The developers of TalkBank initially positioned their decision as a “version with the minimum permissible functionality,” as if hinting at the further improvement of their solution.

The chat bot-project NaKa , represented by a team of developers cooperating with the Moscow Industrial Bank, also deserves attention. NaKa service allows you to transfer money from a card to a Visa and Mastercard card of any Russian bank. If you believe the description of the solution at the Telegram Bot Store, the card data is reliably protected in accordance with international standards for the security of payment systems.

While the messengers win over each other's users, you can see how the players in the financial and banking services market on these platforms compete with each other with chat bots. This means that the capacious, correct and accurate answers of the virtual assistant to the largest possible number of user requests are likely to set a certain standard of customer service very soon throughout the industry.

Continue to follow the updates to the blog company PayOnline , specializing in the automation of online payments, and stay abreast of the most advanced technologies of the Russian and international financial sector.

Source: https://habr.com/ru/post/305642/

All Articles