How to rise after a catastrophic failure

Introduction

In 2010, I founded Fab , then Hem , which separated from it, and was the general director of both until 2015.

Venture capital Fab has grown to $ 300 million.

Nothing succeeded.

')

I zafeili. *

Failure presses and causes pain to all involved in it. I am responsible for that catastrophic collapse. It took me two years and some physical and mental retreat to come to a condition to speak and sincerely write about it.

This post is a summary of the sequence of events of the Fab + Hem project and begins to review the lessons I have learned from this entire story. In the next few weeks, more posts will be prepared in which the issue will be considered in greater depth, especially with regard to the lessons learned. Along the way, I will discuss how those events affect the choices that I make today as part of the reflection-recovery process.

Thank you in advance for reading.

* (Reader's note: Fab + Hem companies failed as venture capitalists. However, Fab.com and Hem.com brands live with their new owners , and I wish them both great success.)

A story for the public about the catastrophic collapse

In 2004-13, I wrote dozens of posts about startups and my experience in terms of successes and failures in business. Many people read these posts, and many said they valued them highly.

Then in 2013-14, Fab collapsed. I made some bad decisions at a critical time, including trying to inspire people through the now infamous post “This is a crappy startup . ” Humiliated, horrified by the opportunity to get into an unpleasant story, trying to stay focused on straightening the ship, I pulled back and turned off my blog .

Today is my first real attempt to write something publicly in a few years.

Respect failing?

It seems that the venture capital industry treats failure with respect. Venture capital investment is a “peak” business in which very few winners return a contribution to them and make up for all the losses. The entire venture capital investment model depends on entrepreneurs and investors taking risks, trying to go beyond what is possible, testing hypotheses, maneuvering, failing and trying again.

I believe that respecting failure has some meaning. I agree with the distinction made between innovation failure and implementation failure, which Ron Ashkenas considers in his HBR article “When not to respect with failure” .

We pay tribute to the innovation failure - the failure that occurs when trying to invent and create.

Failure of implementation is not worthy of respect - a failure that occurs when teams do not work properly, when companies are unable to switch from the innovation mode to the execution mode.

This is exactly what happened with Fab. An exciting idea spawned an innovative website / application and developed into a rapidly growing business that could not be implemented on a sustainable working model. There is absolutely no reason at all to respectfully note the failure that was the company Fab.

However, the lessons of failure to implement contain their own humble and informative value to the business community.

From time to time we see a post in Medium about another start-up failure at an early stage, but less common are eyewitness accounts of a catastrophic implementation failure, similar to what happened with Fab. That is why I am writing my post today and intend to post more: I would like to show some features of large-scale failure so that people can learn from the mistakes made and, possibly, from my particular experience in trying to recover from it.

On the road to healing

Before moving on, I would like to thank everyone who participated in the history of Fab + Hem.

Healing from such an experience is a very difficult affair and undoubtedly takes time and considerable effort. It is also quite possible that some wounds will never fully heal. The experience gained from interacting with a startup is one of the most emotional and mentally painful life experiences through which a person can pass. In trenches on the battlefield of a startup, it is impossible to separate business and personnel - this is the case for founders, employees and investors. A mixture of hundreds of millions of dollars, numerous acquisitions with outdated game strategies in the widest geographic space, in the absence of consistent execution, creates an even more flammable situation.

Our employees gave the company themselves completely. They made it their life. I hope that each of them received useful lessons from their experience and that they view their experience of working at Fab in its entirety, and not just how it all ended. I am proud that more than 15 new startups were launched by former employees of Fab + Hem. Hundreds of people from the Fab continued their personal and professional growth in a variety of companies. I wish you all a great success.

Our investors give us their money and their trust. Some of them invest their personal funds. Many act on behalf of individuals and organizations that they represent. It hurts me that the actions of Fab + Hem did not lead to the desired result. I know that many of the investors are still dealing with the consequences of those events.

I said “I beg your pardon” many times then, both privately and publicly, and I am ready to repeat this until all the people who were hurt in those events or suffered in part because of my decisions will need to be heard this. I apologize.

US “flash sales” industry in 2007–15

In 2007-14, more than $ 1.35 billion was invested in online flash sales in the United States.

Flash sales typically include daily pushing customers to purchase goods through emails and in-app notifications.

The theory behind the flash sale model is that, in contrast to Amazon’s “intentional” e-commerce style, when a customer searches for a specific request, a flash sale will create demand, pushing ideas from buyers to the acquisition, similarly, perhaps, to television channels of home purchases, which give approx. 6 billion dollars a year (for comparison: the world's largest retail network Walmart - 480 billion).

In the top 7 most advanced flash sales companies were then:

• Zulily, women's and children's clothing, investments of 390 million dollars, of which 250 million are IPO and 140 million are private investments. Currently owned by QVC.

• Fab, designer products, venture capital $ 320 million. Currently owned by PCH International. Hem, a company separated from Fab, belongs to an investment group supported by Vitra.

• Gilt, luxury goods, venture capital $ 270 million. Currently owned by the parent company Saks 5th Avenue.

• One Kings Lane, household items, venture capital of $ 225 million. Currently owned by Bed Bath & Beyond.

• Ideeli, branded clothing, venture capital $ 107 million. Currently owned by Groupon.

• Haute Look, branded clothing, venture capital $ 40 million. Currently owned by Nordstrom.

• Rue La La, branded clothing, venture capital $ 22 million. Currently owned by Kynetic (formerly GSI Commerce). *

Of these companies:

Work today is still independent - 0.

IPO passed - 1.

Sold for more than the funds they collected - 2 (Zulily and Haute Look).

Failed to fail like a venture investment - 5.

If a venture investor had invested the same amount in the A series rounds of all 7 companies, he would receive a positive return on his investment simply from the Zulily IPO.

Fab + Hem chronology: 6 years of impressive growth and catastrophic collapse

In mid-2011, Fab suddenly appeared on the scene from the ashes of a failed social network and turned out to be the fastest growing and most discussed e-commerce company. After thirty months - at the end of 2013 - Fab rapidly went down and then was eventually sold for a small part of the collected capital. How did it happen that Fab, the 2nd largest flash sales company in terms of financing, collapsed as an object of venture investment? Could this have been prevented?

In my next post, I’ll take a close look at the main lessons I learned from the Fab movement to impressive heights and a subsequent fall. In order to show the big picture, the chronology of events is shown below in large detail and some of the main lessons are presented.

Growth Phase: Mid 2011 - Mid 2013

2012 - Fab completed the first full calendar year as a flash sales site; goods worth 112 million dollars were sold - in 2011, sales were 18 million. More than 10 million people subscribed to our daily e-newsletter. We felt like kings!

But we were not them.

Sure that we built a scalable model that could achieve world domination (time showed that we, alas, were wrong) - we reached Europe through numerous acquisitions and increased by $ 100 million when we valued our value at $ 500 million.

We have violated one of the main principles of venture capital: “Collect money as much as you can, only when the product-market correspondence is debugged” . We went to the hyperstroke, but did not fully decide on the highly functional model of performance. We have not successfully completed the transition from innovation to execution. *

This distinction is important to understand the modern “unicorns” and their investors: long before reaching the status of a unicorn, it is better to develop a stable, reproducible, scalable business model and work with maximum efficiency. This may sound like just a sensible consideration, but you will be surprised when you find out how many “unicorns” still figure it out for themselves.

Fab was not Uber. We did not have a well-scalable work plan and tactics that could be replicated in different markets. Our model was extremely tense with respect to people, stocks and warehousing. Before the start of our activity in the USA, we had no business in other countries. If we, before going to other countries, made Fab a profitable company in the United States, the continuation of the company's history could have been very different and, quite possibly, very positive.

At the end of 2012, the 18-month-old company Fab had already flown almost to the sun. We have not reached the sales volume of 140 million dollars planned for 2012 (imagine the growth from 18 million to 112 million - and this is considered a big failure in relation to the plan!). We have invested heavily in online marketing, TV advertising, in entering the international market (30% of funds and a third of my time) and in warehousing. We needed a huge capital injection in 2013 to continue to grow.

In early 2013, our Board of Directors considered two possible ways:

(A) Stop, cut costs, and focus only on the US market, focusing on a sales profit of approx. 150 million dollars or

(B) Continue actions to ensure 100% growth per year and world domination. To be fair, there was no particular discussion.

Only one member of the Council spoke in favor of path A, while everyone else, including myself, insisted on rocket take-off. (One more note for the beginners of the "unicorns" and their investors: you know how annoying that councilor is, who constantly screams "Stop!", While everyone else exclaims with excitement "Forward!" But, although you secretly want to remove him from the Council, listen more attentively to him!) .

We laid huge sales figures in the 2013 plan - and hit the wall.

Trying to get 300 million dollars to fully finance our existing investments - including stocks and warehouses on two continents, we reduced marketing allocations to save money, and sales fell sharply.

A badly injured unicorn is lame, stumbles and stumbles: mid 2013 - mid 2014

In June 2013, we grew by $ 150 million with a valuation of $ 900 million (later the preliminary estimate was reduced to $ 800 million), which should have been a huge success for a 2-year brand. But in reality, we failed with our financing: we needed $ 300 million to reach the planned indicators and support large investments, which were already in full swing. In June 2013, Fab was a newly-minted “unicorn” who found itself on a perilous path. I remember how one after another there were phone calls with congratulations on the status of "unicorn" and how bad it was for them. Only a few knew what it means to get $ 150 million in estimating the value of $ 900 million, and they understood that we are swimming in a crappy situation. It was a bad thing.

Shortly after the proclamation of the "unicorn", I tried to get the additional required $ 150 million, but I could not.

I then took steps to adjust the course and reduce the rate of combustion: one mass layoff in Europe and three rounds of cuts in the USA were carried out, which reduced the staff in Fab North America from 400 people to approx. 85 by the end of 2013. We cut marketing costs. We tried to simplify the business and narrowed the scope of goods. Honestly, it was a deadly tailspin. The only good moment was a reduction in the rate of combustion, but the business itself was losing support and its value.

Looking back, I regret most of all about this period. I tried to sharply slow down the rocket taking off, but it was incredibly difficult to do, and the disaster was complete. I too quickly focused on reducing costs and narrowing the scope instead of taking a step back and working out with the Council a plan to save our shareholders' funds. Everyone always says: "We must act quickly and decisively." Now I disagree with this approach. It would be more correct to say: “We must act thoughtfully, according to plan and with support for help.” I have moved too far away from our Council in my decisive actions and have not asked for sufficient help from him. I didn’t connect our management team well to the search for solutions. I unceremoniously fired some of my most loyal colleagues. I broke up with my best friend and co-founder - trying not to notice that the main spirit, culture and mission of the company always formed from both of us - then it was necessary to work out a way to make it part of the solution.

No one will ever know what could have happened to Fab if I had acted differently at that time, but I certainly know now that I would act more slowly and involve more good smart people around me in the process.

From Fab to Hem to the end: mid 2014 - early 2016

In the middle of 2014, due to a sharp drop in sales, the company continued to lose money and was burdened with a third-party stock of low-profit goods worth $ 10 million. I decided to sell the Fab brand and focus our remaining resources on the promising business of branded products, Hem.com. The unicorn has been forgotten; Hem was the last attempt to create some value from the company's best remaining investments.

We sold Fab to PCH International in early 2015. I moved to Berlin to create Hem, closer to our integrated development and manufacturing team. Hem was a great start; the products were attractive, the profits were very good, but this was far from the growth story of the “rocket” into which our original investors, Fab, invested. At the end of 2015, we needed $ 7 million in additional funding to make Hem's operation profitable with an annual sales volume of approx. 25 million dollars.

In February 2016, Hem was sold to a group of investors supported by the furniture company Vitra from Switzerland. So ended the story of Fab-Hem .

Since confidentiality agreements prohibit me from sharing any details regarding the Fab and Hem acquisitions, I can only tell you that not one of our investors has returned even the initial investments.

Hundreds of jobs have been created and lost in 6 years.

I failed.

Attempt to personally recover from public failure

It is not easy to go through the consequences of a public failure. About recovery after the failure of a startup, there is no course of study at a business school or any lecture on the Internet or discussion on any reality show. When your startup collapses, you do not automatically receive lifetime membership in the Founders Recovery Institute.

Failure is rubbish. Catastrophic failure - complete rubbish.

It means loneliness. When failure happens at some impressive level, it suddenly turns out that everyone hates you. Your employees hate you. Your investors hate you. The press is mocking you. Industry avoids you. Those "cool" startup guys who, in their own way in their letters, sent you grumpy emoji, disappeared.

That is life. You are to blame yourself. Live with it.

I had some career success, but recently there was a grand failure. Specials: success, well, just cool better than failure ( Sophia Tucker formulated it better ).

One of the best tips that I heard recently about public failure was Jeff Bezos: “If you do something interesting in the world, then be prepared for criticism,” he said. - "If you are not able to withstand criticism, then do not do anything new or interesting."

Jeff talked about the attitude to open criticism, which inevitably arises when there is a public failure, but I think his advice is well applicable to all its types.

Stand up and start over

So the failure happened - what to do next?

Each founder, after a failure, must go through some reappraisal of values. You need to ask yourself a series of questions like:

• Was it possible to prevent failure? Could I or could we have done more or something else to create or save funds? (You will be asking yourself about this for many years, playing again and again those events in your memory and in discussions with other people.)

• Am I able to start up at all?

• If I had the opportunity to re-enter it, would I take it?

• What lessons have I learned from this experience?

• What did this experience show me about myself: what is good in me and what needs to be improved?

• Will people follow me into battle again? Should they?

• Will people invest in me again? Should they?

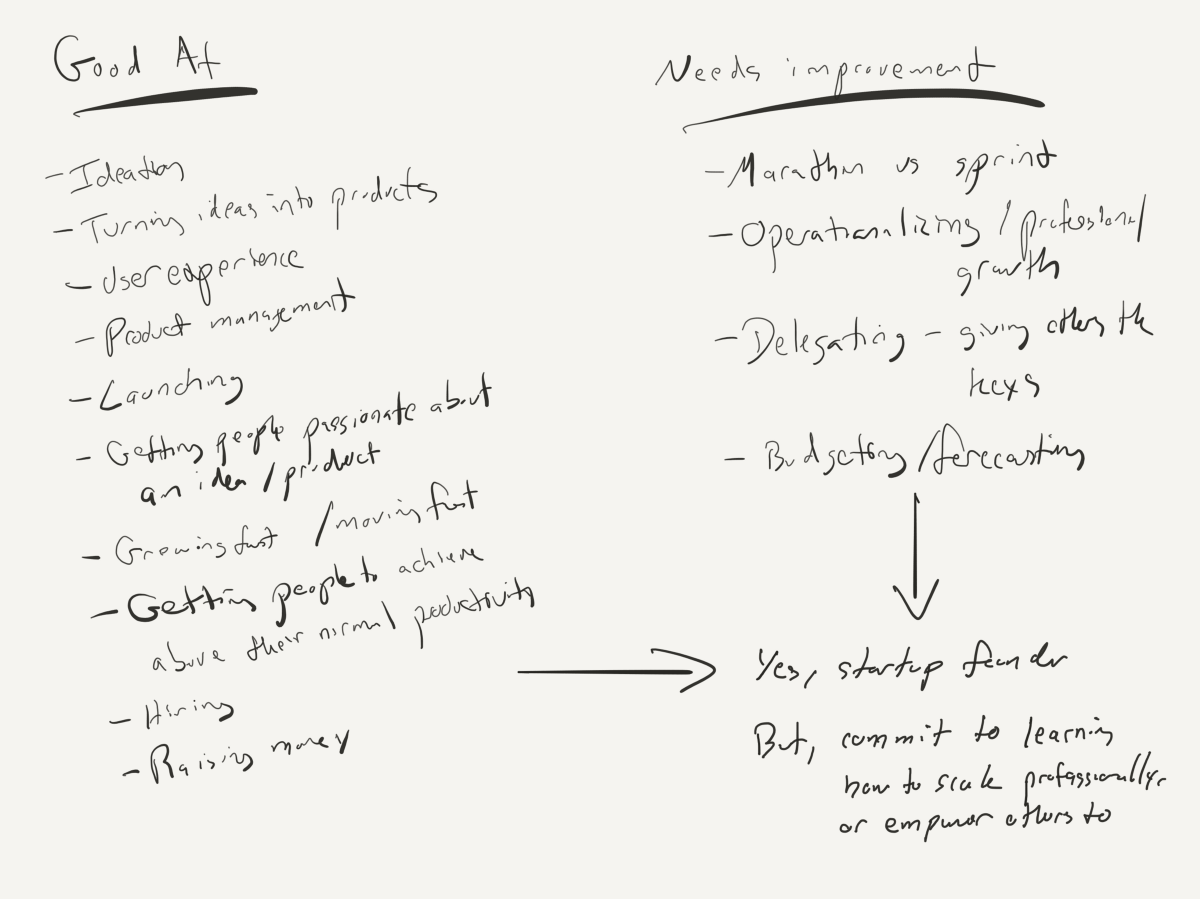

Shortly after receiving a report about the failure of the Fab company, I made up for myself, the founder-CEO, something like a “characteristic”:

Jason Goldberg: Self-esteem Performance, 2014

I discussed my self-esteem with different people: co-founders, members of the Council, employees, trainers, consultants, investors, my spouse. I wanted to make sure I didn’t miss anything by embarking on this path to personal growth.

General opinion: I was well suited to being a founder and CEO of a startup, but to avoid possible failure in the future, I must either learn to evaluate operations more professionally or authorize others to do it for me. It was acknowledged that I did really well at the start of the company, but not so well with its current work. In the coming years, I must either significantly strengthen my weak points, or double the reliance on my strengths, instructing others to do scaling. Making such a decision without help — whatever it may be — was the key to success.

Process awareness

My imperative advice to those who are in the process of becoming on their feet: fully focus on what you are really good at and go back to basics by doing this. Prove to yourself and others that you still have great skills, experience and skills that can be extremely useful, whether in a working company, in another startup, in writing a book, in educating people, in volunteering, etc. d. Just after your failure, find some business that will remind you that you remain very strong in something valuable to people.

At the same time, more often than before, remember your weak points. If you do not pay attention to them, you will most likely repeat the same mistakes.

Finally, get down to business and hide a little from public attention.

In the story of Fab + Hem, I was lucky that in this situation I had a year with Hem. In 2015, I left the Fab deck and the US start-up scene, moved to Berlin and created, by all accounts, a great brand, the Hem company. A year with Hem allowed me to start the recovery after the Fab, and also try to save some funds for our investors.

This was the main goal, although the weight of the Fab was too big for Hem. Hem inherited the complex capital structure of Fab (more than 100 shareholders in 5 investment rounds at inflated estimates), its complex business structure (more than 15 subsidiaries worldwide) and mountains of debts and obligations of Fab. Imagine trying to explain to your founding team that 90% of the company's share capital was already distributed pre-sales at wholesale prices, that the resale value was more than $ 300 million, and that under each stone and at each turn there was still money due on then a random old account from a previous company that everyone has forgotten about. It was difficult to say the least.

Hem was a good company, put on a completely wrong path.

The agreement of the founders was absent. Investor reconciliation was absent.

One of my biggest discoveries by the end of Hem was the realization that while I was experiencing great pride, creating something clearly “good” in Hem, this “good” was stuck in a quagmire stretching from the Fab.

Turning the page

Although I liked what we did with Hem, but at Christmas at the end of 2015, when I visited Australia, I had to make an important decision: do I invest personally in the continuation of Hem with a group of investors who considered acquiring a controlling stake, or would I leave company and start all over again.

On one of our vacation days, my husband Chris forced me to answer the most important question: “Jason, if you put aside all the emotions of the past few years with Fab-Hem,” he asked, “if you are ready to spend the next few years creating something — and investing our own money in it — will it be Hem or something else? ”

It took me less than 2 seconds to respond: "Something else." The way forward for Hem with a new investor would be different from what I wanted; my way: technology. I was the wrong person to invest in Hem and run this company. In addition, for many years I had one idea - a passionately desired project - which I constantly postponed because of work. Now is the right time to tackle her.

February 2, 2016 at 16:00 immediately after the signing of the final documents for the sale of Hem, I flew to India, to the city of Pune, where the best engineering and technical group in the world is and where I still live until now. *

I'm ready to shake things up, go back and try again, this time with a new company and a fresh idea: Pepo .

In Pepo, I was joined by Sunil Khedar (co-founder and CTO), as well as a team of many of our top-notch technicians and product managers from Hem, Fab and Social Median. Sunil and I started working together in 2008; Our team of 20 people at Pepo has more than 100 years of experience working together on large-scale Internet projects. In other words, the average Pepo team member worked with Sunil and me for today for 5 years, creating products used by millions of people.

I am currently funding Pepo and besides the fact that we will launch this company later this year, I am not ready yet to discuss in more detail.

What can I tell you - I am working intensively now, doing what I love most: creating a product from scratch and planning a launch strategy. I want to repeat the magic takeoff, but this time without failure.

Source: https://habr.com/ru/post/304342/

All Articles