E-commerce: Russia vs China. Part II. Segmentation

Continuation of the study on e-commerce of China and Russia. This time we will split the markets of China and Russia into segments and examine them under a magnifying glass (or under a calculator, as you like).

In Russia , the most promising and developed product segments include:

')

Least promising and least growth categories:

In China, the most popular product categories also include clothing and footwear, household appliances and electronics, products for everyday use, as well as children's products, and in addition, cosmetics and perfumes unpopular in Russia. For most Chinese (especially for young people), making a purchase online is easier than doing it in the traditional way. Many people prefer to buy clothes and shoes using the platforms Taobao, Tmall, HC360.cn and others, recently this method of purchasing clothes and shoes has become increasingly popular.

As for the “children's products” segment, due to the cancellation of the “one family - one child” policy, this category in the future is able to take one of the leading positions. The demand for this product category is continuously growing at the moment, the products in this group have a great offer, including a rich selection of imported goods from the Huggies, Pampers, Chicco, Fisher Price, Heinz brands and others.

It is also worth noting that in China there is a trend of a healthy lifestyle. Due to the deteriorating environmental situation, high air pollution (especially in Beijing and industrial cities of the South of China), the demand for goods for maintaining and maintaining health (for example, protective masks) is constantly growing.

Such factors as the instability of the economic situation in Russia, the limitations of EU countries on the purchase of certain goods, as well as rising prices for products, led to the fact that Russian consumers have refocused on the Chinese market.

In addition to clothing and footwear, which are leaders in orders from online stores in China, such goods as:

Note that among Russian goods , the most popular are:

The most promising areas for mutual supply of goods are the border cities of China (Haihe, Suifenhe, Harbin, Manchuria) and the border cities of Russia (Blagoveshchensk, Vladivostok, etc.).

In addition, as part of the creation of a logistics center in the Sverdlovsk region, this region will also become a major exporter and importer of goods in the future.

Russian market:

Source: According to Insales

Chinese market:

Russia:

According to the Data Insight eCommerce Index Top 100 rating, the number of top online stores includes stores that receive 56% of all orders, the number of orders and sales are key indicators of the rating. Of the 100 largest stores ranking the top 10 stores receive 30% of all orders. Of the rankings of the top 100 stores, the largest share is occupied by such product segments as electronics and appliances, food, clothing, shoes, accessories, children's products and toys.

Top 10 e-commerce players:

Top 10 Chinese E-Commerce Players

In Russia , the most promising and developed product segments include:

- Household appliances and electronics (23% of the total market and a cash volume of 159.6 billion rubles) are generally one of the most promising and developed categories in terms of consumer potential. The market share of Internet commerce in the segment is increasing, besides, a huge number of players and high competition are observed in this market, which is caused by low entry barriers to the market and high popularity of this segment among consumers. The reason for the popularity of this category is the lower cost of products on the Web, an extensive selection and quick delivery times.

- Clothing for adults (volume 94.3 billion rubles) - Russian buyers are becoming more active and are increasingly turning to shopping at foreign trading platforms where the offer of this product segment is higher and prices are more favorable. Among the trends in the clothing segment for adults, there is a general increase in the number of players, and the emergence of narrowly focused online stores.

- Products for children - children's online stores serve up to 1 million orders per month, where about 60% of orders fall at the 50 largest stores. Among children's products, the fastest growing category is children's clothing, where the growth rate reaches up to 100% per year. Unlike other product groups, children's products are essential goods, and therefore their purchase can hardly be postponed until later, which is why, in a crisis, this product group has declined to the very least. In the future, it is expected that the growth trend will continue and the share of children's goods will increase in the overall market structure until 2018.

- Auto parts, building materials, household goods - in this category there is an increase in Internet penetration and a reduction in the retail presence of players in this segment. It is predicted that these categories will grow faster than the e-commerce market and an increase in the share of these segments in the overall market structure is expected.

')

Least promising and least growth categories:

- Flowers - first of all, the low popularity of the flower market during the year is associated with a pronounced seasonality of this product. Demand for this category occurs only during holiday seasons, such as March 8, February 14, or Teacher's Day and school graduations. In addition, the unstable economic situation has affected the flower market, there is a noticeable increase in the price of flowers, due to the change in the dollar / euro rate, and also due to the increase in prices for the transportation of goods.

- Cosmetics and perfumery - the reason for the low category prospects is the growth of the euro / dollar rate, which, of course, influences the growth of prices for imported products from Italy, France, Japan, and Korea.

- Drugs - above all, the low potential of this product group is due to the fact that, as a rule, consumers prefer to purchase products of this segment in the traditional way.

In China, the most popular product categories also include clothing and footwear, household appliances and electronics, products for everyday use, as well as children's products, and in addition, cosmetics and perfumes unpopular in Russia. For most Chinese (especially for young people), making a purchase online is easier than doing it in the traditional way. Many people prefer to buy clothes and shoes using the platforms Taobao, Tmall, HC360.cn and others, recently this method of purchasing clothes and shoes has become increasingly popular.

As for the “children's products” segment, due to the cancellation of the “one family - one child” policy, this category in the future is able to take one of the leading positions. The demand for this product category is continuously growing at the moment, the products in this group have a great offer, including a rich selection of imported goods from the Huggies, Pampers, Chicco, Fisher Price, Heinz brands and others.

It is also worth noting that in China there is a trend of a healthy lifestyle. Due to the deteriorating environmental situation, high air pollution (especially in Beijing and industrial cities of the South of China), the demand for goods for maintaining and maintaining health (for example, protective masks) is constantly growing.

What Russia and China can supply each other

Such factors as the instability of the economic situation in Russia, the limitations of EU countries on the purchase of certain goods, as well as rising prices for products, led to the fact that Russian consumers have refocused on the Chinese market.

In addition to clothing and footwear, which are leaders in orders from online stores in China, such goods as:

- Tea, souvenirs, dishes with Chinese traditional characteristics.

Preparations of traditional Chinese and Tibetan medicine that increase immunity, tone, sedatives, etc. - Traditional instruments for the treatment of Chinese traditional medicine - needles, diagnostic tools, dietary supplements.

- DVRs, Chinese navigators, which are distinguished by lower prices, but not inferior in quality to imported goods and domestically produced goods. Such goods are sold in Russia with a large markup of up to 100%.

- Bed linen, home textiles, home furnishings - the difference in the price of Chinese and domestic products is also extremely high, but often these goods from China are of quite high quality, especially Chinese silk bedding is appreciated.

- Cases and accessories for mobile devices - in the Chinese market, the choice of this product category is huge, and the difference in price between goods on Chinese online stores and retail outlets is very large. Therefore, it is advisable to purchase products of this product group in China.

Note that among Russian goods , the most popular are:

- Souvenirs with Russian specifics, traditional food and alcohol (vodka, honey)

- Candy and chocolate made in Russia

- Flour and cereals are in great demand in the Chinese market, it is noteworthy that the selling price is many times higher than the purchase price for the product.

- Vegetable oil, gozinaki, halvah

- Mineral water - in Russia there are large reserves of mineral waters, and in China a poor ecological situation, this category can be attributed to goods for health and for combating the harmful effects of the environment on human health.

- Russian ice cream

- Powdered milk, baby food

The most promising areas for mutual supply of goods are the border cities of China (Haihe, Suifenhe, Harbin, Manchuria) and the border cities of Russia (Blagoveshchensk, Vladivostok, etc.).

In addition, as part of the creation of a logistics center in the Sverdlovsk region, this region will also become a major exporter and importer of goods in the future.

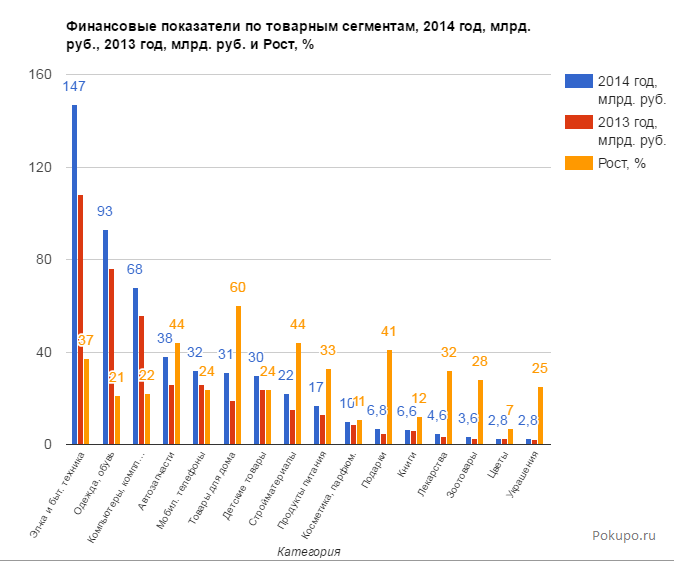

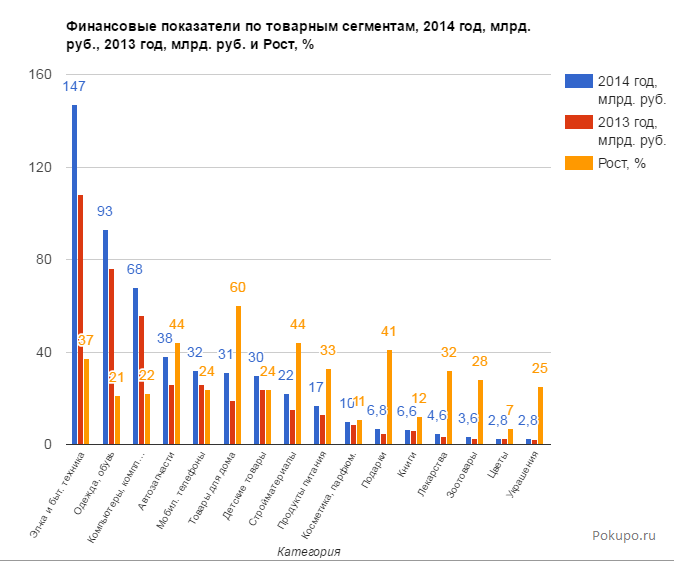

Financial indicators by product segment

Russian market:

Source: According to Insales

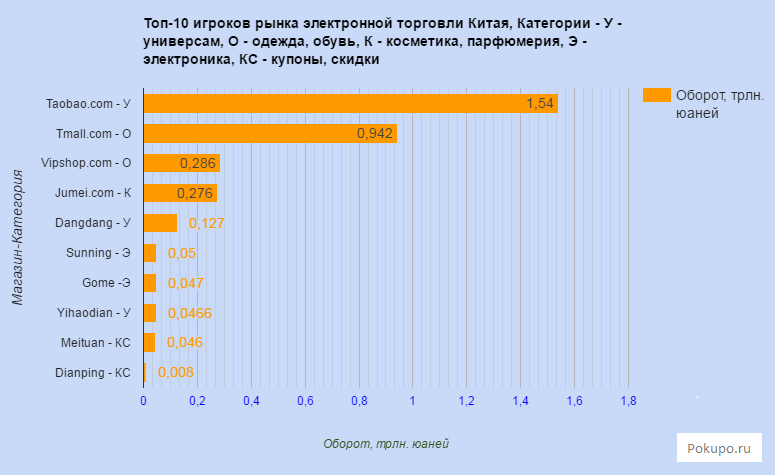

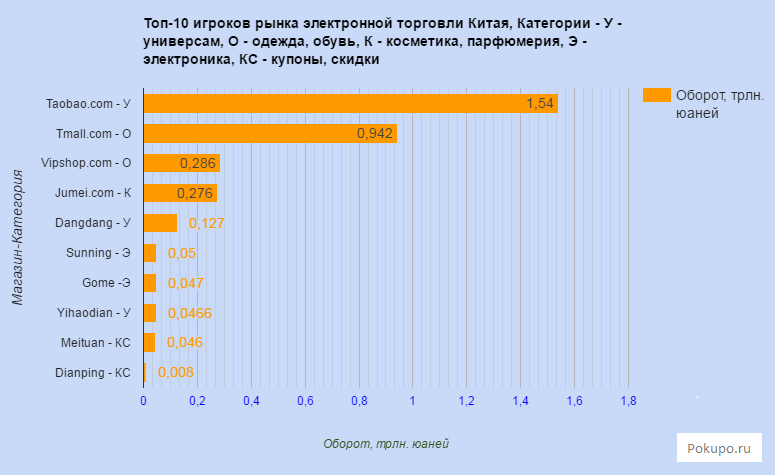

Chinese market:

Top 10 e-commerce market players

Russia:

According to the Data Insight eCommerce Index Top 100 rating, the number of top online stores includes stores that receive 56% of all orders, the number of orders and sales are key indicators of the rating. Of the 100 largest stores ranking the top 10 stores receive 30% of all orders. Of the rankings of the top 100 stores, the largest share is occupied by such product segments as electronics and appliances, food, clothing, shoes, accessories, children's products and toys.

Top 10 e-commerce players:

Top 10 Chinese E-Commerce Players

Source: https://habr.com/ru/post/303314/

All Articles