9 secrets of online payments. Part 9: Setting up a payment service for the type of business

Helping hundreds of clients in setting up a payment service, we made sure that there is no universal payment solution for all types of business. Each online store or service has its own characteristics and requires an individual approach. In the ninth, final issue of "9 secrets of online payments from PayOnline ", we will talk about how to set up a payment service for your type of business.

Helping hundreds of clients in setting up a payment service, we made sure that there is no universal payment solution for all types of business. Each online store or service has its own characteristics and requires an individual approach. In the ninth, final issue of "9 secrets of online payments from PayOnline ", we will talk about how to set up a payment service for your type of business.Retail: Online Shopping

Online stores make up the lion's share of PayOnline's customer base - and it is on their settings that we, as they say, “have eaten a dog”. And, of course, recommendations for retail are universal and easily scale to almost all other types of business. So, what should pay attention to the owner of an online store?

Part 1. Setting up 3D Secure

Part 2. Recurring payments

Part 3. Payment selection page

Part 4. Payment Form

Part 5. Mobile payments

Part 6. Payment in one click

Part 7. Fraud monitoring system

Part 8. Returns and how to avoid them.

Part 9. Payment service settings for the type of business

In the first place - the size of the average check and daily turnover. If these figures differ from “hospital averages”, it is necessary to adjust the appropriate filters. Otherwise, you run the risk of rejecting payment for the order of your dreams by 200,000 rubles, or even suddenly stop accepting payments in the middle of the working day due to exceeding the maximum allowable turnover of payments in 24 hours.

')

After that, it is worth looking at the geography of customers. If you receive orders and, accordingly, payments from other countries, ask if they are included in the basic list of countries from which payments are approved by default. If not, you should attend to the expansion of the list of "open" countries.

Next, pay attention to the 3-D Secure protocol settings. We always recommend that customers check all payments using 3DS, as this guarantees 100% protection against fraud. However, it is necessary to take into account that in Russia only 80% of the cards are signed on 3DS. Thus, with the growth of turnover and sales, these 20% begin to play a prominent role, and businesses have to find a compromise between security and conversion. You can read about how to set up 3D-Secure in detail in our first issue of this series.

It is worth paying attention to the payment form - its format, design and number of fields. You can embed a form on a website using Iframe technology - and reduce the number of steps in your conversion chain. You can implement your own form design - and “reassure” users, increasing their confidence in the payment process. You can reduce the number of fields - however, you should not forget that each field of the form provides “food for thought” to the fraud monitoring system, helping it to minimize the risks of fraud and its attendant financial losses for your business. More about setting up a payment form here .

And, of course, it is worth remembering about your client and striving to make the order payment process as simple and painless as possible. To do this, implemented a great tool - " payments in one click ." The card is tied to the payer's account on your site, and all subsequent purchases are made without entering the card details.

"Mobile-oriented" business

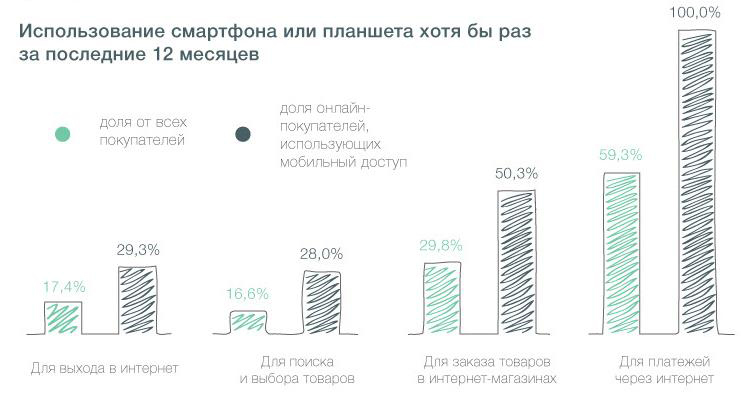

If you follow the audience of site visitors, you know exactly from which devices they come to it. The Data Insight study “Internet commerce in Russia-2014” showed that Russian online buyers are increasingly using mobile devices in the shopping process - and this trend shows steady growth year after year.

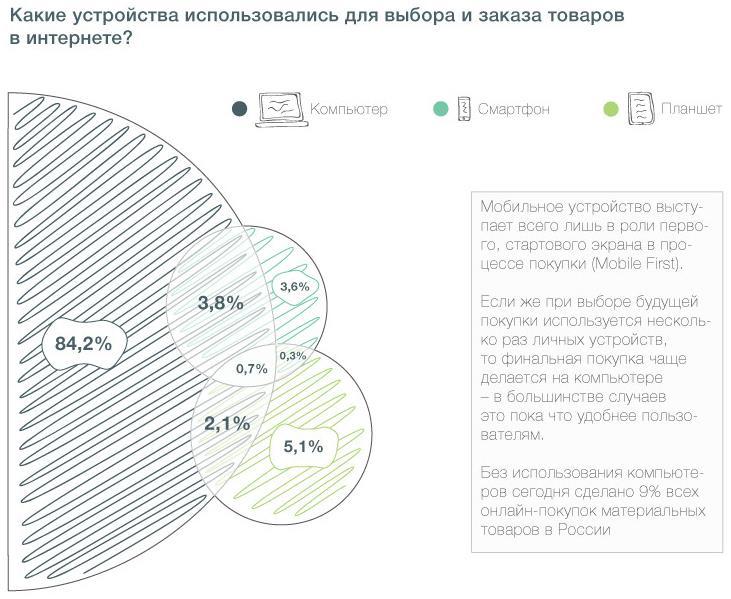

In addition, many users use several screens at once at different stages of a purchase:

Which of these can be concluded?

First of all, buyers are switching to mobile purchases. Of course, before the end of the era of total desktop rule is still far away, but now we can confidently say about the need to introduce both mobile sites and applications, and mobile payment solutions. Read more about setting up mobile payments here .

If you use only the mobile version of the site in sales, remember: making a payment is the last step in the ordering process, and problems on the payment form can ruffle any buyer, leaving a negative impression of the service. In order to avoid this, it is necessary to provide the buyer with the opportunity to use the mobile form.

The payment form adapted for mobile devices has a lot of advantages:

- It adapts to the screen size of any mobile device, from compact smartphones to full-fledged tablet computers. Thus, the fields do not "move out" beyond the screen.

- Often the number of fields in it is much less than in the usual form.

- Filling out the form does not cause inconvenience: the input fields are large enough, the chance to miss and click "not there" is minimal.

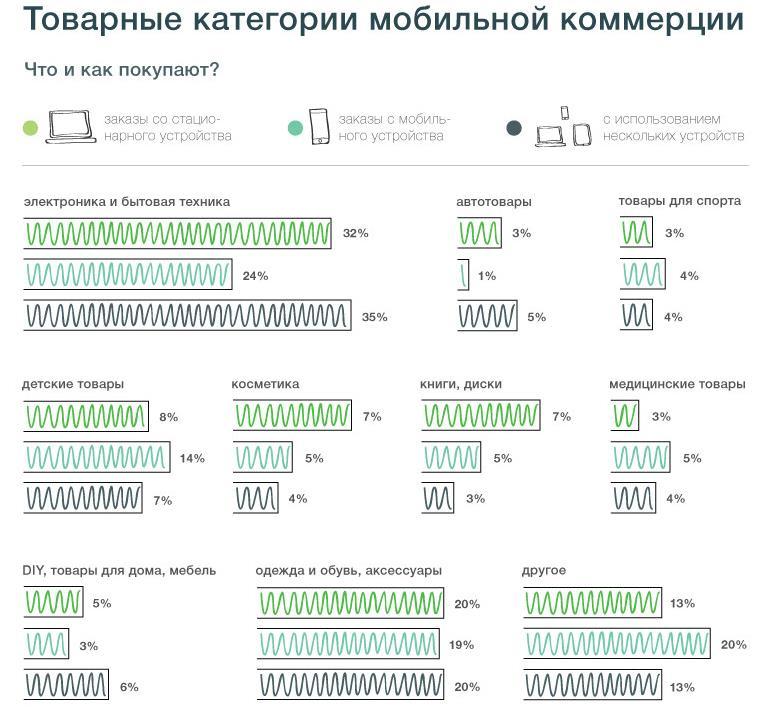

Of course, not all businesses need this option. In the diagram you can see in which segments the customers most often use stationary computers and / or mobile devices. They should think about connecting a mobile solution to their online store.

Tourism: Online Travel Agency

A distinctive feature of working with services from the field of online tourism is the "long record". A long entry is an additional parameter for ordering an air ticket, which reflects the passenger's identification parameters: the number of the ticket itself, the passenger's last name, as well as the flight details (airport name, etc.). When buying other products on the Internet, such parameters are not requested. In accordance with the rules of the international payment systems (MPS), the presence of a “long record” allows reducing the commission of an acquiring bank. This is due to the fact that the cost of such an operation for the acquiring bank will be lower, which will accordingly lower its commission. The use of a “long record” also reduces the risk of approving a fraudulent transaction, because there are additional parameters and it is more difficult for fraudsters to fool the system. The payment solution for the tourism industry (in the case of PayOnline, this is a Pay-Travel product) allows you to use a “long record” and minimize the cost of Internet acquiring.

Another “feature” of the payment system that significantly affects your profit is the settings of the monitoring system of fraudulent transactions. For some types of business, basic settings are suitable, while others will require fine tuning and customization. Monitoring systems for different payment service providers differ from each other. The system of fraud monitoring of the PayOnline payment system contains more than 150 filters that check the account of the payer, the country of payment, the country of issue of the card, the number of transactions from this card, the amount of payment and much more.

For tourism, for example, cross-border payments are typical. With the standard settings, the antifraud is more likely to have problems: the cards are issued in one country, and the payment is made in another. This will lead to the rejection of the transaction, and thus loss of profit. Just so disabling the anti-fraud will not work - it will increase the number of fraudulent transactions.

And in order to properly configure the filters, you will need to work together with specialists from a travel company and a payment service. After all, for the correct setting of filters, both detailed information on the geography and specifics of the client’s business, and fraud monitoring system statistics and expert knowledge of risk monitoring specialists are needed. Only this combination will allow you to choose the necessary system settings without harming the business. More details about how the fraud monitoring system works can be found here .

Utilities: utilities

In the area of payment for housing and communal services, there are also some nuances: for example, the commission for payments of the processing center, the IPU and the acquiring bank, which the online store usually pays, can be transferred to the payer himself. In this case, the final amounts are credited to the organization’s account in a “pure form”.

Another point to consider when choosing a payment partner is the ability to upload data to the billing system and provide registries for machine processing. The volume of information on payments in this area can be truly gigantic, while they are of the same type, so convenient data registries are an important part of the payment service.

Microfinance organizations

Microfinance organizations issuing short-term loans of small volume at a daily interest rate require enhanced functionality: in addition to standard Internet acquiring, the ability to make payments on cards is necessary.

For MFI specialists, an extended functionality of the “Personal Account” is needed in order not to get confused about who the loan was issued to and who gave it back.

Another option needed for such a service is rebuilds. Rebill - regular payments, which are used to make periodic payments without the participation of the buyer, to reduce the inconvenience of the user from the need for periodic self-initiated payment. In the case of an MFI, the borrower once enters his bank card details at the time the loan is issued, and at the appointed time they write off the amount to be returned.

By the way, rebills will be useful not only for MFIs - they can effectively accept payments for various services, assuming the availability of access for the buyer for a predetermined paid period of time and the subsequent extension of this access due to automatic regular payment - for example, subscribing to online magazines or functional services like dating sites. The use of a rebill allows buyers to pay for goods using a credit card without entering full payment details, reducing the online payment procedure to a few seconds. Acceptance of payments using the rebill procedure is not inferior in terms of security to the standard payment procedure and complies with the security requirements of international payment systems.

Having studied all nine secrets of online payments, with which PayOnline introduced Habrahabr readers, an online store or service can significantly increase the capabilities of its website by setting up a payment service. And if you want to know more, you know who to turn to !

Source: https://habr.com/ru/post/303214/

All Articles