On Amazon, there is a war of algorithms for the position of the "best" product

In 2011, two algorithms left unattended raised the price of the book to $ 23 million

Amazon started as a bookstore in 1994, but has now become a real monster of online commerce . Anything is sold at the site. The most convenient - there you can compare prices of different sellers and choose the most suitable offer. Moreover, the Amazon algorithm performs such a comparison for us and finds an “optimal offer” (“Buy Box”); all that remains is to click the “Add to cart” button.

Nobody knows how the Amazon algorithm works: the formula includes not only the price, but also the number of positive reviews, and something else. The problem is that merchants are actively manipulating the Amazon algorithm to get into the coveted “Buy Box”. And the task of the merchant is not only to get to the optimal position, but also to sell the goods at the highest possible price, without losing the position. Watching the battle of trading bots on Amazon with constant price spikes is quite amusing: this study was conducted by experts from Northeastern University (USA), pdf .

Do you know about the dictatorship of default settings ? This law is valid everywhere: the absolute majority of users are always content with the default settings in the system and do not change absolutely anything. That is, formally giving the user a choice, in practice you can control the actions of the absolute majority of users by simply changing the default settings in the right direction.

')

The same law applies to Amazon. Formally, each buyer can spend a few seconds to compare the prices of different sellers, but in practice, 82% of Amazon’s sales occur through the default “Buy Box” window.

“Buy Box”

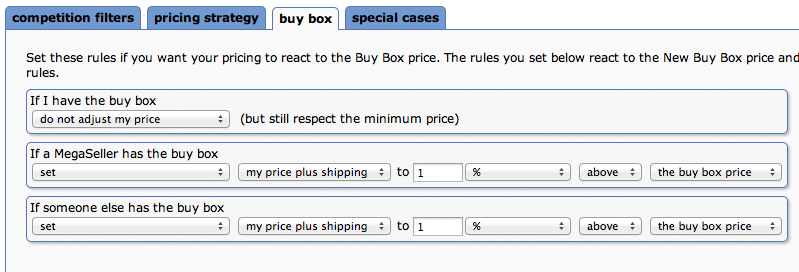

Therefore, sellers are very important to get there, they are ready for anything. Moreover, specialized firms like Sellery have appeared , which develop their own bots in order to get into the “Buy Box” with an optimal price. Developers sell these bots to Amazon merchants.

The most interesting thing starts when bots begin to adapt and react to each other's actions. In this case, the prices of goods on Amazon automatically change hundreds of times a day.

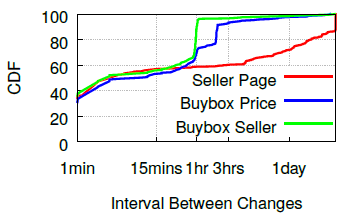

Researchers from Northeastern University recorded the prices of 1,641 products from the list of popular on Amazon. Every 15 minutes, the price of this product was recorded at the “Buy Box” position, as well as the price of 20 other sellers, and their ratings.

Here are typical price hikes from a published study .

Adjusting the price of goods in the “Buy Box”

Frequency of price changes

The researchers tried to study the unknown factors that influence the entry into the “Buy Box”, and identified several combinations of factors. This is mainly a combination of competitive pricing and a large percentage of positive reviews.

But such a system has a congenital defect: after all, getting into the “Buy Box”, the product receives more positive reviews. How to get these reviews if the product is not promoted? “This is a feedback loop,” says Christo Wilson, an associate professor at Northeastern University, one of the authors of the paper. “If a company uses algorithms, it gives it a competitive advantage, because it can react quickly and get more sales.” And then they get more reviews for these sales, and this is a positive signal that will allow them to maintain the position of the “best” product in the future. I don’t think that Amazon is worried about using algorithmic sales — they get their money anyway. ”

Algorithmic adjustment of the price gives the effect: about 60% of all goods in the “Buy Box” are sold at a price higher than competitors. That is the point: maximize sales while maintaining the highest possible price.

According to researchers, bots for price changes are used by about 2-10% of sellers on Amazon, but they own almost a third of the “best” items in the “Buy Box”.

In general, the bots wars on the trading platform are quite normal. Sellers optimize their prices by competing with each other. However, sometimes this leads to curious consequences. For example, in 2011, the two algorithms left unattended managed to raise the cost of a scientific book on biology to $ 23,698,655.93 (plus $ 3.99 for shipping).

Once a day, the profnath set the price 0.9983 times the price of the bordeebook. Prices stayed in this position for several hours until the bordeebook “noticed” the change in the price of the profnath and did not raise its price 1.270589 times the maximum price of the profnath [note: the bordeebook most likely did not have this book available, and the seller hoped to earn on it resale if received order]. In this order, the events continued in the same order throughout the next week.

Most of all in this situation, an endless amount of possible chaos and problems surprises. It is unlikely that we stumbled upon a single example of a constantly rising price spiral - and all it took was two sellers, changing their price according to the price of the other in proportion, ultimately leading to an overall price increase. And although it may be harder to calculate, you can think of other strange scenarios that can occur if the number of participating vendors becomes more than two.

So such algorithms need supervision, otherwise they will still do things ...

Source: https://habr.com/ru/post/302698/

All Articles