Stripe API & Partnership: An Inside Look

Gordon Wintrob, editor of GET PUT POST , an e-mail about API applications that “captured” the market, recently interviewed Kristina Kordova, head of customer service department at Stripe, one of the most prominent companies among our Western colleagues. Earlier, as part of a series of articles on payment services, we told about its founders - the Collison brothers, and also about what Stripe started with, how it looks from the inside, how it became a multi-billion dollar company and won the love of its partners. Today we will talk about the company's approach to partnerships and how they help the platform grow, and we will also discuss the issue of building an API development process that takes into account customer needs to the maximum. Next, directly interview.

Gordon Wintrob, editor of GET PUT POST , an e-mail about API applications that “captured” the market, recently interviewed Kristina Kordova, head of customer service department at Stripe, one of the most prominent companies among our Western colleagues. Earlier, as part of a series of articles on payment services, we told about its founders - the Collison brothers, and also about what Stripe started with, how it looks from the inside, how it became a multi-billion dollar company and won the love of its partners. Today we will talk about the company's approach to partnerships and how they help the platform grow, and we will also discuss the issue of building an API development process that takes into account customer needs to the maximum. Next, directly interview.What applications are most missing now Stripe?

Applications built around financial data recons, which is one of the main components of any business. Once a month, and sometimes more often, every business has to keep accounts in order to determine cash flow, payments and other similar parameters.

')

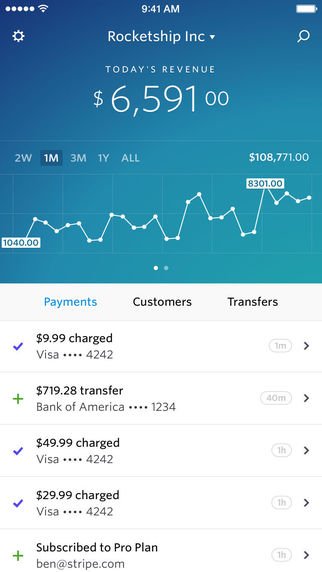

This is the Stripe information panel on the iPhone.

Another interesting area is data storage tools. For example, it would be great to create such a solution that allows you to combine data from Stripe with other useful data about customers for the purpose of their subsequent processing and analysis.

As an example, a situation where the analyst needs to determine how many new customers have registered after the marketing campaign, or how many operations were performed based on the A / B test results. It would be great to simplify this process for those who know only SQL.

Another area of application is support request processing. Suppose I own a business. If I manage to embed Stripe billing information into the customer support system, it will help me to better define priority requests or group them into categories. For example, it is possible to divide customers into those who apply for the first time and those who do it regularly.

About partnerships in the field of work with data.

One example is Baremetrics , an analytic application based on Stripe. It helps you understand the calculation of monthly regular income and track the dynamics of its change over time. In addition to information about your bank account, the service provides a lot of other valuable data.

Another example is the ChartMogul service, which analyzes your subscriptions to services. It helps to understand why customers choose certain monthly plans. How many customers switched from gold to silver? How many customers failed to pay in the past month due to the fact that their credit card stopped working for one reason or another? Answers to such questions are very important for any SaaS business.

ChartMogul helps business owners to deal with such concepts as monthly regular income, customer outflow, etc.

Intercom , for example, is in high demand among the entire Stripe community. This service helps automate communication with your customers. The ability of management at any time to understand who is the most important client of the company allows you to allocate resources in proportion to the needs.

About barriers to payment

In theory, the Internet is a limitless space. However, when it comes to real attempts to make a financial transaction, this is absolutely not the case. Anyone can send an email to any part of the world, but many people are unable to receive payments online or even shop at the largest online stores. This is largely due to the presence of artificial barriers that surround the movement of money online.

We want every developer and entrepreneur, no matter what country he is in, to have access to the tools needed to create an international online business.

How many employees work now in the company? How do you organize the technological processes associated with the API?

In total, the company employs 400 people worldwide.

The product development team is working on creating new custom products, such as Atlas , and on integrating our core products, such as the store control panel, into various platforms and custom APIs.

We also have a large infrastructure team that supports internal tools and basic systems, as well as a team engaged in risk assessment and data management. In addition, there is a team of "field engineers" - developers who help partners.

About types of partnership

Our cooperation can be divided into three types.

Firstly, these are partners involved in the distribution of our services. These are companies that offer businesses their own platforms, within which they help their customers manage their payment processes through Stripe. For example, many businesses today open up on the basis of specialized online trading platforms, such as Shopify, or electronic billing platforms, such as FreshBooks or Invoice2Go. Stripe concludes partnership agreements with such services and provides full support to their customers in all matters related to payments.

Secondly, we cooperate with other companies. For example, with Apple, we are working on integrating Apple Pay, and with Google - for a similar integration of Android Pay . This will give sellers the opportunity to accept not only credit cards, but also these services as a method of payment. Another example is cooperation with companies such as Plaid in order to create their own products based on the ACH clearing and settlement system.

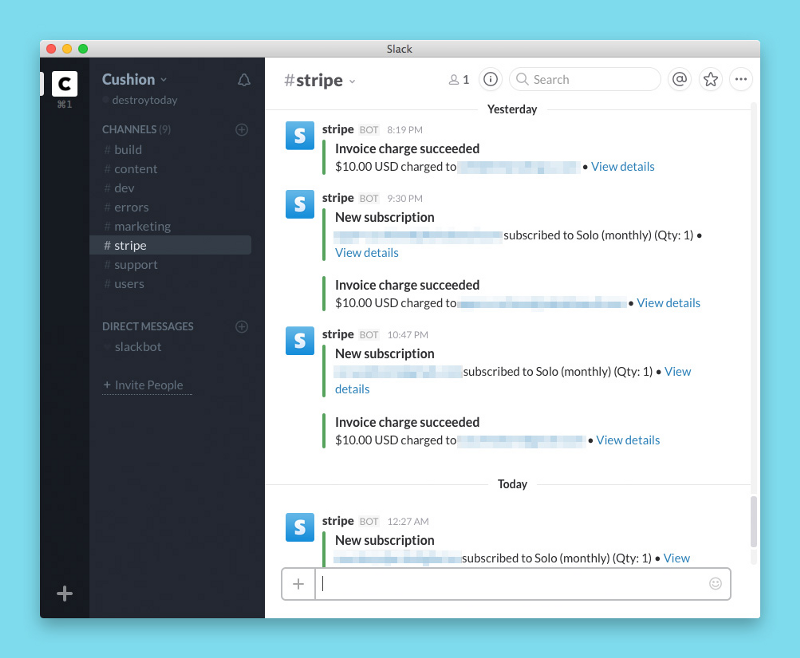

And last but not least. We cooperate with other companies in the field of data processing. We are talking about third-party developers who create applications based on the Stripe platform. Solutions in this area are very different, from the ability to receive notifications about Stripe payments made on Slack to integrate payment data with Stitch Labs for keeping records of turnover.

Cushion integrates Stripe into Slack as a separate channel

Stripe is not just about payments. About Relay and Atlas Products

Many users see Stripe as a platform and infrastructure service.

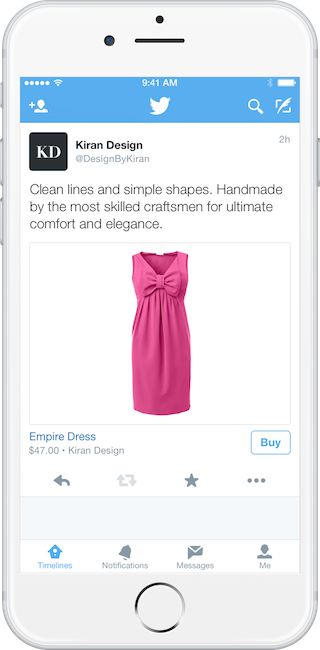

Relay was the result of a partnership dialogue with companies such as Twitter and Facebook, which create their own commercial products based on Stripe. Discussions with them gave us information about how we should work on the product and how to approach the development of the API.

Before the appearance of Atlas, we constantly heard from users complaints about the difficulty of creating an international business. Especially often talked about this company operating in emerging markets. Many of them considered the option of registering a legal entity in mature markets, such as the United States or the United Kingdom, with the sole purpose of gaining access to the best banking and business services.

Practice has shown that Atlas was the solution to a long-standing problem. This may seem surprising, but many Stripe employees not only were themselves entrepreneurs themselves, but in addition to this, many of them come from outside the United States. The founders of Stripe, for example, came to the United States from Ireland, and it was here that they began from scratch to work on a completely new type of service.

We have made it our goal to make it possible for more businesses to start work without having to invest thousands of dollars in airline tickets, lawyers' services, and payment for creating a company.

Atlas actually turns a laborious and expensive process into a simple and clear, ready-to-use product. Ultimately, the infrastructure we create is needed not only to receive payments, but also to give people the opportunity to create and manage international business, no matter in which country in the world they are.

Bring a team with you

Not so long ago, Evi Bryant, Stripe CTO, announced a new company policy and invited all those who are interested in working at the company to think about getting a job together with their current project partners.

“Any group of 2 to 5 people can get on Stripe as one team. Just include a summary of each participant in the application, indicating what role they are applying for and a short description of how you know each other or what you used to work together, ”Bryant explained.

Beating up the old phrase for a party invitation - BYOB (“Bring your own booze, bring drinks with you”), Stripe calls the new BYOT initiative, which stands for Bring Your Own Team (“take your team with you”). Groups-applicants will go through the interview process together and will even have the opportunity to work together on the project and show their skills and teamwork effectiveness. Bryant admits that you can only find out how good an idea is by trying it in practice.

According to an interview with an interview with Christina Kordova.

Source: https://habr.com/ru/post/301956/

All Articles