Bidmanedzherami and killing rate - is the loss of almost half of the profits

Most advertisers in Yandex.Direct set rates incorrectly and lose up to 50% of their profits .

This is the so-called interrupt, when the user sets the rates depending on the value of the positions in the Yandex.Direct interface. For example, if the cost of entering a special placement is $ 1, set the rate equal to $ 1.01. Also, this article is about bidmanagers, programs that do the same thing automatically.

')

This method of setting bids is used by almost all novice advertisers. But this leads to significant losses in profits.

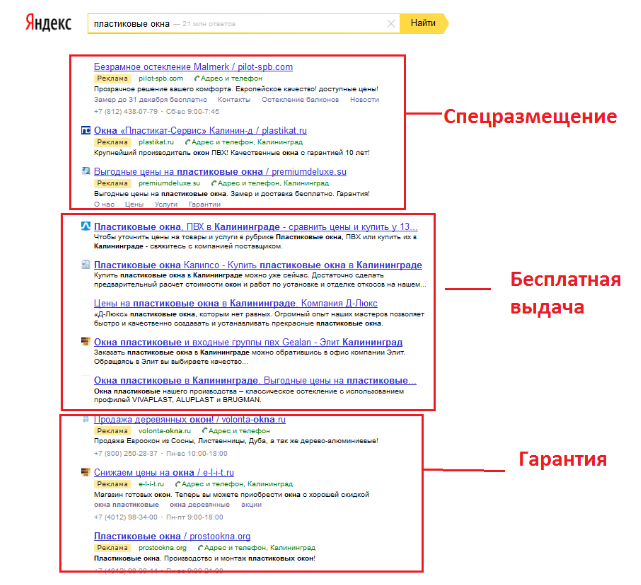

Special placement and warranty

Yandex.Direct has two ad units:

- Special placement (special, Wed) - above the results of the free search

- Warranty - under search results

If the ad does not fit into any of these blocks, then it falls into the dynamics . In this case, the ad is displayed on page 2-3 of the search results. In some cases, ads from the speakers may be periodically displayed in 4th place in the warranty.

Click Value

The value of a click is the maximum amount of money you are willing to pay for 1 click. In a narrower sense: the value of a click is the profit that an average click brings to you.

For example, you buy teapots for $ 200, and sell them for $ 300. Conversion of clicks to sales is 1%. Then the value of a click is (300 $ -200 $) * 1% = 1 $. Here you will find an article that describes in detail the calculation of the cost per click.

A sincere bid is a bid equal to the value of a click.

Customer benefit

Please note that the cost per click and its value per click are different things. There is such a thing as a consumer benefit. This is the difference between the value and price of the goods. For example, if you are ready to buy a kettle for $ 100, but bought it for $ 80, then our benefit is $ 20.

In the case of contextual advertising, we are consumers because we buy goods (clicks) from Yandex. Our total benefit will be equal to

Number of clicks * (Value of a click - Cost of a click).

Compromise

The number of clicks and cost per click depend on the rate. With an increase in our rate, the number of clicks increases, but the cost of a click increases. Therefore, we need to find a compromise between the number of clicks and the cost of a click.

We believe that our goal is to increase profits. If the value of the click is chosen correctly, then maximizing the benefits will allow us to get the maximum profit.

Auction

Now there are two types of auctions at the same time in Direct:

- Inside the blocks is a VCG auction . It is proved that in it the optimal rate is equal to the value of the click.

- Between the blocks is a GSP-auction .

Since none of the supporters of bidding and bid managers argue with the fact that the optimal bid in VCG (inside the blocks) is equal to the value of the click, we only need to consider the GSP auction. In the future we will assume that we use the strategy “in the block at the lowest price”.

VCG and GSP have one thing in common: the rate does not directly affect the cost per click. The cost per click is affected by the position, which in turn is affected by the bid. But if a change in rate does not change position, then the cost per click does not change. For example, if the cost of entering a special is $ 1, then while you are in last place in a specialist, you will pay $ 1 for a click, regardless of the rate.

Tsiferki

The Yandex.Direct interface displays the value of the positions. For example:- Entry to the special placement: $ 2

- Entrance to the warranty: $ 1

For the sake of brevity, we will say, instead of the “cost of positions in the Yandex.Direct interface,” just tsiferki .

Simple model

A little later, I will prove that tsiferki mean virtually nothing, but now assume that tsiferki absolutely true. In other words, if we make a bid greater than the entrance to the specialist, then we will be in special allocation at 100%.

In this case, what will the quick manager or punch a 1 cent bet give us? Nothing! We will pay as much as with a sincere bid. For example, the entrance to the CP = $ 2 value of a click for us is equal to $ 3.

- If we put $ 2, then we will be in CP and pay $ 2 per click

- If we put $ 3, then we will be in CP and pay $ 2 per click

As we can see nothing has changed. However, there are many advantages to a sincere bet compared to a knockdown.

Not optimal

Both a sincere bet and a cutout bet are not the best practices.

Suppose we have a key with 1000 impressions per month, the value of a click for us is $ 3, the CTR in the guarantee is 1%, and in the specialist it is 10%. Let the cost of entering the special is $ 2.8, and in the guarantee - $ 0.50.

- Sincere bid = $ 3.

- Bidmaneger will put 2.81 $.

It is easy to see that in both cases we will pay $ 2.8 per click in the specialist.

Calculate the benefit:

| Special placement | Warranty | |

| Click Value | 3 $ | |

| Shows | 1000 | |

| CTR | ten% | one% |

| Cost per click | 2.8 $ | 0.50 $ |

| Clicks | 10% * 1000 = 100 | 2% * 1000 = 10 |

| Benefit | 100 * (3 $ -2.8 $) = 20 $ | 10 * (3 $ -0.5 $) = 25 $ |

In this case, the guarantee is more profitable for us than a specialist. But the sincere bid and bidmanedzher chose specials.

At the end of the article you will learn the formula for the optimal rate in Direct. The purpose of this example is to show that in a simple model, a sincere bet and a bidmanager behave the same. But if you drop deeper sincere bet there are a number of advantages.

Props

From time to time there are inadequate competitors. They put an unrealistically large bet, for example, $ 50.

These inadequacies force us out of our position. Worst of all is the last advertiser in the specialist - he is knocked out in a guarantee. To return to the guarantee he needs to set a backup - a bet of $ 49. The prop will make inadequate to pay in full. It is only necessary to wait until the budget is inadequate or it does not drain the budget, or place an adequate rate - in the end we will return to our previous position.

The problem is that the propsman themselves can back up. But even if this does not happen, the pimp will still receive super-expensive clicks. Therefore, you need to follow the backup. Otherwise, you can burn the entire budget. Bedmanagers can't prop. As a result, you should spend your time on backup.

But if you put your sincere bet, then you do not need props. Your bets are secure backups. Let's say your bet is $ 10 and this bet is sincere. There are two options:

- Inadequate can not pay $ 10. There are 2 sub-options here:

- Before setting a bid, the potential inadequate will see the cost per click of $ 10.01 in the interface. This will force him to abandon the original plan and place a more adequate bet.

- A complete inadequate will still put $ 50. But he will not be able to pay $ 10.01. Therefore, sooner or later he will go to minus without any props.

- Inadequate can pay $ 10 per click. In this case, we can not do anything. Even if you put him a backup, then you will achieve, only that he will sooner or later place an adequate rate, which will be higher than yours. As a result, your position will not change, and you will spend time and money on backup.

And if we podoprut?

I have never met a person who was propped up. At the same time, most of my fellow colleagues have repeatedly propped up someone. Conclusion: only newcomers are inadequate.

Although there is a possibility that we will support. If our rate is adequate, then we can keep it indefinitely. And the backup for the propsman is an inadequate rate and he is forced to follow her and receive super-expensive clicks.

Support in order for you to leave your position, and not just out of harm. Therefore, the propsman will quickly calm down and remove his backup, or he will drive himself into a minus, due to over-expensive clicks.

Warm up auction

Supporters of bid managers are beginning to say that a sincere bid warms up the auction, but this is not the case. If we take a closer look at their examples, then “reducing the heating of the auction” will be just a delay of the inevitable for a couple of days.

Alexei Dovzhikov, in several articles, gave one example, which he called proof of the heating of the auction.

Suppose the cost of entering the CP = $ 1, and the value of a click for us is $ 2. We are in last place in the SR. Some time after setting the bet, Vasya comes in and can pay $ 3, but he plays a hand overrun.

- If we bet 2 $

- comes Vasya puts $ 2.01

- we can't do anything

- If we use bidmanager:

- Our initial bet would be $ 1.

- Vasya puts $ 1.01

- we put $ 1.02

On this example for some reason ends. Of course, one can hope that Vasya inadvertently falls into amnesia and our rate will be higher than Vasina’s. But Yandex sends an email to users with a warning about lowering positions. And without it, users periodically go to the interface.

Therefore, almost certainly, Vasya will kill our rate by 1 cent to 1.03 $. Our bidmanedger will kill Vasya by 1 cent to 1.04 $. Vasya will get bored at some point and he will start betting in increments of 10-20 cents. Thus, in a couple of days we will reach a bet greater than $ 2 and our bidmanager will calm down.

What do we get in the end? We will delay the inevitable for a couple of days (at best for a couple of weeks). My language does not turn to call it “reducing the heating of the auction.” Moreover, we achieved this at a very high price - I will explain this a little later.

Present auction warm up

Suppose the cost of entry in the CP = $ 1, and the value of a click of $ 1.10. We are in last place in the SR. Some time after setting the bet, Vasya comes in who can pay $ 1.07, but he plays interrupting.

- If we bet $ 1.10

- Vasya sees that SR cannot afford him and sets the cost of entering the guarantee.

- If we use bidmanager:

- Our initial bet would be $ 1.

- Vasya puts $ 1.01

- we put $ 1.02

- ...

- We bet $ 1.07

- Vasya may fall into the auction rage: “This is more than I expected. But the difference is only one cent. Smash and `win` this auction!” $ 1.08

- ...

- In the end, Vasya can bet $ 1.11 $, which the bid manager will not be able to kill.

In this way, your bid manager can get your competitor to deliver more than he originally planned.

And what will happen if Vasya keeps his composure? There are two options:

- Vasya will bet the entry to the guarantee (the same as with a sincere bet)

- Vasya can just “score” and leave a bet of $ 1.06. And the cost of a click for us will be equal to $ 1.07 against $ 1 with a sincere bet.

As can be seen from this example, the bid managers warm up the auction: they increase the bids of competitors.

Uppercuts

There is a very old method of cheating bid managers. Suppose you have a keyword `Samsung laptops`, you can bet no more than $ 1, and Vasya - as much as $ 2, but he uses the bidmanager. You and Vasya are fighting for the entrance to the special placement.

If you enter Samsung laptops into Direct Keyword, your ad will be shown not only to those users who typed “Samsung laptops”, but also to those who typed: “buy samsung laptops”.

Most keyword impressions occur precisely by subqueries. This is easily seen: take any of your keywords and punch it through WordStat with and without quotes. You will get that in quotes there will be only 1-10% of traffic.

We take advantage of this fact and collect most of the clicks from Vasya:

- Set the bid 0.80 $

- Vasya puts $ 0.81.

- Opens WordStat and add a lot of keywords:

- samsung laptops to buy

- samsung laptops prices

- Samsung A12345 laptop

- and so on

- Let's bet on these keywords a bet of $ 1.

- Neither Vasya nor his manager will not notice these manipulations.

Despite the fact that Vasya can pay twice as much per click, our share in the specialist will be much higher than that of Vasya.

It is also easy to see that if Vasya had not used the bidmanager, but had placed his sincere bet, then we would have failed.

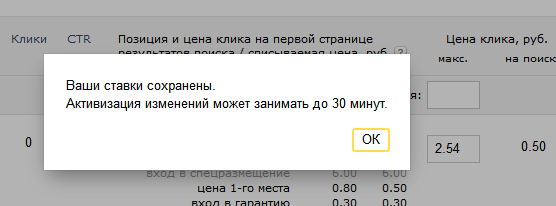

Rate update frequency

Suppose we have a key with the cost of entry into the CP = $ 1. We set a bet of $ 1. After some time, the cost of entry was equal to $ 1.02. Until we update the rates, we will be in warranty. Because of this, we do not receive enough clicks. If we used a sincere bet, we didn’t have such problems.

To estimate the losses from this effect, you need to understand how often bid managers update rates and how often tsiferki change.

In the specification of many bid managers there is a phrase “updating rates every 10 minutes”. But this is nothing more than a marketing ploy. Even if the bid-manager will update the rates once a second, there is a delay in updating the rates on the Yandex side:

In the Help direct written:

- The tsiferki in the interface change every 15 minutes

- Updating rates from the interface can take 5-60 minutes. Judging by my experience:

- At night, about 5 minutes

- During the day, due to the heavy load, 1.5 hours can pass

To this must also be added the time from the specification of the bi-manager. Together it will turn out 40-60 minutes. From this article it follows that every 20 minutes, 15% of tsiferok changes (data from a sample of 50,000 keywords).

For 40-60 minutes, which are required for the bid manager, about 30-45% of tsiferok will change. However, you need to take into account two facts, each of which reduces losses by half:

- Changes do not occur at the beginning of the period, but on average in the middle. And so they will touch half the number of hits.

- Half of the changes will reduce the cost of entering the CP and we will continue to stay in the CP.

Thus, only because of this effect, the big managers lose about 7-11% of their share in the CP.

Rate adjustments

In Yandex.Direct, you can set rate adjustments depending on the day of the week and time of day, gender and age, network and device. I am developing a service to manage these adjustments (Can). During the testing of cans, I discovered one interesting anomaly.

A significant part of the tests showed a strange result. Biddon worked too well. For example, for one client, the estimated improvement should have been no more than 30%, while the test showed + 40%!

Twice rechecking the test methodology and statistical significance, I began to study the data. It turned out that the number of clicks through-chur greatly increased. Especially for a group of 25-35 years old (this is the most delicious traffic). The rates in this group increased by only 35%, and the number of clicks - almost one and a half times.

For me it was a surprise. Much of my book is based on the statement that clicks are growing more slowly than a bid. For example, if you increase the rate by 1.35 times, the number of clicks will increase by no more than 1.35 times. Previously, in my practice there was not a single case where this assumption did not work. But it seems that there are exceptions to this rule.

Competitors “abnormal” customers used bid managers. If the client bet $ 1, then the competitor interrupted him by betting $ 1.01. The problem was that for the age group “25-35 years old” the rate was 35% higher ($ 1.35). However, the bid manager did not see this.

Complex model

Several past examples show that the digits in the Yandex.Direct interface can lie. In other words, if we bet a cent higher than the “cost of entering special allocation,” then the number of impressions in the specialist will be far from 100%.

Yandex guarantees?

The promoters of bid managers say that Yandex guarantees us that if we put the bid higher than the cost of entering the specialist, we will be in special placement. And now let's think about it?

Let's say we have the key `apartments for rent» and Yandex gives us “guarantees” the first place at our rate. Vasya has the key to him 'conditioners, to which Yandex also “guarantees” the first place.

What will happen if a user in Yandex search types "apartments for rent with air conditioning"? Whose announcement will take first place? After all, both of us Yandex allegedly guaranteed the first place! Will we both be in the first place?

To understand this, open the Direct Help and read:

Acting on a search is the price that can be charged at the moment when you click on an ad from the search results page for a query that exactly matches the key phrase. In reality, depending on the number of competitors, their rates, CTR, geography and time of impressions for a specific user-defined request, each time an ad is shown, this price will dynamically change within the maximum rate you set.

So Yandex does not guarantee us anything. Tsiferki act only if there are many conditions.

Request

One of the most interesting conditions: the user's request for Yandex search must exactly match the advertiser's keyword in Yandex.Direct. Let's call the impressions on request that exactly match your keyword accurate, and all the rest - wide.

As we already know, there are several times less accurate displays than wide. Accurate impressions are almost always no more than 10%. This fact you can easily check. For this you need to break through your keywords in Wordstat.

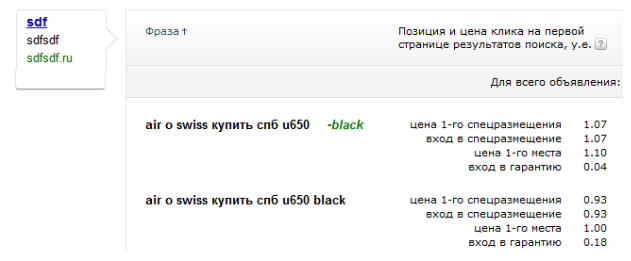

Cost of different impressions

The cost of the position in Yandex.Direct depends not only on the competitors' rates, but also on the CTR (ad clickability). But the devil is in the details ... Let's go back to help:

In reality, depending on ..., CTR , ..., on a specific request made by the user , each time the ad is shown, this price will dynamically change

This phrase suggests that in Yandex.Direct CTR is considered at the level of each query, and not the keyword. This was confirmed by Elena Firsova, a former employee of Yandex, now the CEO of Origami.

Since the CTR is considered at the request level (and not the keyword), and the cost of the position depends on the CTR, the cost of the positions will be different in different requests.

To confirm this, you need to add several very close keywords to Direct and make sure that they have different numbers:

You can repeat this experiment with any other pair of keywords.

Consequently, each request has a different cost of positions, which means that the cost of positions in the Yandex.Direct interface is simply tsiferki (90% -99%).

What will be the cost of entering the CP = $ 1, and we will bet at $ 1.01? We will be in the specialist only in 51% -55% of cases, and not 100%, as it seems to the developers of bid managers.

Smooth ride

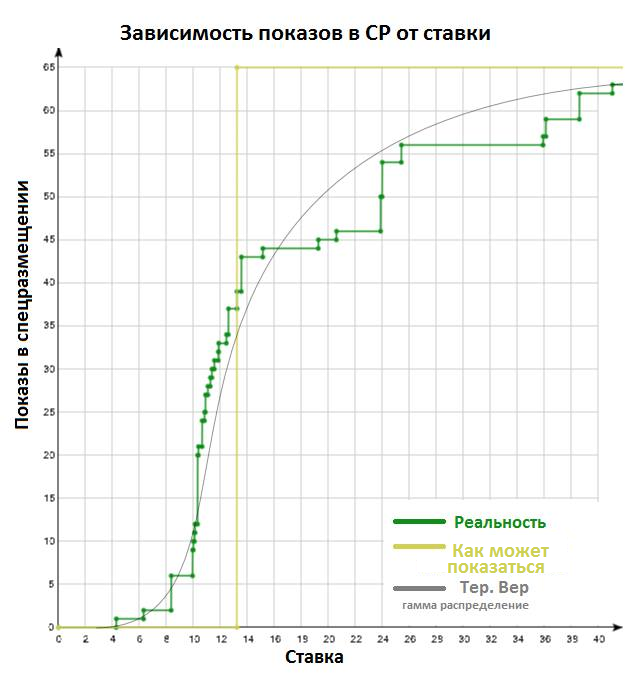

I took the low-frequency keyword `boneco aos`. In the interface, the price of entry into the SR was equal to 13.22 rubles. I found about 40 of his subqueries: `boneco aos reviews`,` boneco aos buy` and so on. The total number of hits was 65.

For each request, I removed the cost of entering the CP and plotted the dependence of the number of impressions in the specialist on the rate:

According to this schedule, it is obvious that the shows have different cost of entry to the spec. Even if we are dealing with low-frequency keys. It is also clear that the share in the specialist changes smoothly with the rate and nothing happens especially at the rate of 13.22.

Example 1

Let the cost of entering the CP is $ 1, and the value of a click is $ 2. Consider 2 situations:

- Bidmanager and rate 1.01 $. The gap of one cent will provide us with a little more than half of the hits in the specialist.

- A sincere rate of $ 2 will provide us with a share in the spec close to 100%.

Example 2

Let the cost of entering the SR is $ 2.01, the entrance to the guarantee is $ 0.10, and the value of a click is $ 2. Consider 2 situations:

- Bidmanager and rate 0.11 $. Slightly more than half of our impressions in the guarantee, the rest - in the dynamics.

- A sincere bid of $ 2 will provide us with a share in the spec with a little less than 50%, and all other shows are guaranteed.

Example 3

Let's go back to the example, which allegedly illustrates the warming up of the auction.

Suppose the cost of entry in the CP = $ 1, the value of a click - $ 2. We are on the last spec. After a while, Vasya comes in who can pay $ 3, but plays in a manual backfill.

- If we bet 2 $

- comes Vasya puts $ 2.01

- we get a little less than half of the impressions in special placement, and Vasya is a little more than half

- If we use bidmanager:

- Our initial bet would be $ 1.

- Vasya puts $ 1.01

- We put $ 1.02

- Vasya puts $ 1.03

- We put $ 1.04

- Vasya sooner or later begins to interrupt in increments of 10 cents.

- In a couple of days, Vasya will place a bet of $ 2.

Thanks to Bidmanager we delayed the inevitable for a couple of days. Now we will think: at what price did we achieve this? Depending on the settings of the bid manager:

- Will bet equal to the cost of entering the warranty. We in the past example have already considered this case.

- Leave a bet of $ 2. But the bidmanedger forced Vasya to interrupt with a big step. Because of what the gap between our rate and Vasina increased. Consequently, the share of our impressions in the specialist has decreased.

Optimal rate

Consider the strategy "in the block at the lowest price." We will consider that we need to choose from two blocks: guarantees and special placement. The number of clicks from the dynamics is negligible compared to the specs, so we consider the profit from the dynamics for simplicity to be zero.

Warranty unavailable

Consider the case when the cost of entering the warranty is higher than in the special placement. In this case, the warranty is not available to us (we can not get into it).

Expected profit from CP can be calculated by the formula:

Profit SR = Clicks * (Value- CPC SR )

Profit from the dynamics, we believe zero. Therefore, we need to compare the profit from the CP with zero. If the profit from the CP is greater than zero, then special placement is more profitable for us:

Profit SR > 0

Clicks * (Value- CPC SR )> 0

Value- CPC SR > 0

Value> CPC SR

CPC SR <Value

We need to enter the special placement in all shows, in which the cost of entering it is less than the value of the click. If we set a sincere bet, then that is exactly what will happen. Therefore, in this case:

BestBid = Value

Now on the fingers I will explain why this is happening. Let's say the value of a click for us is $ 1. Consider 2 cases:

- If we set a bid greater than the value of the click. For example, $ 2.

- This will not affect the impressions with the cost of entering the CP less than $ 1.

- But, for example, there may be a show with an entry price of $ 1.5 from which we will begin to receive clicks. With each such click we will receive $ 1.5 - $ 1 = 0.5 $ loss.

- If we set the bid less than the value of the click. For example, $ 0.5, then there may be a show with an entry price of $ 0.75, from which we will stop receiving clicks, although each of these clicks would bring us $ 1-0.75 $ = $ 0.25 profit.

- Therefore, you need to set the rate equal to $ 1.

Why the optimal rate does not depend on the cost of entering the spec? Everything is very simple. A bid equal to X is an order for Yandex to enter the special in all shows in which the cost of entering a specialist is less than X. Therefore, we don’t need to know the cost of entering a specialist, it’s enough that Yandex knows it.

For example, you have a broker. You call him and say "When Apple shares fall to $ 100, then buy." This saves you from having to track stock prices.

Warranty available

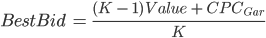

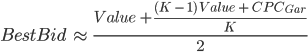

Consider the case when the warranty is available to us. Now we will understand when it is more profitable for us to be in the SR. To do this, you need to compare the profit from the two blocks and remember the school math:

We have received that it is more profitable for us to be in special accommodation when the cost of entering it is less than the right side of the inequality. If we set such a rate, then Yandex will be in special placement only in those shows in which profitable placement is more profitable.

Numerical experiments

- In the case of a simple model, you can prove that this formula is correct using a table in Google Docs :

- The first sheet shows that the formula is correct and selects the optimal block.

- The second sheet of the rate according to the formula brings more profit than bidmenezhery

- It is also clear that bidmanagers are no better than a sincere bid. Even with the strategy in the block at the lowest price and a simple model

- In the case of a complex model (when the cost of positions for different shows is different), the results are even more depressing:

- Bidmenezhery always much worse sincere bet

- Sincere bet is always worse than formula bet, but not much

- Effective sincere rate of about 98 %

- The effectiveness of the rate by the formula is almost 100 %

- The effectiveness of bidmanedzherov about 55 %

- Even with the strategy “shows in the block at the lowest price”, the bottom-managers will almost halve the profit.

findings

As can be seen from the formula, the optimal rate does not depend on the cost of entering the spec.

If you consider the cost of entering the CP when setting a bet, then you simply select bets from the ceiling.

Max. available position

Since inside the blocks the sincere rate is optimal, and between the blocks the rate is according to the formula, the optimal rate for the strategy “max. available position ”will be somewhere in between.

It is considered that K = 10. Then the formula takes the form = 0.95 * Value + 0.05 * CPC gar . That is approximately equal to 0.95 * Value.

BestBid = 95% * Value

How to determine the value of a click - see this article .

findings

- There is no reason to interrupt tsiferki 1 cent.

- Breaking down the dial by 1 cent will not give 100% share of hits

- The optimal rate does not depend on the cost of entering the CP

- The cost of entering the CP in the interface is only in the minority of hits

- Therefore, the use of bidmanedzherov it is, in fact, setting bets from the ceiling

- With the use of bidmanager, you lose up to half the profit

- Using manual managers requires manual installation

- Bidmenedzhera warm auction

- There is a more efficient and easy way to set bids: 95% of the value of a click

note

- When calculating the value of a click, you need to consider VAT. The easiest way to do this is by dividing the value of the click by 1.18

- Manual killing is even worse than bidmanedzhera

Not all optimization programs are the same. The article concerns only bidmanagers. Another class of services - optimizers, on the contrary, are useful and increase profits. Optimizers set bids based on conversion prediction

- Bedmanagers - make bets based on the cost of positions in Direction.

- Conversion Optimizers (K50, Marine Software, Adobe AdLense, Origami, Bid-Expert) - bet on the basis of the conversion forecast and the average check. But they are intended for large customers. The only exception is my free Bid-Expert .

Andrey Belousov, CEO HTraffic.

Source: https://habr.com/ru/post/301930/

All Articles