Attention: Is IT in IT under attack?

Not the first time I try to draw the attention of [Habr] society to the problems of micro, small and medium business in IT. Increasingly, people began to write after the publications: I helped someone, unfortunately for some reasons - no. But the fact that questions are raised topical - is obvious. Therefore - I continue.

It would seem, where does this, disputed at first glance, thesis: “The IP is under threat?”

')

№1. Observations

It is a known fact that in 2013-2014, especially in the so-called depressed regions (for example, Buryatia) after increasing payments to the Pension Fund of Russia, etc. were closed in large quantities - thousands of IP. Someone says that these were “empty cases”, but in reality the situation there was difficult. In 2015, like, the trend recovered - to growth.

PI is pure small business. Further, as a rule (which does not mean always) go to the LLC. Or even PAO, foreign firms, etc. PI is easy to register and now - easy to close. Accounting is also simple, and there are plenty of online services. Tax - and you can start at all with 6%. Today in Russia there are 3,627,436 IPs , which is certainly not bad.

But still, this, the simplest form of entrepreneurship, has obvious disadvantages.

One of them is responsibility: when you read articles, and I do this at least once a week on this topic, you often come across “manuals” where they say that yes, the IE has a small hitch - he answers with all his property (about the exception in the form of necessary property and the like - I will not discuss, as it is written abound). It would seem, so what?

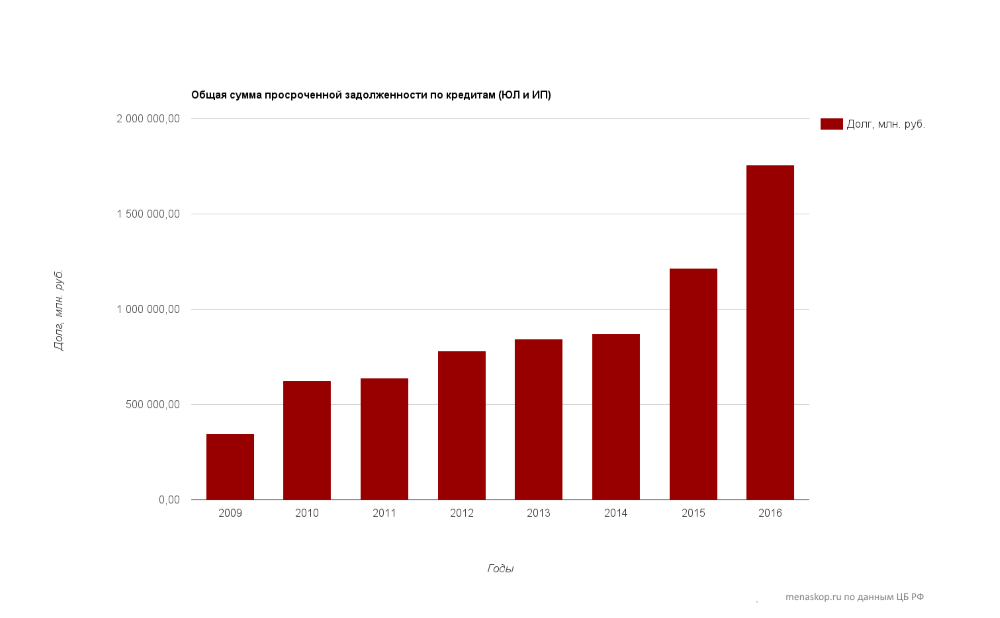

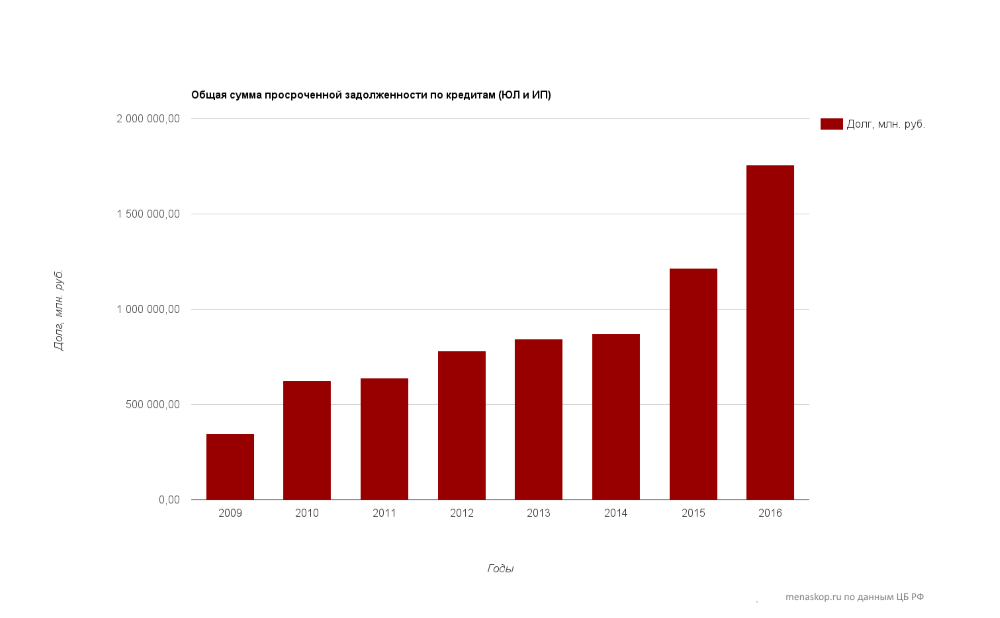

But here are the data from the official website of the Central Bank of the Russian Federation .

Schedule number 1. Total debt of individual entrepreneurs and legal entities for loans

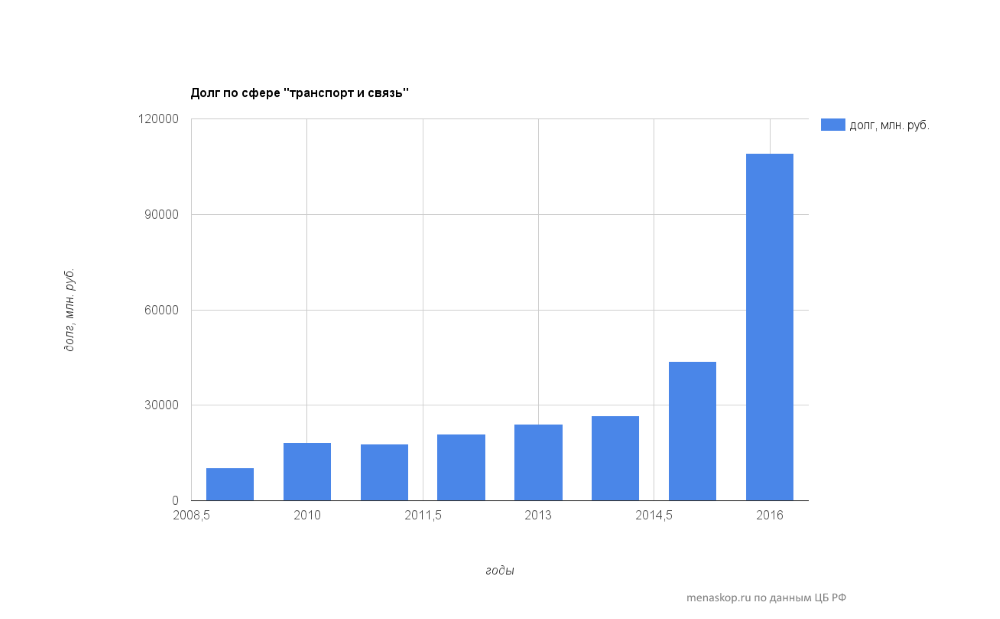

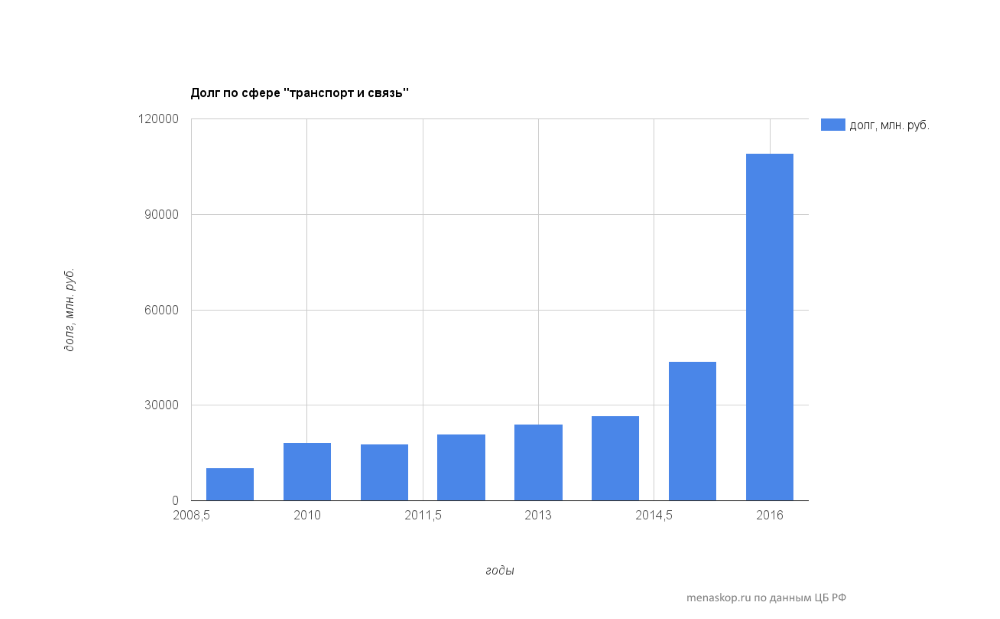

Schedule №2. Total debt of individual entrepreneurs and legal entities for loans in the field of "transport and communications"

In my opinion - the numbers say, maybe I'm wrong. In addition, there are statistics on loans .

If we turn to the press from statistics, the data is about the same: “According to Fitch, the Russians owed the banks about 11 trillion rubles last year. And there are about 40 million such debtors, more than half of the economically active population of the country. Able to service their debts - about 8 million. "

So it turns out that speaking in passing article 24 of the Civil Code of the Russian Federation may very soon have a completely different, tremendous value. I will quote: “A citizen is liable for his obligations with all property belonging to him, with the exception of property on which, in accordance with the law, no penalty can be levied”.

SP, I dare to remind, is in a literal reading an individual entrepreneur without forming a legal entity. And, if earlier the tax authorities often quoted the famous Art. 2 of the Civil Code of the Russian Federation, pointing out that entrepreneurial activity should be profitable (which is not true, since it should be directed towards this, but in the conditions of the market it is not always possible, otherwise everyone would do business just one, two done), then Now, for sure, will insist on reading the following: "... is an independent business which is carried out at your own risk activities aimed at systematically profit from the use of property, sale of goods, works or services by persons regis ovannymi as such in accordance with the law. "

Taking into account the general state of the economy, the scenario is more than real.

№2. Recent events

Not so long ago, Robokassa, at the direction of the Central Bank, which in itself is absurd, closed the calculations with individuals, which is explainable, but also with individual entrepreneurs, which is in general a direct violation of both the Civil Code and the Constitution: “everyone has the right to free use of their abilities and property for entrepreneurial and other economic activities not prohibited by law ”, as well as generally accepted principles and norms of international law, which, for obvious reasons, are now generally accepted to be forgotten, although they are even higher in legal force than the same CC, even more so - to the many steps up from any acts of the Central Bank.

Exactly the same pattern was followed (and according to the same instructions of the Central Bank) in the WebMoney system and less noticeable - IntellectMoney.

I do not even want to go into a legal analysis that this is nonsense, when the rules of “soft” law completely replace imperative provisions, because they have said it many times, but the fact that there is no legal mechanism to resist this scheme is surprising. More precisely, there is a mechanism, but no one is in a hurry to launch it and, apparently, it will not.

And again, there is a problem of IP property: it is easy to withdraw IP working capital because they are the means of the individual himself and vice versa (simplified, but I think it is clear what this is about). Therefore, the IP is painfully unprofitable for the Central Bank, since it is this approach to property that allows you to find workarounds for withdrawing funds, say, the most trivial approach - “return of unused funds”. The problem also lies in the fact that instead of improving the legal technique, as almost always, they decided to patch the hole with a ban. While valid. But as you know, the patch is always a temporary phenomenon.

In addition, the very procedure of working with individual entrepreneurs (and this is not looking at the fact that they actually blocked financial oxygen) for the same VM became complicated, in particular, it now needs to be registered with RosFinMonitoring in order to work under an agreement with WebMoney. But how much is this possible for small companies, of which not so little in the status of an entrepreneur? And why this measure, if everything goes through the banks in the end, and all the banks reporting are sent directly to the Central Bank? The question is open to me.

Actually, the Central Bank has already complicated IP life, tightening the nuts on spec. accounts (the Qiwi case turned out to be extreme in this sense, which does not negate the positive trends in this activity, in particular, the increase in the cost of laundering: from 5 to 10-12%). Actually, in this perspective, the Order of the Government of the Russian Federation of April 19, 2016 No. 724-p1 is very interesting, according to which “from July 1, 2016 (with some exceptions), inspectors of control bodies conducting inspections against entrepreneurs will be prohibited from requesting a series of documents and information ": the method of carrots and sticks in action?

Preliminary results

Thus, a situation arises when, for the IP economy, and especially in the IT field, since this is an area where any startup can become a millionth or even a billionth in a matter of months, not just that for years, is an important factor that also provides self-employment. population, which is too important in a crisis, but on the other hand, for the Central Bank it is a red rag that is easier to clean than develop standards on which the IP would have to work and develop.

Counterflow: 2016-2017 they just have to show how they will try to eliminate it, because over 3,500,000 living people are more than 2.5% of the total population of Russia, and 4.77% of the able-bodied people (data depending on sources may differ, but not too much). In my opinion, this is an occasion to think that the legislation, and first of all in the IT sphere as one of the most promising, takes the path of modernization, not tabooing. Of course, in this I am just a down and out idealist.

PS But freelancers in large numbers - namely IP.

Additions to the discussions (comments): the promise of the article is that now SP is a convenient form for start-up entrepreneurs, because PI is easy to register, easy to keep records, etc. But all this is done by the Government and other state authorities. The policy of the Central Bank of the Russian Federation, both in general on the monopolization of the financial services market, and the latest examples on Robokassa, WebMoney and IntellectMani showed that, despite all the trends, there is one, the most important one - the implementation of the Central Bank’s recommendatory acts that contradict the general logic of the development of legislation, since the Central Bank has its own logic and is simple: the PI has a legal path to circumvent the efforts of the Central Bank on the so-called “finding” of funds, so the PI can and should be temporarily or permanently turned into a dangerous and therefore ineffective form of business. The trend of lending, which is indicated above in the charts, can only contribute to enhancing this effect. This idea can be accepted or not, but the fact remains that everything is already shown and accomplished, and the general direction of the Central Bank, which I directly criticize, resulted in a huge fall of the ruble, the crisis in the public sector and the outflow of capital, which they are trying to block revoking licenses, acquiring cheap money, however, without thinking that the deposit insurance agency suffers, i.e. same state.

And to all the commentators who attacked me, but did not bother to reach for the links and bring proof, please

official figures, there is no official place .

It would seem, where does this, disputed at first glance, thesis: “The IP is under threat?”

')

№1. Observations

It is a known fact that in 2013-2014, especially in the so-called depressed regions (for example, Buryatia) after increasing payments to the Pension Fund of Russia, etc. were closed in large quantities - thousands of IP. Someone says that these were “empty cases”, but in reality the situation there was difficult. In 2015, like, the trend recovered - to growth.

PI is pure small business. Further, as a rule (which does not mean always) go to the LLC. Or even PAO, foreign firms, etc. PI is easy to register and now - easy to close. Accounting is also simple, and there are plenty of online services. Tax - and you can start at all with 6%. Today in Russia there are 3,627,436 IPs , which is certainly not bad.

But still, this, the simplest form of entrepreneurship, has obvious disadvantages.

One of them is responsibility: when you read articles, and I do this at least once a week on this topic, you often come across “manuals” where they say that yes, the IE has a small hitch - he answers with all his property (about the exception in the form of necessary property and the like - I will not discuss, as it is written abound). It would seem, so what?

But here are the data from the official website of the Central Bank of the Russian Federation .

Schedule number 1. Total debt of individual entrepreneurs and legal entities for loans

Schedule №2. Total debt of individual entrepreneurs and legal entities for loans in the field of "transport and communications"

In my opinion - the numbers say, maybe I'm wrong. In addition, there are statistics on loans .

If we turn to the press from statistics, the data is about the same: “According to Fitch, the Russians owed the banks about 11 trillion rubles last year. And there are about 40 million such debtors, more than half of the economically active population of the country. Able to service their debts - about 8 million. "

So it turns out that speaking in passing article 24 of the Civil Code of the Russian Federation may very soon have a completely different, tremendous value. I will quote: “A citizen is liable for his obligations with all property belonging to him, with the exception of property on which, in accordance with the law, no penalty can be levied”.

SP, I dare to remind, is in a literal reading an individual entrepreneur without forming a legal entity. And, if earlier the tax authorities often quoted the famous Art. 2 of the Civil Code of the Russian Federation, pointing out that entrepreneurial activity should be profitable (which is not true, since it should be directed towards this, but in the conditions of the market it is not always possible, otherwise everyone would do business just one, two done), then Now, for sure, will insist on reading the following: "... is an independent business which is carried out at your own risk activities aimed at systematically profit from the use of property, sale of goods, works or services by persons regis ovannymi as such in accordance with the law. "

Taking into account the general state of the economy, the scenario is more than real.

№2. Recent events

Not so long ago, Robokassa, at the direction of the Central Bank, which in itself is absurd, closed the calculations with individuals, which is explainable, but also with individual entrepreneurs, which is in general a direct violation of both the Civil Code and the Constitution: “everyone has the right to free use of their abilities and property for entrepreneurial and other economic activities not prohibited by law ”, as well as generally accepted principles and norms of international law, which, for obvious reasons, are now generally accepted to be forgotten, although they are even higher in legal force than the same CC, even more so - to the many steps up from any acts of the Central Bank.

Exactly the same pattern was followed (and according to the same instructions of the Central Bank) in the WebMoney system and less noticeable - IntellectMoney.

I do not even want to go into a legal analysis that this is nonsense, when the rules of “soft” law completely replace imperative provisions, because they have said it many times, but the fact that there is no legal mechanism to resist this scheme is surprising. More precisely, there is a mechanism, but no one is in a hurry to launch it and, apparently, it will not.

And again, there is a problem of IP property: it is easy to withdraw IP working capital because they are the means of the individual himself and vice versa (simplified, but I think it is clear what this is about). Therefore, the IP is painfully unprofitable for the Central Bank, since it is this approach to property that allows you to find workarounds for withdrawing funds, say, the most trivial approach - “return of unused funds”. The problem also lies in the fact that instead of improving the legal technique, as almost always, they decided to patch the hole with a ban. While valid. But as you know, the patch is always a temporary phenomenon.

In addition, the very procedure of working with individual entrepreneurs (and this is not looking at the fact that they actually blocked financial oxygen) for the same VM became complicated, in particular, it now needs to be registered with RosFinMonitoring in order to work under an agreement with WebMoney. But how much is this possible for small companies, of which not so little in the status of an entrepreneur? And why this measure, if everything goes through the banks in the end, and all the banks reporting are sent directly to the Central Bank? The question is open to me.

Actually, the Central Bank has already complicated IP life, tightening the nuts on spec. accounts (the Qiwi case turned out to be extreme in this sense, which does not negate the positive trends in this activity, in particular, the increase in the cost of laundering: from 5 to 10-12%). Actually, in this perspective, the Order of the Government of the Russian Federation of April 19, 2016 No. 724-p1 is very interesting, according to which “from July 1, 2016 (with some exceptions), inspectors of control bodies conducting inspections against entrepreneurs will be prohibited from requesting a series of documents and information ": the method of carrots and sticks in action?

Preliminary results

Thus, a situation arises when, for the IP economy, and especially in the IT field, since this is an area where any startup can become a millionth or even a billionth in a matter of months, not just that for years, is an important factor that also provides self-employment. population, which is too important in a crisis, but on the other hand, for the Central Bank it is a red rag that is easier to clean than develop standards on which the IP would have to work and develop.

Counterflow: 2016-2017 they just have to show how they will try to eliminate it, because over 3,500,000 living people are more than 2.5% of the total population of Russia, and 4.77% of the able-bodied people (data depending on sources may differ, but not too much). In my opinion, this is an occasion to think that the legislation, and first of all in the IT sphere as one of the most promising, takes the path of modernization, not tabooing. Of course, in this I am just a down and out idealist.

PS But freelancers in large numbers - namely IP.

Additions to the discussions (comments): the promise of the article is that now SP is a convenient form for start-up entrepreneurs, because PI is easy to register, easy to keep records, etc. But all this is done by the Government and other state authorities. The policy of the Central Bank of the Russian Federation, both in general on the monopolization of the financial services market, and the latest examples on Robokassa, WebMoney and IntellectMani showed that, despite all the trends, there is one, the most important one - the implementation of the Central Bank’s recommendatory acts that contradict the general logic of the development of legislation, since the Central Bank has its own logic and is simple: the PI has a legal path to circumvent the efforts of the Central Bank on the so-called “finding” of funds, so the PI can and should be temporarily or permanently turned into a dangerous and therefore ineffective form of business. The trend of lending, which is indicated above in the charts, can only contribute to enhancing this effect. This idea can be accepted or not, but the fact remains that everything is already shown and accomplished, and the general direction of the Central Bank, which I directly criticize, resulted in a huge fall of the ruble, the crisis in the public sector and the outflow of capital, which they are trying to block revoking licenses, acquiring cheap money, however, without thinking that the deposit insurance agency suffers, i.e. same state.

And to all the commentators who attacked me, but did not bother to reach for the links and bring proof, please

official figures, there is no official place .

Source: https://habr.com/ru/post/301316/

All Articles