Will the introduction of unconditional income lead to the unwinding of inflation?

Among the reactions to my first article on unconditional income, there is a predominance of the fear that after entering the database, all prices will simply start to rise, and the value of money will begin to fall, and will simply create a “new zero”. Let's call this argument the “new zero argument.”

ANN: although the idea of giving out money to everyone who needs it is noble, no one will benefit from it, since everything will cost more, especially rent. Therefore, entering the database does not make sense and will simply lead to the creation of a new zero.

In economic terms, it is the fear of inflation, or even hyperinflation, and this is perhaps the most popular reaction to the intention to transfer more money to the lower and middle classes. So how justified is this fear?

')

First, read the TED-Ed three-minute lesson on inflation and deflation.

Now that we know more about where money comes from, and why we need a little inflation, we need to understand that an idea with an unconditional income does not mean printing $ 3 trillion dollars every year and then scattering them from a helicopter.

Money that guarantees unconditional income may already exist and circulate in the economy. It will not be new money, but money that will go from one place to another. Therefore, the value of each dollar will not change, they will simply change their owners.

It is also important to note that a serious expansion of the money supply does not necessarily have to have a strong effect on prices. For example, the policy of quantitative bias from the Fed did not lead to sufficient inflation to which they aspired.

“Even after pumping trillions of dollars into the economy, the Fed does not manage to achieve an inflation rate of 2%, except in short-term periods. It is good that many critics predictions about hyperinflation were not confirmed. But the Fed has not reached its goals. In an economy that is trying to get out of a terrible debt pit, one of the main problems of which is huge unemployment, too little inflation can be disastrous and retard development. Quantitative easing was not powerful enough to create the desired inflation.

So, unconditional income, even if money was printed for it, would not necessarily lead to inflation. In addition, judging by the experience of introducing unconditional income, it does not cancel capitalism, but improves it. This increases entrepreneurial activity. There are also examples of the use of partial unconditional income that can be checked for inflationary effects.

In addition, we need to understand how increasing demand does not always directly affect price increases, and how real estate prices will behave in the case of the introduction of unconditional income. I divided all the evidence into four sections, which I called exhibits A, B, C, and D.

In 1982, Alaska introduced partial unconditional income paid annually to all its inhabitants. Before that, inflation was highest there compared to other states. But since then it has become the smallest.

Partial unconditional income was introduced in Kuwait in 2011, when each citizen was given $ 4,000. Everyone was terribly afraid of inflation, since it was so big there. As a result, the situation has improved, and inflation has decreased from record levels to 4%.

In other cases, researchers of unconditional income found examples of increasing entrepreneurial activity. People invest money in themselves and their future, create new enterprises and help move the economy. This means more competition for profits, better products and services at lower prices.

This is practical evidence that we should not be afraid of inflation.

In order to calm the fears of hyperinflation by scientific methods, it is important to understand the basic principles of the fluctuations of supply and demand, and how they relate to goods and services.

Where there is demand and supply is paid, demand is unlikely to change, since the main income simply replaces one payment method with another. Replacing food stamps with basic income will not force people to buy more milk. People will simply buy milk for money, not for coupons.

Where demand increases, depending on the product or service, supply may increase without additional effort, increase with the help of investments, or not increase. The latter case, in which prices may increase, is more related to luxury goods and services, rather than the main ones.

This is academic proof that you should not be afraid of inflation.

Usually, people are afraid of rising prices for rental housing when they first encounter the idea of unconditional income. But in this regard, you need to understand two things:

- Now in the USA there are five times more empty houses than homeless people. This indicates that there is a large amount of unused stock that you just need to make available. Most often this happens because people used to live in these houses, and now they cannot afford it. Unconditional income will correct this situation and bring people back to their homes.

- Technologies make a big contribution to the value of homes, especially in such a future, when everyone will have an unconditional income. Each month will receive an amount sufficient for rental housing, and will want to spend as little as possible from this amount. Homeowners will want to compete for this money with other owners. Win the smallest available offers. One example of this approach is the Google Homes project, when Google creates homes and rents them much cheaper than others. Another example is the affordable housing project WikiHouses.

These two reasons, coupled with the fact that for the first time everyone can really live wherever they want, a market of very cheap state-level houses will be created, and smart entrepreneurs will compete for dominance on it.

This is a theoretical proof that one should not be afraid of inflation.

The two less well-known economic problems are how we perceive the value of money in different ways, depending on how we received it, and how quickly we spend it.

There is a popular opinion that unearned money is felt differently than the money earned, and therefore it is easier to spend it. Since it is expected that people will quickly spend unearned money, there is a fear that after the introduction of unconditional income, people will start paying more for goods and services, which will lead to higher prices. However, this fear is not confirmed by observations - in Alaska, the opposite picture is observed.

The speed of money, that is, the frequency with which the dollar is spent in the economy, is another variable in the inflation equation. The greater the rate, the more inflation can be. But at the same time, the speed of money in general at the moment is the smallest in the entire history of the United States, if measured by its total money supply. But in reality, it has been falling since 2007.

A healthy economy needs a lot of speed.

This is an economic proof of not being afraid of inflation.

Inflation is not a natural disaster. This is a complex equation with many variables, and in the context of unconditional income, it does not look so scary.

After all, we have evidence of this.

After all, capitalism will only be improved in this way.

After all, technologies will develop, they will make goods, such as at home, cheaper.

After all, the capacity of the economy is underutilized, and under-consumption is systematic.

But what should be afraid ...

Unconditional income will lead to an increase in wages by increasing the ability of individuals to bargain and by reducing the number of employees, and therefore enterprises will have to raise the cost of production so that their profits do not decrease.

This means that if now your salary is $ 20,000 a year, you will not only get an increase of $ 12,000 a year, but also $ 10,000 from a salary increase. Your new income will be $ 42,000 per year, and products can grow by 1.4%.

Do you think that if you increase your income by $ 22,000 a year, you will overpay for $ 50? Even if you think, and even if you say that the prices of products will rise for everyone, including those who receive only $ 12,000 a year of unconditional income. Then you need to understand one more thing:

Any unconditional income should be indexed to outpace inflation .

The minimum wage has become outdated over time due to inflation and the fight against its increase, so an unconditional income should be raised every year to match inflation.

And it is better to index it, for example, to labor productivity, so that the achievements of society benefit each of its members, and not just the elect.

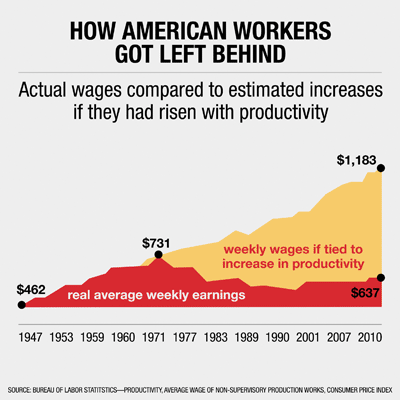

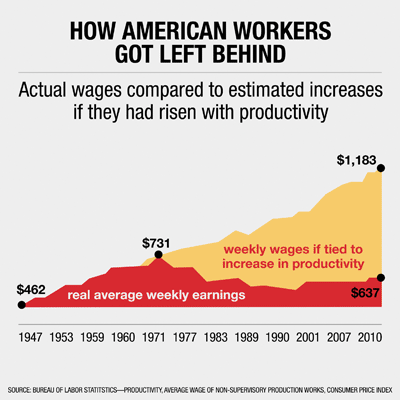

Real average weekly income compared to what could be calculated from the increase in total labor productivity

As a result, unconditional income would always grow faster than inflation, and every year we could buy more goods and services than in the previous year.

This opportunity is especially important to realize faster, in advance, bearing in mind that every year the achievement of progress reduces the need for human labor, and as a result, people's incomes. So why are you and I worried about inflation?

ANN: although the idea of giving out money to everyone who needs it is noble, no one will benefit from it, since everything will cost more, especially rent. Therefore, entering the database does not make sense and will simply lead to the creation of a new zero.

In economic terms, it is the fear of inflation, or even hyperinflation, and this is perhaps the most popular reaction to the intention to transfer more money to the lower and middle classes. So how justified is this fear?

')

First, read the TED-Ed three-minute lesson on inflation and deflation.

This does not mean that we have to print new money.

Now that we know more about where money comes from, and why we need a little inflation, we need to understand that an idea with an unconditional income does not mean printing $ 3 trillion dollars every year and then scattering them from a helicopter.

Money that guarantees unconditional income may already exist and circulate in the economy. It will not be new money, but money that will go from one place to another. Therefore, the value of each dollar will not change, they will simply change their owners.

It is also important to note that a serious expansion of the money supply does not necessarily have to have a strong effect on prices. For example, the policy of quantitative bias from the Fed did not lead to sufficient inflation to which they aspired.

“Even after pumping trillions of dollars into the economy, the Fed does not manage to achieve an inflation rate of 2%, except in short-term periods. It is good that many critics predictions about hyperinflation were not confirmed. But the Fed has not reached its goals. In an economy that is trying to get out of a terrible debt pit, one of the main problems of which is huge unemployment, too little inflation can be disastrous and retard development. Quantitative easing was not powerful enough to create the desired inflation.

So, unconditional income, even if money was printed for it, would not necessarily lead to inflation. In addition, judging by the experience of introducing unconditional income, it does not cancel capitalism, but improves it. This increases entrepreneurial activity. There are also examples of the use of partial unconditional income that can be checked for inflationary effects.

In addition, we need to understand how increasing demand does not always directly affect price increases, and how real estate prices will behave in the case of the introduction of unconditional income. I divided all the evidence into four sections, which I called exhibits A, B, C, and D.

Exhibit A: Evidence on the effect on inflation

So Alaska

In 1982, Alaska introduced partial unconditional income paid annually to all its inhabitants. Before that, inflation was highest there compared to other states. But since then it has become the smallest.

Partial unconditional income was introduced in Kuwait in 2011, when each citizen was given $ 4,000. Everyone was terribly afraid of inflation, since it was so big there. As a result, the situation has improved, and inflation has decreased from record levels to 4%.

In other cases, researchers of unconditional income found examples of increasing entrepreneurial activity. People invest money in themselves and their future, create new enterprises and help move the economy. This means more competition for profits, better products and services at lower prices.

This is practical evidence that we should not be afraid of inflation.

Exhibit B: supply and demand fluctuations

B means Basics (basic)

In order to calm the fears of hyperinflation by scientific methods, it is important to understand the basic principles of the fluctuations of supply and demand, and how they relate to goods and services.

Where there is demand and supply is paid, demand is unlikely to change, since the main income simply replaces one payment method with another. Replacing food stamps with basic income will not force people to buy more milk. People will simply buy milk for money, not for coupons.

Where demand increases, depending on the product or service, supply may increase without additional effort, increase with the help of investments, or not increase. The latter case, in which prices may increase, is more related to luxury goods and services, rather than the main ones.

This is academic proof that you should not be afraid of inflation.

Exhibit C: Home of Google and WikiHouse

C means Creativity

Usually, people are afraid of rising prices for rental housing when they first encounter the idea of unconditional income. But in this regard, you need to understand two things:

- Now in the USA there are five times more empty houses than homeless people. This indicates that there is a large amount of unused stock that you just need to make available. Most often this happens because people used to live in these houses, and now they cannot afford it. Unconditional income will correct this situation and bring people back to their homes.

- Technologies make a big contribution to the value of homes, especially in such a future, when everyone will have an unconditional income. Each month will receive an amount sufficient for rental housing, and will want to spend as little as possible from this amount. Homeowners will want to compete for this money with other owners. Win the smallest available offers. One example of this approach is the Google Homes project, when Google creates homes and rents them much cheaper than others. Another example is the affordable housing project WikiHouses.

These two reasons, coupled with the fact that for the first time everyone can really live wherever they want, a market of very cheap state-level houses will be created, and smart entrepreneurs will compete for dominance on it.

This is a theoretical proof that one should not be afraid of inflation.

Exhibit D: Unearned Income and Money Speed

D means Depression

The two less well-known economic problems are how we perceive the value of money in different ways, depending on how we received it, and how quickly we spend it.

There is a popular opinion that unearned money is felt differently than the money earned, and therefore it is easier to spend it. Since it is expected that people will quickly spend unearned money, there is a fear that after the introduction of unconditional income, people will start paying more for goods and services, which will lead to higher prices. However, this fear is not confirmed by observations - in Alaska, the opposite picture is observed.

The speed of money, that is, the frequency with which the dollar is spent in the economy, is another variable in the inflation equation. The greater the rate, the more inflation can be. But at the same time, the speed of money in general at the moment is the smallest in the entire history of the United States, if measured by its total money supply. But in reality, it has been falling since 2007.

A healthy economy needs a lot of speed.

This is an economic proof of not being afraid of inflation.

Fear of inflation

Inflation is not a natural disaster. This is a complex equation with many variables, and in the context of unconditional income, it does not look so scary.

After all, we have evidence of this.

After all, capitalism will only be improved in this way.

After all, technologies will develop, they will make goods, such as at home, cheaper.

After all, the capacity of the economy is underutilized, and under-consumption is systematic.

But what should be afraid ...

Salary increase

Unconditional income will lead to an increase in wages by increasing the ability of individuals to bargain and by reducing the number of employees, and therefore enterprises will have to raise the cost of production so that their profits do not decrease.

This means that if now your salary is $ 20,000 a year, you will not only get an increase of $ 12,000 a year, but also $ 10,000 from a salary increase. Your new income will be $ 42,000 per year, and products can grow by 1.4%.

Do you think that if you increase your income by $ 22,000 a year, you will overpay for $ 50? Even if you think, and even if you say that the prices of products will rise for everyone, including those who receive only $ 12,000 a year of unconditional income. Then you need to understand one more thing:

Any unconditional income should be indexed to outpace inflation .

Indexation of unconditional income

The minimum wage has become outdated over time due to inflation and the fight against its increase, so an unconditional income should be raised every year to match inflation.

And it is better to index it, for example, to labor productivity, so that the achievements of society benefit each of its members, and not just the elect.

Real average weekly income compared to what could be calculated from the increase in total labor productivity

As a result, unconditional income would always grow faster than inflation, and every year we could buy more goods and services than in the previous year.

This opportunity is especially important to realize faster, in advance, bearing in mind that every year the achievement of progress reduces the need for human labor, and as a result, people's incomes. So why are you and I worried about inflation?

Source: https://habr.com/ru/post/300540/

All Articles