On the road of disappointment: Twitter again failed to meet investors' expectations

Twitter once again disappointed investors by posting first-quarter results, which showed sluggish revenue growth. The microblogging service is trying to attract new users amid attempts to improve its complex interface with several new features, Reuters reports .

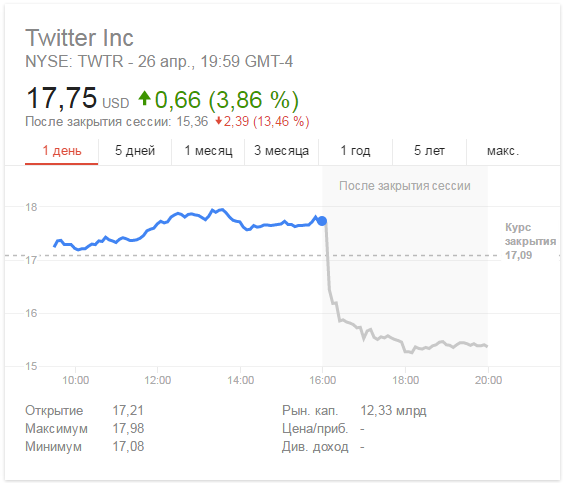

Against the background of the company's financial results, its quotes fell by 13.46% to $ 15.39 after the main session. At the close of trading the paper cost $ 17.75.

')

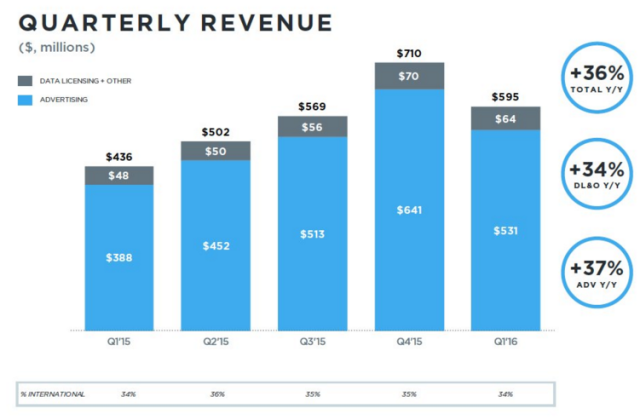

The company's revenue for the first quarter grew by 36%, to $ 594.5 million. Nevertheless, this value did not meet the expectations of analysts, who predicted revenue of $ 607.8 million.

Twitter lowered its revenue forecast for the next quarter by 12%. The company estimates it at $ 590-610 million. This is also not in line with analysts' predictions, which, according to a Thomson Reuters survey, expect an average revenue of $ 677.57 million.

The company predicts EBITDA (earnings before interest, taxes, and depreciation) of $ 145–155 million. The volume of capital expenditures for the whole of 2016, according to Twitter, will reach $ 300-425 million.

“The growth of brand revenue in comparison to year to year was lower than we expected. At the same time, this category of advertisers still accounts for a large part of our revenue ”, comment on the results in the company.

Twitter CEO Jack Dorsey said that the priority this year will be finding developers and other employees in the company's divisions.

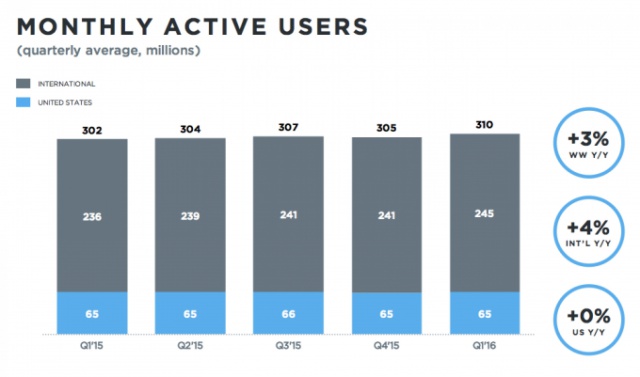

The monthly attendance of the service increased by 5 million to 310 million. In the fourth quarter of 2015, the company reported a drop in the number from 307 million to 305 million people.

BTIG analyst Rich Greenfield noted that the Twitter user base in the US, in the home service market, has not grown since last quarter. Re / code notes that this may be a bad sign for the company: perhaps it has reached a ceiling in its development.

Net loss of microblogging service Twitter Inc. in the first quarter of 2016, it fell by 51% in annual terms to $ 79.731 million. Net loss per share was 12 cents per share, instead of 25 cents per share last year.

Source: https://habr.com/ru/post/300444/

All Articles