The prophecy came true: Apple's financial results deteriorated for the first time in 13 years

Source: CNBS

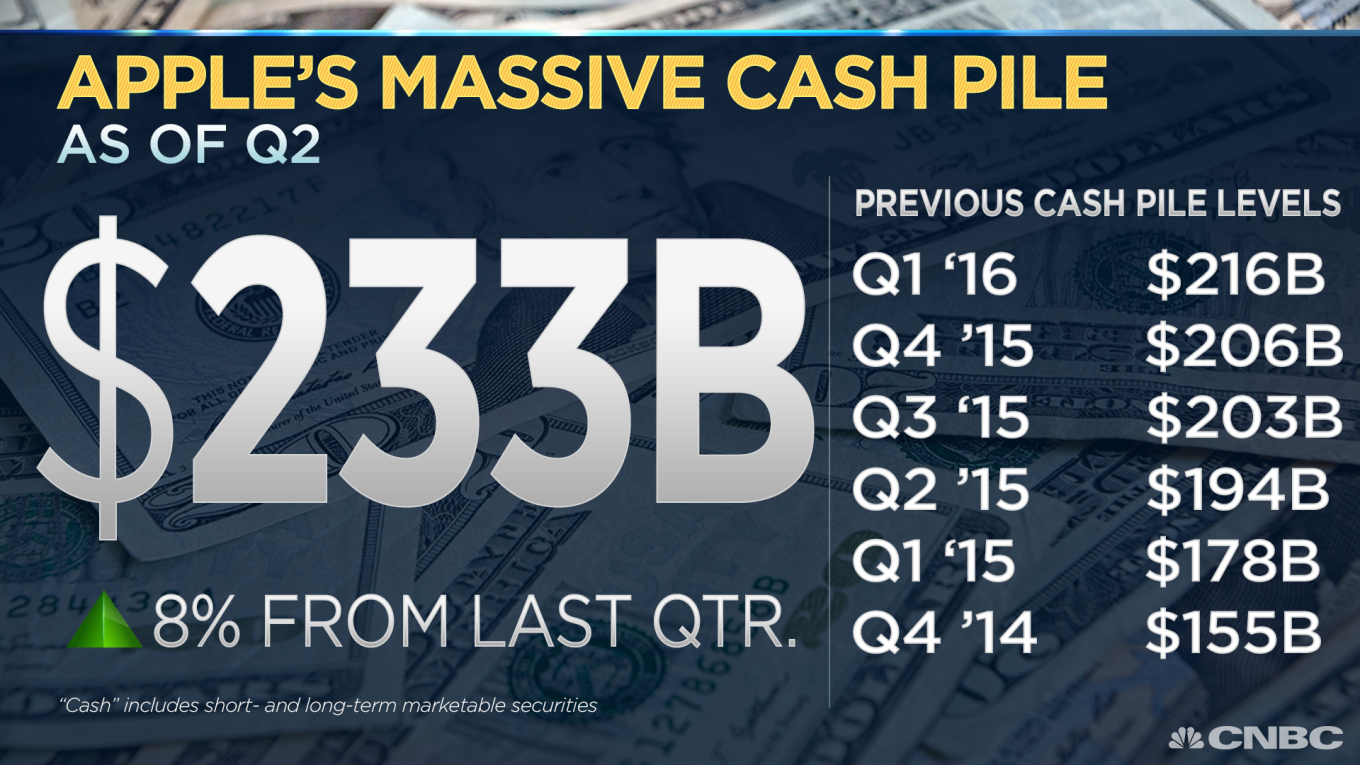

On April 26, after the closing of the main session of trading on the stock exchange in New York, the quotes of the most expensive company in the world fell by almost 8%. The fall occurred against the background of the company's performance in financial quarter II . This in turn caused a drop in quotations of Asian suppliers of the corporation.

In the second quarter of 2016 fiscal year, there was a decrease in iPhone sales for the first time since the launch of smartphones in 2007 and the first decline in revenue since 2003, writes The Verge, citing company reporting.

')

Apple CEO Tim Cook said that he is ready for major asset acquisitions to solve the company's growth problems. Over the past four quarters, Apple has acquired 15 companies, Cook announced during a newsgroup. But apparently, none of the transactions were large enough to inform shareholders about them earlier.

Unlike other Silicon Valley giants ( Alphabet , Cisco , Facebook ), Apple never made large-scale purchases, the biggest deal in its history was the acquisition of headphone maker Beats Electronics for $ 3 billion in 2014. And that is why Cook's words about the possibility of a big M & A deal attracted increased market attention.

In the first three months of 2016, Apple reduced its net profit by 22.8% - to $ 10.5 billion, compared with $ 13.6 billion in the same period in 2015.

Apple's quarterly revenue fell 12.8% from $ 58 billion to $ 50.6 billion, which is close to the bottom of the company's own forecast ($ 50-53 billion).

Analysts polled by Thomson Reuters, predicted Apple's profit at the level of two dollars per share on revenue of $ 51.97 billion. Earnings per share decreased by 18.5% on the back of the share buyback program (buyback) from $ 2.33 to $ 1.90.

In the second fiscal quarter, Apple sold 51.19 million iPhones against 61.17 million in the comparable period of the previous year, according to company reports. Wall Street analysts on average were expecting a fall - up to 50 million.

The sales of iPads fell to 10.2 million, Macs - four million, while analysts expected them to be at 9.95 million and 4.53 million, respectively. The number of iPads sold fell by 19% compared with the second quarter of last year, while sales of computers fell by 12%.

News of the fall in sales of Apple did not come as a surprise to investors: the company itself in January warned of an unusually low increase in the number of orders for the iPhone, noting that this could adversely affect the results of the second quarter.

The average price of smartphones sold for the quarter was $ 642, while in the previous quarter the figure was $ 691. The decrease in the average price of the financial director Luca Maestri explained the popularity of cheap iPhone 5s and the average price of iPhone 6 and 6 Plus and the fact that buyers are less likely to change their old smartphone to a new one.For the current (third) fiscal quarter, Apple forecasts revenue in the range of $ 41 billion to $ 43 billion. Representatives of the company noted at the same time that the real demand for her smartphones is still higher than her own expectations. The consensus forecast of Wall Street was significantly higher - $ 47.3 billion.

Smartphones provide Apple with two thirds of revenue. In February, analysts at Gartner calculated that in the fourth quarter of 2015, the number of iPhones sold decreased by 4.4% year-on-year. They noted that this was the first decline in smartphone sales in the company's history.

The head of the company, Tim Cook, said that Apple in the second quarter showed good results, given the strong headwinds macroeconomic winds. The gain was affected by the strengthening of the dollar, without it, sales would have decreased only by 9%, and not by 13%.

Despite the fall in sales of the main product, Apple services such as the App Store , Apple Music and Apple Pay were popular in this financial quarter. Revenue from them was $ 6 billion, up 20% from last year.

The number of subscribers to Apple Music has grown to 13 million. In February, it did not exceed 11 million.

Apple also announced an increase in quarterly dividends to 57 cents per share.

San Jose Mercury News published yesterday a list of Silicon Valley 150. The ranking of the most profitable companies is based on financial indicators recorded in the four reporting quarters.

First place in the ranking was taken by Apple, in which last year's sales amounted to $ 235 billion. Next comes Alphabet, which earned $ 75 billion in a year.

Source: https://habr.com/ru/post/300436/

All Articles