Money20 / 20 Europe 2016: Conference Overview

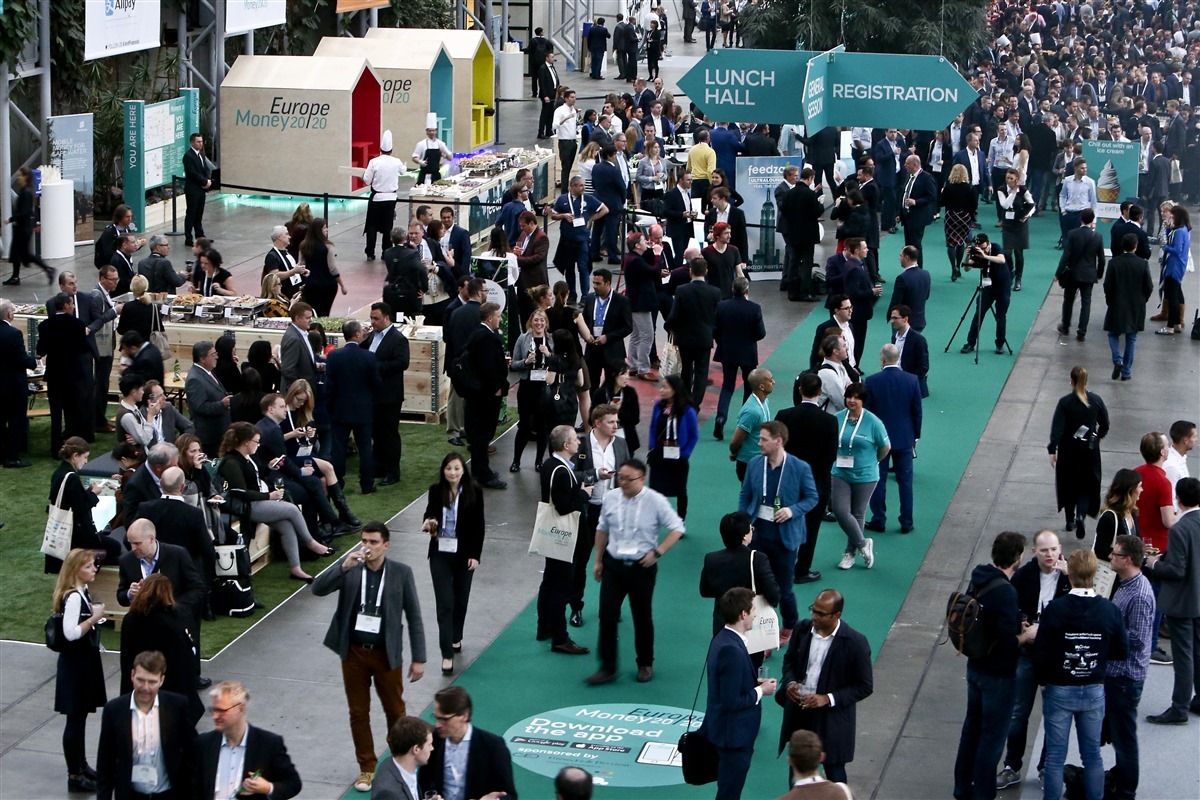

This month, the Money20 / 20 Europe 2016 Financial and Technology Conference, the European version of the famous Money20 / 20 Forum, which is usually held in the US in Las Vegas, took place in Copenhagen, the capital of Denmark. The event gathered more than 3.7 thousand guests and 422 speakers from 75 countries. More than 200 sponsors took part in organizing the conference. More than 100 media partners of Money20 / 20 Europe were engaged in covering the main events of the four-day “marathon”.

This month, the Money20 / 20 Europe 2016 Financial and Technology Conference, the European version of the famous Money20 / 20 Forum, which is usually held in the US in Las Vegas, took place in Copenhagen, the capital of Denmark. The event gathered more than 3.7 thousand guests and 422 speakers from 75 countries. More than 200 sponsors took part in organizing the conference. More than 100 media partners of Money20 / 20 Europe were engaged in covering the main events of the four-day “marathon”.An event of this scale can not be ignored. We at PayOnline , an international payment acceptance system, have prepared for you an overview of the most interesting and significant from our point of view theses of Money20 / 20 Europe 2016.

A rich program of the forum united the conference and exhibition zones. On the very first day, experts from BBVA, Visa and MasterCard spoke at the Money20 / 20 Europe site, presenting the latest news of their companies. Google, Samsung, Amazon and Alipay were represented by a whole delegation of directors.

A common message to all financial institutions participating in the Money 20/20 conference was the message: “We are open for cooperation.” All of them are ready to listen and discuss possible conditions with great desire. Yes, each of them works within the framework of its own streamlined processes, however there are also innovative units in such companies that allow them to adapt quickly. Some major players, such as ING, establish individual corporate entities whose main activity is technology testing. In general, all major players understand that the consumer does not intend to wait until everything is done in the old manner. Therefore, large companies are ready to act now.

')

One of the loudest statements made at Money20 / 20 Europe was the news that the Chinese Alipay mobile payment service will be launched in Europe this summer. Alipay will start moving west from Great Britain, France and Germany. In May, the company will release an updated application to which the Local Services Platform function will be added, giving recommendations on shopping with geolocation.

Amazon offered online stores, whose products are presented on the retailer's portal, their Amazon Payments payment service. The main goal of this step is the company's desire to help sales partners expand their ability to receive payments. According to Amazon Payments Vice President Patrick Gautier, this will also increase customer confidence. The affiliate program will be implemented through software developers for e-commerce, including Shopify, Presta Shop and Future Shop. These companies will provide ready-made links for payment services, training and marketing support. At the moment, the program is open, but so far only available in 4 countries: USA, Germany, Great Britain and Japan.

Diebold spoke about his new mobile banking concept and introduced the Cryptera security application. In addition, the company introduced a new concept of an ATM for mobile devices , which issues and accepts cash without a screen, card reader or keyboard. Instead, the ATM uses the client’s mobile device as the main interface. According to the company representative, the concept was developed taking into account the modern pace of life, the new machines will allow customers to get faster and more convenient access to cash.

Verifone, one of the world leaders in the field of payment and commercial solutions, introduced Verifone Carbon, a beautiful, flexible payment terminal that uses all the power of modern “iron stuffing” and embedded software. Verifone Carbon is a business solution suitable for owners of cafes, fast food restaurants and retail stores. A characteristic feature of the device is the presence of two high-resolution screens optimized for the seller and the buyer.

Panasonic presented a contactless payment terminal for aircraft, allowing passengers to pay for food and services using a contactless card. At the moment, the terminal works only with MasterCard cards. In the near future, Panasonic plans to complete negotiations with other payment companies, including American Express, Union Pay and Visa.

Another interesting payment solution presented by the company Droplet. The Zero Touch billing service allows UK residents to make purchases using cameras. The system "identifies" the buyer and transmits all available information about him on the screen of the seller. The buyer, in turn, can pay for purchases without the need to use a card, smartphone or other payment instrument, money is automatically deducted from the account after passing the identification and payment confirmation procedure.

Giants of the financial world, such as HSBC, publicly discussed a full-fledged two-year strategy to create a bank without borders, providing services to customers from around the world. The launch of AtomBank was announced at the conference , Mondo and TandemBank were present , confirming the reality of this approach.

MasterCard has expressed interest in working with social media giants Facebook and Twitter in order to create their own payment services.

“We see what a place on the social media market is occupied by companies such as Facebook and Twitter, so our representatives are sitting in Silicon Valley and negotiating with them,” said Ann Cairns, president of international markets, MasterCard, during an interview with CNBC.

The representative of MasterCard clarified that the result of the joint work could be “the emergence of something like a direct payment service between network users”. Of course, the Facebook Messenger application in some countries already allows you to make money transfers to your friends. But MasterCard wants to go even further and add the ability to make payments to the existing functionality. As for Twitter, this social network already offers commercial services to retailers, in particular, placing the “buy” button in their tweets. Cairns also added that collaboration with Facebook and Twitter is likely to follow the same pattern the company works with other partners.

Western Union has announced the launch of a new B2B platform that allows you to create connections between companies and provides them with the ability to make mutual settlements. Making international transfers is not an easy task for a business, since signing and fulfilling the conditions of individual agreements with suppliers through traditional channels requires considerable effort and attention. Floating exchange rates can also cause a lot of trouble and lead to losses. Western Union's B2B division called Western Union Business Solutions was created to eliminate such problems. The platform is powered by Edge, which allows businesses to establish relationships with each other and work on invoicing and payments.

QIWI and CONTACT are the only Russian companies that have placed a booth at the Money20 / 20 Europe Expo Center. At the joint stand of the companies, the projects of money transfer and payment services, as well as e-commerce solutions were presented - a direct payment and logistics gateway to Russia for merchants and consumers from around the world.

BBVA CEO Carlos Torres Vila shared information that the bank is now devoting the lion's share of its attention and investment to design, wishing to better adapt to the new user experience. Under the word "design" expert means not only the appearance, but also the whole process of interaction between people. Torres Vila noted:

“Many startups choose one tiny part of what banks do. However, there are so many of them that together they cover all the activities we do. In each such tiny part there is a dozen of companies that do their job well. At the same time, their capabilities are much longer ours, but the value for the client is greater.

Other themes of European Money 20/20 were blockchain, increasing the availability of digital technologies and methods of digital and biometric identification.

Microsoft announced a strategic partnership with R3 . The consortium participants will work together to develop blockchain-based solutions suitable for use in everyday life. First of all, the partners intend to modernize banking processes and simplify operations through the introduction of distributed registry technology, which ultimately will save billions of dollars.

Continuing the blockchain theme, a representative of the Isle of Man Government, Brian Donegan, expressed the opinion that it was high time for the financial industry to write a law similar to the Internet law signed by Bill Clinton in 1996, which actually launched the development of the global network. Founder and Managing Director of Trust EU Affairs Monica Monaco, in turn, announced a trial version of the legal framework for AML and KYC for cryptocurrency in the EU, it will be presented in September 2016.

Many presenters talked about the relevance and importance of biometric technology for their business and how these technologies became part of their products and identification management procedures. Ann Cairns, a MasterCard representative, spoke about the growth in overall demand for MasterCard services, which occurred after the company launched biometric selfies as an authentication strategy. Andy Maguair, HSBC's chief operating officer, also mentioned the role biometric technologies can play in compliance control and cost cutting.

The topic continued the public discussion. The key expert who skillfully guided the conversation in the right direction was Peter O'Neill, Chief Director of FindBiometrics. Emilio Martinez from Agnitio, Clive Burke from Daon, Craig Ramsey from HSBC and Olov Renberg from BehavioSec also participated in the conversation. Experts unanimously concluded that the introduction of biometrics in large enterprises and banks requires a platform approach. Not all forms of biometric interaction are equally good for every task and, as a result, they cannot single-handedly meet the requirements of “single-channel interaction”, which is key for both consumers and large companies. Peter O'Neill expressed a common opinion for all participants that thanks to the success of Apple, Samsung and Android in the introduction of biometric technology, the latter are now becoming widely available.

Of course, it was not without discussion of the problem of protecting personal information. Are the laws regulating these issues equally in different countries of the world? Of course not. Based on their global experience, HSBC speakers said that things that are considered acceptable and easily accepted by consumers in the United Kingdom are not always acceptable in other countries. This once again confirms the need for an individual approach to the consumer in terms of the use of certain biometric technologies in each individual country, since this subject is closely related to security certification, data storage and encryption standards. Is there a need for regulation? Yes. There is a lot of work to be done and FIDOAlliance should play the role of the main player, however, practical application is already taking place now, so regulation does not always keep pace with real processes.

The review was prepared using LTP and Linkedin materials. Subscribe to our blog, there are still many interesting posts ahead. And if you need to organize payment acceptance on the website or in a mobile application, please contact our specialists with pleasure to answer all your questions and help with integration.

Source: https://habr.com/ru/post/300292/

All Articles