Online Store Accounting: Beginner's Guide

Accounting, registration, tax reporting ... After these words, it is terrible to start a business. Bolder! In fact, everything is quite simple. In the article I will tell you how to set up accounting and tax accounting in the online store. You will learn:

Read if you are going to open your business or start working officially.

Just a private owner will not be able to create any serious online store. If only because it will not be able to conclude an agreement with the bank for acquiring (receiving money from credit cards). If you are going to sell for more than 100 thousand rubles a month, you need official registration. For small businesses, there are only two such forms - IP (individual entrepreneur without forming a legal entity) and LLC (limited liability company). To choose from them, you need to answer five questions:

')

Determine which category your products belong to:

The company is only liable for claims in the amount of its own assets, the individual entrepreneur is responsible for all of its property. So, if someone becomes ill from the farm cottage cheese sold by you, the LLC will not be taken away more than it has money and goods, and the IE can take away everything, including the car and the favorite purebred cat (there are nuances: select the only housing and a minimum of things necessary for living. The owner of an LLC may, under certain conditions, also be deprived of property, but it is more difficult to do it. Read more in the article ).

At high speeds, an IE cannot use a simplified taxation system, and it becomes more profitable to open an LLC. For 2016, the ceiling is set at 79 million rubles.

PI is one owner. If there are several of you, then you need to open an LLC.

To sell a store registered on the IP, you need to issue a lot of documents. Sell Ltd. is much easier. In general, the sale of a business is a complex, multifaceted question. Be sure to consult with those who have already done it at least once. If you do not find such a person in your environment - write to me.

Ltd. may suspend its activities without loss, and the PI have obligatory payments (pension and medical insurance).

So, if at least one statement is true:

... then you need an LLC. Otherwise, enough IP.

If your sales volume is more than 79 million rubles a year, only ESSENTA will do.

ESS is a common taxation system. These are all the charms of a large company: VAT, balance sheets, a bunch of different taxes, etc. Suitable for large merchants and those who work with large commercial and industrial enterprises. You hardly need this, at least not for the first year.

If less, choose a simplified tax system . It is much easier to keep records, you can use online accounting services, and such firms are less likely to check the tax. There are two simplified systems:

1. Revenues minus expenses (tax 15%)

You have the right to deduct from the income received the cost of goods, expenses on the Internet, website creation, delivery, etc. With the resulting profit you need to pay 15% tax>. Suitable for those who resell goods, but does not produce itself. To deduct expenses, they must be paid, received, and related to your business.

Example: If you are selling electronics, then the cost of pre-sales preparation and adjustment of equipment can be deducted from the taxable amount. But a tax inspector is unlikely to accept a receipt for the purchase of 5 kg of mandarins and a bottle of wine.

2. Income (tax 6%)

You will pay 6% tax on all amounts received. No expenses can be deducted from them. It is suitable if you have few documented expenses (for example, you sell something made by yourself), or a very large markup.

Now you need to prepare and submit documents for registration. Before you begin, select from the classifier the types of activities (this is mandatory for tax), and for an LLC, the company name and address.

You can choose several types of activity by classifier (OKVED), it all depends on what else you are going to do. On the Internet, many articles on the choice of OKVED, look. For the online store, you should definitely choose code 52.61, Retail by Orders . This will be your main code.

Code 52.61 is a group. It includes codes 52.61.1, Retail postal (mail-order) trade and 52.61.2, Retail trade, carried out through television stores and computer networks (electronic commerce, including the Internet). In theory, the codes inside the group do not need to be specified if you selected a group. However, in some regions, tax inspectors have their own understanding of the law, and they may refuse to register if only a group is indicated. They will be wrong, but you are no better off. Therefore, just in case, specify all three.

In addition to the main code, you can select additional. Without need, do not register unnecessary OKVED, and indeed for a start-up company it is undesirable to have more than seven pieces - too many OKVEDs can attract tax attention and you may be asked for an explanation.

It should be short and easy to pronounce. It is very likely that you will have to dictate it to your partners on the phone - you need to make sure that they understand you completely. Great if the name matches your domain or store name.

The address must be before registration. Tax in the fight with one-day firms seriously tightened registration and this creates difficulties for real companies. To register, you must have a letter of guarantee or a preliminary lease agreement with the owner of the premises. Be prepared for the fact that the tax inspector will visit the owner and make sure that the premises really exist and will be given to you. Approximately the same procedure now with the opening of a settlement account in the bank.

So, we have OKVED codes, name, address and tax system. If time is dear to you, contact specialists ( accounting outsourcers ). Their mass is next door to you, they are easily searched for by the request “registration of individual entrepreneurs and LLC”. They will do everything on their own with the parameters you specified.

If you want to save, use the online service for the preparation of documents for self-registration of the FE and LLC. I recommend the My Case service: registration of individual entrepreneurs and registration of LLC . Everything is free. Please note: you just prepare the correct documents. Take them to the tax will have to themselves. Instructions for further steps there, on the site of the service.

You started selling. What documents should an online store issue?

Immediately after placing and paying for the order, you must send the customer a confirmation of the purchase by e-mail. This is just a free form letter . It will be generated and sent automatically by your e-commerce system. It can be of almost any kind and form, there should be only a few required fields :

A letter can be with pictures, photographs, the most intricate fonts and colors. Large scope for individualization! Most systems allow you to create your own template. In Ecwid you can edit the letter on any paid plan.

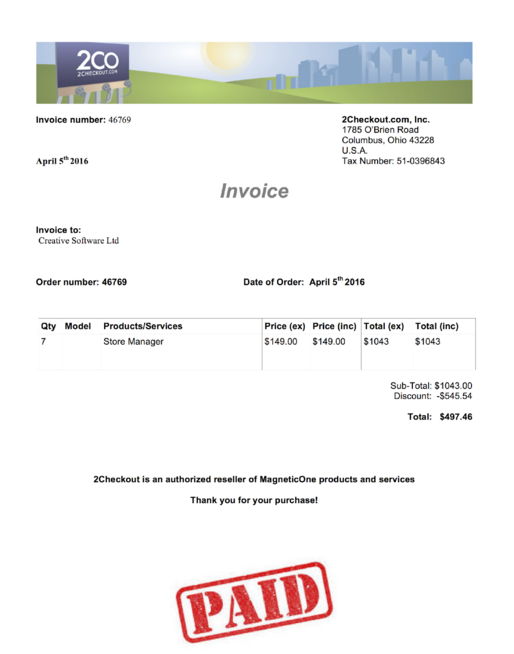

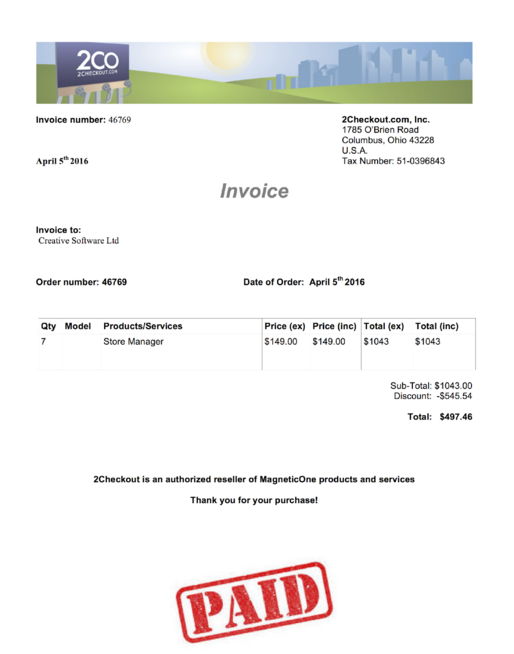

Together with the goods in the parcel the buyer is put the invoice (in Internet sales, it is also called invoice ). The information in it duplicates the letter. It will also be prepared by your e-commerce system. And yes, it can also be arranged as you like! Here is a good example of an invoice:

If your product is electronic, then you do not send the invoice. The buyer can independently enter his personal account in the store and click on the link “Download invoice”. Even in Russia, e-invoice has recently been sufficient, while abroad this is the norm for a long time.

Important: Some carriers require to issue invoices on their own form. For example, when you send goods by Russian Post , you will need special forms (in Ekvide, you can fill them in automatically, connect the application ). Specify in advance what form is needed and whether your e-commerce system is able to prepare such documents. If not, you can print invoices through 1C or “My warehouse”.

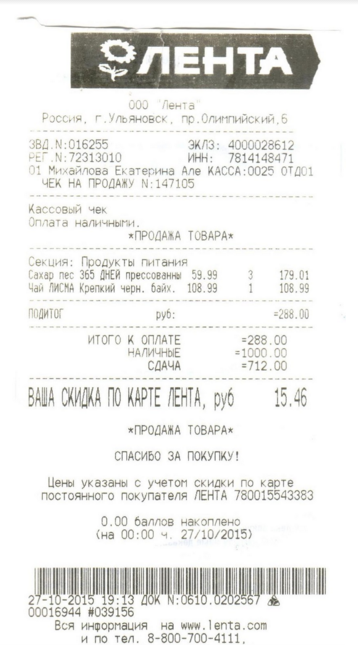

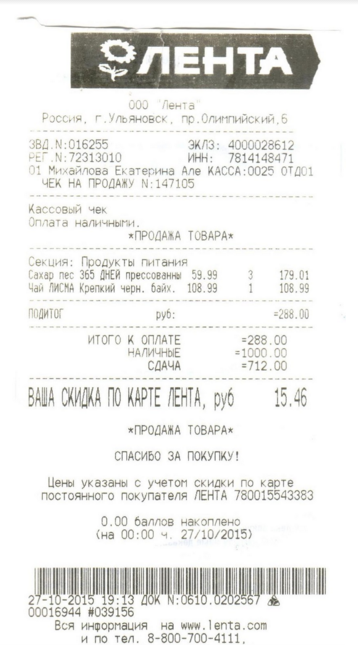

If you are going to trade for cash (payment upon receipt of the goods), then you will be required to issue a cash voucher to the customer. For this we need mobile cash register machines (cash registers). Such a device is issued to the courier along with the invoice. To issue a check, you must pay special attention! The algorithm of actions of the cashier is prescribed in the laws and instructions of the FTS and should be as follows:

Important: If your courier violates the algorithm and runs into a tax officer who is not in the spirit, he may bring you a serious fine for not using the cash register. To break the law and get on a fine, it is enough, for example, to issue a check after delivery or to give up the goods before issuing a check.

If you have a cash register, combined with a POS terminal, your courier will also be able to accept payment using bank cards right at the time of issuing the goods (acquiring). The only difference is that you will have to issue two checks: cashier's check and slip (credit card withdrawal check).

The choice of terminals and a CCM is wide, the legislation in this area is changing rapidly, and I would not rely on one source of information. Be sure to visit several firms selling cash registers. Go through the major banks of your city and talk to them about mobile terminals. Russian Standard, VTB and Sberbank have a lot of experience in acquiring and they can provide terminals for free. Read the latest articles about the choice of apparatus. Otherwise, you risk to buy the device, which in six months will have to be changed due to the changed legislation.

Cashier checks must be approved by the tax authority. They will print you CCM, again, you do not need to manually write out anything. Your details in KKM will be registered in the company where they will be sold to you. In some cash register check can also be branded - insert your logo there. Ask your cash register supplier about this.

The first rule of tax reporting is not to do it yourself. Our legislation is crooked and constantly changing, take a professional. There are several options:

Expensive, it is necessary to provide a workplace (computer + software), and it is difficult to find a good accountant.

This option should be chosen in very rare cases:

In all other cases, other options will be more profitable.

Thousands of them. You can choose a company from any city. If the outsourcer correctly put the work, then you do not have to see, the documents can be exchanged via the network. There are many articles on the Internet, how to choose such an accounting company. Good outsourcer:

For example, a very good outsourcer of APB (Association of Professional Accountants). Satisfies all the above conditions. Just contact through the feedback form or write. Equido is the accounting department of APB.

The already mentioned “My Case ” prepares reports and independently sends them to the tax office on the basis of the documents entered by you. The service is easy to use, inexpensive and reliable. Online services are suitable for IP and LLC on a simplified tax system. But be prepared that you will have to work as an operator - independently enter documents into the system.

In the age of information technology, manually copying documents from one system to another is not comme il faut. Ekvidd and most other online shopping management systems have integration with 1C . If you are going to use other programs or services, then Ecwid has unloading csv for importing into third-party systems.

Finally, I remind you that in Russia you cannot sell online stores:

Author: Alexander Kovalenko - Operational Director at Ekvide and founder of the accounting company APB.

Alexander on Facebook and Twitter .

- how to choose an organizational form for an online store - IP or LLC;

- which accounting system to choose - a basic or a simplified one;

- how to register a PI or LLC;

- what documents the online store should issue;

- where to find an accountant for an online store;

- how to submit tax reports.

Read if you are going to open your business or start working officially.

Five questions about IP and LLC

Just a private owner will not be able to create any serious online store. If only because it will not be able to conclude an agreement with the bank for acquiring (receiving money from credit cards). If you are going to sell for more than 100 thousand rubles a month, you need official registration. For small businesses, there are only two such forms - IP (individual entrepreneur without forming a legal entity) and LLC (limited liability company). To choose from them, you need to answer five questions:

')

1. What exactly are you going to sell?

Determine which category your products belong to:

- Simple goods : everyday industrial things, dishes, crafts, small inexpensive electronics, clothing, accessories for mobile.

- A product for which there may be claims : something that may be harmful to health (for example, perishable products), expensive goods with a warranty period (expensive electronics, etc.).

The company is only liable for claims in the amount of its own assets, the individual entrepreneur is responsible for all of its property. So, if someone becomes ill from the farm cottage cheese sold by you, the LLC will not be taken away more than it has money and goods, and the IE can take away everything, including the car and the favorite purebred cat (there are nuances: select the only housing and a minimum of things necessary for living. The owner of an LLC may, under certain conditions, also be deprived of property, but it is more difficult to do it. Read more in the article ).

2. How much per year are you going to sell?

At high speeds, an IE cannot use a simplified taxation system, and it becomes more profitable to open an LLC. For 2016, the ceiling is set at 79 million rubles.

3. Do you own one shop or do you have partners?

PI is one owner. If there are several of you, then you need to open an LLC.

4. Do you build an online store for yourself or intend to sell it later?

To sell a store registered on the IP, you need to issue a lot of documents. Sell Ltd. is much easier. In general, the sale of a business is a complex, multifaceted question. Be sure to consult with those who have already done it at least once. If you do not find such a person in your environment - write to me.

5. Are you going to take a big break in your trading?

Ltd. may suspend its activities without loss, and the PI have obligatory payments (pension and medical insurance).

So, if at least one statement is true:

- you sell a product for which you can make serious claims;

- the sales volume is expected to be more than 79 million rubles;

- you have or will have a partner;

- you have thoughts in the near future to sell your online store;

- your sales may stop for a long time ...

... then you need an LLC. Otherwise, enough IP.

Choice of accounting system

If your sales volume is more than 79 million rubles a year, only ESSENTA will do.

ESS is a common taxation system. These are all the charms of a large company: VAT, balance sheets, a bunch of different taxes, etc. Suitable for large merchants and those who work with large commercial and industrial enterprises. You hardly need this, at least not for the first year.

If less, choose a simplified tax system . It is much easier to keep records, you can use online accounting services, and such firms are less likely to check the tax. There are two simplified systems:

1. Revenues minus expenses (tax 15%)

You have the right to deduct from the income received the cost of goods, expenses on the Internet, website creation, delivery, etc. With the resulting profit you need to pay 15% tax>. Suitable for those who resell goods, but does not produce itself. To deduct expenses, they must be paid, received, and related to your business.

Example: If you are selling electronics, then the cost of pre-sales preparation and adjustment of equipment can be deducted from the taxable amount. But a tax inspector is unlikely to accept a receipt for the purchase of 5 kg of mandarins and a bottle of wine.

2. Income (tax 6%)

You will pay 6% tax on all amounts received. No expenses can be deducted from them. It is suitable if you have few documented expenses (for example, you sell something made by yourself), or a very large markup.

Registration of SP or LLC

Now you need to prepare and submit documents for registration. Before you begin, select from the classifier the types of activities (this is mandatory for tax), and for an LLC, the company name and address.

1. Type of activity on OKVED

You can choose several types of activity by classifier (OKVED), it all depends on what else you are going to do. On the Internet, many articles on the choice of OKVED, look. For the online store, you should definitely choose code 52.61, Retail by Orders . This will be your main code.

Code 52.61 is a group. It includes codes 52.61.1, Retail postal (mail-order) trade and 52.61.2, Retail trade, carried out through television stores and computer networks (electronic commerce, including the Internet). In theory, the codes inside the group do not need to be specified if you selected a group. However, in some regions, tax inspectors have their own understanding of the law, and they may refuse to register if only a group is indicated. They will be wrong, but you are no better off. Therefore, just in case, specify all three.

In addition to the main code, you can select additional. Without need, do not register unnecessary OKVED, and indeed for a start-up company it is undesirable to have more than seven pieces - too many OKVEDs can attract tax attention and you may be asked for an explanation.

2. Name for LLC

It should be short and easy to pronounce. It is very likely that you will have to dictate it to your partners on the phone - you need to make sure that they understand you completely. Great if the name matches your domain or store name.

3. Address for LLC

The address must be before registration. Tax in the fight with one-day firms seriously tightened registration and this creates difficulties for real companies. To register, you must have a letter of guarantee or a preliminary lease agreement with the owner of the premises. Be prepared for the fact that the tax inspector will visit the owner and make sure that the premises really exist and will be given to you. Approximately the same procedure now with the opening of a settlement account in the bank.

Ways to register

So, we have OKVED codes, name, address and tax system. If time is dear to you, contact specialists ( accounting outsourcers ). Their mass is next door to you, they are easily searched for by the request “registration of individual entrepreneurs and LLC”. They will do everything on their own with the parameters you specified.

If you want to save, use the online service for the preparation of documents for self-registration of the FE and LLC. I recommend the My Case service: registration of individual entrepreneurs and registration of LLC . Everything is free. Please note: you just prepare the correct documents. Take them to the tax will have to themselves. Instructions for further steps there, on the site of the service.

Documents required to issue an online store

You started selling. What documents should an online store issue?

1. Letter of purchase confirmation

Immediately after placing and paying for the order, you must send the customer a confirmation of the purchase by e-mail. This is just a free form letter . It will be generated and sent automatically by your e-commerce system. It can be of almost any kind and form, there should be only a few required fields :

- the seller (it's you) contact details;

- customer;

- what you bought, quantity and amount;

- the total amount of the order.

A letter can be with pictures, photographs, the most intricate fonts and colors. Large scope for individualization! Most systems allow you to create your own template. In Ecwid you can edit the letter on any paid plan.

2. Consignment note

Together with the goods in the parcel the buyer is put the invoice (in Internet sales, it is also called invoice ). The information in it duplicates the letter. It will also be prepared by your e-commerce system. And yes, it can also be arranged as you like! Here is a good example of an invoice:

If your product is electronic, then you do not send the invoice. The buyer can independently enter his personal account in the store and click on the link “Download invoice”. Even in Russia, e-invoice has recently been sufficient, while abroad this is the norm for a long time.

Important: Some carriers require to issue invoices on their own form. For example, when you send goods by Russian Post , you will need special forms (in Ekvide, you can fill them in automatically, connect the application ). Specify in advance what form is needed and whether your e-commerce system is able to prepare such documents. If not, you can print invoices through 1C or “My warehouse”.

3. Cashier's check

If you are going to trade for cash (payment upon receipt of the goods), then you will be required to issue a cash voucher to the customer. For this we need mobile cash register machines (cash registers). Such a device is issued to the courier along with the invoice. To issue a check, you must pay special attention! The algorithm of actions of the cashier is prescribed in the laws and instructions of the FTS and should be as follows:

- Get the money, tell the amount of money to the buyer "Your money is 5000 rubles."

- Knock on the cash register check.

- Call the amount of the transfer "Your delivery of 151 rubles 15 kopecks."

- To hand over the check and change at the same time and only in the hands of the buyer ! And bills and coins are issued together.

- Hand over goods and invoice.

Important: If your courier violates the algorithm and runs into a tax officer who is not in the spirit, he may bring you a serious fine for not using the cash register. To break the law and get on a fine, it is enough, for example, to issue a check after delivery or to give up the goods before issuing a check.

If you have a cash register, combined with a POS terminal, your courier will also be able to accept payment using bank cards right at the time of issuing the goods (acquiring). The only difference is that you will have to issue two checks: cashier's check and slip (credit card withdrawal check).

The choice of terminals and a CCM is wide, the legislation in this area is changing rapidly, and I would not rely on one source of information. Be sure to visit several firms selling cash registers. Go through the major banks of your city and talk to them about mobile terminals. Russian Standard, VTB and Sberbank have a lot of experience in acquiring and they can provide terminals for free. Read the latest articles about the choice of apparatus. Otherwise, you risk to buy the device, which in six months will have to be changed due to the changed legislation.

Cashier checks must be approved by the tax authority. They will print you CCM, again, you do not need to manually write out anything. Your details in KKM will be registered in the company where they will be sold to you. In some cash register check can also be branded - insert your logo there. Ask your cash register supplier about this.

How to submit reports

The first rule of tax reporting is not to do it yourself. Our legislation is crooked and constantly changing, take a professional. There are several options:

1. Hire your accountant

Expensive, it is necessary to provide a workplace (computer + software), and it is difficult to find a good accountant.

This option should be chosen in very rare cases:

- You are forced to comply with strict secrecy: working for the defense or the mafia. Online store is not about that.

- Your workflow is already so great that it is more profitable for you to have your own accountant than to pay professionals. It is unlikely that at the beginning of work you can brag like this.

- There are three employees in your company since its inception: the CEO, the Commercial Director and the secretary. Then, of course, you cannot do without the Chief Accountant =)

In all other cases, other options will be more profitable.

2. Hire an outsourcer

Thousands of them. You can choose a company from any city. If the outsourcer correctly put the work, then you do not have to see, the documents can be exchanged via the network. There are many articles on the Internet, how to choose such an accounting company. Good outsourcer:

- regularly updates its site;

- can work exclusively remotely;

- provides a financial guarantee for their work;

- boasts good reviews.

For example, a very good outsourcer of APB (Association of Professional Accountants). Satisfies all the above conditions. Just contact through the feedback form or write. Equido is the accounting department of APB.

3. Use electronic bookkeeping services

The already mentioned “My Case ” prepares reports and independently sends them to the tax office on the basis of the documents entered by you. The service is easy to use, inexpensive and reliable. Online services are suitable for IP and LLC on a simplified tax system. But be prepared that you will have to work as an operator - independently enter documents into the system.

Document exchange with e-commerce systems

In the age of information technology, manually copying documents from one system to another is not comme il faut. Ekvidd and most other online shopping management systems have integration with 1C . If you are going to use other programs or services, then Ecwid has unloading csv for importing into third-party systems.

What is forbidden to sell in the online store

Finally, I remind you that in Russia you cannot sell online stores:

- Alcohol, tobacco and other excisable goods.

- Spy devices - hidden cameras, etc. They cannot even be bought, according to the court department of the Supreme Court in 2012, 72 people were convicted of this, in 2013 - already 152, in 2014 - 212.

- Medicines, however, online pharmacies online is full. This question is thin and not included in the topic of the article. I have only one urgent advice for you: if you are going to open an online pharmacy, you absolutely must understand what you are doing at each step (and then this article is not for you). If you are not an expert in pharmacy - find yourself another niche.

- Drugs and their propaganda, which now include harmless images of cannabis. There were several cases for the sale of badges, caps and T-shirts with similar patterns. Do not sell anything like that.

- Bitcoins and other cryptocurrencies. Many e-commerce systems support accepting bitcoins. When configuring, please make sure that this option is disabled in your settings.

Author: Alexander Kovalenko - Operational Director at Ekvide and founder of the accounting company APB.

Alexander on Facebook and Twitter .

Source: https://habr.com/ru/post/300058/

All Articles