What can really be a radical financial reform?

Those who attended school remembers that the usual geometry studied in school is called Euclidean geometry and is based on a small number of axioms. And if (what is usually already studied not at school) to replace even one axiom with another one, we get another and in many ways surprising non-Euclidean geometry.

The purpose of this short article is to formulate those “axioms” on which all modern monetary and financial systems are based, and then replace these axioms with others, in order to see how a theoretically maximally radical reform of the existing monetary and financial system can look.

Basics or "axioms" on which the modern monetary and financial system is built

1. In each state there is its own and only one national currency. Which is actually called money.

')

2. Money is scarce and their own intrinsic value is equal to the ratio of their deficit to their utility.

3. Money is always not only a means of payment , but also a means of accumulation and they themselves are a commodity.

4. Money is inseparable from banks and the banking system. And the banking system is always two-tier (these are commercial banks and the central bank above them as the lender of last resort in a system based on “partial reservation of deposits”).

5. No one disputes the right of banks to take interest on loans issued and it is taken for granted that investors have the right to receive interest on their deposits. Those. it is possible (decently) to talk and argue about the amount of interest on loans, but the very existence of a loan interest in the economy is not disputed.

6. The only source of clearly non-inflationary financing of long-term investments is considered only long-term savings. Any other means of obtaining (or issuing) money for investment is at least potentially potentially related to the risk of increased inflation. This axiom, like the others mentioned here, is considered practically unshakable.

7. Non-cash money (as well as cash involved in the turnover, too) live and move exclusively within the framework of simple accounting entries - “debit-credit” - and these billing records are movement, emission and money availability. You can also say that each currency is always stored (counted) in one particular place (in a bank, under a mattress, etc.).

From these axioms we can derive several interesting statements in themselves:

1. Since money is always the debts of some economic entities recognized by other entities, and since the bulk of non-cash money is released into circulation through loans issued by commercial banks, your money is the debts of other people to banks.

Thus, if all or even just many economic agents refuse to return their loans, then the value of your personal money will immediately fall sharply.

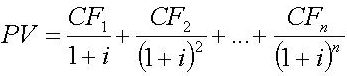

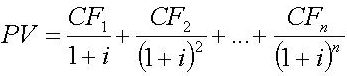

2. If you have money you can not only save, but also multiply, getting interest income on them for one reason or another, it is equivalent to the fact that the value of one and the same amount of money today exceeds its value in the future (even if zero inflation).

Hence, there is a well-known method of estimating future cash flows with their discounting (the farther into the future, the greater the discount).

But in this way, our money today makes us neglect the future . Do not believe?

Evaluate for yourself the method of discounting the value of any constant cash flow over an interval of say 100 years. Probably you will immediately agree that it is much better to get all this money right away.

And if this stream is intended not only for you, but also for your children and grandchildren - will they agree with your desire to get everything immediately and not leave anything to them?

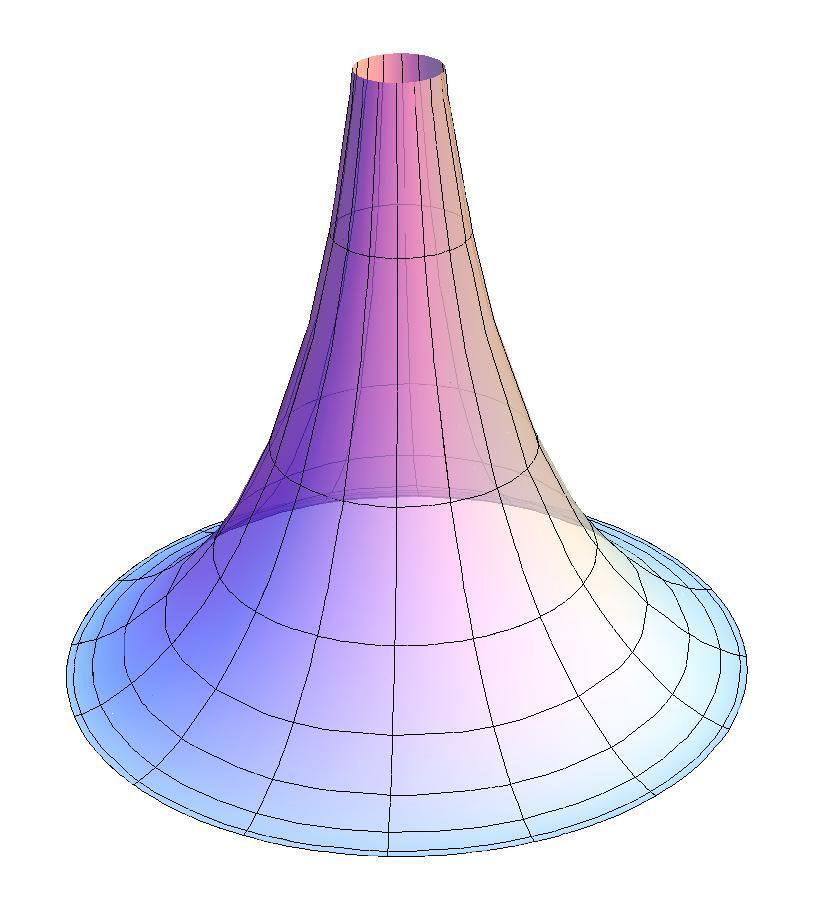

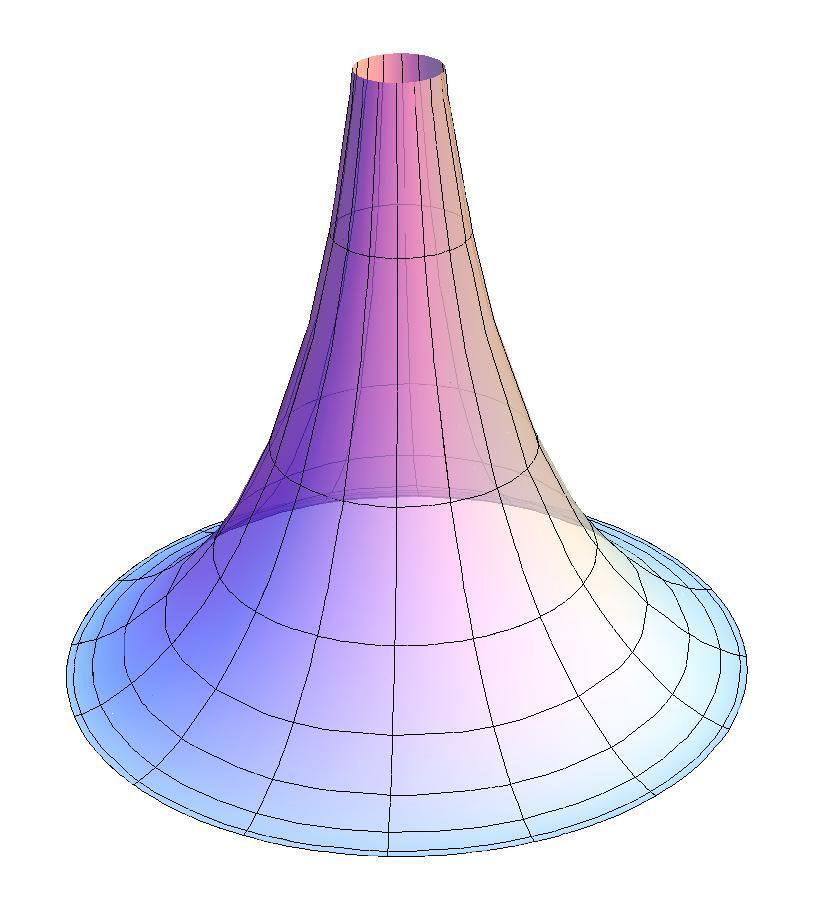

And now let's mentally imagine that money “grows old, wear out”, for possessing it you have to pay an amount proportional to the time of possession (this is payment for a simple or scientifically-demurrage).

Then the cash flow consisting of money with a demurrage is much more interesting to stretch for 100 years than to grab everything at once. And the value of such money in the future becomes higher than their value today.

The importance of the axiomatization of the foundations of the monetary and financial system is of course not connected with these consequences, examples, but with the fact that it allows us to evaluate various proposals for reforms and improvements in the monetary system. And thus distinguish real reforms from cosmetic improvements. And it is even possible (as stated at the beginning of this article) to try to outline the most effective reform of the financial system.

For example, let's try to evaluate from these positions the proposals of the Stolypin Club - which are positioned as development economics (authors: Titov, Glazyev and others).

The authors of "development economics" offer:

- create a system of preferential crediting of the real sector of the economy at 5-6% per annum,

- reduce business taxes,

- achieve stabilization of the ruble exchange rate,

- create new state "development institutions",

- reduce (limit more precisely) the number of checks and freeze the tariffs of natural monopolies.

We will not criticize these proposals within the framework of the existing financial system. Such criticism has already been expressed enough. Let's look at only one thing - are they going to attempt the basics? Hardly ever. Only a bit on Axiom No. 6 they run into, arguing, not too convincingly for many, that there will be no inflation growth from a small additional issue of “cheap” credit money. And actually everything. No overthrow of the basics.

What is interesting - one of the authors - Glazyev is perceived by many as a conductor of old and unsuccessful in the opinion of probably the majority socialist and communist ideas.

Only here the best experience (and it’s the most radical from the point of view of economics and finance) and the actual experience of the past of our country does not offer to use it.

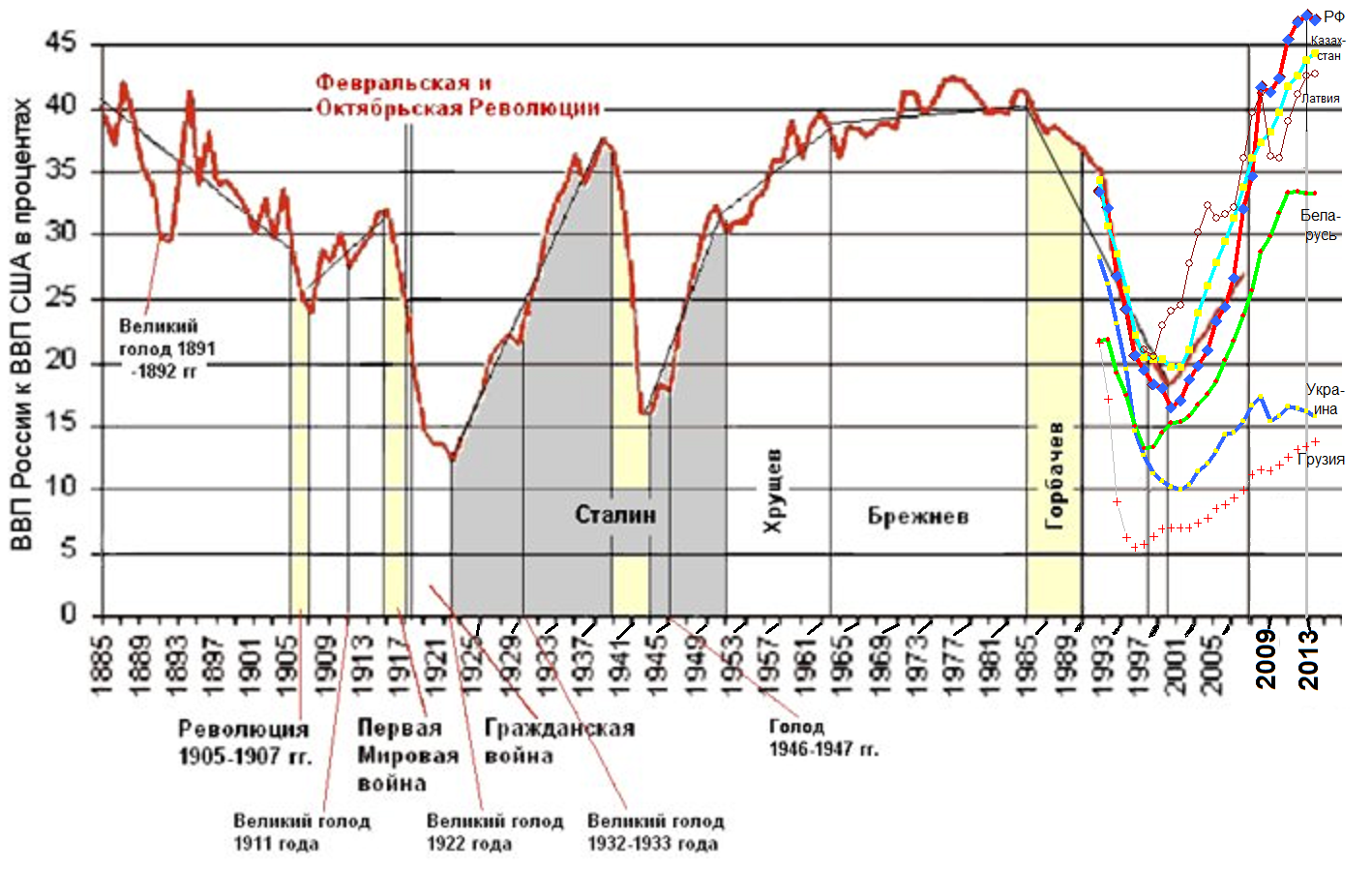

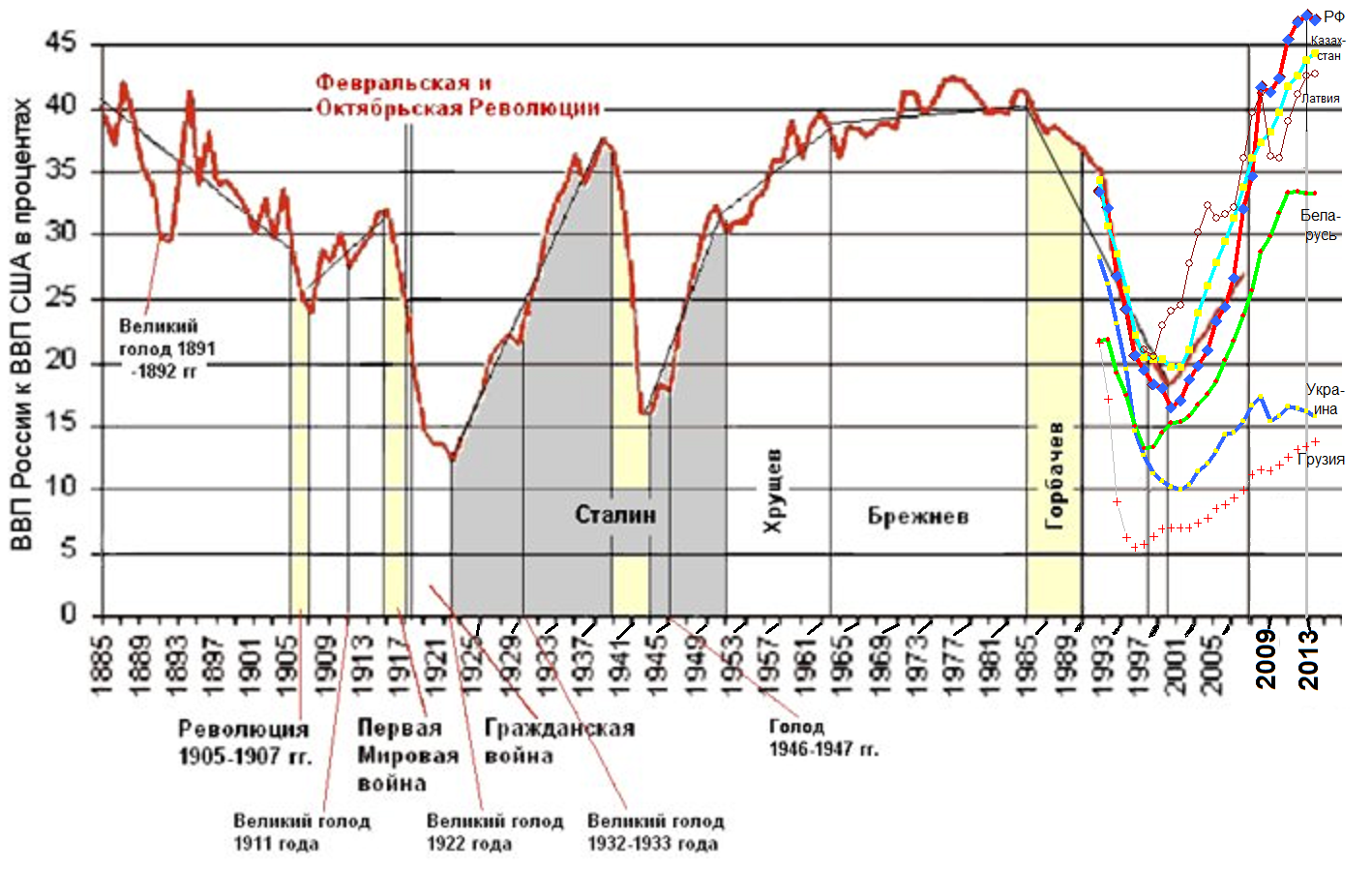

At the same time, in the 40s-50s in the USSR, a monetary system was created (purely empirically created, smart economists did not attach hands to it) the monetary and financial system is completely different than now.

This experience was so strongly camouflaged by ideology (as it was then, it is still so now), that for a long time no one has analyzed it at all as an economic experience. Only relatively recently (Valentin Katasonov, Kurman Akhmetov) separate attempts began to appear precisely of an economic study of that period.

Then, at the same time, axioms No. 1 (the only currency), No. 2 (money is scarce), No. 6 (the only source of financing investments — savings) were “violated”, and all other “axioms” (except perhaps the last axiom) were partially violated. And this system worked roughly and roughly (of course very roughly and very approximately) like this:

- Means of production and in general the goods of group “A” could be bought and sold only for non-cash money. Saving up, stealing this money was to some extent meaningless.

- Transfer of non-cash money to the wage fund and material incentives was practically prohibited. Thus, strictly speaking, various types of money acted with their own individual areas of circulation: non-cash rubles and cash rubles.

- The Gosbank of the USSR could issue non-cash money without thinking about inflation and non-cash money was “drawn” strictly according to the industrial production figures planned by the USSR State Planning Committee.

What economic results this led to can be found here http://www.sdelanounas.ru/blogs/9142.

Let us now look from the point of view of the “axiomatics” of the economy to other statements.

For example, Andrei Movchan is a representative in my opinion of a good liberal school (we will not speak about its bad representatives). In his opinion, it is necessary to focus on the fact that:

- Make our country attractive for investment and really protect property rights (of course !!!);

- Reduce the various risks of investors (of course !!!);

- Reduce the role of the state in the economy (more likely than not, but with reservations);

- Reduce regulation and supervision (also yes).

A good liberal program, although not promising quick success, is again essentially a cosmetic program, since it does not affect any economic basis at all.

Are there any more radical offers in the monetary and financial sphere in the world?

Yes there is. For example, many Western economists are moving (already for a long time and not for the first time) the idea of abandoning partial reservation, making 100% reservation of deposits, and even possibly returning to the gold standard (axiom No. 4 is canceled). Radically? Yes. Especially impressed that thereby canceled legalized for centuries, fraud of banks, repeatedly issuing a loan the same deposit money. I really have this idea - if it is considered as the only idea of reform - I don’t like it at all. Because the scarcity of money from this will not disappear. As a result, the economy will not become better from such a reform.

It is also worth mentioning the "helicopter" money (this is a complete, even brought to the logical absurdity, a departure from the scarcity of money) or, say, a currency secured by commodity stocks (the Terra currency of Bernard Liethard). However, in my opinion it is more useful to go straight to the point for which all this is actually written.

What is the most radical reform of the financial system can be thought out, in order to abandon the dogmas that seem unshakable, to build a truly radically different monetary and financial system. Be sure to rely not on pure speculation, but on the experience that has already been accumulated by various civilizations.

However, you must first formulate the main objectives of the Real Radical Reform of the Monetary System.

Strategic goals are to:

1. The money that is used as a means of payment, it would always be enough in the economy. So that there is no need to even discuss how much money the economy needs. In order for the pace (and direction) of economic development to be determined not by the possibility of financing something, but only by the availability of available material resources and a little demand.

2. So that no one wants to be rich with money and no one believes that a sign of success is money.

3. So that the economic activity of the people as much as possible depends on them, and not on the decisions of the central state bodies.

In principle, these basic objectives should be sufficient.

But besides strategic, we need a closer tactical goal. And it is simple, it does not need to be reinvented: it is an accelerated (faster than in any other countries) growth in gross domestic product - GDP.

We agree at once that this goal is exclusively tactical. Having ensured the accelerated growth of GDP already after and on the basis of this, it is possible to think what exactly this growth (or growth) of GDP should be directed “to guns or oil”. It would be something to share.

And, of course, we must at least in general answer the following question: do we really need a radical reform or a good liberal program is enough.

I suppose now the situation in the Russian economy is partly reminiscent of the one that developed in our country in the 1930s.

And then and now it is required (was required) accelerated modernization (then industrialization) of the economy. And then and now it was necessary to prepare for war at the most accelerated pace.

The only difference is that at that time it was an almost inevitable ordinary war, and now a new type of war is on and it cannot be defeated without creating a new civilization that rests on a solid economic foundation. About the need to build not only a new economy, but also a new civilization - I have to limit myself to this statement - otherwise we will move too far away from the topic.

Now let's get down to shaking the fundamentals of the financial system (just kidding).

It is almost obvious that a single national currency cannot solve all the tasks of economic reform. Yes, the national currency must exist (it also, among other things, unites the state), but definitely not one, but .... They can and should be a lot. This can be done as follows:

1. To finance investments in what is called heavy industry, in large infrastructure projects, in the development of natural monopolies, etc. - it is necessary (desirable) to use special money, limited in circulation (I already wrote about this earlier (post 22268)

And this will be well combined with the experience of industrialization and post-war reconstruction in the USSR in the 40-50s.

Let me remind once again, then non-cash loans of the State Bank were used for financing, which were drawn up in accordance with the Gosplan plan and which could not (or should not have been) influenced the amount of money in payroll and material incentives. And, accordingly, they did not require the accumulation of the population.

And as one of the mechanisms of release into circulation of these investment money, you can use the accounting of enterprise bills, i.e. to finance real deals, as it was at first with the USSR gold medal. With the same special Means of Settlement, one can pay for the state’s share in project financing.

Thus, first of all, you can eliminate the hard link between the amount of investment money and savings of citizens and organizations.

For comparison, I note that in the current monetary and financial system, remaining within the framework of liberal approaches, money for investments can only be saved or stolen or taken away (for example, from other countries or from their own future). There are no other options for accelerating economic growth in the liberal paradigm.

2. Back to our mental reform.

We will not be limited to the introduction of one new additional state currency - Special Settlement Means. To further overcome the shortage of money syndrome and to mitigate the effect of not being able to accurately determine the amount of money needed by the economy, it is necessary to allow (and for a start it is enough just to allow) the introduction of local additional currencies of one of two forms: either according to the time-money scheme or as money with a demurrage.

This proposal is again based on the experience of many civilizations, both of the past, and of our own current experience (for example, Shaymuratovo local “money”). In many countries, by the way, local local money has long been allowed (in Germany, for example).

Further. There should be an effective barrier (barrier, prohibition) of using new funds for settlements as a commodity, including for currency speculation. Since if speculation on the stock exchange is relatively harmless (the question of their usefulness is also really a big and interesting question), then speculation on the foreign exchange market is a necessary evil, which do not bring real benefits to the economy.

It may not even be necessary to impose taxes on the purchase of foreign currency or other restrictions on the purchase and sale of foreign currency for the “main national currency”, if money with a demurrage is widely and consistently used.

Thus, in passing, the task of strengthening the ruble exchange rate will be partially solved. Strengthening will be enough for now - it should not be an independent goal.

Moving further along the list of axioms we arrive at the banking system. Now, after a real quantitative easing, based on the introduction of a multi-currency national monetary system, it’s time to also give up partial reservation of deposits (that is, introduce 100% reservation of deposits), which will give the following serious bonuses:

- liquidated, as I already wrote, the legalized fraud of commercial banks;

- there will be no need for many of the current functions of the Central Bank, and in the future it is possible in itself, at least in its current form;

- the stability of the banking system to any crises will increase;

- it will be possible to practically start the destruction in the medium term of the loan interest itself, which will remove the last objective reason for the shortage of money - as a means for settlement.

However, if for a new Settlement Funds or other new money to finance investments (as well as for local currencies), a 100% reservation must be entered and postulated immediately, then the transition to a 100% reservation of the usual national currency can be gradual and smooth.

Limiting the scope of the usual currency emitted by banks operating (still) under partial reservation will make not only desirable, but also inevitable, a sharp decline in what the Bank of Russia calls the key rate. I cannot prove this thesis.

But the goal is to eliminate the destructive influence not only on the economy, but also on all the behavior of people - loan interest - this goal must be achieved one way or another.

Monetary policy issues are closely linked to inflation. And inflation is not only of monetary nature. Therefore, there should be a separate subprogram of reforms aimed at eliminating non-monetary causes of inflation. In particular, the growth rates of natural monopolies.

Here I would refer to the following useful things:

different money for enterprises and for individuals may allow not administratively, but economically stopping the growth of tariffs of natural monopolies. To do this, you can use the following technique: what the population pays - goes only for the wages of the workers of these monopolies and can be rather simply regulated and limited. Those.tariffs will cover only living labor, and all development programs of natural monopolies are financed with special money for investment and are not included in tariffs at all.

I did not invent it, I read it somewhere and thought it was right. And then, if the tariffs continue to grow, it is only proportional (and even lagging behind) the growth of real money incomes of the population (the entire population, including both working and retirees, but without taking into account the narrow layer of the richest).

This will be the first stage of radical reform. I would not undertake to describe the second stage, although it is obvious that it must follow quickly enough in order for the stated goals to be fully realized. But first it will be necessary to get and comprehend the experience of the implementation of the first stage.

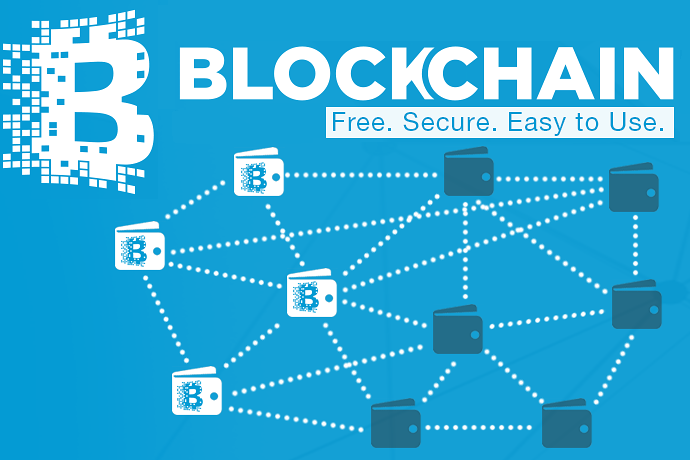

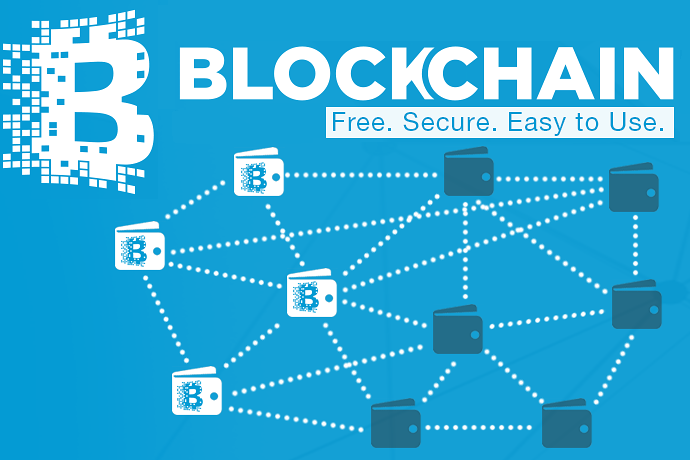

However, I will make one remark. In these notes, the last axiom is not affected in any way - the money that exists now is the numbers on bank accounts, made using the simple double entry method. This money is always stored (recorded) strictly in one place. And it would be necessary to change this axiom, what can be done using cryptocurrency technologies.

But it’s still difficult to make any real proposals, since all cryptocurrencies I know (let’s say for definiteness, this is Bitcoin and Dash) cannot pretend to the role of ideal money in principle, since otherwise they are based on the mechanism of their emission and storage. same axioms as ordinary money. But no, they have already abandoned the axiom of banks' obligation. They do not need banks at all. Is it because they are trying to ban? And anonymity and the possibility of using it for financing terrorism and for other bad purposes - is this more a pretext?

But now, unfortunately, they are much more a commodity exchange than a means of payment. And there are no prerequisites for them to cease to be a commodity and a means of accumulation. Although I look at Dash cryptocurrency with great interest. She at least solved the task of self-financing her development.

Existing cryptocurrencies are also immanently deficient in nature, like ordinary money. And their number has nothing to do with the needs of the economic turnover.

I believe that the third or some further generations of cryptocurrency will still be able to begin to be widely used in the real economy primarily as a means of payment and at the same time they (I would like to achieve this) will no longer be a commodity, will not be deficient, will not be used for savings, but they will preserve and enhance their advantages of distributed emissions and distributed information storage.

Of course, the above is not an economic program - it is only one of the methods of developing (or analyzing) economic programs (and / or currencies) with little use of ideas and techniques from the natural sciences.

But if you saw in it the features of economic reform, then, for convenience of perception, I summarize what was proposed (or what was suggested to think about):

1. We introduce a multi-currency national monetary system. In particular, we introduce separate types of new money to finance the modernization of the economy. Allow local additional currencies.

2. All new types of money, both national and local, are working with the requirement of 100% reservation of deposits. And the maximum amount of demurrage is used as a means of preventing the flow of money from the calculations.

3. Banks are not (should not be) mandatory participants in settlement systems. Where we can do without them - we manage. If banks on a competitive basis try to integrate themselves into new settlement systems, please. But there should be no initial legislative preferences for banks.

4. The role of project financing and, more generally, the role of planning, including the national one, is increasing.

5. The system of forming tariffs for natural monopolies is changing. Their growth cannot be higher than the growth of the real money incomes of the bulk of the population of a particular region (and of course without taking into account the growth of the incomes of the richest), and all development and modernization programs are financed by special investment money.

6. Instead of fighting all that is not the ruble, a policy of state support (not indiscriminate, of course, but purposeful) is being pursued to systems of local currencies, cryptocurrency, and other potential new means of payment. After all, you can fight against, and you can lead.

The purpose of this short article is to formulate those “axioms” on which all modern monetary and financial systems are based, and then replace these axioms with others, in order to see how a theoretically maximally radical reform of the existing monetary and financial system can look.

Basics or "axioms" on which the modern monetary and financial system is built

1. In each state there is its own and only one national currency. Which is actually called money.

')

2. Money is scarce and their own intrinsic value is equal to the ratio of their deficit to their utility.

3. Money is always not only a means of payment , but also a means of accumulation and they themselves are a commodity.

4. Money is inseparable from banks and the banking system. And the banking system is always two-tier (these are commercial banks and the central bank above them as the lender of last resort in a system based on “partial reservation of deposits”).

5. No one disputes the right of banks to take interest on loans issued and it is taken for granted that investors have the right to receive interest on their deposits. Those. it is possible (decently) to talk and argue about the amount of interest on loans, but the very existence of a loan interest in the economy is not disputed.

6. The only source of clearly non-inflationary financing of long-term investments is considered only long-term savings. Any other means of obtaining (or issuing) money for investment is at least potentially potentially related to the risk of increased inflation. This axiom, like the others mentioned here, is considered practically unshakable.

7. Non-cash money (as well as cash involved in the turnover, too) live and move exclusively within the framework of simple accounting entries - “debit-credit” - and these billing records are movement, emission and money availability. You can also say that each currency is always stored (counted) in one particular place (in a bank, under a mattress, etc.).

From these axioms we can derive several interesting statements in themselves:

1. Since money is always the debts of some economic entities recognized by other entities, and since the bulk of non-cash money is released into circulation through loans issued by commercial banks, your money is the debts of other people to banks.

Thus, if all or even just many economic agents refuse to return their loans, then the value of your personal money will immediately fall sharply.

2. If you have money you can not only save, but also multiply, getting interest income on them for one reason or another, it is equivalent to the fact that the value of one and the same amount of money today exceeds its value in the future (even if zero inflation).

Hence, there is a well-known method of estimating future cash flows with their discounting (the farther into the future, the greater the discount).

But in this way, our money today makes us neglect the future . Do not believe?

Evaluate for yourself the method of discounting the value of any constant cash flow over an interval of say 100 years. Probably you will immediately agree that it is much better to get all this money right away.

And if this stream is intended not only for you, but also for your children and grandchildren - will they agree with your desire to get everything immediately and not leave anything to them?

And now let's mentally imagine that money “grows old, wear out”, for possessing it you have to pay an amount proportional to the time of possession (this is payment for a simple or scientifically-demurrage).

Then the cash flow consisting of money with a demurrage is much more interesting to stretch for 100 years than to grab everything at once. And the value of such money in the future becomes higher than their value today.

The importance of the axiomatization of the foundations of the monetary and financial system is of course not connected with these consequences, examples, but with the fact that it allows us to evaluate various proposals for reforms and improvements in the monetary system. And thus distinguish real reforms from cosmetic improvements. And it is even possible (as stated at the beginning of this article) to try to outline the most effective reform of the financial system.

For example, let's try to evaluate from these positions the proposals of the Stolypin Club - which are positioned as development economics (authors: Titov, Glazyev and others).

The authors of "development economics" offer:

- create a system of preferential crediting of the real sector of the economy at 5-6% per annum,

- reduce business taxes,

- achieve stabilization of the ruble exchange rate,

- create new state "development institutions",

- reduce (limit more precisely) the number of checks and freeze the tariffs of natural monopolies.

We will not criticize these proposals within the framework of the existing financial system. Such criticism has already been expressed enough. Let's look at only one thing - are they going to attempt the basics? Hardly ever. Only a bit on Axiom No. 6 they run into, arguing, not too convincingly for many, that there will be no inflation growth from a small additional issue of “cheap” credit money. And actually everything. No overthrow of the basics.

What is interesting - one of the authors - Glazyev is perceived by many as a conductor of old and unsuccessful in the opinion of probably the majority socialist and communist ideas.

Only here the best experience (and it’s the most radical from the point of view of economics and finance) and the actual experience of the past of our country does not offer to use it.

At the same time, in the 40s-50s in the USSR, a monetary system was created (purely empirically created, smart economists did not attach hands to it) the monetary and financial system is completely different than now.

This experience was so strongly camouflaged by ideology (as it was then, it is still so now), that for a long time no one has analyzed it at all as an economic experience. Only relatively recently (Valentin Katasonov, Kurman Akhmetov) separate attempts began to appear precisely of an economic study of that period.

Then, at the same time, axioms No. 1 (the only currency), No. 2 (money is scarce), No. 6 (the only source of financing investments — savings) were “violated”, and all other “axioms” (except perhaps the last axiom) were partially violated. And this system worked roughly and roughly (of course very roughly and very approximately) like this:

- Means of production and in general the goods of group “A” could be bought and sold only for non-cash money. Saving up, stealing this money was to some extent meaningless.

- Transfer of non-cash money to the wage fund and material incentives was practically prohibited. Thus, strictly speaking, various types of money acted with their own individual areas of circulation: non-cash rubles and cash rubles.

- The Gosbank of the USSR could issue non-cash money without thinking about inflation and non-cash money was “drawn” strictly according to the industrial production figures planned by the USSR State Planning Committee.

What economic results this led to can be found here http://www.sdelanounas.ru/blogs/9142.

Let us now look from the point of view of the “axiomatics” of the economy to other statements.

For example, Andrei Movchan is a representative in my opinion of a good liberal school (we will not speak about its bad representatives). In his opinion, it is necessary to focus on the fact that:

- Make our country attractive for investment and really protect property rights (of course !!!);

- Reduce the various risks of investors (of course !!!);

- Reduce the role of the state in the economy (more likely than not, but with reservations);

- Reduce regulation and supervision (also yes).

A good liberal program, although not promising quick success, is again essentially a cosmetic program, since it does not affect any economic basis at all.

Are there any more radical offers in the monetary and financial sphere in the world?

Yes there is. For example, many Western economists are moving (already for a long time and not for the first time) the idea of abandoning partial reservation, making 100% reservation of deposits, and even possibly returning to the gold standard (axiom No. 4 is canceled). Radically? Yes. Especially impressed that thereby canceled legalized for centuries, fraud of banks, repeatedly issuing a loan the same deposit money. I really have this idea - if it is considered as the only idea of reform - I don’t like it at all. Because the scarcity of money from this will not disappear. As a result, the economy will not become better from such a reform.

It is also worth mentioning the "helicopter" money (this is a complete, even brought to the logical absurdity, a departure from the scarcity of money) or, say, a currency secured by commodity stocks (the Terra currency of Bernard Liethard). However, in my opinion it is more useful to go straight to the point for which all this is actually written.

What is the most radical reform of the financial system can be thought out, in order to abandon the dogmas that seem unshakable, to build a truly radically different monetary and financial system. Be sure to rely not on pure speculation, but on the experience that has already been accumulated by various civilizations.

However, you must first formulate the main objectives of the Real Radical Reform of the Monetary System.

Strategic goals are to:

1. The money that is used as a means of payment, it would always be enough in the economy. So that there is no need to even discuss how much money the economy needs. In order for the pace (and direction) of economic development to be determined not by the possibility of financing something, but only by the availability of available material resources and a little demand.

2. So that no one wants to be rich with money and no one believes that a sign of success is money.

3. So that the economic activity of the people as much as possible depends on them, and not on the decisions of the central state bodies.

In principle, these basic objectives should be sufficient.

But besides strategic, we need a closer tactical goal. And it is simple, it does not need to be reinvented: it is an accelerated (faster than in any other countries) growth in gross domestic product - GDP.

We agree at once that this goal is exclusively tactical. Having ensured the accelerated growth of GDP already after and on the basis of this, it is possible to think what exactly this growth (or growth) of GDP should be directed “to guns or oil”. It would be something to share.

And, of course, we must at least in general answer the following question: do we really need a radical reform or a good liberal program is enough.

I suppose now the situation in the Russian economy is partly reminiscent of the one that developed in our country in the 1930s.

And then and now it is required (was required) accelerated modernization (then industrialization) of the economy. And then and now it was necessary to prepare for war at the most accelerated pace.

The only difference is that at that time it was an almost inevitable ordinary war, and now a new type of war is on and it cannot be defeated without creating a new civilization that rests on a solid economic foundation. About the need to build not only a new economy, but also a new civilization - I have to limit myself to this statement - otherwise we will move too far away from the topic.

Now let's get down to shaking the fundamentals of the financial system (just kidding).

It is almost obvious that a single national currency cannot solve all the tasks of economic reform. Yes, the national currency must exist (it also, among other things, unites the state), but definitely not one, but .... They can and should be a lot. This can be done as follows:

1. To finance investments in what is called heavy industry, in large infrastructure projects, in the development of natural monopolies, etc. - it is necessary (desirable) to use special money, limited in circulation (I already wrote about this earlier (post 22268)

And this will be well combined with the experience of industrialization and post-war reconstruction in the USSR in the 40-50s.

Let me remind once again, then non-cash loans of the State Bank were used for financing, which were drawn up in accordance with the Gosplan plan and which could not (or should not have been) influenced the amount of money in payroll and material incentives. And, accordingly, they did not require the accumulation of the population.

And as one of the mechanisms of release into circulation of these investment money, you can use the accounting of enterprise bills, i.e. to finance real deals, as it was at first with the USSR gold medal. With the same special Means of Settlement, one can pay for the state’s share in project financing.

Thus, first of all, you can eliminate the hard link between the amount of investment money and savings of citizens and organizations.

For comparison, I note that in the current monetary and financial system, remaining within the framework of liberal approaches, money for investments can only be saved or stolen or taken away (for example, from other countries or from their own future). There are no other options for accelerating economic growth in the liberal paradigm.

2. Back to our mental reform.

We will not be limited to the introduction of one new additional state currency - Special Settlement Means. To further overcome the shortage of money syndrome and to mitigate the effect of not being able to accurately determine the amount of money needed by the economy, it is necessary to allow (and for a start it is enough just to allow) the introduction of local additional currencies of one of two forms: either according to the time-money scheme or as money with a demurrage.

This proposal is again based on the experience of many civilizations, both of the past, and of our own current experience (for example, Shaymuratovo local “money”). In many countries, by the way, local local money has long been allowed (in Germany, for example).

Further. There should be an effective barrier (barrier, prohibition) of using new funds for settlements as a commodity, including for currency speculation. Since if speculation on the stock exchange is relatively harmless (the question of their usefulness is also really a big and interesting question), then speculation on the foreign exchange market is a necessary evil, which do not bring real benefits to the economy.

It may not even be necessary to impose taxes on the purchase of foreign currency or other restrictions on the purchase and sale of foreign currency for the “main national currency”, if money with a demurrage is widely and consistently used.

Thus, in passing, the task of strengthening the ruble exchange rate will be partially solved. Strengthening will be enough for now - it should not be an independent goal.

Moving further along the list of axioms we arrive at the banking system. Now, after a real quantitative easing, based on the introduction of a multi-currency national monetary system, it’s time to also give up partial reservation of deposits (that is, introduce 100% reservation of deposits), which will give the following serious bonuses:

- liquidated, as I already wrote, the legalized fraud of commercial banks;

- there will be no need for many of the current functions of the Central Bank, and in the future it is possible in itself, at least in its current form;

- the stability of the banking system to any crises will increase;

- it will be possible to practically start the destruction in the medium term of the loan interest itself, which will remove the last objective reason for the shortage of money - as a means for settlement.

However, if for a new Settlement Funds or other new money to finance investments (as well as for local currencies), a 100% reservation must be entered and postulated immediately, then the transition to a 100% reservation of the usual national currency can be gradual and smooth.

Limiting the scope of the usual currency emitted by banks operating (still) under partial reservation will make not only desirable, but also inevitable, a sharp decline in what the Bank of Russia calls the key rate. I cannot prove this thesis.

But the goal is to eliminate the destructive influence not only on the economy, but also on all the behavior of people - loan interest - this goal must be achieved one way or another.

Monetary policy issues are closely linked to inflation. And inflation is not only of monetary nature. Therefore, there should be a separate subprogram of reforms aimed at eliminating non-monetary causes of inflation. In particular, the growth rates of natural monopolies.

Here I would refer to the following useful things:

different money for enterprises and for individuals may allow not administratively, but economically stopping the growth of tariffs of natural monopolies. To do this, you can use the following technique: what the population pays - goes only for the wages of the workers of these monopolies and can be rather simply regulated and limited. Those.tariffs will cover only living labor, and all development programs of natural monopolies are financed with special money for investment and are not included in tariffs at all.

I did not invent it, I read it somewhere and thought it was right. And then, if the tariffs continue to grow, it is only proportional (and even lagging behind) the growth of real money incomes of the population (the entire population, including both working and retirees, but without taking into account the narrow layer of the richest).

This will be the first stage of radical reform. I would not undertake to describe the second stage, although it is obvious that it must follow quickly enough in order for the stated goals to be fully realized. But first it will be necessary to get and comprehend the experience of the implementation of the first stage.

However, I will make one remark. In these notes, the last axiom is not affected in any way - the money that exists now is the numbers on bank accounts, made using the simple double entry method. This money is always stored (recorded) strictly in one place. And it would be necessary to change this axiom, what can be done using cryptocurrency technologies.

But it’s still difficult to make any real proposals, since all cryptocurrencies I know (let’s say for definiteness, this is Bitcoin and Dash) cannot pretend to the role of ideal money in principle, since otherwise they are based on the mechanism of their emission and storage. same axioms as ordinary money. But no, they have already abandoned the axiom of banks' obligation. They do not need banks at all. Is it because they are trying to ban? And anonymity and the possibility of using it for financing terrorism and for other bad purposes - is this more a pretext?

But now, unfortunately, they are much more a commodity exchange than a means of payment. And there are no prerequisites for them to cease to be a commodity and a means of accumulation. Although I look at Dash cryptocurrency with great interest. She at least solved the task of self-financing her development.

Existing cryptocurrencies are also immanently deficient in nature, like ordinary money. And their number has nothing to do with the needs of the economic turnover.

I believe that the third or some further generations of cryptocurrency will still be able to begin to be widely used in the real economy primarily as a means of payment and at the same time they (I would like to achieve this) will no longer be a commodity, will not be deficient, will not be used for savings, but they will preserve and enhance their advantages of distributed emissions and distributed information storage.

Of course, the above is not an economic program - it is only one of the methods of developing (or analyzing) economic programs (and / or currencies) with little use of ideas and techniques from the natural sciences.

But if you saw in it the features of economic reform, then, for convenience of perception, I summarize what was proposed (or what was suggested to think about):

1. We introduce a multi-currency national monetary system. In particular, we introduce separate types of new money to finance the modernization of the economy. Allow local additional currencies.

2. All new types of money, both national and local, are working with the requirement of 100% reservation of deposits. And the maximum amount of demurrage is used as a means of preventing the flow of money from the calculations.

3. Banks are not (should not be) mandatory participants in settlement systems. Where we can do without them - we manage. If banks on a competitive basis try to integrate themselves into new settlement systems, please. But there should be no initial legislative preferences for banks.

4. The role of project financing and, more generally, the role of planning, including the national one, is increasing.

5. The system of forming tariffs for natural monopolies is changing. Their growth cannot be higher than the growth of the real money incomes of the bulk of the population of a particular region (and of course without taking into account the growth of the incomes of the richest), and all development and modernization programs are financed by special investment money.

6. Instead of fighting all that is not the ruble, a policy of state support (not indiscriminate, of course, but purposeful) is being pursued to systems of local currencies, cryptocurrency, and other potential new means of payment. After all, you can fight against, and you can lead.

Source: https://habr.com/ru/post/299676/

All Articles