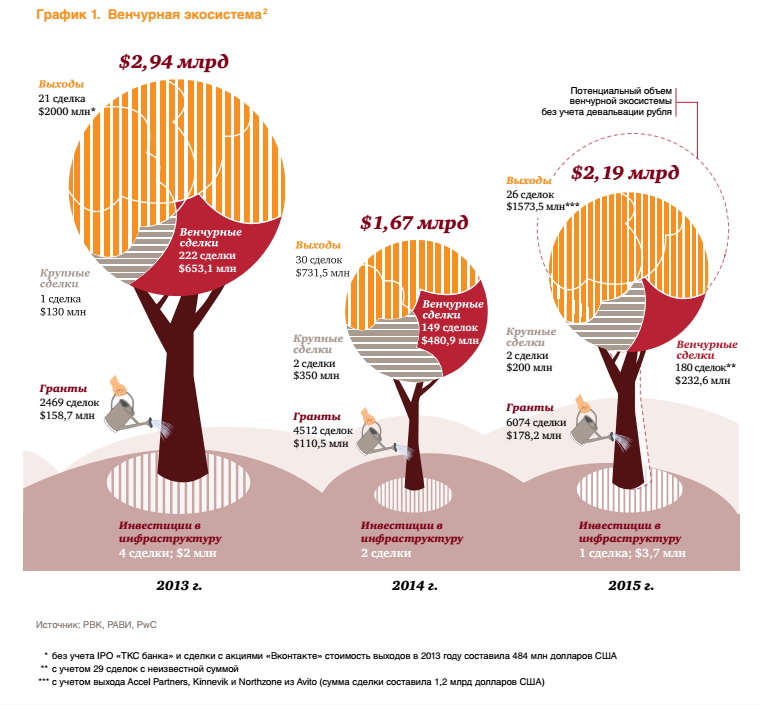

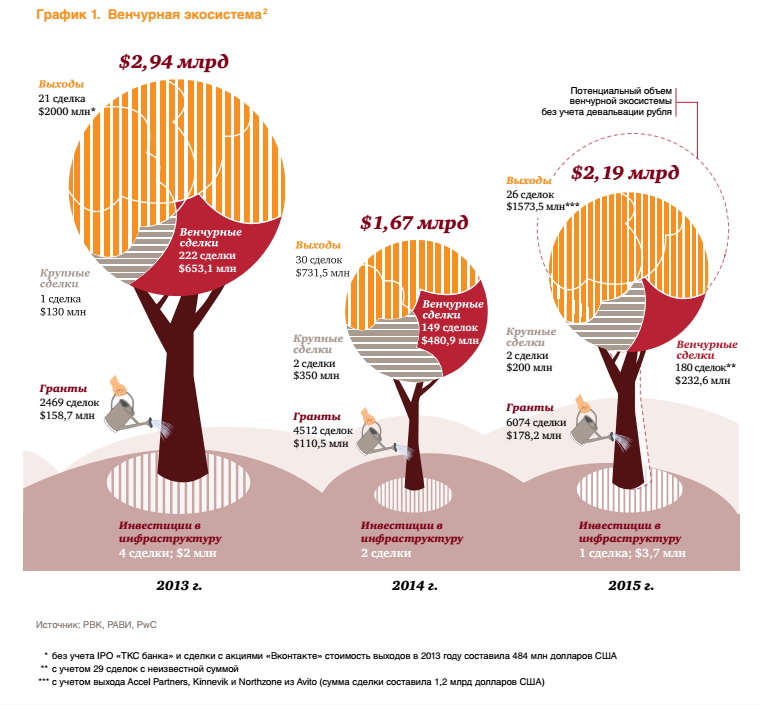

In 2015, the Russian venture capital market declined in monetary terms, but the number of transactions increased

Yesterday, March 24, the results of the new research of the Russian venture capital market for 2015 became known. The PwC Innovation Center and the Russian Venture Company ( RVC ) have published the fifth report on this topic - “MoneyTree: Navigator of the Venture Market”.

The volume of the market was significantly influenced by currency revaluation, but “it is impossible to evaluate the unequivocal effect, as the situation varies from transaction to transaction,” says Andrei Ekimenko, director of corporate finance at PwC Russia.

Most of the venture capital market of the Russian Federation accounts for transactions on the exit of investors from companies. The total volume of such transactions last year amounted to $ 1.5 billion against $ 731 million in 2014. At the same time, Ekimenko stressed that more than 75% of this amount was accounted for by one transaction - by the exit of investors from Avito .

')

The number and funding of grants grew due to the activity of the state funds Bortnik and Skolkovo .

The venture capital market dropped by 52% ($ 232.6 million) over the year. The average size of the transaction has actually halved (to $ 1.5 million) - mainly due to a reduction in investments at an early stage (by 80% to $ 0.8 million).

RVC board member Gulnara Bikkulova explained to Kommersant that in 2014 there was an increase due to the investment activity of the Internet Initiatives Development Fund: “This year the new investment plan for investment projects has not been formed in a volume comparable to last year’s.” Private investors invest in late-stage projects to reduce risks. In 2016, Ms. Bikkulova is counting on increased activity of business angels and the revival of seed investments, Kommersant writes .

According to the report, the number of venture transactions in 2015 was 180 (including 29 transactions with an unknown amount), which is 21% higher than the 2014 figure. At the same time, the number of venture transactions in the IT sector in 2015 compared with the previous year decreased by 27% and amounted to 97 transactions with a total value of $ 205.9 million. However, the bulk of venture capital deals (88% in 2015) traditionally accounted for the IT sector.

One of the deals was made in the games subsector - USM Holdings Alisher Usmanov invested $ 100 million in the eSports community Virtus.pro .

In July 2015, the company CarPrice.ru , which is engaged in online valuation and sale of used cars, received $ 40 million investment. According to the company's management, this is a record-size investment transaction in 2015. Baring Vostok Private Equity Fund V, Almaz Capital and other investors have invested in the online service. Co-founder of the company, Eduard Gurinovich, said that an investment of this size is necessary for the service due to certain features of the business model and the growing popularity of the company.

The volume of the market was significantly influenced by currency revaluation, but “it is impossible to evaluate the unequivocal effect, as the situation varies from transaction to transaction,” says Andrei Ekimenko, director of corporate finance at PwC Russia.

Most of the venture capital market of the Russian Federation accounts for transactions on the exit of investors from companies. The total volume of such transactions last year amounted to $ 1.5 billion against $ 731 million in 2014. At the same time, Ekimenko stressed that more than 75% of this amount was accounted for by one transaction - by the exit of investors from Avito .

')

The number and funding of grants grew due to the activity of the state funds Bortnik and Skolkovo .

The venture capital market dropped by 52% ($ 232.6 million) over the year. The average size of the transaction has actually halved (to $ 1.5 million) - mainly due to a reduction in investments at an early stage (by 80% to $ 0.8 million).

RVC board member Gulnara Bikkulova explained to Kommersant that in 2014 there was an increase due to the investment activity of the Internet Initiatives Development Fund: “This year the new investment plan for investment projects has not been formed in a volume comparable to last year’s.” Private investors invest in late-stage projects to reduce risks. In 2016, Ms. Bikkulova is counting on increased activity of business angels and the revival of seed investments, Kommersant writes .

According to the report, the number of venture transactions in 2015 was 180 (including 29 transactions with an unknown amount), which is 21% higher than the 2014 figure. At the same time, the number of venture transactions in the IT sector in 2015 compared with the previous year decreased by 27% and amounted to 97 transactions with a total value of $ 205.9 million. However, the bulk of venture capital deals (88% in 2015) traditionally accounted for the IT sector.

In April 2015, the Internet Initiatives Development Fund (IIDF) invested 210 million rubles in a Group-IB company specializing in information security. This is about five times less than what Group-IB itself was looking for.Among the IT sub-sectors in terms of the number of transactions and the amount of investment, the e-commerce segment remained the leader. In 2015, 17 transactions worth $ 73 million were made in this subsector. The second place in terms of the number of transactions was taken by cloud technologies and software - in this segment, 11 transactions were concluded for a total of $ 34.4 million, which is 2 transactions less than in 2014 (by 28% in cash equivalent).

At the end of 2015, 2can & ibox raised $ 3 million. 2can & ibox planned to enter the markets of Vietnam, Indonesia and Thailand. Among the investors of the project are the funds of InVenture Partners, Almaz Capital, “UST Group” Grigory Berezkin.Startups and expanding projects have suffered less. The authors of the study single out transactions worth more than $ 100 million - there were two of them, as in 2014, but their total volume decreased from $ 350 million to $ 200 million.

One of the deals was made in the games subsector - USM Holdings Alisher Usmanov invested $ 100 million in the eSports community Virtus.pro .

2015 record

In July 2015, the company CarPrice.ru , which is engaged in online valuation and sale of used cars, received $ 40 million investment. According to the company's management, this is a record-size investment transaction in 2015. Baring Vostok Private Equity Fund V, Almaz Capital and other investors have invested in the online service. Co-founder of the company, Eduard Gurinovich, said that an investment of this size is necessary for the service due to certain features of the business model and the growing popularity of the company.

Source: https://habr.com/ru/post/299654/

All Articles