Money is a story of trust

Money is the means of exchanging relationships, the universal equivalent. encyclopedic Dictionary

Money - a specific product of maximum liquidity ... WikipediaCompletely new forms of money are entering the age of rapid digital flourishing in the struggle for the future world order. What will it be - the “blood” of the economy of the future? To understand the prospects, you must be aware of history. I propose to start a little to refresh the basic facts.

Evolution from the beginnings

A variety of means for calculations at the dawn of its existence was limited only by the varieties of scrap materials: shells, pearls, stones with holes, cattle, furs and animal skins. In ancient Russia, for example, skins, salt, honey, and cattle were used along with the coins. Later, metals in coins, bars, and even in the form of scrap became popular when trading.

So throughout time, people tried to find some equivalent of their work, taken in the whole environment of their existence. And what is the difference between a noble metal ingot and a pebble in the hole? Yes, of course, universality - the ingot is more likely to be applicable not only within the framework of a single island on which people endowed such stones with purchasing power. Gold became the most universal payment instrument and the first antifraud system appeared - “tooth test”. Means of calculation turned out quite reliable, versatile, but very difficult for regular transportation and daily calculations.

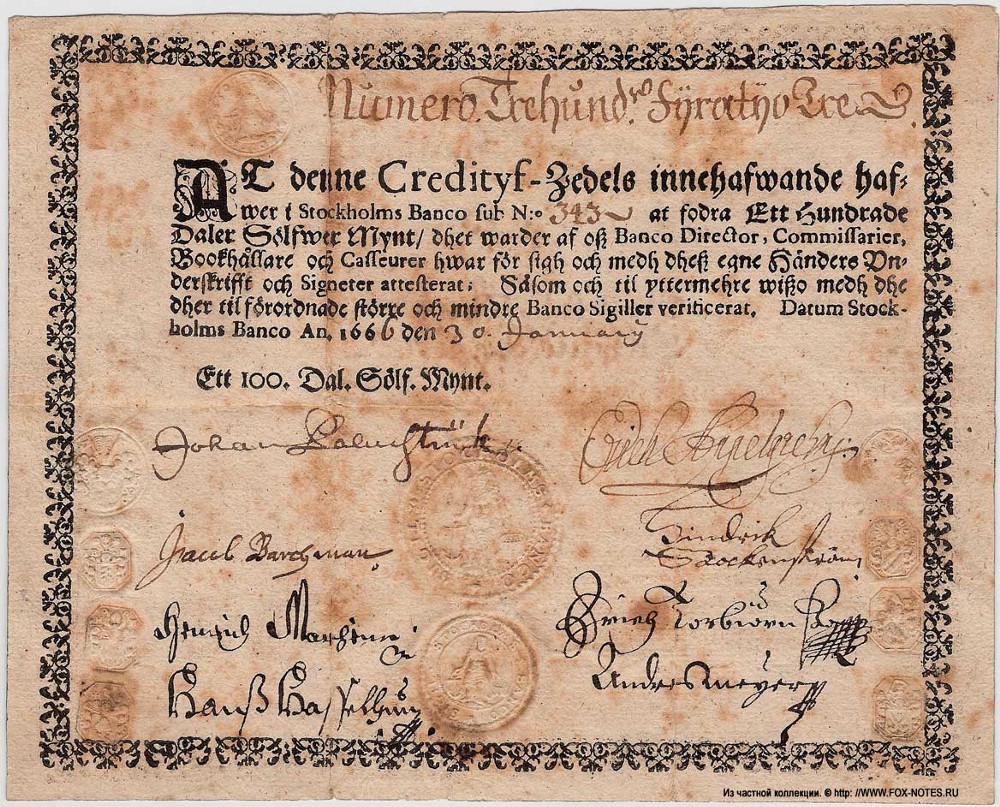

100 dalers from Stockholm Bank, 17th century

In the 17th-18th centuries, the system of circulation of banknotes began to be established, which allows one to get rid of the constant carrying of gold with them. Receiving such a piece of paper, a person understood exactly that its value corresponded to the amount of precious metal stored in the bank that was declared on it, the authenticity was confirmed by complex stamps and murals, which of course caused an unreliable confidence in the piece.

This is the birth of fiduciary (from the Latin. Fiducia - trust) money. Degrees of protection on them were gradually becoming more complex, control over the issue was centralized. The main banks of the states began to regulate the issue of banknotes, controlling monetary policy, and the money itself gained another adjective - fiat (from Latin fiat - decree, an indication, “so be it”).

')

Our days

The most important milestone in the development of the monetary system and the formation of the modern way of life is the Bretton Woods Agreement, reached by a number of countries in 1944, which left the “gold standard” in the past and approved the dollar issued by the US Federal Reserve as a key currency. Further events developed rapidly.

One ruble 1961–1991

The bond between money and precious metals was weakened even more by the 1973 Jamaican International Conference. In accordance with the agreements in the adopted agreement, exchange rates were no longer rigidly established by the states and began to be controlled by the market. Almost completely destroyed any influence of metals on the valuation of currencies, the collapse of the block of the Warsaw Pact countries in 1991, the monetary system of which was still determined by gold reserves (although a number of countries, including Russia, still keep precious metals in gold reserves) ). The only measure of currency was the market valuation - its confidence in the purchasing power of the means of settlement. Of course, the assessment of the value of banknotes with this approach is influenced by many factors: from specific indicators in private areas of the country to news background, and ultimately the overall image of the state.

Is it possible to believe in the image factor, which is created by skillful manipulations? How to exclude it when assessing our solvency? Is it possible to get a single currency for the whole world?

In 1998, an event that was not particularly noticed at that time happened: a description of a concept called “b-money” was released - an anonymous distributed electronic money system. Only 11 years later, the first implementation of cryptocurrency, bitcoin, was released by a certain developer (and perhaps not just one) under the pseudonym Satoshi Nakamoto. More information about bitcoin can be read in the concept of the author. Following the Internet "flooded" many different altcoin'ov (where, alt - alternative). I want to elaborate a little more on only some aspects of cryptocurrency.

Blockchain - trust protocol

I recently heard this definition of blockchain technology and I really liked it. Where does faith to money come from that have no real incarnation, but also created by some enthusiastic developers? Let's go from the general to the particular. If we consider the blockchain technology itself, we can distinguish two key properties:

- the use of consensus mechanisms (lat. consensus - agreement, sympathy, unanimity) between network participants, which allow you to accept changes to the base by voting. Currently, there are two types used: proof-of-work and proof-of-stake, as well as their mixtures. The first is aimed at confirming the recorded transactions by most of the network participants, is quite time-consuming, since Each participant confirms its authenticity by the work done, is used for public networks. This kind of popular elections. The second is to confirm a larger share of assets, appropriate for use in an environment where the consolidation of assets in the same hands is a priori impossible, applicable for closed networks. In fact, a kind of parliamentary vote, taking into account the representation of parties. A real example could be a consortium of banks that have certain shares of liquidity and provide transfers through the blockchain;

Formation of data blocks - open storage of all data, including complete transaction history. Each new block is the next version of the entire database, signed by the hash, the hash itself is part of the block data. Thus, each subsequent block is a coil of the evolution of the base as a whole. In the open source you can see a lot of any online information, statistics and graphs on bitcoin.

It can be said that the principles of democracy are the basis of technology; I’m not afraid of this word, even though it is already discredited. As for cryptocurrency, here we also get some interesting characteristics, but sometimes very controversial in terms of their compatibility with existing legislation. Let's look at the example of bitcoin:

- the almost complete impossibility of identifying, according to open data, the state of the assets of specific participants to identify a person for an address consisting of sequences of random characters is quite problematic, until he himself gave you this opportunity, and the number of such IDs from one owner can be unlimited. This property is not only an advantage, but also a stop factor for the implementation of mechanisms to counter the legalization of proceeds from crime and the financing of terrorism. Although the recent assertion about the unconditional anonymity of transfers is increasingly being questioned;

Comparison of privacy models - secure algorithm for transferring assets from one owner to another, based on cryptography. Everyone can see how much money is stored in the account, but only a person with a private key can write off. By the way, the address is the hash of the public key of the pair. Of course, this part can be regarded as separable from the concept of cryptocurrency and attributed to the basic technology, but I am inclined to believe that this is already an applied level of implementation and it can vary greatly in different solutions;

- predetermined volume of emissions, which, in theory, should further lead to deflation. It is obvious that not every state is capable of allowing such a strong injection into its economy. In our case, I am afraid that ruble liquidity simply will not be able to withstand the competition and will be under severe pressure from the alternative. And the question is, of course, in ...;

Specified emission function of bitcoin coins - ... provision. The security feature of cryptocurrency is probably one of the most interesting features. There is a myth that the provision for different -coin: the electricity spent on their generation or the total processor time spent on mining blocks. Another proposition is that a cryptocurrency basically has no underlying asset. Both statements are erroneous, in reality the guarantee is: confidence in the technology as a whole, nuances of private implementation, probability of solving accumulated problems and, finally, recursively - the scale of use of the system or, again, trust in it. It is clear that the last aspect is valid for any currency. By the way, no one will tell you what is the underlying asset for the US dollar or the European Euro ..?

About the "gold standard" in the 21st century

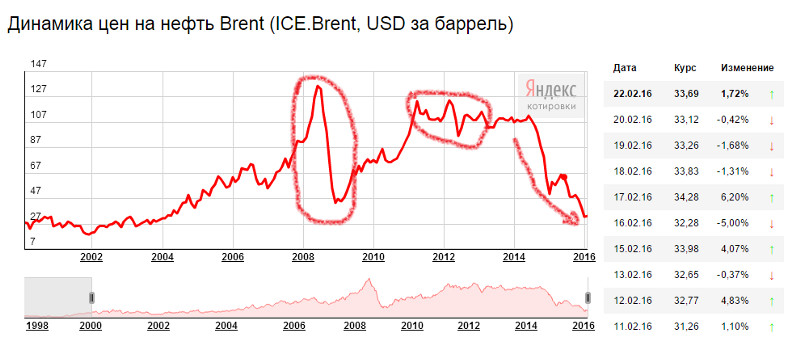

Now we are all at the point of rethinking the economic model and finding new solutions that could provide civilization with a steady progress. One often hears that one of the right ways to solve the problems that have accumulated in Russia is to return to the “gold standard”, which will make the currency indestructible. Below I have cited two graphs of price changes since 2000.

Dynamics of prices for Brent crude oil since 2000

Gold price dynamics since 2000

Yes, gold is a much more stable asset than oil, but still subject to fluctuations depending on market conditions. Like any other metal, gold has long been a commodity and has lost its unlimited credibility - its security. Solving new problems with old methods does not look promising at all. The digital age requires a digitized economy and, most likely, a digital currency, part of the supply complex of which can be at least classical forms in the form of noble metals, even hydrocarbons, well, if anyone still believes in them, even as it was written on the Soviet ruble, “everyone property of the USSR.

Source: https://habr.com/ru/post/299008/

All Articles