Saudi Arabia's mobile market can generate $ 350 million in profit annually

Emerging markets always remain attractive to IT companies, but not all of them may be obvious. According to analysts from Newzoo , residents of Saudi Arabia can bring developers about $ 350 million in revenue annually only in the segment of mobile applications. Most of these revenues will come from the so-called "whales" - users who spend in games much more than others and do not even pay attention to the lack of localization of the game.

“Saudi Arabia is a very peculiar market when it comes to user habits in the online sector. This is the second largest market for Snapchat, and it has the highest rate of video views per user for YouTube.

')

Saudi Arabia ranks 27th in the world in terms of revenues for the gaming industry, and residents of the country prefer top projects from leading developers, ”shared the co-founder of Gameguise localization studio Amir Bozorgadesh.

High incomes from mobile applications and other online services in Saudi Arabia are possible due to the absence of any significant taxes for citizens, free medical care and education. Most of the solvent population one way or another involved working in the state-owned company Saudi Aramco. According to unofficial data, the estimated cost of Saudi Aramco may exceed that of Google and Apple combined.

Such a lifestyle implies a large amount of free time that users can spend on YouTube, various services in the form of Snapchat or mobile games.

Nearly 42% of local players acquire additional content through in-game purchases via an in-app purchase. About 66% pay less than $ 10 per month, which is a normal indicator for the market. But almost 22% of users pay from $ 10 to $ 50 per month, 11% pay within $ 50 to $ 100 per month and 4% pay from $ 100 to $ 500. According to these indicators, the country is one of the leaders in the mobile market - moreover, almost 1% of players spend more than $ 1,000 on in-game purchases every month.

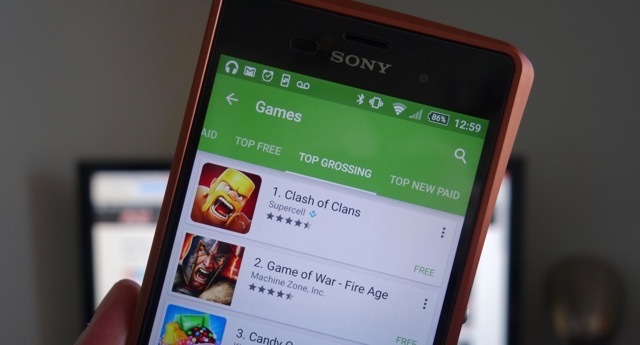

Most of the country's players do not use application stores for the Middle East, which makes it difficult for most developers to enter this market. In pursuit of local audiences, they launch their applications there and do not receive the desired response.

Compared to China, Saudi Arabia’s mobile market may not be as attractive, but the average bill among local users is much higher. Due to this, Saudi Arabia is ideally suited as an additional project with a large number of in-game payments, and not free instant messengers or similar game projects targeted at the mass market and popular in China.

Source: https://habr.com/ru/post/298938/

All Articles