What you need to know about the oil and gas industry. Likbez from analysts Changellenge >>, Issue 1

Changellenge analysts >> from those people who know everything and about everything. Still, working on each new case, they study a huge number of sources from all over the world and interview experts from leading companies in the industry. Congratulations to all: these walking encyclopedias decided to share their knowledge with everyone. In the first issue of educational program in various industries from Changellenge >> - a brief overview of the oil and gas industry, its current state and prospects.

')

The oil and gas market is going through difficult times. The excess of supply over demand for hydrocarbons led to a drop in oil prices. But the Earth’s population is growing, and technologies are rapidly developing - therefore, the demand for energy resources will steadily increase and the overproduction crisis cannot drag on for a long time. Most of today's existing technologies are focused specifically on hydrocarbon energy sources. Transferring them to alternative renewable energy will take a long time and will require significant financial investments. The volume of demand for hydrocarbon fuels will not be reduced for a long time.

When the excess of supply over demand changes to the opposite picture, oil companies will need to offer something to their customers. But even here a whole complex of problems is hidden. The era of easy oil production is over, and the extraction of hydrocarbon resources is becoming more difficult and more expensive. Reserves have to be extracted in hard-to-reach fields, geographically distant from the places of processing and resource consumption, from deep-seated layers with poor reservoir properties. Such deposits require large investments, but can contain valuable resources in demand. Therefore, even now, despite the financial difficulties and instability of the economy, oil and gas companies should think about capital-intensive projects that will allow them to stay afloat in the future.

One of the promising challenges for the oil and gas sector is gas condensate production. Gas condensate is an elite oil product. The rectification of condensate results in a production almost identical to that obtained from crude oil, but limited only to light low-boiling fractions. Compared to oil, gas condensate is a higher-quality raw material for fuel, since more high-quality gasoline can be obtained from it. At the dawn of the oil industry in the United States, gas condensate, even without refining, was used instead of gasoline as fuel for refueling a car. During the processing of gas condensate emit naphtha, gas oil, and other components that are used to produce various fuels, such as boiler fuel, diesel fuel, jet fuel and high-octane gasoline. Aromatic hydrocarbons, monomers and olefins derived from condensate are used as semi-finished products for the petrochemical production of plastics, fibers, fabrics and synthetic rubbers.

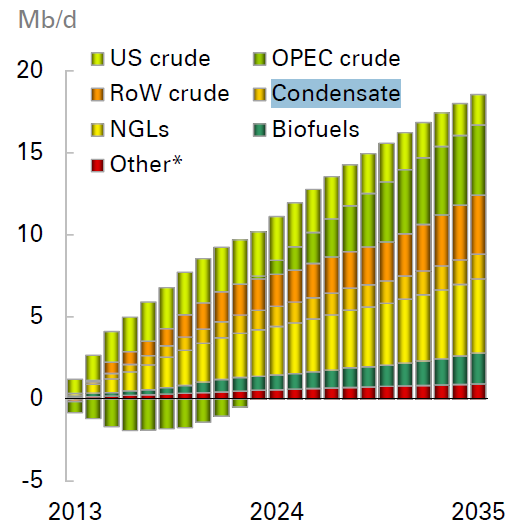

The forecast of aggregate growth of global demand for liquid fuels up to 2035.

Source: BP Energy Outlook 2035

According to BP Energy Outlook 2035, the demand for gas condensate will increase noticeably in the coming years and may reach 5 million barrels by 2035, which will significantly exceed the demand for biofuels and will be about a quarter of the global demand for liquid hydrocarbon fuels. In the structure of demand for gas condensate, the leading positions are occupied by countries in the Asia-Pacific region, which, with low production, are among the largest consumers of condensate (about 30 million tons). In particular, India accounts for 18% of this volume, South Korea - 33%, Japan - 34%. In South Korea, gas condensate consumption in 2014 increased by 10% due to the demand from oil refineries and chemical enterprises. A similar situation was observed in India (+8%) and Japan (+19%).

Gas condensate deposits are widespread throughout the world and contain a significant portion of the hydrocarbon resources of the planet. The best known are the Karachagan field in Kazakhstan, the North field in Qatar, which passes to South Pars in Iran, Kupiagua in Colombia, Hassi-Rmel in Algeria, Panhandle-Hugoton in the USA and Groningen in the Netherlands. The oil industry of Russia occupies its place in the gas condensate market. The most famous and large-scale here are the Shtokman field in the Barents Sea, the Urengoyskoye, Vuktykulskoye and Orenburg gas condensate fields.

The world leaders in the production of gas condensate are North and South America (47%), followed by the countries of the Middle East (31%) and Europe (11%). Among the countries in terms of production, the United States leads with a large margin (almost 146 million tons in 2014, 31% of world output), second place is occupied by Saudi Arabia (91 million tons), then Canada (32.4 million tons), Russia in the world ranking for 2014 is on the fourth line.

Russia, the second largest oil producer in the world, in 2016, according to Bloomberg, can keep production at a close to the post-Soviet record level due to gas condensate. Gas condensate production in Russia has been steadily growing over the past 6 years with an average rate of about 8% per year. A significant part of the condensate is produced by three companies - Gazprom (58%), Novatek (19%) and Rosneft (6%), the remaining falls to the PSA operators (Sakhalin) and the largest VINKs.

When extracting a gas condensate, an extremely important resource for Russia, high-tech equipment and software is needed, which is not always available due to the economic and political constraints of the current situation. Lack of transport, including pipeline for transportation of gas condensate from remote areas difficult to operate, often becomes the reason that production there is not profitable. Despite this, in 2014 Russia produced 26.2 million tons of gas condensate, of which 2.38 million tons - on the shelf. The leaders in offshore production on the Russian shelf are Sakhalin Energy and Exxon. Closes the three leaders of the company "Chernomorneftegaz" working on the Crimean shelf and produced in 2014 61.4 thousand tons of gas condensate. However, in early 2015, offshore production showed a decline of 3%. The increase in gas condensate production in early 2015 occurred at the expense of continental deposits and outpaced the growth rates for the same period of the previous year.

In 2016, ultra-light oil can become the main source of growth in oil production in Russia, offsetting the decline in production at key fields that were launched during the Soviet era that has been going on for several years. The main volume of gas condensate production in Russia is in the Urals Federal District, about 70%, and the main production facilities for the stabilization of gas condensate are also concentrated here. Gas condensate production in Russia this year could grow by 17%, while the main increase will be provided by new fields in Western Siberia.

Source: https://habr.com/ru/post/298894/

All Articles