How a small business is killed in Russia: an example of electronic money

Every time I write material on a website, I have to explain that I work as a lawyer in the IT field. This is very important because IT, especially in Russia, requires certain qualifications and specialization. And in fact, not so many people are deeply involved in this particular industry, especially electronic payments and e-commerce (perhaps, it would be primarily Yekaterinburg, St. Petersburg and Moscow.

Every time I write material on a website, I have to explain that I work as a lawyer in the IT field. This is very important because IT, especially in Russia, requires certain qualifications and specialization. And in fact, not so many people are deeply involved in this particular industry, especially electronic payments and e-commerce (perhaps, it would be primarily Yekaterinburg, St. Petersburg and Moscow.In this article, I don’t want to offend large Russian companies, or especially representatives of public authority. Its goal is completely different: to present material to society in order to uncover market trends based on an analysis of legislation before and after its adoption, that is, to highlight a practical extract of legal norms that, in my opinion, are created in the gap from both real legal reality and those principles on which the development of the legal system (not even the legal system) as a whole should be based.

Beginning of the era

')

Surely everyone knows that in Russia electronic money appeared quite a long time ago: in 1998, in the form of WebMoney. Then Yandex.Money entered the arena, and by the beginning of 2000, the first major exchanger was born - Roboks (then sold to Ocean Bank and closed in 2015). Actually, Roboks spawned one of the first aggregators - Robokassa, and a little later Z-Payment, Pay-U, their brothers from Ukraine (Interkassa, W1) and so on entered the arena. Enumeration of one and all - beyond the scope of this article.

The aggregators had one undoubted plus: with their help, it was not necessary to conclude 10-20-30 contracts, but to immediately connect the acceptance of payments and at the end of the reporting period get one act (as, as a rule, everyone worked under an agency agreement, which was disclosed in several articles in the Civil Code). If someone is convinced that this is a relative plus, then you should study the practice that will tell you how much the accountants (and lawyers) are trying to simplify the eternal document flow. Or let's dwell on the fact that this has always been important to my clients.

The disadvantages of these systems are obvious . But still for small and even medium-sized businesses, when an online store is opened by 1-3 people (although in fact a large number) or as an additional point of sale, this approach solved a lot of problems, both organizational and legal and accounting. And no one forbade concluding direct contracts during development.

For example, for the same WebMoney, the calculation went the same way as calculations by checks, and this is a separate accounting (besides electronic checks in the Russian legal system is a phenomenon prohibited by law rather than vice versa), which, by the way, in the provinces, not all were ready do it right away. Similarly, with the agency agreement: I still remember how articles on the topic were stamped, what is the agent's income and how income and expense should be taken into account, which the Ministry of Finance also spoke about more than once, for example, in a letter dated April 16, 2012 No. 03-11 -06/2/56.

But the main “problem” of aggregators was not this: agents are always more agile than the large supplier companies or manufacturers. That is why the agency agreement is so well developed in industrialized (and then) developed countries: the USA, Great Britain, Germany, etc.

Yes, agents take their margin, but this is a normal process, given the fact that customers need to look for, the product should be provided competitive in some parameters with all the consequences. In Russia, agents (especially because of the primary stage of development of terminals) began to be treated as parasites, although the same aggregators, at least take Roboks, even Z-Payment (with these two worked more, therefore it is easier to navigate), created much simpler connection diagram of stores.

If someone doesn’t know, I’ll say that the contract with WebMoney and especially Yandex.Money for small (first of all for them) start-up online stores has always been difficult (I can already hear the cries of the opposite side, but for me the fact is fact). The third giant, Qiwi, created its service shop, but that was later, after the first consolidation stage, when in 2010 they sent letters to everyone saying that contracts were terminated, but at the same time during the year when someone wanted to replenish a wallet (except WebMoney, initially, their replenishment was at 5%), received the inscription that payment is not possible, but with the help of Qiwi you can pay thousands of providers. If we recall that on terminals with a small bird, authorization was entered into the logo via the telephone, as well as in the case of online payment, this was an unprecedented example of obtaining a customer base through unfair competition. But, since even RBC and Yandex.Money did not go to court and no decision was made (this is by the way about the small number of good personnel in it-jurisprudence), then in this article I’ll say that this is just my opinion and nothing more. Blaming someone is beyond my control.

And at that time (2010 - 2011), when the market was on the rise stage, the legislators, with the filing of quite specific lobby groups, began to promote the now known Federal Law No. 161 “On the National Payment System”. I still remember how his prototype was discussed at the “electronic commerce 2009” in Moscow, the first industry conference at which I personally participated. Then the discussions boiled down, of course, to the fact that there are already enough norms on the market and a separate law is not needed. But this is for the market, and for the state, which operates within the framework of only the imperative method and public law, everything turned out to be the opposite.

And further

Of course, the big players then shook up: especially the banks. After all, according to Federal Law No. 161, all payment solutions were supposed to be either NCO (non-bank credit institution) or the bank itself. But such money from small and even medium-sized businesses was not. In addition, in addition to the authorized capital (10 and 100 million rubles, respectively), it was necessary to comply with the requirements of the Central Bank of the Russian Federation, which are not more stringent than the requirements of Rosfinmonitoring, in which the aggregators should have been composed according to the amendments to the Federal Law "On Counteracting Legalization ..." But the requirements of the Central Bank are much more formal - they, if someone is not up to date, form the basis for the withdrawal of most bank licenses .

At the same time, in this case, MasterBank's example is indicative: I had to deal with connecting to this structure more than once (and even to Russlavbank via the Contact system, but only 2 times).

It has always been a very long, bureaucratically unpleasant process, sometimes taking up to 6 months (if we are talking about small stores). And in this sense, the aggregators always won: their market was not so over-regulated, but at the same time, guided by common norms and aspirations not to lose their own money, they developed quite good anti-fraud solutions. Do not think that everyone did this and, in order not to make hasty statements, I will leave it for a separate analysis. I will only add that it was still more difficult with Kontakt: I had to fly to them for the first time after six months of correspondence in order to prove that I and my client are living people.

Here I will note one obvious absurdity, which for some reason, both my colleagues and industry experts generally try to get round: the banks in 2011 had already worked out the entire mechanism for combating fraudulent operations. Already developed all the necessary tools to insure funds. So why not use them to ensure the safety of citizens and organizations that worked with electronic money, including through aggregators?

The answer to my opinion is obvious: this whole notorious system from the bundle of the Federal Law No. 151, 152, 115, as well as banking legislation from the Federal Law “On the Central Bank of the Russian Federation” to “On banks ...” and relevant decisions (letters and other regulatory, but not always of legal acts), the Central Bank of the Russian Federation does not work and was created only for the purpose of full control of the banks themselves, and not to create an effective system to combat black cash and bank transfer. At least the opposite has not been proven in practice.

Actually, after the start of a mass revocation of licenses (in 2013) from banks, this was fully confirmed: legal entities lost their money for many months (for example, in Irkutsk when the local Radian bank was closed for a year), and in some cases forever. Citizens up to 750,000 are insured. But who prevented the introduction of this insurance system without Federal Law No. 161? In addition, sums from above are not insured and cases have just appeared when the same vip depositors of Master.bank began returning their hard-earned money (in this case, not taking care of their money, but the fact of black holes in the legislation due to the inept work of the executive and legislative and often judicial authority).

The essence of the matter is simple: despite this very complex process, multi-dimensional checks, MasterBank became one of the first to be processed between Sberbank, Alfa Bank, Uralsib and other lucky ones with the slogan “who closes faster” and more profitable (because banks closed, and the assets remain, however, it is also a separate issue).

The question is, if there is no difference, then why pay more, and even longer?

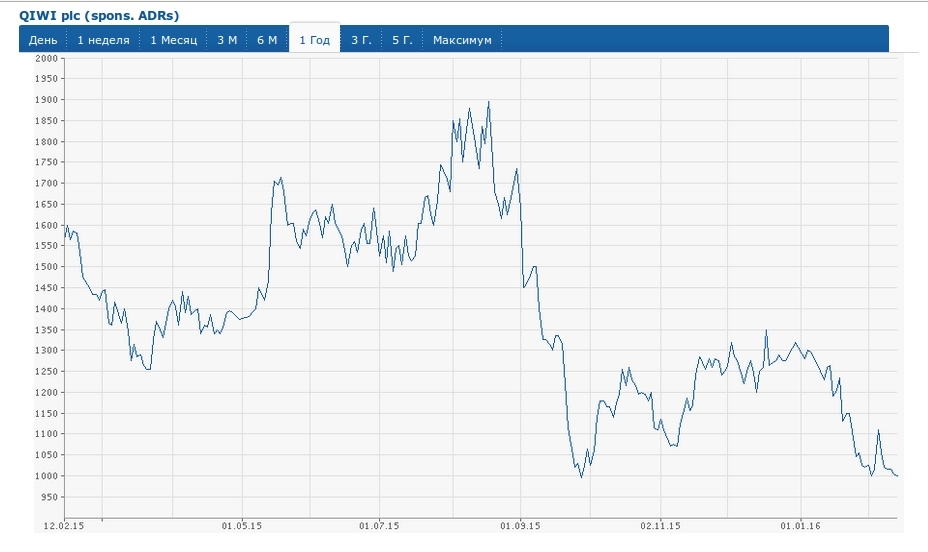

In addition, you should not whitewash those who are in gray: Qiwi shares after the Central Bank announced the same battle with money laundering through the terminals (and what else to do during the man-made crisis, how not to pump money by any means?), Fell - just collapsed , which is very significant. You can't fool the numbers.

About what's wrong

Moreover, Federal Law No. 161 was developed as a result within the framework of the most terrible legal technique, which had a lot of negative last. However, the norms themselves also did not become something positive. I will cite only a number of examples, since their list is simply huge.

The very concept of electronic money: it is simply not in the law. More precisely, there is this: “electronic money - money that was provisionally provided by one person (the person who provided the money) to another person who takes into account information about the amount of money provided without opening a bank account (to the obliged person) who provided money to third parties and for whom the person who provided the money has the right to transfer orders exclusively using electronic redstv payment ", but it is not the concept, but these signs of actions that are needed in order to place the process of the emergence of electronic money. That is why the law later made an insert about deferred payment. And until now, the Central Bank is trying to interpret the rules so that they are at least close to the already established practice (if someone receives reviews from K + or the guarantor - can specifically follow in 2015 there was not a single review without such comments, improvements and other activities of the entourage).

But all this backfired to the legislator where I expected it - in digital currencies: in 2009 there was Bitcoin and then it was interesting how the legislator would link it to the Federal Law No. 161. It turned out - no way. Thus, he, the legislator (lawyers actually call this a very wide range of subjects, some of which create laws at least somehow, and another part accepts, this is particularly significant within the framework of this law: he passed the readings with a bang! “, The benefit of our time is easy to track down, although none of the recipients even understood the essence of the regulated phenomena) did not separate the digital ones (the CBR would designate them later) or, as they are known more, crypto money from electronic.

When the corresponding letter came out (there is a brief overview in my joint article on Habré ), Yandex.Money immediately began to explain that electronic is not digital money and so on. And it had to be done in the law, as it should be, since a sectoral act was adopted. But, as is known, there is no single state strategy in Russia, so the legislative acts are patches, not a new model line for expanding the old collection.

About cellular

Another consequence of the adoption of this Federal Law was the fact that mobile operators lobbied part of the articles for themselves and began to directly oppose banks. In particular, the online ruru terminal with its predatory interest (and in general the mobile payment service from 8% -15% is sometimes even higher; when acquiring 2-3% or even 4% cannot be considered otherwise), the creation of MTS Bank, much later Megaphone co-branding and kiwi (and then biline) are all links of absolutely one chain.

Of course, this global trend was not created by our big three, it only follows it: when Facebook itself indicates the direction of an insane, in the sense of security, a deal with Whats'up, everything is clear to everyone. The only question is that banks, who thought that they would heal after Federal Law No. 161, were even better - oh, how wrong they were.

After all, it was not only electronic payments that suffered: Migom, Contact, Rapida left the arena (the latter eventually acquired through Otkritie, which in my opinion should be told separately, Qiwi), my favorite bank24.ru (also now in the omnipresent Discovery ) and some regional NPOs that served as settlement centers for small payments.

At the same time, mobile operators: a) increased the cost of payment SMS (payments were answered by authorization through applications and other innovations); b) complicated the procedure for not directly concluding contracts; c) set the price for the mobile payment, which nobody can actually bring down, since the industry is monopolized (apparently, people like to pay more, but I’m used to counting money: for me the extra 5% is 5,000 per 100,000 rubles, and this is an hour of work, I would like to value my time, taking into account the possible 60-70 years lived, this is not so little as it seems, especially excluding sleep, movement and everything that is not directly connected with difficulty).

As a result, the consumer was given the service “as is”, as in the well-known license. And everyone is happy, although when it came to the fact that the aggregators winding 0.5-5% of the criticism seemed constructive to many. Today, the justification of mobile payment is higher in cost than bank acquiring, in my opinion, no one personally provided it. This is the most notorious IMHO, which was developed on the basis of attending many conferences from Ulan-Ude to Tyumen and from Tyumen to Moscow.

Another negative aspect of the adopted law, perhaps the most negative, is the necessary monopolization: Yandex.Money sold to Sberbank with a bang (although this is the best deal on the market), Prokhorov got rid of RBC without frustration (and who knows who sell); Immediately Telemoney left, having created a good cashback system (it was possible to make purchases with a special store for the returned funds); Wellpay also closed, however, his marketing was initially aimed at spending money, rather than increasing the base and the list goes on. But worst of all, many aggregators and even payment systems either went into the gray segment (for example, Okpay or PerfectMoney), thus the state lost taxes, or were placed under the wing of the bank (from the same MainPay not widely known to the RFI bank). Only a few had the means to create NPOs: the coin, the RBC, and pay-u are remembered first.

But in the end, the same RBC turned into an ordinary processing center, however, like the coin. What does this mean for consumers and the market as a whole?

1. small companies - always self-employment of the population, that is, programmers, economists, etc., who worked in them actually lost their jobs, or had to become employees of banks, and this is not to everyone's liking;

2. large companies actually killed their achievements themselves: e-money taught customers to pay online (and in Russia it was not very easy to do this), but in fact many wallets returned to the card system (you can look at the full name of Qiwi, at Yandex policy with the exception of only to some extent remained the VM, and then only under its own manual bank). So, instead of our own, we again remained in the Visa / MasterCard system. How it ends is clearly seen in the creation of the notorious World maps. Simply put: we killed the infrastructure, and then in its place we began to make the same Visa and Mastercard in the image of the “competitor” of the same Visa, instead of giving birth in the global market not just a mouse, but something of our own.

3. large companies themselves eventually came to the conclusion that aggregation is a property that the consumer needs, and not something far-fetched, some sort of layer. Look at Yandex.cass - in 2014 they declared that aggregators are a world evil, and in 2015 they became the largest aggregator. Qiwi and even sluggish WebMoney, Molokov's PayU, didn’t go off this road at all. Processing centers, such as PayOnline, also for some reason began to aggregate WM, qiwi, and so on. I wonder why, since it is so bad and unprofitable to anyone?

The whole question was not in the form, but in the subjects: as soon as there were 3 major players left on the arena and a few smaller ones, everything and everyone began to arrange. Here are just all the innovations that small players could offer the market - at best, they remained chips inside large services, where these same chips are lost against the general background. And most importantly - the competition fell 2-3 levels lower. For example, not so long ago, TKS Bank began to actively use. And what did you find? That with the replenishment of more than 300 000 there is a commission in the whole 2%. And this is normal, but when small business representatives did it, it was said otherwise.

Yes, of course, the big players suggested, for example, Android and iOS applications and other innovations, but why shouldn’t the market choose the most, what’s good and what’s bad? The question is, of course, rhetorical.

The most important thing that we lose in such cases is hope: quite recently the Central Bank made a statement that bitcoin is absolutely dangerous. And today, the Kiwi is ready to release its crypto-ruble. Qiwi is ready, and small and even medium-sized companies? Many almost immediately turned the business, realizing that arguing with the regulator, who even operates outside the law (at that time), is useless (although they even tried to sign an online petition). And to revive the once abandoned is not the same as creating something new.

In a word, we ourselves put obstacles to ourselves, which then led to the need to adopt amendments to the Administrative Code and other legislative acts, whereas we could have been at the cutting edge of progress: for that, in general, everything was there. Not without reason, the same WebMoney created WMX, and Yandex.Money was one of the first to start talking about the promise of blockchain technologies. About their third fellow already said.

For me, as a lawyer, all this is very shameful: the fact is that my first specialization is international law. And I did quite a bit of work when analyzing the nature of electronic money. This area for me was an oasis in inert Russian law. And not onlyI thought so: here, on Habré, there is V. Kolosov (who described the agreement of this site with the authors in great detail) - on his resource you can also find quite a few information on the analysis of electronic money.

What is the result?

As a result, we get legislation that changes to the immediate needs of one or other government circles or monopolies, and as a result, it becomes filled with solid gaps, which no one tries to eliminate. But at any opportunity they impose fines and other types of punishments: it feels like me, a person with a higher education, wants to prove that this education itself is zilch, and all the principles of private law are a fiction of the evil West, and not what we accepted in 1990 and develop to this day. And all this is called - “not to interfere with small business development”. I do not know why, but I do not think so.

PS I personally did not lose from the process described, and even won, but this does not mean that it is good for me. But for me, no matter how pathetic it may sound, the truth in this case is more precious than money.

Source: https://habr.com/ru/post/298634/

All Articles