10 trends in the world of fintech, which is useful for start-ups to know

With this article we begin the cycle of materials devoted to the creation of fintech-startups. The first post from the planned series will be of interest to those who are thinking about the foundation of a financial and technological project. Our company PayOnline , which specializes in automating the acceptance of online payments, is confident that it will be useful for entrepreneurs who create startups in this area of the economy for the first time to know about industry trends and take them into account when building their business models and business development strategies.

With this article we begin the cycle of materials devoted to the creation of fintech-startups. The first post from the planned series will be of interest to those who are thinking about the foundation of a financial and technological project. Our company PayOnline , which specializes in automating the acceptance of online payments, is confident that it will be useful for entrepreneurs who create startups in this area of the economy for the first time to know about industry trends and take them into account when building their business models and business development strategies.Introduction

Before you start a fintech startup (as with any other project), you need to understand the challenges you face. Do not underestimate the rate of perception of goods by customers. It is often the case that the end user is forgotten when developing a “perfect” product, which inevitably leads to problems after the product sees the light. As a result, quite often startups have to spend additional resources and time to bring people to the fact that the product they created is designed to make life easier for customers, that they really need it. And therefore, do not forget that the product being developed must be ideal for the end user, and not only for the creators themselves, whose judgments about its usefulness may be wrong. In order not to be trapped, it is very important to conduct market research in advance, despite the fact that this stage can be very time-consuming and resource-consuming.

Release 1. 10 trends in the world of fintech, which is useful for startups to know

Release 2. 5 principles about which it is important to know to every founder of a technology startup.

Issue 3. Excursion to the world finteh hubs

Release 4. The global range of fintech accelerators

Issue 5. Russian and foreign platforms for attracting collective funding

In the context of modest resources and limited access to customer bases, startups often focus their efforts on solving local problems and do not think about entering the global market, which can later turn into serious problems. Therefore, the founders of start-ups need to think in advance strategies to further scale the business.

')

As a rule, young companies rely on the funds of the founders, but few in the early stages of a startup’s development turn to the help of business angels or investors. Most start-ups lack the support of experts in the chosen industry, which would add professionalism and help them cope with many factors.

If you want to develop your startup into a successful company, then modern technologies alone are not enough - you just cannot do without a good marketing strategy. Do not dwell only on your product - remember to develop your own business. To sell your product, you need to introduce potential buyers, and this is the task of marketing.

Knowledge of the legislative framework will give the founders of young companies a number of advantages. In addition, we should not forget that in the field of financial technology, banks are often considered as potential partners or customers, rather than competitors. In addition, the founders of startups will face many other problems, which may differ depending on the chosen niche and market.

Fintech Trends: Top 10

And now let's consider the main trends in the world of fintech:

Trend 1: Transition from innovative business models to technological innovations

In recent years, the financial services market has undergone significant changes due to the emergence of many fintech startups, the number of which continues to grow rapidly. Strange as it may seem, innovations in the industry were brought not by financial experts, but by technology experts and people seeking to use modern technology for the benefit of the best customer experience.

Trend 2: Identity authentication and security come out on top

Thanks to technological innovations, it is easier and simpler to make transactions, but at the same time security issues are becoming more pronounced. A huge number of applications allow users to make transactions with one or two clicks. However, it is this simplicity that makes transactions more insecure, and the issues of user authentication and fraud protection become much more complex. While banks are joining forces to create a powerful network in response to the rapid development of Fintech, companies that protect against fraud and personal authentication also work together to provide the best possible user experience.

Trend 3: Banks - if you can’t fight, then take the lead

Banks have found a new strategy in the fight against the present-day threat of the domination of freshly baked Fintech companies - the giants of the banking industry have begun to unite their efforts in order to jointly become a new source of innovation. They took over from financial and technological startups the desire to provide the best value for the end customer, and the largest market players also became obsessed with the FINTECh innovations that were previously alien to them. Many of them organize incubators to develop startups in the industry. The power of banks allows them to make significant investments in the development of innovation. In addition, banks have a number of advantages, among which access to a huge client base is critical - something that young companies do not have.

Trend 4: Multi-channel experience is important.

Mobile revolution is an important factor that must be kept in mind, and in order to succeed, companies should take into account that their product must be available on various devices. Due to the increased popularity of smartphones, the users' approach to shopping has changed, and these changes in customer behavior have greatly influenced the policies of companies providing services and selling goods. Thus, the retail industry is undergoing a significant shift: the number of customers in traditional stores is declining, online research is becoming especially important, and smartphones are becoming an integral part of shopping.

Trend 5: The Fintech Revolution is global

In 2015, the total investment in financial and technology companies amounted to about $ 50 billion. Below is a map presented at FinTech Week London 2015 , which shows the size of investments in fintech companies by region. From this we can conclude that the greatest funds in the development of the industry are invested in the USA, Europe and Asia. However, it is interesting and obvious that new centers of innovation are emerging: Africa and Australia.

There are several reasons for the fact that innovation in the industry contributes to the functioning of companies in the global market. One of them is that innovation comes from professionals who are knowledgeable in modern technology. Increasing technological competition contributes to the development of business without borders. Technological advances allow companies to operate in the global market, despite the fact that they can physically be located in one country, which increases competition for local companies that have not reached a similar stage of technology development.

Another reason is the fact that technical innovations, by their nature, are quickly implemented and allow fintech companies to make significant progress and reach a new level in a relatively short period of time. In addition, financial and technological startups, not having such a huge client base as the same banks, are forced to participate in international conferences, various events and exhibitions.

Trend 6: New industry players are emerging.

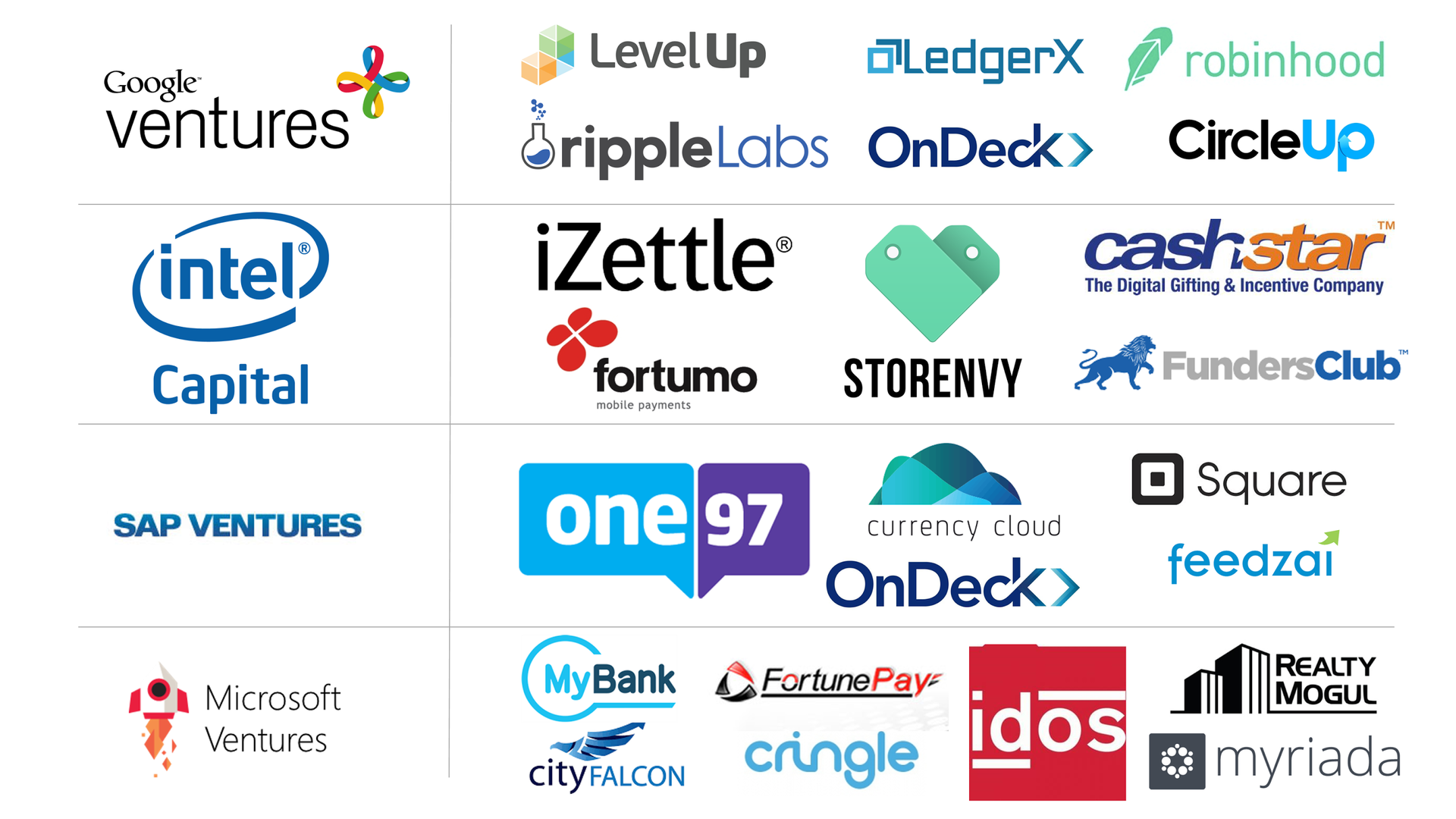

Technological companies that had not been involved in finance before, noticed the growing popularity of the financial and technological sector, and without undue delay began to promote their own initiatives in the industry. Such IT giants as Microsoft, Intel and Google show a keen interest in the FINTECH sector, supporting it with considerable investments.

Trend 7: New partnerships are emerging.

Earlier we talked about the growing interest in FINTECH start-ups from IT giants and banks. This interest led to new investment flows and the emergence of incubators. However, other market players go hand in hand with fintech-industry, whose field of activity at first glance is not related to finance, while they may become competitors of financial and technological companies. These are social media companies such as Facebook and WeChat, which understand the enormous opportunities financial transactions can bring to them within their social networks.

Trend 8: Fintech is evolving

Despite the offensive finteha, banks have resisted in the face of new competition - the development of the financial and technological industry has had little effect on them. So you can characterize the first phase of development of the industry. Nevertheless, there are many prerequisites for significant changes in the sector, thanks to which FINTECH is evolving, expanding its borders and going beyond payments and loans. The so-called second version of Fintech (Fintech 2.0, as it was named in the article FinTech 2.0 Paper: Rebooting Financial Services ) will be based on cloud technologies and in part will be the result of the transition to open data.

While some fintech companies today are focused on the race for the status of unicorns, Fintech 2.0 provides much greater opportunities for fundamental global changes in the infrastructure and functioning of the entire financial sector of the economy. To realize the possibilities of Fintech 2.0, banks and financial and technology companies must cooperate to complement each other.

Trend 9: Payments and lending - the most attractive areas of fintech

There is a wide variety of types of players in the fintech industry. However, some of its areas seem more attractive to investors and attract more attention to themselves than all the others. In the diagram below, taken from an article in the LTP portal, we see how investments were distributed among the sectors of the fintech industry in 2013 and 2014. It follows from the diagram that the lion’s share of investments fell on the sector of payments (14%) and lending (19%).

Trend 10: The number of unicorns finteha grows

Over the past two years, the number of unicorns in the industry has increased significantly. Companies like Stripe, POWA Technologies, Avant, Prosper and One97 have joined the ranks of startups worth over a billion dollars. Despite the fact that with the advent of new players, competition is increasing, this is probably a good sign for new and not yet emerged financial and technological companies, as it indicates that investors are willing to invest huge amounts of money in fintech enterprises, which serves as a catalyst for the growth of valuation startups.

For writing this article used materials portal LTP . Stay with us and subscribe to our corporate blog PayOnline - in the near future we will continue a series of articles about what the founders of financial and technological companies need to know.

Source: https://habr.com/ru/post/298592/

All Articles