The company valuation method is relevant.

Good afternoon, dear readers. I read an article stating that the methods for evaluating companies are outdated. In particular, the author of the original article wanted to show that if a company has several large divisions, then summing up the capitalization of each to get the total value of the holding (from the English Conglomerate) is not entirely correct.

With such a statement is difficult to agree. The comment would have been too voluminous, so I decided to write an article.

')

Here I would like to show that the mechanism for determining capitalization remains relevant not only for companies, but also for holdings that have several development directions, and also argue on the example of Alphabet, Exxon Mobile and other companies mentioned in the original article.

Who cares - welcome under cat.

At first there will be a little theory, the most impatient can immediately go to the

Theory

To begin with, the difference between a holding and a company. The holding has many large, fairly independent divisions, while the company is a more atomic entity. From the point of view of capitalization, this is unimportant - a shareholder can only invest in a holding or company as a whole, without being able to determine in which particular division or direction he wants to invest.

For the company, it does not matter, because All activities are directed in the same direction, but for holdings there may be discrepancies. For example, I like the project of points from Google, but I don’t have the opportunity to invest money in it directly - only in the common Alphabet "piggy bank" by buying its shares.

Under the capitalization of the company refers to the total value of the shares. The shares are owned by investors - people, other corporations, funds. For owners, promotions can perform 3 main functions:

- A stock costs money, it is (usually) easy to buy / sell, and therefore a stock is pure capital.

- The company's free profit is paid in the form of dividends in proportion to the number of shares in possession. Thus, the stock is also a source of future income.

- And the most interesting - the action gives the right to participate in the management of the company. The more shares - the greater the possibility of managing the company. Using a blocking package (usually 25% of the shares), for example, you can veto any decision of the board of directors. Or just the right to vote in elections to the board of directors. In particular, capitalization answers the question “how much does a veto on a board of directors cost?”

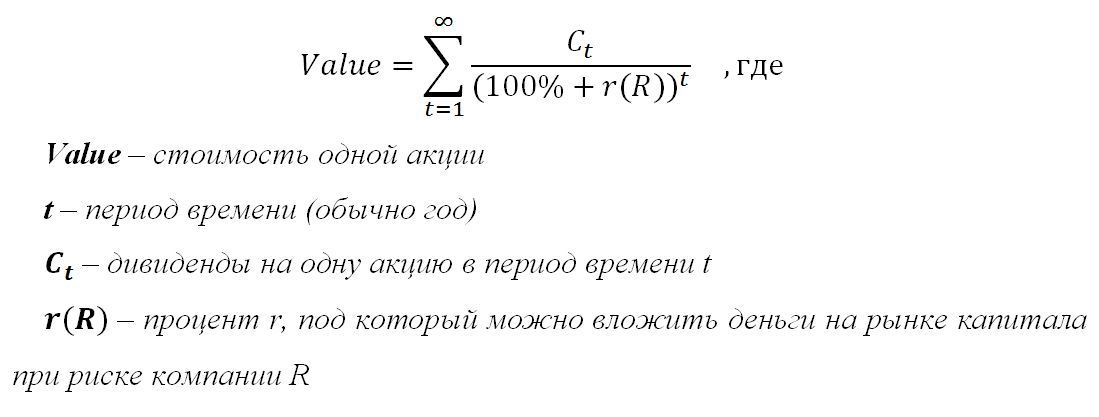

From an academic point of view, the share price can be calculated if future dividend payments are known per share. All other indicators can help in the calculations, but if the future payments are already known, then they (other indicators) become redundant. It is especially interesting that even the income from the sale of the stock, strictly speaking, depends on the amount of future dividends.

The proof is based on three premises:

- There is a capital market where you can invest at a certain percentage, which depends only on the risk of the project (company / company / whatever). The higher the risk, the more money you can invest at a higher percentage.

- On account of future income, you can take a loan in a capital market that will be less than future income. Money tomorrow is cheaper than money today. How much cheaper - depends on risk (remember that the capital market determines the percentage of profitability depending on the risk?).

- Future income cannot be infinite for a limited amount of investment. If a company does not pay all profits in the form of dividends, then the remainder is considered an additional investment in the company.

So, the theorem states that the value of a stock today is the very loan that can be secured by this action. Or, equivalently, this is the present discounted value of all future dividends.

Equity Value Formula

The value of the stock tomorrow is determined exactly the same. If we assume that dividends are paid in equal amounts at all times, then the nominal value of the shares will be the same at all times.

It remains to determine the risk and return. Risk is determined by looking at the general state of players in the industry.

Yield is estimated based on three things:

- Company profitability in the past

- Additional investments that increase future profits. Including, investment means a part of the profits that the company has

squeezedreinvested / reinvests in growth, instead of paying dividends. - The state of the economy, industry and other external factors

Thus, a company can invest all its profit in growth and not pay dividends at all. Shares of such companies are called growth stocks . These are usually young companies in the active phase of growth, start-ups, as well as (oddly enough) IT companies. Probably due to the high volatility of the market and the need to constantly change. Microsoft, for example, in the first few decades of its existence, has never paid dividends to its shareholders, investing all profits in growth.

If all profits are paid in the form of dividends, then the shares of such companies are called shares of profitability . These are usually mature companies in a highly competitive industry. The market is already saturated, and it is possible to grow only due to the decline of other players - oil companies are a very good example of this.

There are also mixed types of shares, in which signs of growth and profitability of shares in different proportions are combined.

It should be noted that neither risk nor future profitability can be determined absolutely exactly, and therefore remain subject to speculation on the part of the company's management and shareholders. It is these speculations that inflate the so-called financial bubbles, which, however, then inevitably burst.

Practice

Exxon Mobile, Apple

Such a capitalization of Alphabet looks even more absurd considering the economy of companies - in 2015 Apple's profit amounted to $ 234 billion, and the profit of the oil giant Exxon Mobile was more than $ 300 billion. Alphabet's income of $ 74.5 billion looks insignificant.

Exxon Mobile is an oil company operating in an extremely highly competitive environment. They have nowhere to grow. Therefore, the value of shares is determined mainly by their future profit, the forecast of which directly depends on the profitability in the past. In this case, the company's capitalization is directly related to the profit in the financial statements.

Apple is an IT company, a leader in its segment. It gives a good profit. The largest known investment project at the moment - electric cars - does not inspire much hope. In addition, Apple loves surprises and keeps the current developments secret. Therefore, the company's shares depend not only on profits, but also on faith in unnamed projects.

After the death of Steve Jobs, not a single “bomb” was released, so belief in incognito projects declined, and the share price depended more on profit, the forecast of which directly depended on profitability in the past. Of course, faith in future projects contributes to the share price, but not as much as Google does.

Alphabet

But it’s impossible to call Alphabet overvalued due to low profits - Amazon is on the market and demonstrates a similar situation. With a margin of 3%, according to all the laws of the market, it cannot have a similar capitalization. So how do these companies do this?

Alphabet - Holding (with English. Conglomerate), owns Google, which dominates the search area, it brings a lot of profit (mainly due to advertising). But the company has a number of large investment projects - unmanned Google-mobiles, augmented reality glasses, the Internet in hard-to-reach places on balloons. All this requires investments, which are taken from the operating profits of other, mature divisions with the secret approval of the shareholders (the shares do not fall, which means investors approve and do not sell their shares).

Thus, the value of the holding's shares depends not only on the profitability of existing divisions, but also on actively developing ones. How much profit will be holding in the future? The answer of the shareholders is obvious - just like Apple, which has a strong current arsenal, but weak future developments.

Amazon - market laws are dictated by shareholders who own companies. And if a shareholder believes that the investment will now bring profit to the company in the future, he is investing money. Even if the specific direction for these investments is determined by the holding or company.

Since There are many shareholders, and all of them have a commercial interest. And the truth is - how else to evaluate a company or a holding? If someone predicts success and invests a tidy sum on this basis, then how not to believe such an assessment? Especially if such "investors" a lot.

Kodak

Therefore, the concept of focusing on one problem for success in the market looks absolutely absurd in our time. Did Kodak have a narrow specialization and where did it lead it?

The decline of Kodak did not happen because of narrow specialization, but because of ignoring the obvious progress. On the contrary, narrow specialization helped Kodak to become successful. The main miscalculation of Kodak is the denial of digital cameras and a bet on film, contrary to all forecasts of external and internal analysts. The slogan “Who needs digital cameras - everyone needs a film” ruined them. Clinging to the past is what Kodak has ruined, but by no means narrow specialization.

Conclusion

It seems that the time has come for cardinal changes that will happen very soon and the case with Alphabet only proves it.

The case with Alphabet shows that the holding company has entered a phase of active growth. Many investment projects inspire confidence and give reason to expect profits (dividends) in the future. There are no prerequisites for cardinal changes, in my opinion.

Source: https://habr.com/ru/post/298504/

All Articles